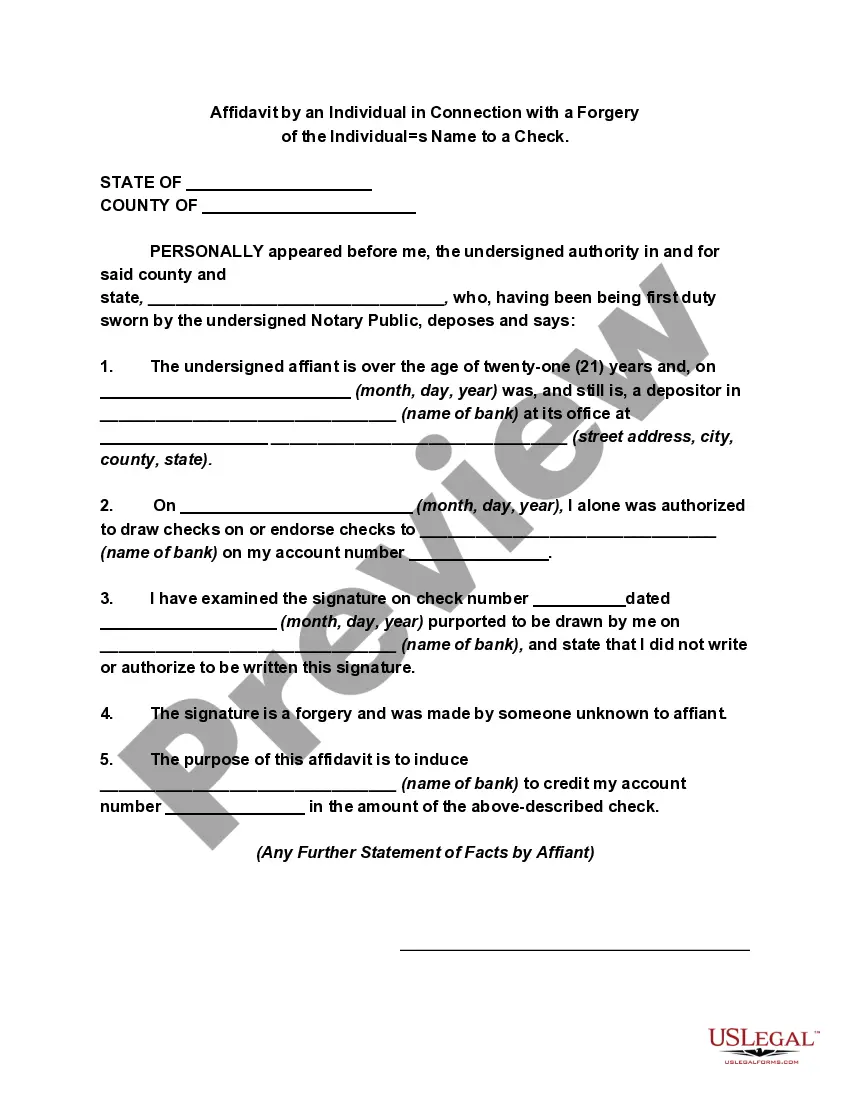

Kings New York Affidavit by an Individual in Connection with a Forgery of the Individual's Name to a Check

Description

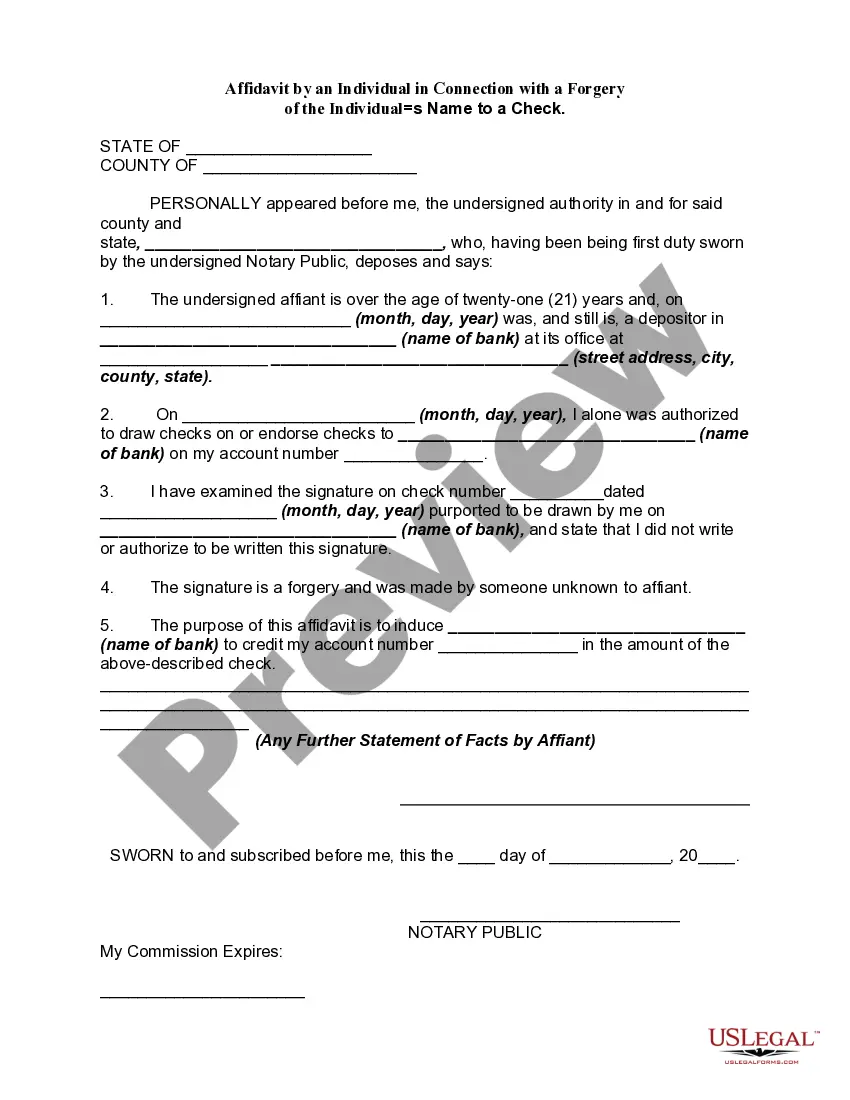

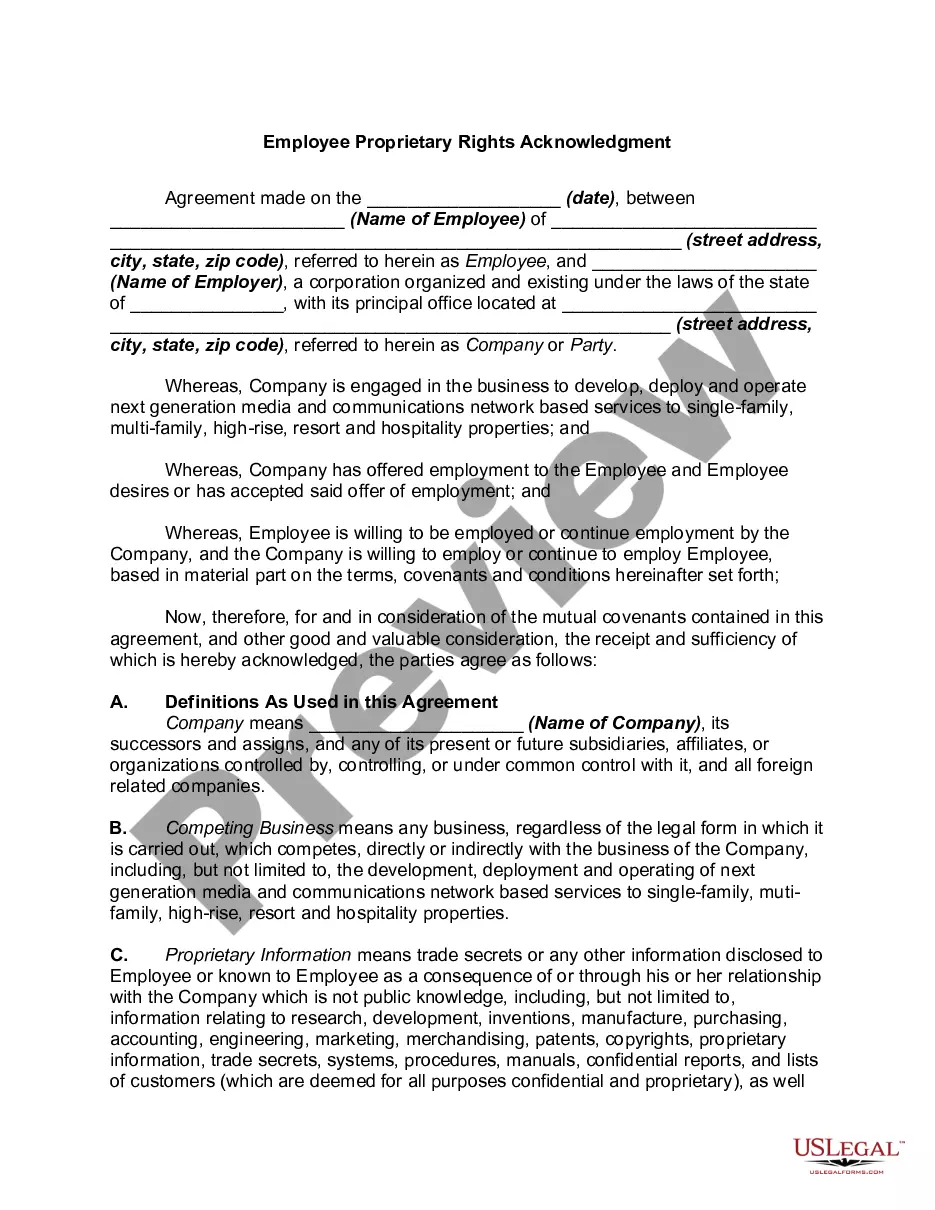

How to fill out Affidavit By An Individual In Connection With A Forgery Of The Individual's Name To A Check?

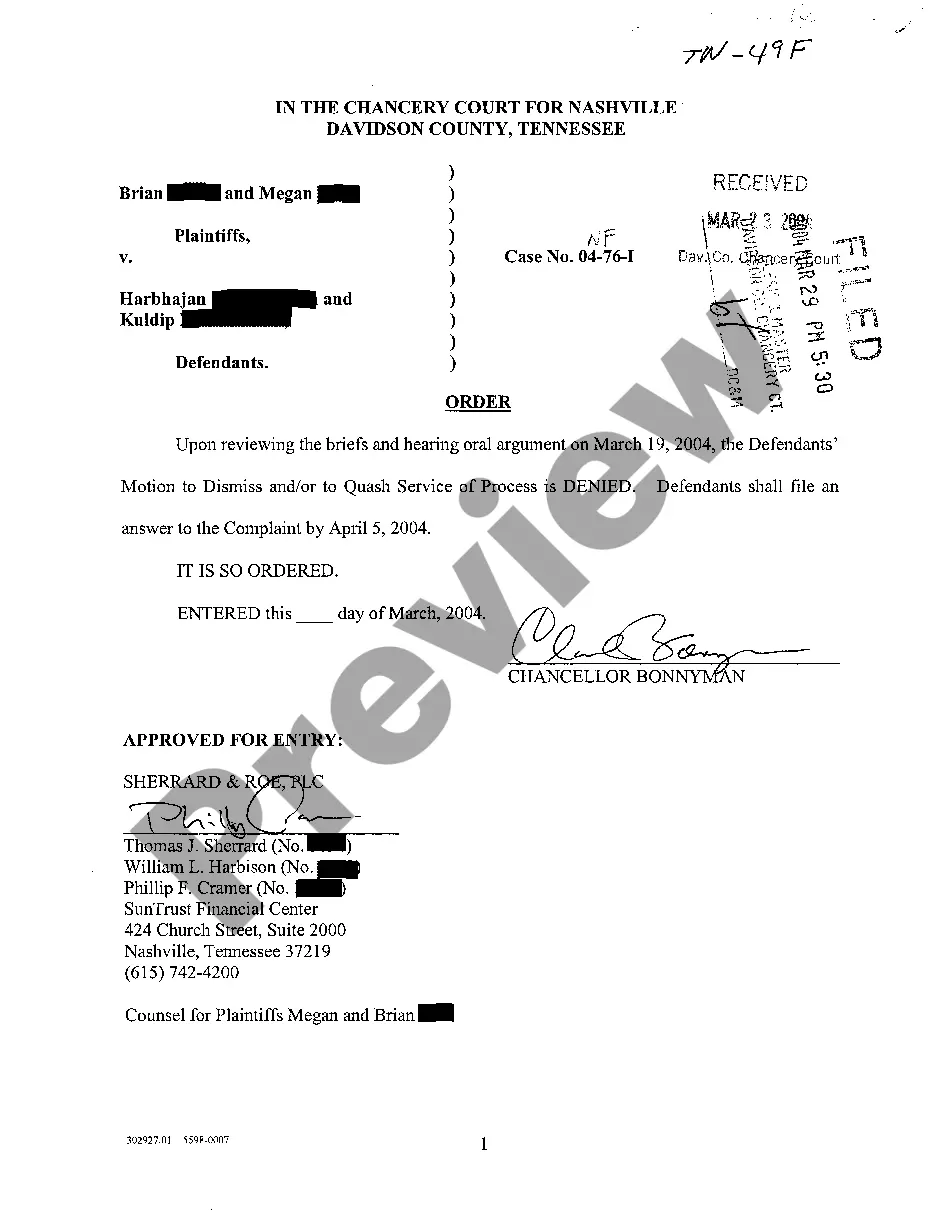

A formal documentation process always accompanies any legal endeavor you undertake.

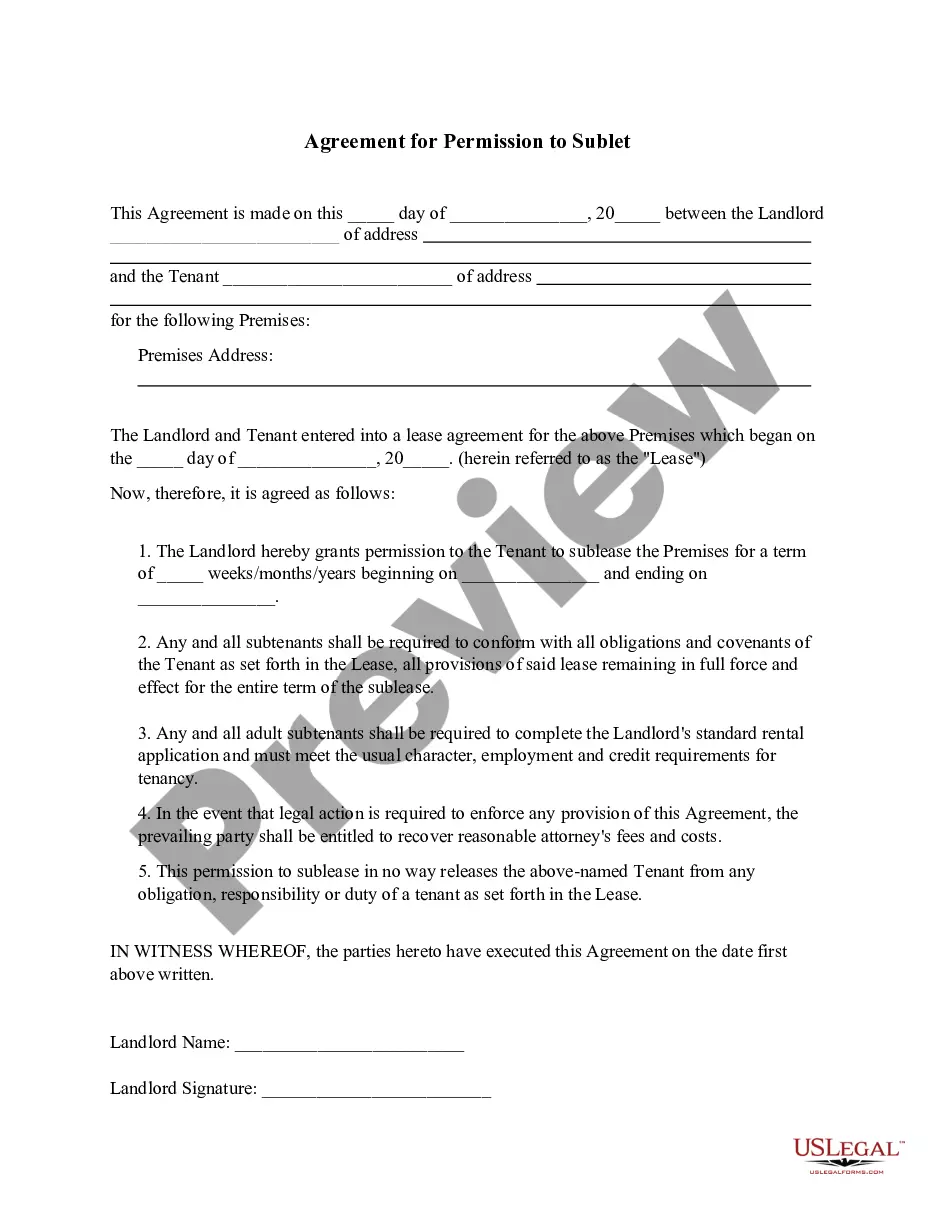

Establishing a business, requesting or accepting a job offer, transferring ownership, and many other life circumstances necessitate that you prepare official documents that vary from state to state.

This is why having everything gathered in one location is incredibly convenient.

US Legal Forms is the largest online repository of current federal and state-specific legal forms.

- On this website, you can effortlessly search for and obtain a document for any personal or business purpose applicable in your area, including the Kings Affidavit by an Individual Regarding a Forgery of the Individual's Name on a Check.

- Finding templates on the site is exceedingly straightforward.

- If you already possess a subscription to our service, Log In to your account, search for the template using the search bar, and click Download to store it on your device.

- After that, the Kings Affidavit by an Individual Regarding a Forgery of the Individual's Name on a Check will be accessible for future utilization in the My documents section of your profile.

- If you are interacting with US Legal Forms for the first time, adhere to this straightforward guide to acquire the Kings Affidavit by an Individual Regarding a Forgery of the Individual's Name on a Check.

- Ensure you have accessed the correct page with your local form.

- Utilize the Preview feature (if available) and browse through the template.

Form popularity

FAQ

You generally have up to 30 days from the statement date to notify the bank of an error, including an unauthorized signature or an unauthorized alteration on a check.

How to Spot a Forged Check SQN Banking SystemsAsk for ID.Look for the Criminal Tremor.Be Cautious of Stamped Signatures on Personal Checks.Hold the Signature Up to the Light.Compare with the Signature on File.Invest in Signature Verification Tools.

You generally have up to 30 days from the statement date to notify the bank of an error, including an unauthorized signature or an unauthorized alteration on a check.

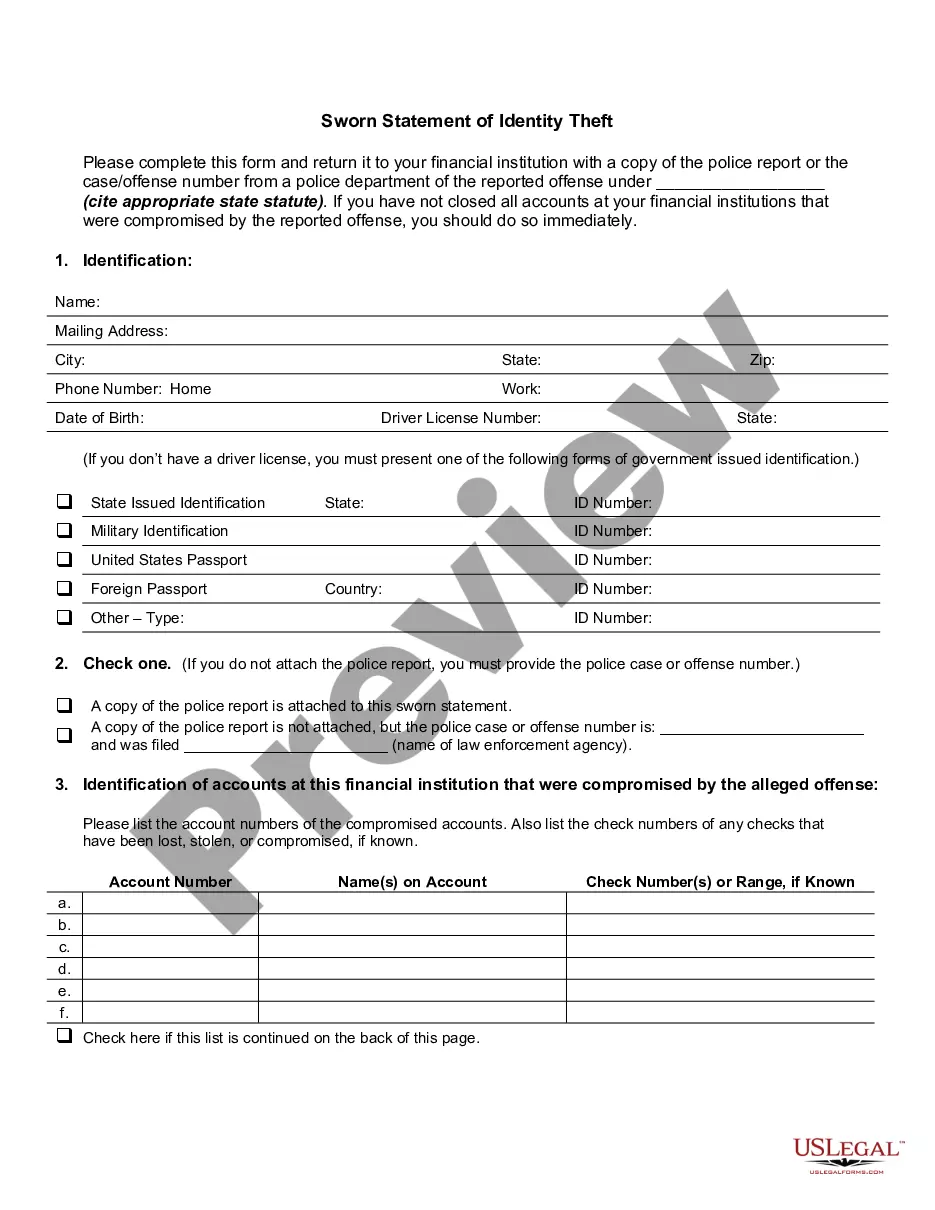

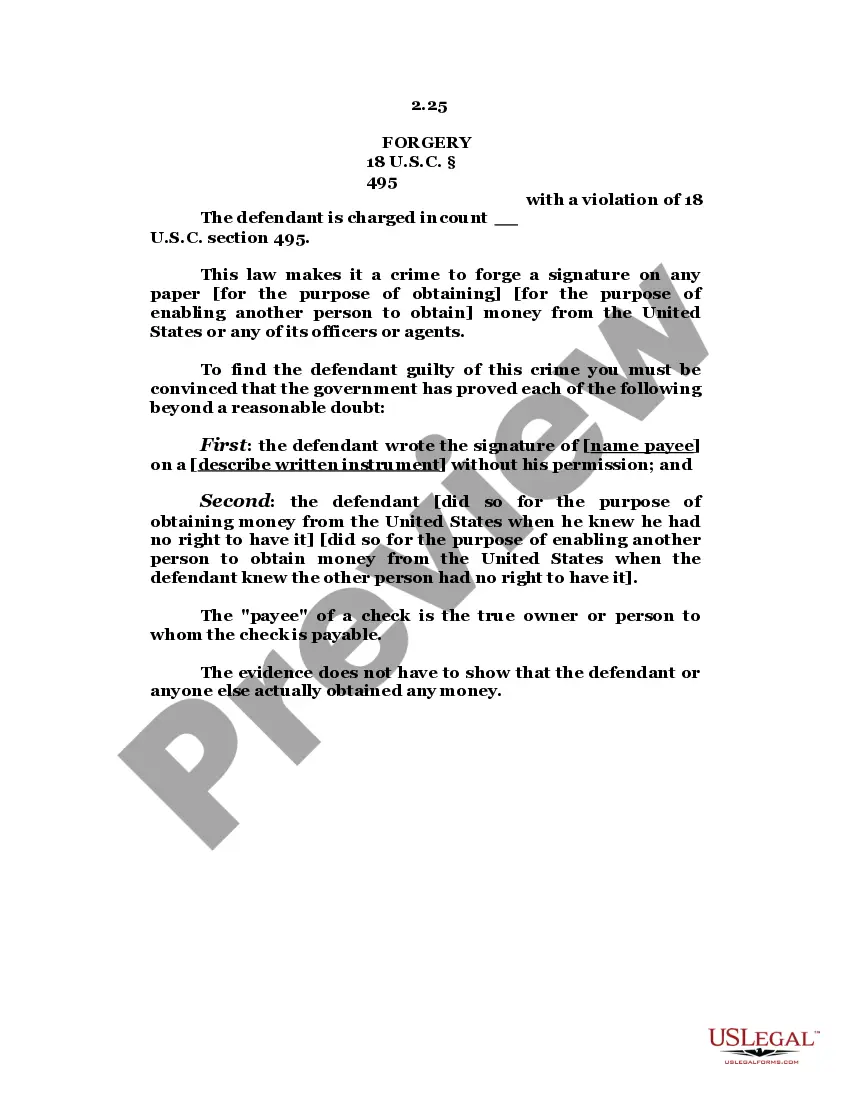

Drawee Bank Liability for Forged Endorsements Under the UCC, a check bearing a forged endorsement is not properly payable (Revised UCC . 4-401). If the drawee bank pays a check bearing a forged endorsement, then it is obligated to recredit the drawer account for the item.

There are three main types of endorsements:Blank endorsement. The term "blank endorsement" can be confusing because it doesn't mean that an endorsement is, strictly speaking, blank.Restrictive endorsement.Endorsement in full.

A forged endorsement involves forging the payee's signature for negotiation. Frequently, a forged endorsed check contains the true signature of the account holder. Forged endorsed items can be identified as first-, second-, or third-endorsed items.

The term forged check is often used to describe a check on which the drawer's signature is forged or unauthorized. Such a check is meaningless as far as the drawer whose signature is forged is concerned. The drawee bank that pays a forged check is generally responsible for the resulting loss.

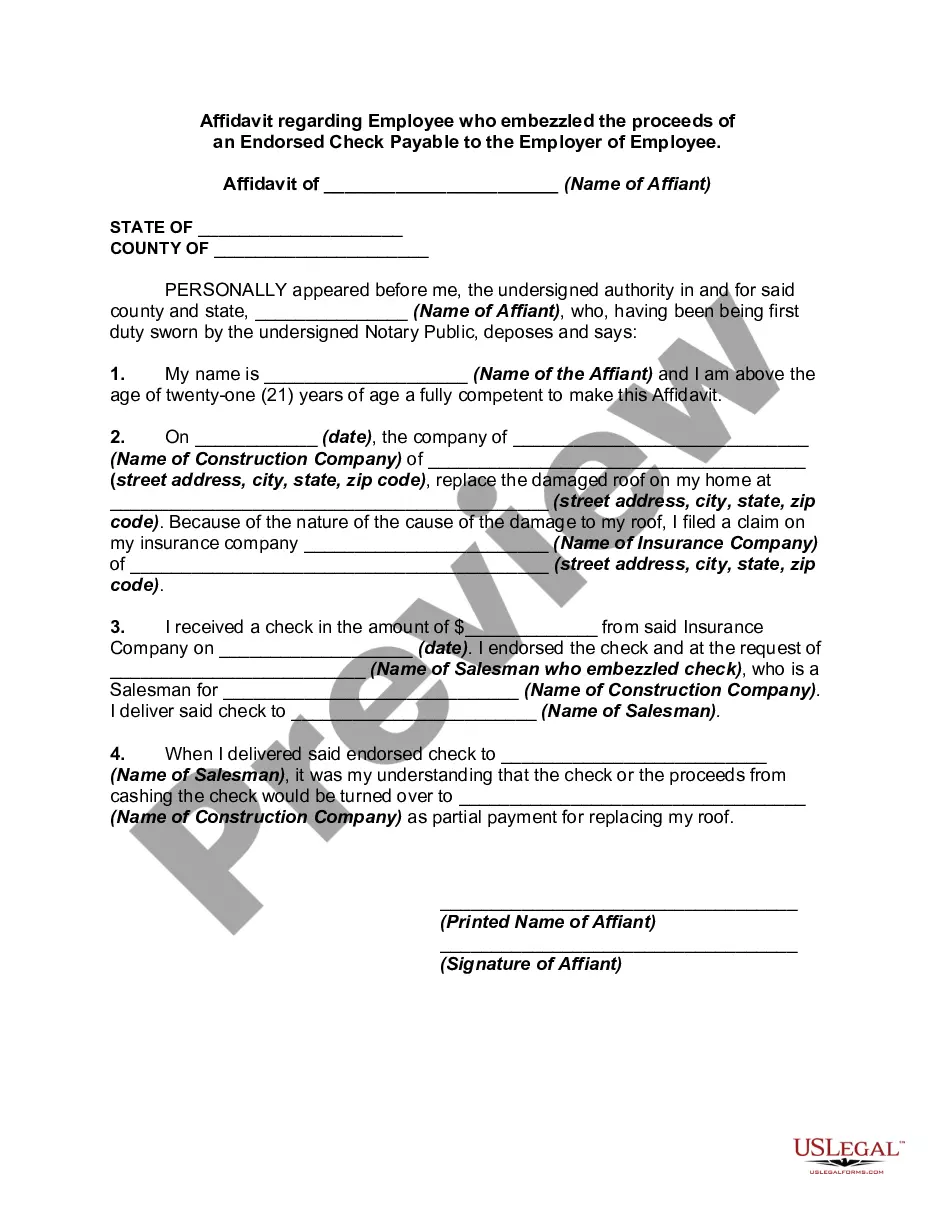

The fraud occurs when the forger erases all inked information except for the signature and changes the payee name to the forger's name. The forger may also increase the amount substantially. This falsified check is then taken to a bank to be cashed.

You generally have 60 days from when you received the bank statement showing the error to notify your bank about the problem.

Forging checks of $250 or less is punishable by up to one year in jail and a $3,000 fine, but when the amount of the check exceeds $250, the penalty increases to up to five years in prison and a $10,000 fine.