Clark Nevada Deed of Trust - Release

Description

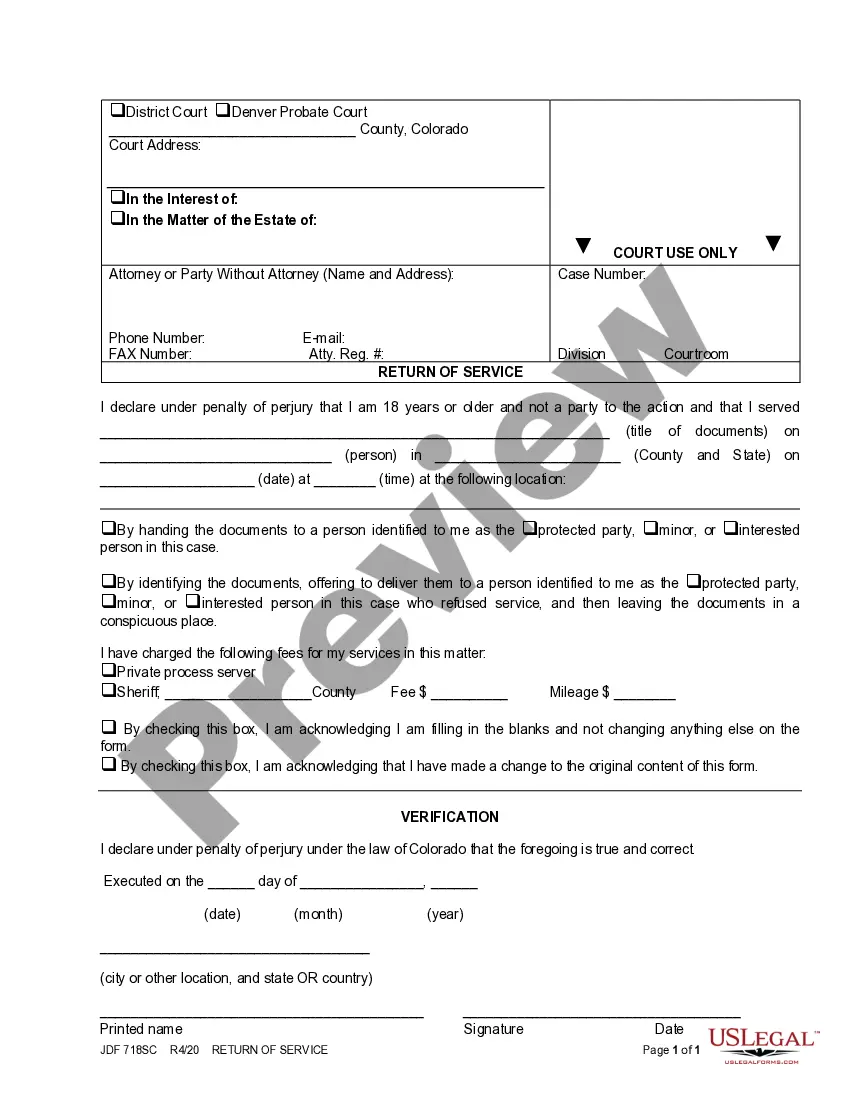

How to fill out Deed Of Trust - Release?

Do you require to swiftly compose a legally-binding Clark Deed of Trust - Release or any other document to oversee your personal or business matters.

You can choose one of two alternatives: engage a professional to create a valid document for you or completely draft it independently. The good news is, there’s another option - US Legal Forms. It will assist you in obtaining well-crafted legal documents without incurring exorbitant costs for legal services.

If the template isn’t what you expected, restart the searching process by using the search bar in the header.

Select the plan that best suits your needs and proceed to payment. Choose the file format you prefer to receive your form in and download it. Print it, complete it, and sign on the designated line. If you have previously created an account, you can simply Log In to it, locate the Clark Deed of Trust - Release template, and download it. To re-download the form, navigate to the My documents tab.

It's straightforward to purchase and download legal forms using our catalog. Additionally, the paperwork we provide is updated by legal professionals, which enhances your confidence when handling legal matters. Try US Legal Forms now and experience it yourself!

- US Legal Forms provides an extensive collection of over 85,000 state-compliant form templates, including Clark Deed of Trust - Release and form bundles.

- We offer documents for various scenarios: from divorce paperwork to real estate forms.

- We have been operating for over 25 years and have established a strong reputation among our clients.

- Here’s how you can join them and acquire the required template without unnecessary complications.

- To begin, carefully check if the Clark Deed of Trust - Release is aligned with your state's or county's statutes.

- If the form contains a description, ensure to review what it is designated for.

Form popularity

FAQ

Filling out a quit claim deed form requires specific information about the property and the parties involved. Start by entering the names of the grantor and grantee, followed by a clear description of the property. Ensure you include the necessary details to facilitate the Clark Nevada Deed of Trust - Release. Using our platform, US Legal Forms, can simplify this process by providing templates and guidance tailored to your needs.

Signing: A quitclaim deed must be signed with a notary public present. Formatting: The notarized deed must include a top cover sheet when it is filed. Recording: The notarized quitclaim deed must be filed with the County Recorder's Office in the county in which the property is located.

Calling our office at (702) 455-4336....Download the Official Records Copy Order Form.Print the order form.Fill out the order form with the appropriate information. Records Search: Locate your document information online.Mail or bring the completed order form and appropriate fees to the Clark County Recorder's Office:

Visit the Recorder of Deeds and ask to file. Take the completed deed to the Recorder of Deeds. Ask if you need to complete any other paperwork. For example, you probably will have to complete a Declaration of Value form. You should be able to complete all required paperwork at the Recorder of Deeds office.

Prepare and Pay Real Property Transfer Tax - The transfer tax is calculated at the rate of $2.55 per $500 of value or a fraction thereof. The transfer tax is based on the full purchase price or the estimated fair market value. Certain transfers are exempt from Real Property Transfer Tax in accordance with NRS 375.090.

Calling our office at (702) 455-4336....Download the Official Records Copy Order Form.Print the order form.Fill out the order form with the appropriate information. Records Search: Locate your document information online.Mail or bring the completed order form and appropriate fees to the Clark County Recorder's Office:

This is called "recording" the deed. When done properly, a deed is recorded anywhere from two weeks to three months after closing.

A conveyance of Nevada real estate must be evidenced by a deed signed by a property owner of lawful age or by the owner's authorized agent or attorney. Nevada law assumes that a deed transfer's the owner's entire interestincluding any water rights or after-acquired titleunless the deed expressly limits the transfer.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

As the buyer of a property, you are the one responsible for recording the deed. Deeds for real estate need to be filed directly with the municipality or county where the property is located. The documents must be signed, witnessed, and notarized in order to be registered.