Bronx New York Deed of Trust - Assignment

Description

How to fill out Deed Of Trust - Assignment?

A document procedure consistently accompanies any legal action you undertake.

Starting a company, applying for or accepting a job offer, transferring ownership, and many other life situations require you to prepare formal documents that vary by state.

This is why having everything gathered in a single location is so essential.

US Legal Forms is the largest online collection of current federal and state-specific legal documents.

This is the simplest and most reliable method to obtain legal documentation. All the templates available in our library are expertly crafted and validated for compliance with local laws and regulations. Organize your documents and handle your legal matters effectively with US Legal Forms!

- Here, you can effortlessly find and acquire a document for any individual or business purpose utilized in your jurisdiction, such as the Bronx Deed of Trust - Assignment.

- Finding forms on the platform is incredibly simple.

- If you already possess a subscription to our library, Log In to your account, search for the sample with the search feature, and click Download to store it on your device.

- Subsequently, the Bronx Deed of Trust - Assignment will be accessible for future use in the My documents section of your profile.

- If you are accessing US Legal Forms for the first time, follow this straightforward guideline to obtain the Bronx Deed of Trust - Assignment.

- Ensure you have reached the correct page with your local form.

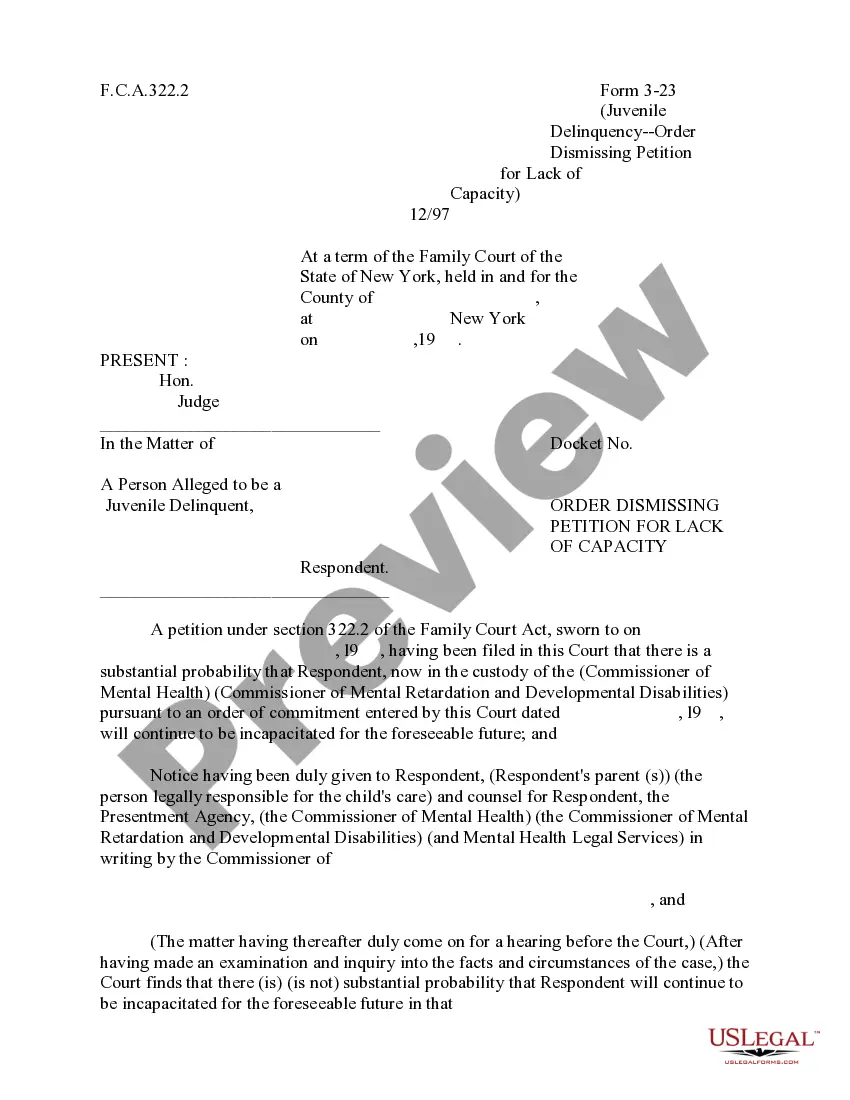

- Utilize the Preview mode (if available) and scroll through the sample.

- Examine the description (if any) to confirm the form meets your requirements.

- Search for another document using the search feature if the sample does not suit you.

- Click Buy Now once you find the required template.

- Choose the suitable subscription plan, then sign in or create an account.

- Select the preferred payment option (either credit card or PayPal) to continue.

- Choose the file format and save the Bronx Deed of Trust - Assignment on your device.

- Use it as necessary: print it or complete it electronically, sign it, and submit where required.

Form popularity

FAQ

Property records are public. People may use these records to get background information on purchases, mortgages, asset searches and other legal and financial transactions.

The fee to file a New York state quit claim deed is unique to each county. However, as of 2018, the basic fee for filing a quit claim deed form ny of residential or farm property is $125, while the fee to file for quitclaim deed NY for all other property is $250.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

In New York, a party must file a real property transfer form to effect a change in home ownership when a deed is filed. The deed is a separate document from the transfer form. Costs that must be paid include the real property transfer tax (RPTT) to the city and the New York state real estate transfer tax to the state.

You can request a certified or uncertified copy of property records dated before 1966 in person. Certified copies cost $4 per page. Uncertified copies printed at a City Register Office cost $1 per page. Visit the City Register Office in the borough where the property is located.

New York Land Records. Select a County to begin your search. The county office which serves the public by recording important documents such as mortgages, contracts, deeds, liens, and mapping plans.

This is called "recording" the deed. When done properly, a deed is recorded anywhere from two weeks to three months after closing.

Search for the Property's Owner on NYCityMap The NYCityMap page can give you information on most properties in New York City. You just need to enter the property's address in the search bar. If the address exists, the map will show you the building's location and information, including the real estate's: Owner.

For counties that are not online, access to recorded documents can be obtained by visiting the County Clerk's office in person, or through phone and mail requests. Search New York State Archives for historical public records including vital records and land records.

In New York, the seller of the property is typically the individual responsible for paying the real estate transfer tax. However, if the seller doesn't pay or is exempt from the tax, the buyer must pay.