Franklin Ohio Promissory Note - Balloon Note

Description

How to fill out Promissory Note - Balloon Note?

Drafting legal documents can be tedious.

Moreover, if you choose to hire an attorney to create a business agreement, ownership transfer documents, prenuptial contract, divorce documentation, or the Franklin Promissory Note - Balloon Note, it may expense you significantly.

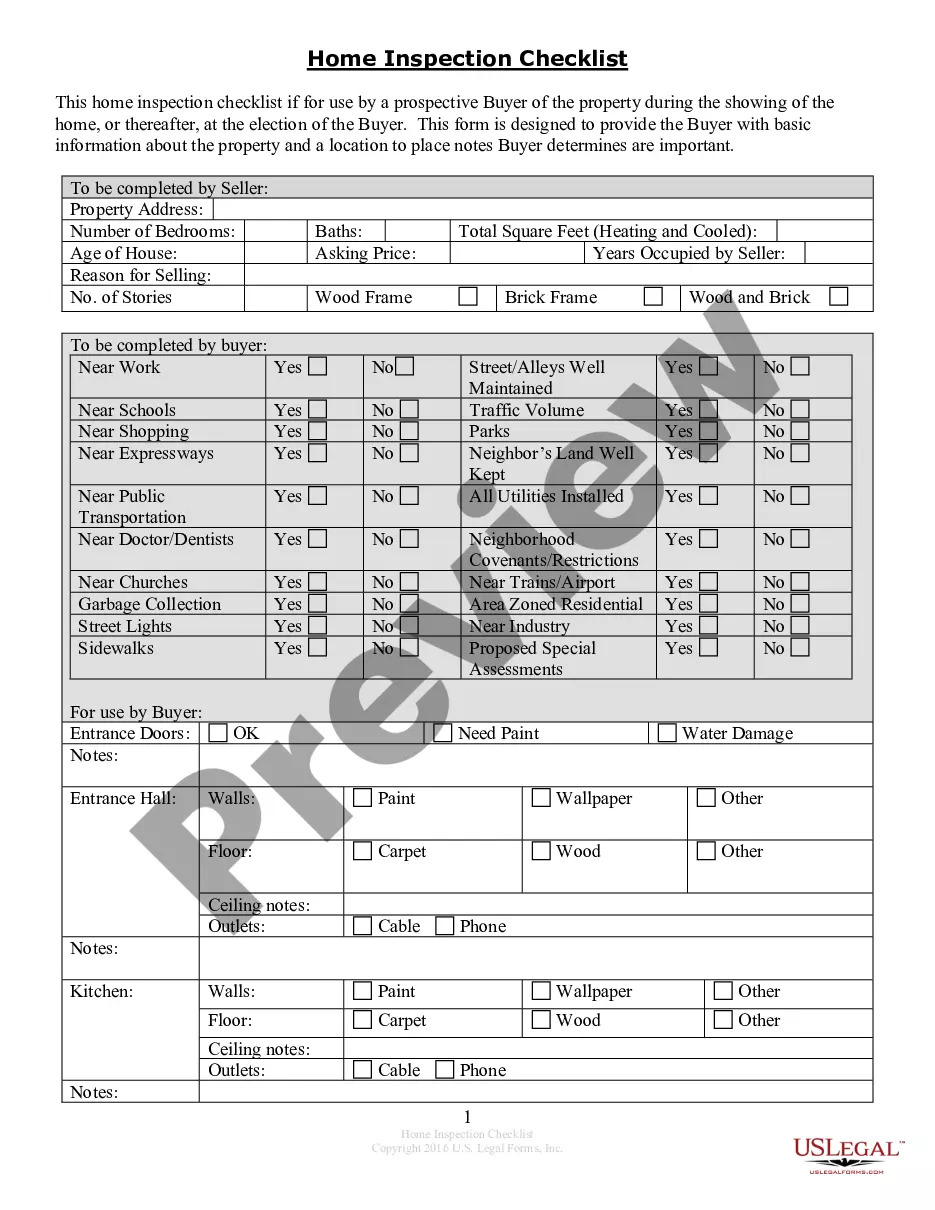

Browse the page and confirm there is a sample for your area. Review the form description and utilize the Preview option, if accessible, to ensure it meets your needs. If the form does not meet your expectations, search for the correct one in the header. Click Buy Now when you find the desired sample and select the most appropriate subscription. Log In or create an account to process your payment. Make a payment with a credit card or via PayPal. Choose the document format for your Franklin Promissory Note - Balloon Note and download it. Once completed, you can print it out and fill it in by hand or upload the samples to an online editor for a quicker and more convenient completion. US Legal Forms allows you to reuse all the documents you have ever obtained multiple times - you can access your templates in the My documents tab in your profile. Try it today!

- What is the most effective method to conserve time and resources while creating valid documents in complete adherence to your state and municipal statutes and regulations.

- US Legal Forms is an ideal answer, whether you seek templates for personal or commercial purposes.

- US Legal Forms is the largest online repository of state-specific legal forms, offering users with current and professionally vetted templates for any scenario accumulated all in one place.

- Thus, if you're in need of the most recent edition of the Franklin Promissory Note - Balloon Note, you can effortlessly find it on our platform.

- Acquiring the documents takes minimal time.

- Users who already possess an account should ensure their subscription is active, Log In, and select the sample with the Download button.

- If you haven't subscribed yet, here’s how you can obtain the Franklin Promissory Note - Balloon Note.

Form popularity

FAQ

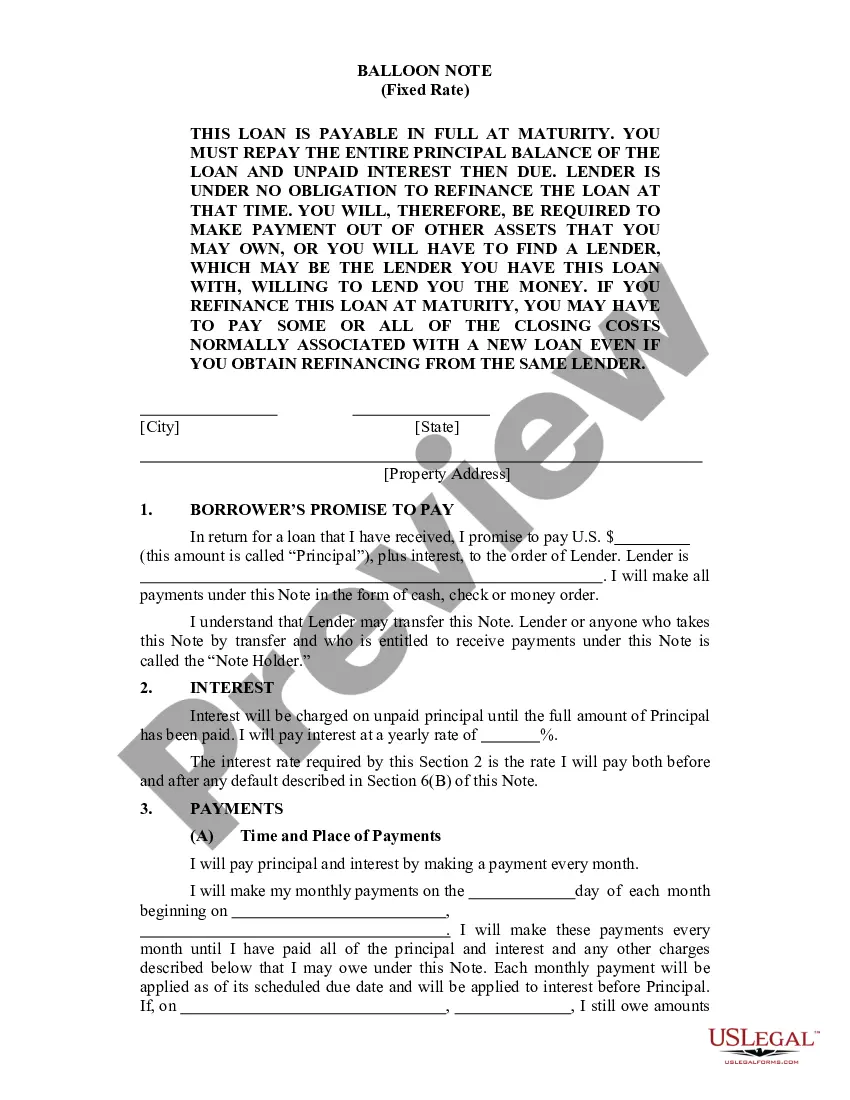

Typically, a balloon payment would represent a percentage of the purchase price of the vehicle. For example, for a car costing R300 000, a 20 % balloon payment would work out at R60 000. This would be paid in one lump sum at the end of the contract period for example 60 months or five years after purchase.

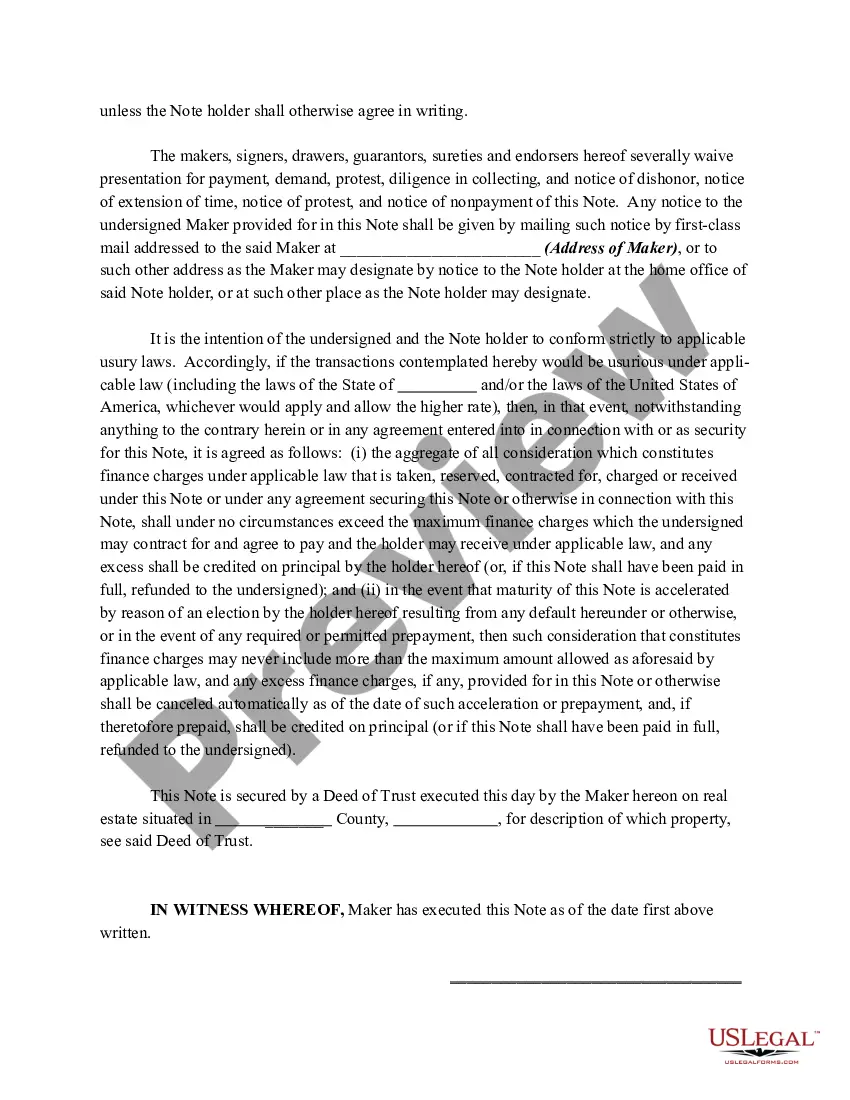

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

Balloon payments allow borrowers to reduce that fixed payment amount in exchange for making a larger payment at the end of the loan's term. In general, these loans are good for borrowers who have excellent credit and a substantial income.

Disadvantages of Balloon Payments People having loans with balloon payments carry a substantial risk as they do not have to pay much of the principal amount; they face a significant financial obligation at the end of the loan period.

A balloon payment is a lump sum that's due at the end of the loan term. It is good because it will: Lower your loan repayments. Allow you to defer payment for part of the total loan amount.

What Is a Balloon Loan. A balloon loan is a type of loan that does not fully amortize over its term. Since it is not fully amortized, a balloon payment is required at the end of the term to repay the remaining principal balance of the loan.

What is a balloon note payment? This is a large payment due at the end of a loan that will pay off the balance. It is often equal to around two times the average monthly payment of the loan. It doesn't matter the amount that is due; you are required to pay the entire balloon payment when it's due.

A balloon payment provision in a loan is not illegal per se. Federal and state legislatures have enacted various laws designed to protect consumers from being victimized by such a loan.

Disadvantages of Balloon Payments Balloon payments can be a big problem in a falling housing market. As house prices decline, the odds of homeowners having positive equity in their homes also drops and they might not be able to sell their homes for as much as they anticipated.

List of the Cons of a Balloon MortgageThere is a significant payment due when the balloon mortgage matures.You will run a higher risk of dealing with a foreclosure.Most lenders do not want to refinance balloon mortgages.The value of your property might go down.Most lenders will not offer a balloon payment today.More items...?