Chicago Illinois Assignment of Money Due

Description

How to fill out Assignment Of Money Due?

Drafting legal paperwork can be challenging. Moreover, if you opt to hire a legal expert to prepare a business contract, documents for property transfer, prenup agreements, divorce documents, or the Chicago Assignment of Money Due, it could prove to be quite expensive.

What is the most efficient method to conserve both time and finances while creating valid forms that fully adhere to your state and local regulations? US Legal Forms is an ideal option, whether you are looking for templates for personal or commercial purposes.

- US Legal Forms boasts the largest online repository of state-specific legal documents, offering users the most current and professionally reviewed templates for any situation all consolidated in one location.

- Therefore, if you require the most recent iteration of the Chicago Assignment of Money Due, you can swiftly locate it on our platform.

- Acquiring the documents takes minimal time.

- Users with existing accounts should verify their subscription's validity, Log In, and select the form using the Download button.

- If you haven't subscribed yet, here's how to obtain the Chicago Assignment of Money Due.

- Browse the page and confirm there is a template for your jurisdiction.

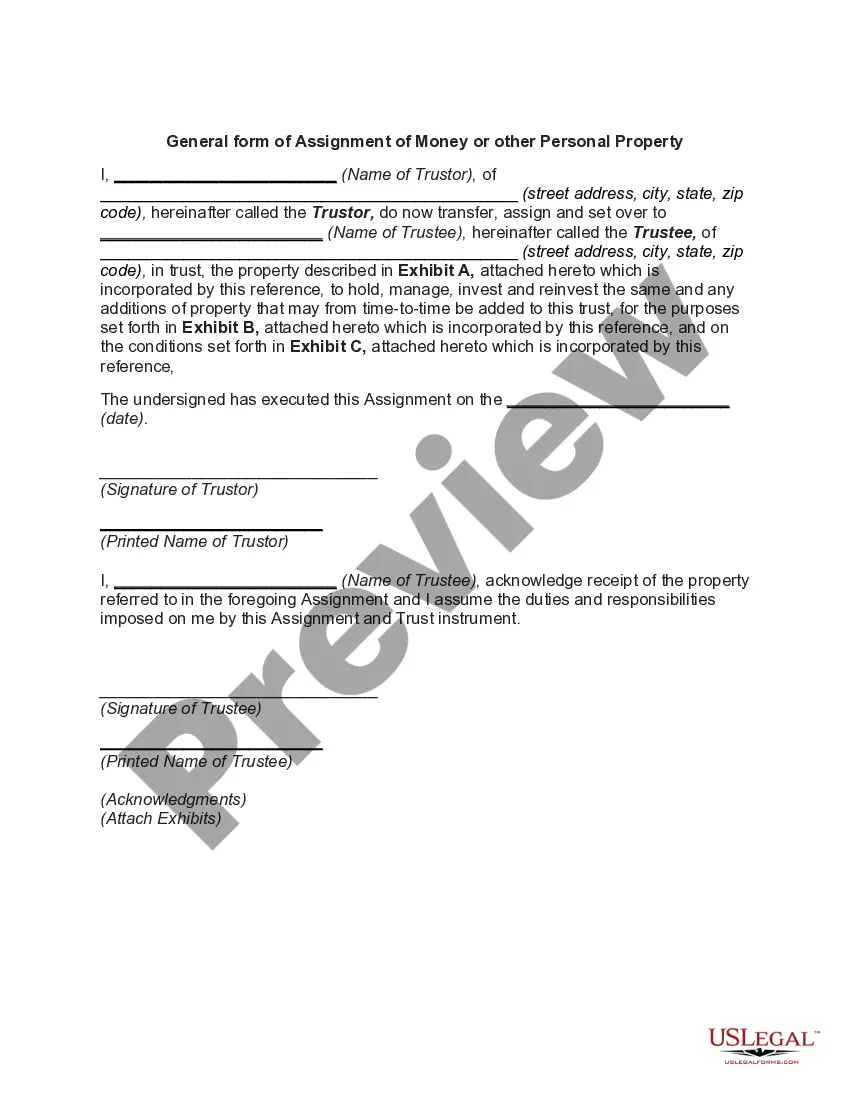

- Review the form description and utilize the Preview option, if accessible, to confirm it is the document you require.

- If the document does not meet your needs, don't hesitate to search for the correct one in the header.

- Click Buy Now once you identify the necessary sample and choose the most appropriate subscription.

- Log in or create an account to complete the payment for your subscription.

- Process the payment using a credit card or through PayPal.

- Select the file format for your Chicago Assignment of Money Due and download it.

- Upon completion, you can print it out and fill it in manually or upload the samples to an online editor for quicker and more efficient completion.

- US Legal Forms allows you to utilize all the documents you've previously obtained repeatedly - access your templates in the My documents section in your profile.

- Give it a try today!

Form popularity

FAQ

File online ? File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail ? You can use Form ST-1 and file and pay through the mail.

The Personal Property Lease Transaction Tax applies to businesses or individuals that either are a lessor or lessee of personal property used in Chicago. Exemptions, Deductions and Credits: The ordinance differentiates between exempt lessees and exempt leases, rentals and uses.

You may submit your change request by completing the Change of Owner Name/Mailing Address Form. If Utility Billing & Customer Service does not have a record of the Full Payment Certificate from your closing, you may be required to provide us with a copy of the deed and/ or full payment certificate.

The City does not impose an income tax on residents or workers in Chicago. All residents of Illinois, including Chicago residents, are subject to State and Federal income taxes.

Sales tax return forms can be downloaded from Federal Board of Revenue (FBR)'s official website i.e. . The next step is to login with your company's user ID and password. A window will appear showing your company's profile and previously submitted return files.

The Department of Finance provides effective and efficient management of the City's financial resources. It is responsible for the collection or disbursement of City revenues and all funds required to be in the custody of the city treasurer.

Effective January 1, 2021, the lease tax rate is 9% for all taxable transactions. In addition, Chicago will begin applying an economic nexus standard to remote vendors starting July 1, 2021. Chicago imposes lease tax on leases/rentals of all property, other than real property, in Chicago.

You can file Form ST-1, Sales and Use Tax and E911 Surcharge electronically using MyTax Illinois to report your sales and use tax liability. If you are reporting sales for more than one location or from a changing location, you must also submit Form ST-2, Multiple Site Form.

Unlike the treatment of SaaS, if the software is electronically delivered and/or housed on the user's computer, it can be subject tax by the State (unless an exemption is available) but not the City (Chicago does not consider this a lease).

In late November, Chicago City Council approved a bump to its tax on nonpossessory computer leases ? meaning cloud services. Effective January 1, 2021, the cloud tax increases from 7.25% to 9%, which is the rate the city taxes other leases or rents.