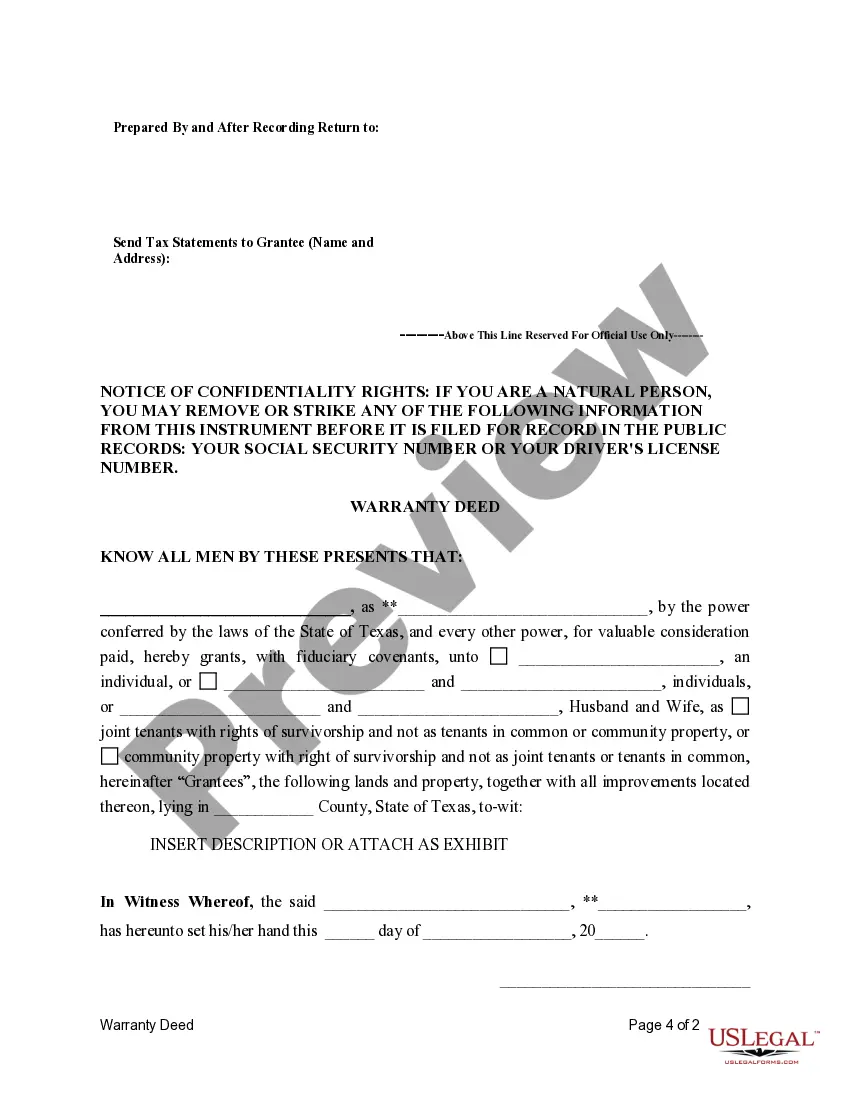

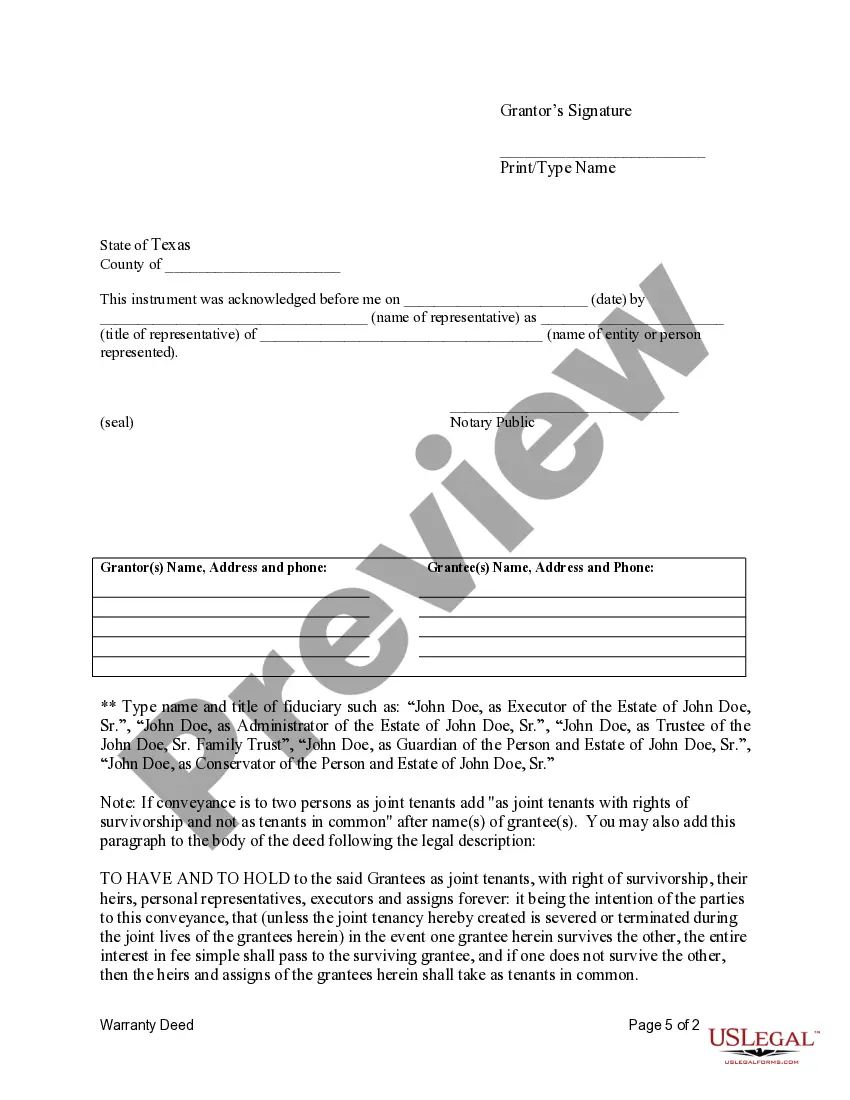

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Fort Worth Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Texas Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Do you require a reliable and cost-effective provider of legal forms to purchase the Fort Worth Texas Fiduciary Deed for utilization by Executors, Trustees, Trustors, Administrators, and other Fiduciaries? US Legal Forms is your ideal option.

Whether you need a simple agreement to establish rules for living together with your partner or a collection of documents to facilitate your divorce through the court system, we have you covered. Our site offers over 85,000 current legal document templates for personal and business purposes. All templates that we offer are not generic and tailored according to the regulations of specific states and regions.

To acquire the form, you must Log In to your account, find the required template, and click the Download button next to it. Please note that you can download your previously purchased form templates at any time from the My documents section.

Is this your first visit to our website? No problem. You can effortlessly set up an account, but before that, ensure to do the following.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal paperwork online once and for all.

- Check if the Fort Worth Texas Fiduciary Deed for utilization by Executors, Trustees, Trustors, Administrators, and other Fiduciaries aligns with the laws of your state and locality.

- Review the form’s description (if available) to understand who it is suitable for and its intended use.

- Restart the search in case the template does not suit your legal needs.

- Now you can establish your account. Then choose the subscription option and proceed to payment. Once the payment is processed, download the Fort Worth Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries in any available format.

- You can revisit the website anytime and redownload the form at no additional cost.

Form popularity

FAQ

The simple answer is no. The executor has the authority to hold the assets for a certain time for safe-keeping before distributing it. But he cannot withhold assets for any selfish benefit. In a few rare situations, the fee of an executor exceeds the value of the estate in which case he will have to take everything.

An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will. It is signed by a court appointed Executor, who is the person named in a will to execute the terms of a Will.

An executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries. They can face legal liability if they fail to meet this duty, such as when they act in their own interests or allow the assets in the estate to decay.

What Are Executor Duties in Texas? Locate and notify all beneficiaries of the will; Give notice to the decedent's creditors; Identify and collect all the decedent's assets; Take steps to maintain and protect the assets; Pay all the decedent's debts; Bring a wrongful death suit, if appropriate, if family members do not;

Protect Yourself as Executor When Facing Estate Litigation Make sure you follow the written wishes of the deceased.Share information with anyone involved in the estate.Document everything that you do for the estate.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

An executor must be impartial. Neither he/she, nor his/her family, friends, may benefit unfairly (for example from the sale of an asset). He/She must carry out the instructions in the will, as well as reasonable instructions of the heirs. Quarrels with heirs should not interfere with his or her duties.

According to the Kentucky Revised Statutes 395.010, it must be completed within 10 years after the person's death. However, it is better to file soon after the person's death and to complete the probate process as quickly as possible.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,