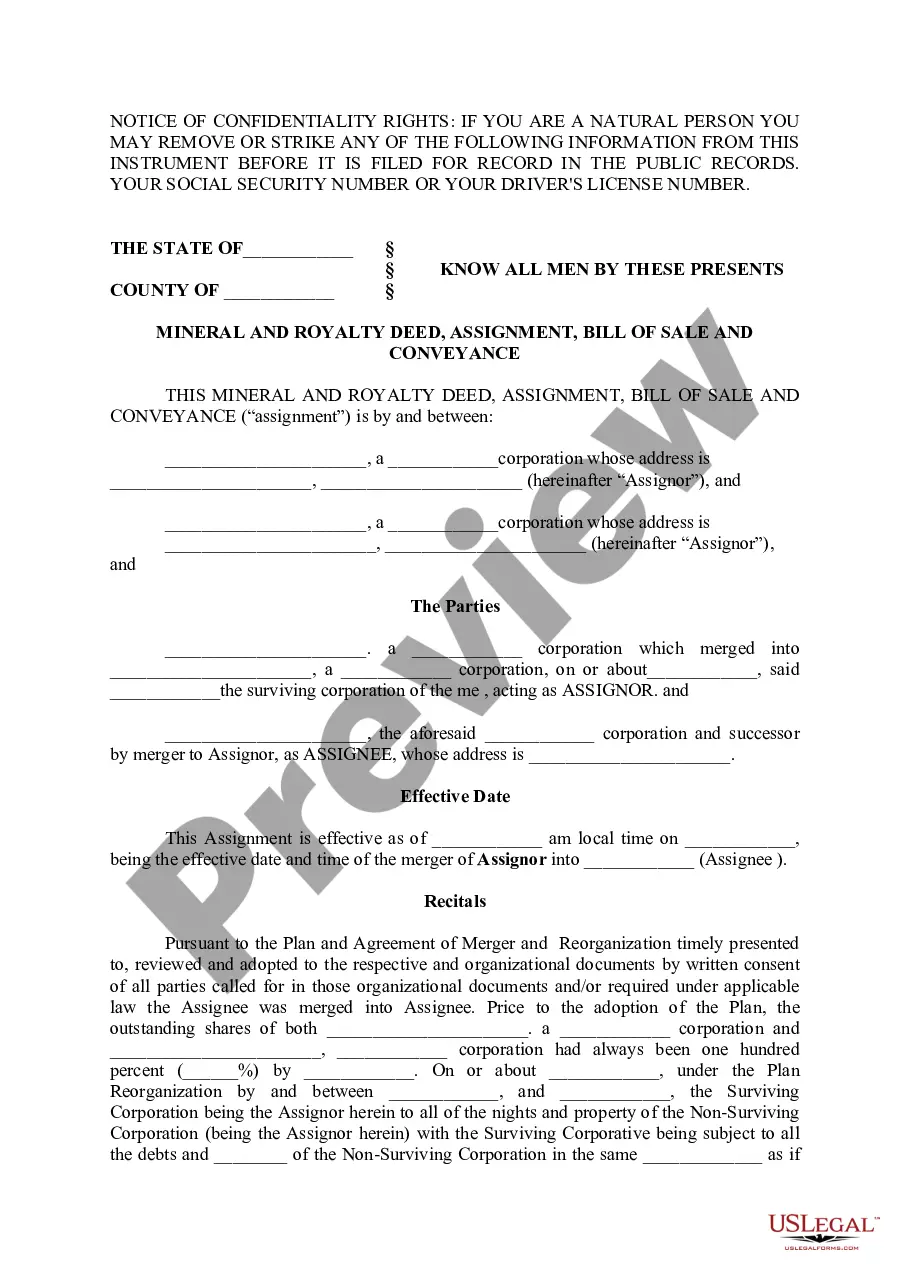

Austin Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance

Description

How to fill out Texas Mineral And Royalty Deed, Assignment, Bill Of Sale And Conveyance?

Do you require a reliable and affordable supplier of legal forms to obtain the Austin Texas Mineral and Royalty Deed, Assignment, Bill of Sale, and Conveyance? US Legal Forms is your best choice.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a collection of forms to facilitate your separation or divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business use. All templates that we provide access to are not generic and are tailored to the needs of specific states and counties.

To obtain the document, you need to Log In to your account, find the required template, and click the Download button adjacent to it. Please remember that you can re-download your previously acquired form templates at any time in the My documents section.

Are you a newcomer to our platform? No need to worry. You can create an account in just a few minutes, but before that, ensure you do the following: Check if the Austin Texas Mineral and Royalty Deed, Assignment, Bill of Sale, and Conveyance meets the guidelines of your state and local area. Review the form’s description (if available) to understand who and what the document is designed for. Start your search anew if the template isn’t suitable for your legal needs.

Give US Legal Forms a try today, and put an end to wasting hours trying to understand legal documents online once and for all.

- Now you can register your account.

- Then choose the subscription option and move forward to payment.

- Once the payment is finalized, download the Austin Texas Mineral and Royalty Deed, Assignment, Bill of Sale, and Conveyance in any available file format.

- You can revisit the website whenever needed and re-download the document without any additional charges.

- Finding current legal forms has never been simpler.

Form popularity

FAQ

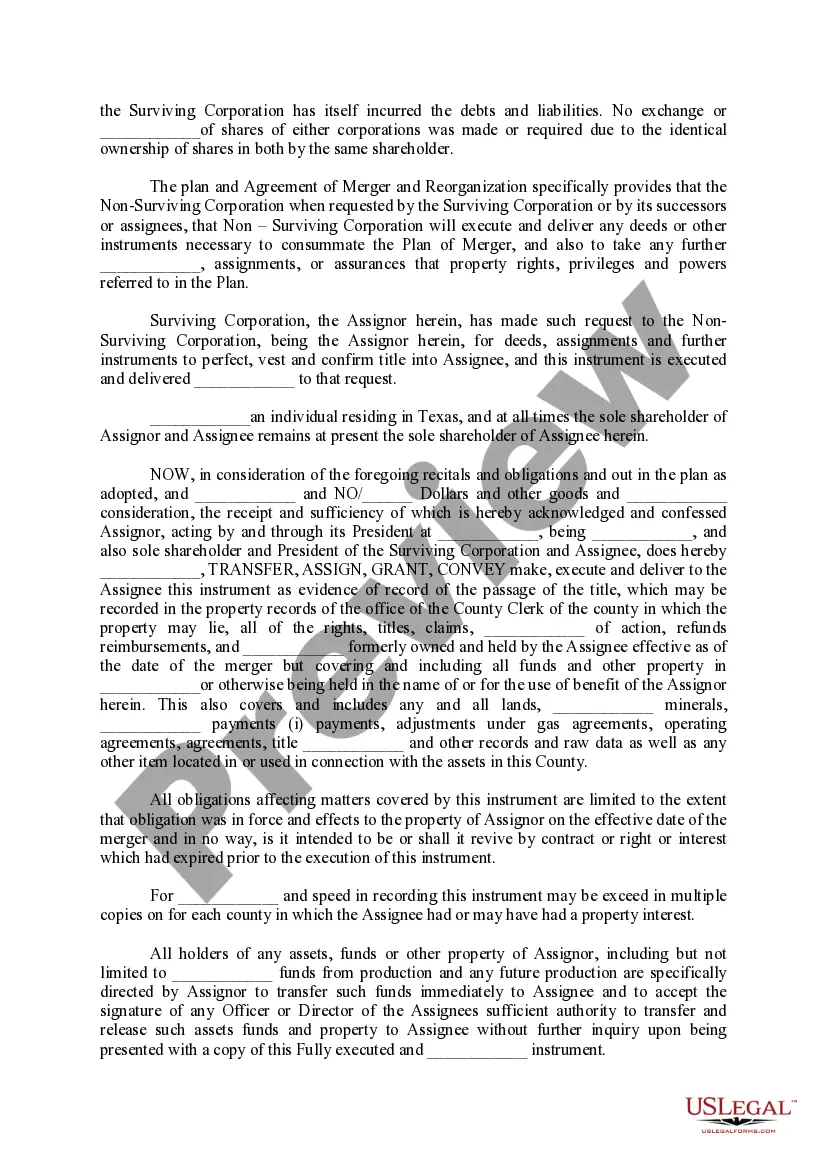

In Texas, Oklahoma, Colorado and Montana, mineral owners can own the mineral rights indefinitely and there is no way for them to passively revert to the surface owner. If a surface owner wants to own the mineral rights under their land, they must find and contact the mineral owners and offer to purchase them.

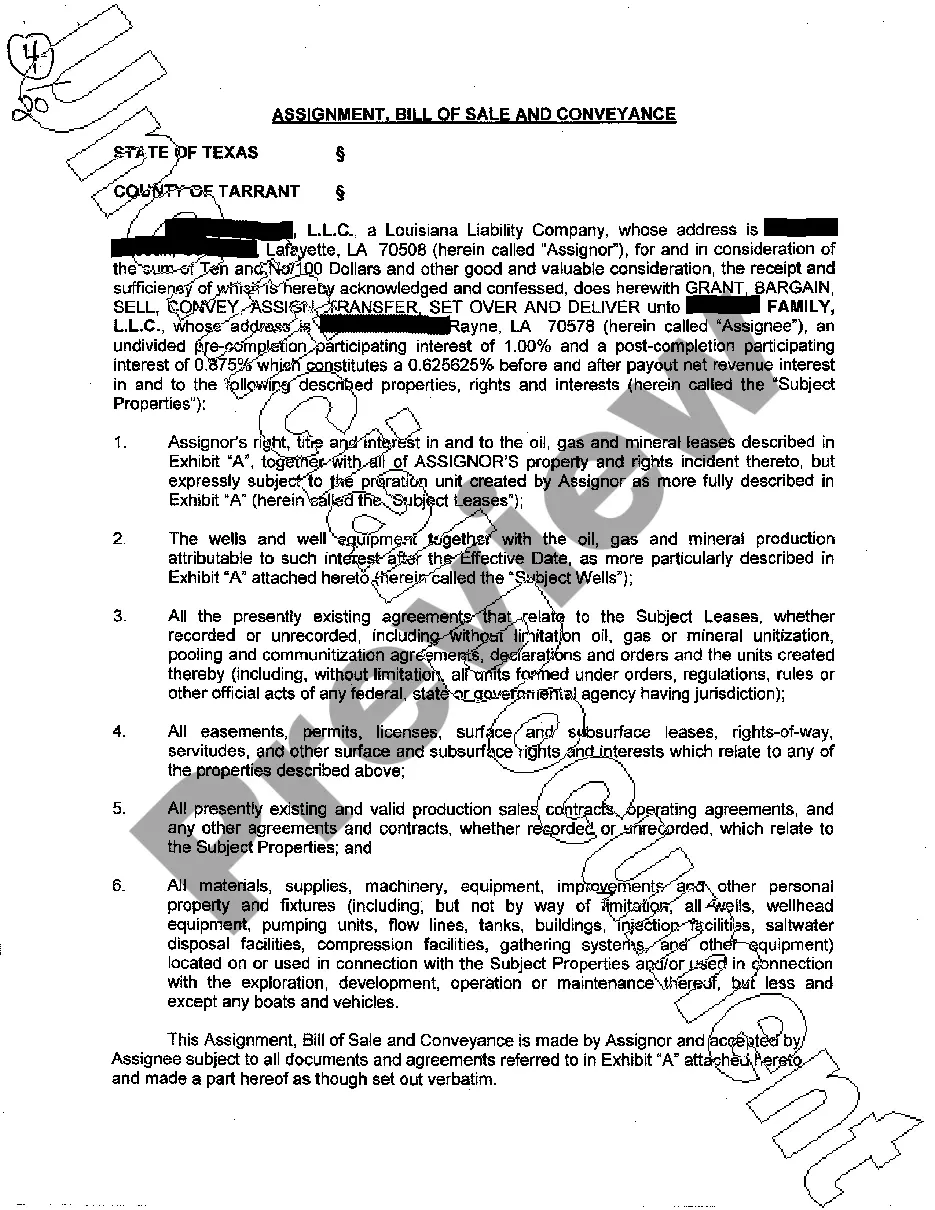

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A ?royalty interest,? on the other hand, is the property interest created that entitles the owner to receive a share of the production.

Call the county where the minerals are located and ask how to transfer mineral ownership after death....They will probably require the following: Copy of the Death Certificate. Copy of the recorded will (or Affidavit of Heirship if there was no will) Probate documents. Completed W9 Form with the new owners' information.

The owner may convey the land but retain the mineral rights through a statement in the deed transferring the land that reserves all mineral rights to the seller. The owner may convey the mineral rights while retaining the land, by which case the seller issues a separate mineral deed to the buyer of the mineral rights.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Like surface interests, mineral interests are passed down by inheritance. If there is a valid will, it controls who gets the property. If not, Texas laws of heirship controls.