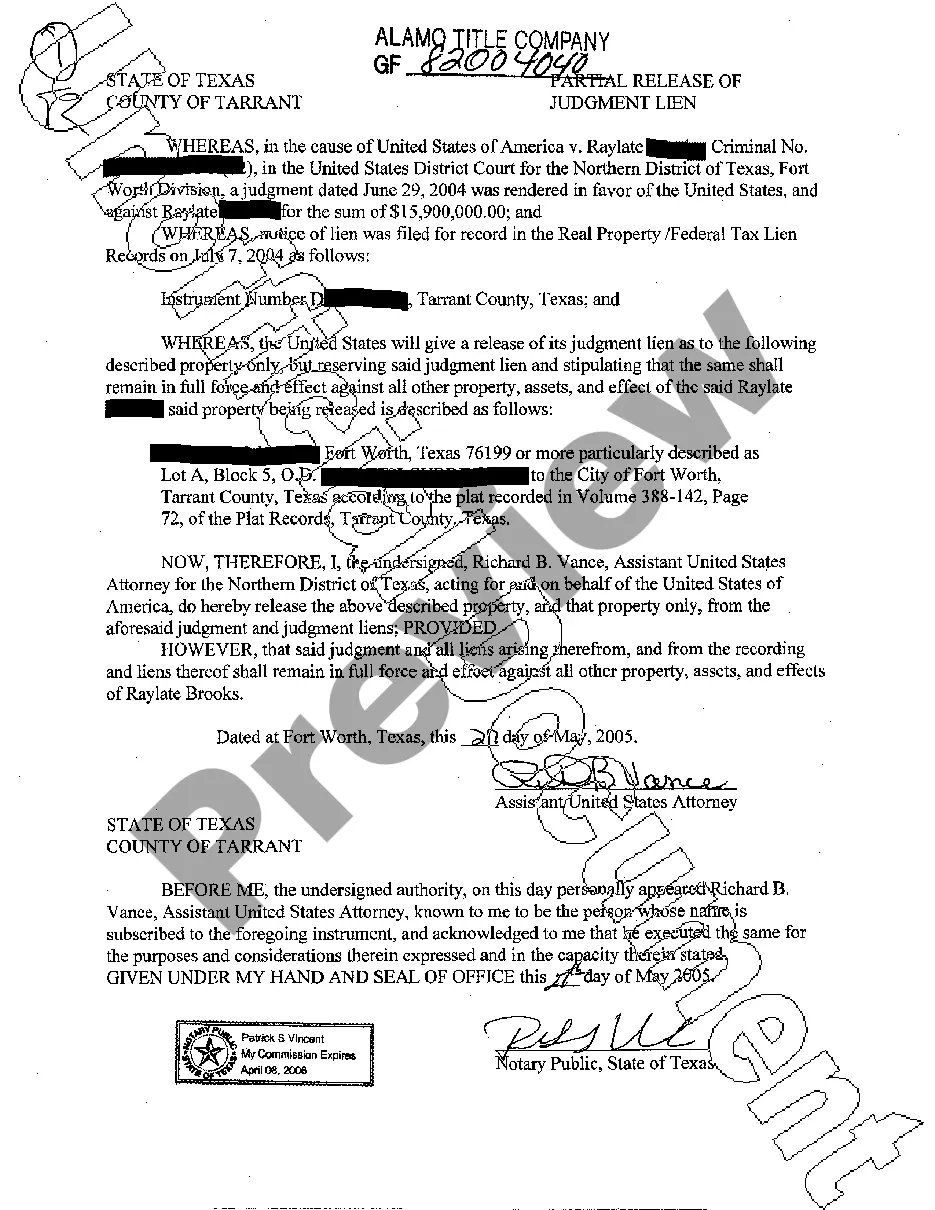

Houston Texas Partial Release of Judgment Lien

Description

How to fill out Texas Partial Release Of Judgment Lien?

If you are looking for a pertinent form template, it’s exceedingly challenging to discover a more user-friendly platform than the US Legal Forms site – one of the most comprehensive repositories on the web.

Here, you can locate countless document samples for business and personal purposes categorized by types and regions, or key terms.

With the sophisticated search feature, acquiring the latest Houston Texas Partial Release of Judgment Lien is as simple as 1-2-3.

Proceed with the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Select the file format and download it to your device. Edit as necessary. Complete, modify, print, and sign the obtained Houston Texas Partial Release of Judgment Lien.

- Moreover, the relevance of every document is verified by a group of experienced attorneys who routinely assess the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Houston Texas Partial Release of Judgment Lien is to Log In to your account and hit the Download button.

- If this is your first time using US Legal Forms, simply adhere to the instructions outlined below.

- Ensure you have located the form you need. Examine its details and utilize the Preview function (if available) to review its content. If it doesn’t satisfy your needs, employ the Search field at the top of the page to find the suitable document.

- Validate your selection. Click on the Buy now button. Then, choose your desired subscription plan and enter your details to register for an account.

Form popularity

FAQ

Filing a Judgment Lien A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

There is no removal procedure for such liens other than entering into a payment arrangement with the taxing authority. The existence of a judgment lien or other type of lien is usually discovered when a title company checks the property records and produces a title commitment in anticipation of a sale or refinance.

The statutes of limitation for collecting (or foreclosing) on both the vendor's lien and deed of trust is four years in Texas. If no legal action has been filed for collection on the liens for four years after the liens ma- ture, there is indication the liens have been paid.

Three commons ways to fight a false lien are to: immediately dispute the lien through statutorily provided preliminary means, a demand to/against the claimant, or a full-blown lawsuit. force the claimant to file a lawsuit to enforce the lien in a shorter period if available where you live. just wait it out.

When a Texas mechanics lien has been paid and satisfied, the claimant must file a release of lien within 10 days after receiving a request for the release of the claim. However, there is no penalty provided by the statute. That doesn't mean that there are no consequences for failing to release it on time.

After the lien on a vehicle is paid off, the lienholder has 10 business days after receipt of payment to release the lien. If the lien was recorded on a paper title, the lienholder mails the title to you.

A release of a portion of real property from the lien of a deed of trust securing a loan on commercial real property in Texas. Lenders in Texas customarily use a partial release of lien to discharge a deed of trust lien against some but not all of the borrower's real property.

Add or Remove a Lien on a Vehicle To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

According to this law, a debtor must file an affidavit with the county to secure the release of a judgment lien against a primary residence. The debtor must first provide a 30-day notice letter to the creator of the judgment, containing a copy of the affidavit the debtor intends to file.

It's done by filing an abstract of judgement with the county you live in. You would have a very difficult time selling any property that has a lien like this on it. You can get a partial release of a lien that resulted due to a judgement against you in Texas if the property is a homestead.