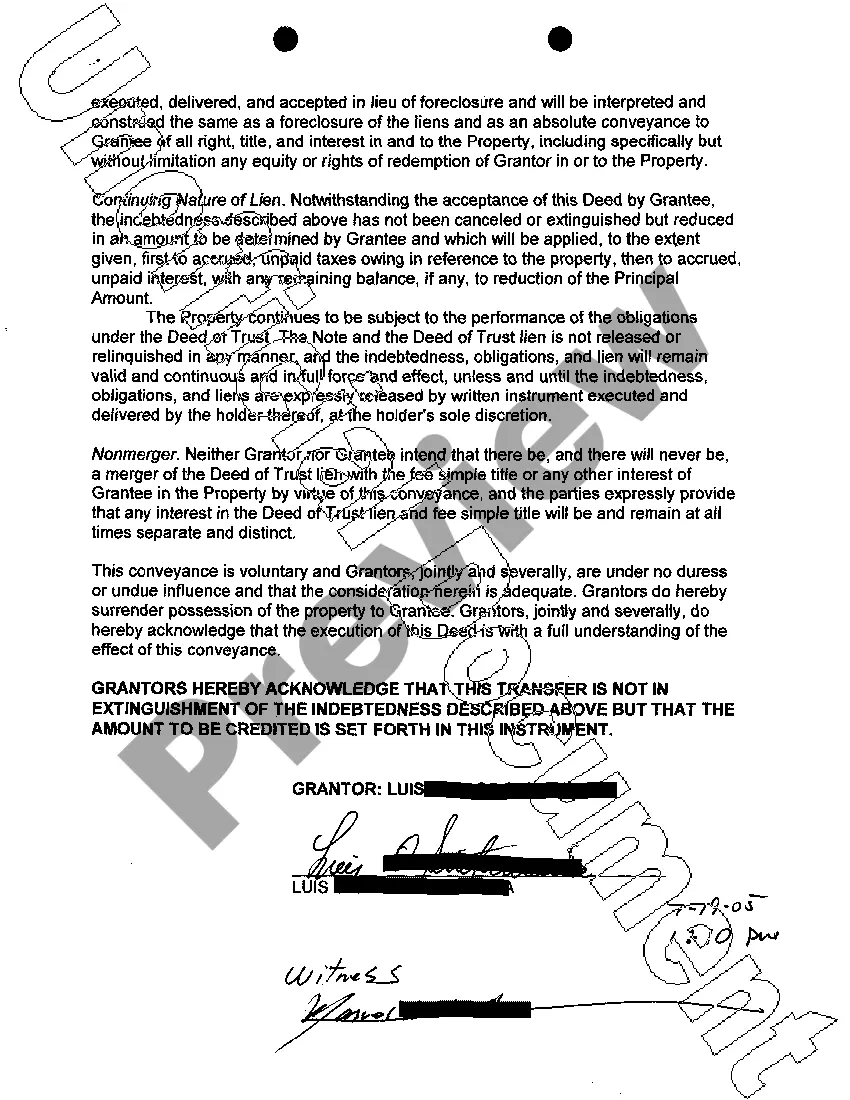

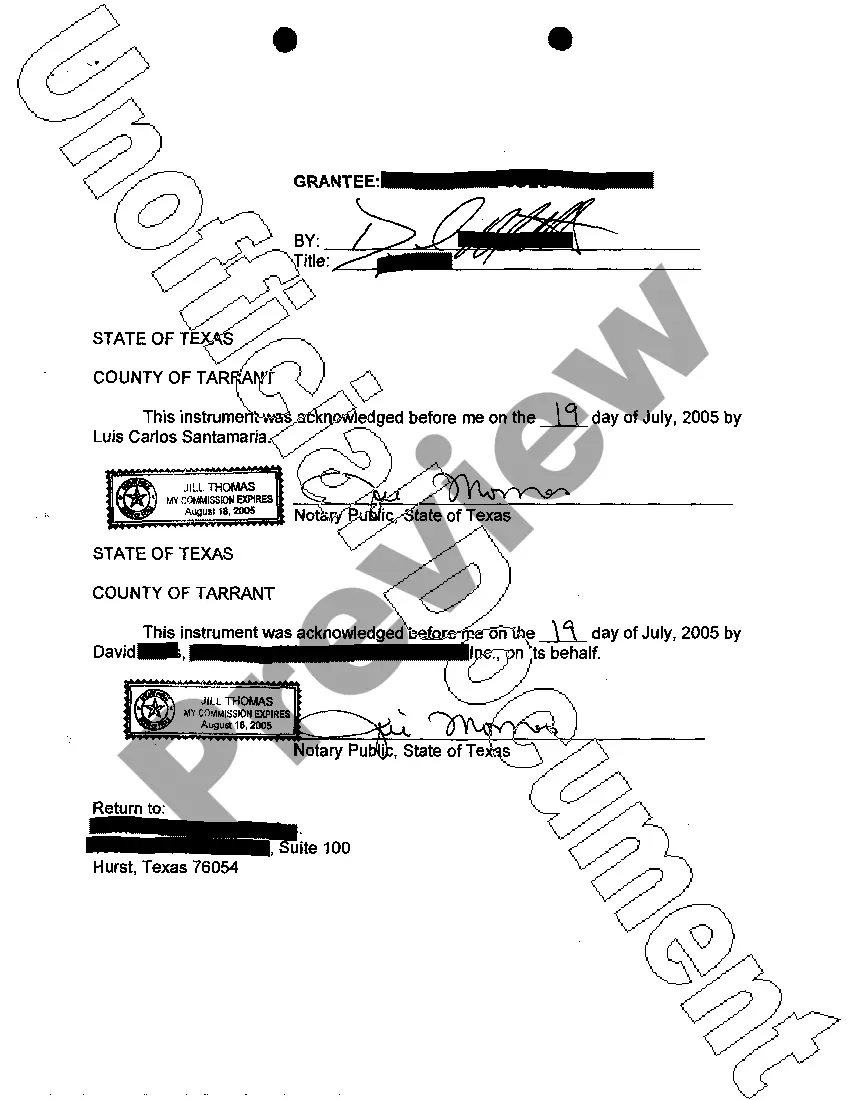

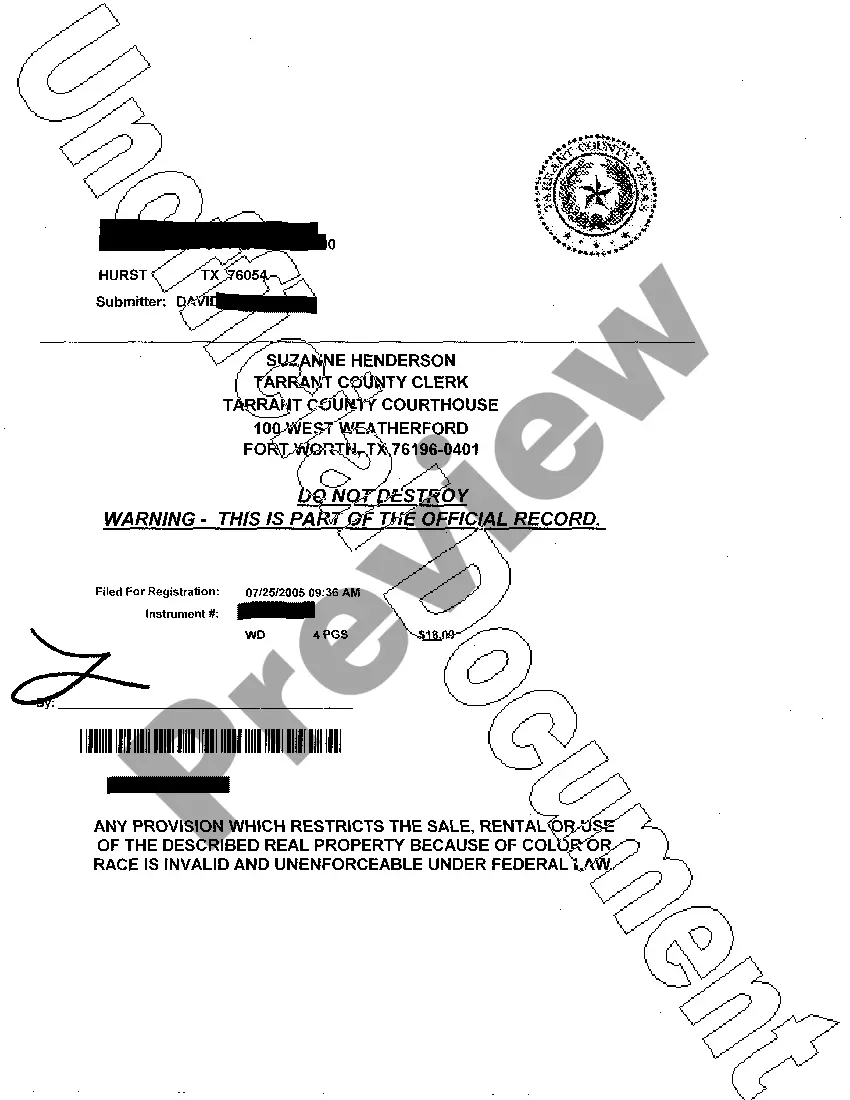

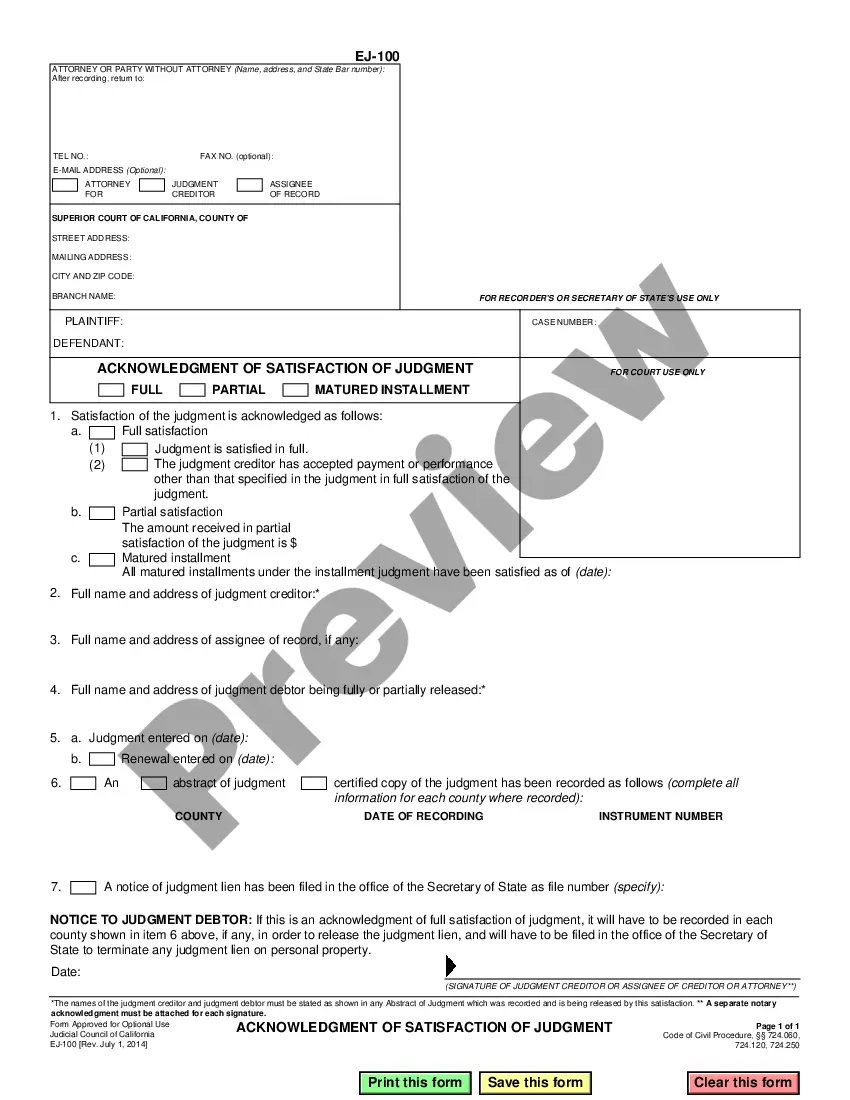

Round Rock Texas Deed in Lieu of Foreclosure

Description

How to fill out Texas Deed In Lieu Of Foreclosure?

Utilize the US Legal Forms and gain instant access to any document you need.

Our valuable website containing thousands of files streamlines the process of locating and acquiring nearly any document sample you might require.

You can download, fill out, and sign the Round Rock Texas Deed in Lieu of Foreclosure in just minutes instead of searching the web for hours trying to find a suitable template.

Leveraging our collection is an excellent way to enhance the security of your record submissions. Our experienced legal experts routinely verify all documents to ensure they are suitable for a specific region and compliant with updated laws and regulations.

If you haven't created an account yet, follow the steps below.

- How can you obtain the Round Rock Texas Deed in Lieu of Foreclosure.

- If you hold a subscription, simply Log In to your account. The Download button will appear on any sample you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

Filing a Round Rock Texas Deed in Lieu of Foreclosure involves several key steps. First, you must contact your lender to discuss your intentions and obtain their approval. Then, you will need to fill out the necessary documents and make sure all requirements are met, which can be streamlined with the help of services like uslegalforms. They provide the tools and resources you need to complete this process efficiently.

A Round Rock Texas Deed in Lieu of Foreclosure does impact your credit score, but usually less severely compared to a foreclosure. You can expect a decrease in your credit score by 100 to 150 points. However, the long-term effects depend on how you manage your finances post-deed in lieu. Taking proactive steps can help you recover more quickly than you might anticipate.

The timeframe for a Round Rock Texas Deed in Lieu of Foreclosure can vary, typically ranging from a few weeks to several months. The process depends on factors such as the lender's policies, the condition of the property, and the negotiation between parties. However, generally, it is faster than a foreclosure process. Understanding the specific timelines can help you plan accordingly.

Lenders may accept a Round Rock Texas Deed in Lieu of Foreclosure to avoid the lengthy and costly foreclosure process. This option allows them to recoup some of their investment more quickly and efficiently. Additionally, it helps them maintain the property rather than deal with it as a vacant asset. Accepting the deed can be a win-win, providing relief for both the borrower and the lender.

Yes, you can buy a house after a deed in lieu of foreclosure, although there are some factors to consider. Typically, you may need to wait a certain period before being eligible for a new mortgage. Lenders often want to see improvements in your credit score, so taking steps to rebuild your financial standing is essential. If you're interested in understanding this process better, the US Legal Forms platform provides resources to guide you through buying a home post-round rock Texas deed in lieu of foreclosure.

To file a deed in lieu of foreclosure, you'll need to first negotiate and reach an agreement with your lender. Once accepted, you should prepare the necessary paperwork, including a deed transfer document, and ensure it complies with Texas law. A service like USLegalForms can guide you in creating compliant documents for a Round Rock Texas deed in lieu of foreclosure.

Several factors might prevent a lender from accepting a deed in lieu of foreclosure, including the existence of multiple liens on the property or a lack of equity. Lenders may also be hesitant if the property is in poor condition or if they believe a foreclosure would yield better financial results. Therefore, homeowners must address these issues when pursuing a Round Rock Texas deed in lieu of foreclosure.

One disadvantage of a deed in lieu foreclosure for homeowners is that it can negatively impact their credit score, similar to a foreclosure. Although it may cause less damage than an outright foreclosure, it still reflects poorly on a homeowner’s credit history. Understanding this consequence is essential for anyone considering a Round Rock Texas deed in lieu of foreclosure.

A major disadvantage for lenders accepting a deed in lieu of foreclosure is the potential loss they may face if the property's value is less than the mortgage balance. This situation may lead to financial losses for the lender, especially if they cannot resell the property quickly. Therefore, the lender must carefully assess each case of Round Rock Texas deed in lieu of foreclosure.

No, a lender is not obligated to accept a deed in lieu of foreclosure in Texas. They will evaluate your financial situation and the property's condition before making a decision. However, many lenders are open to this option as it can be less costly than going through a formal foreclosure process.