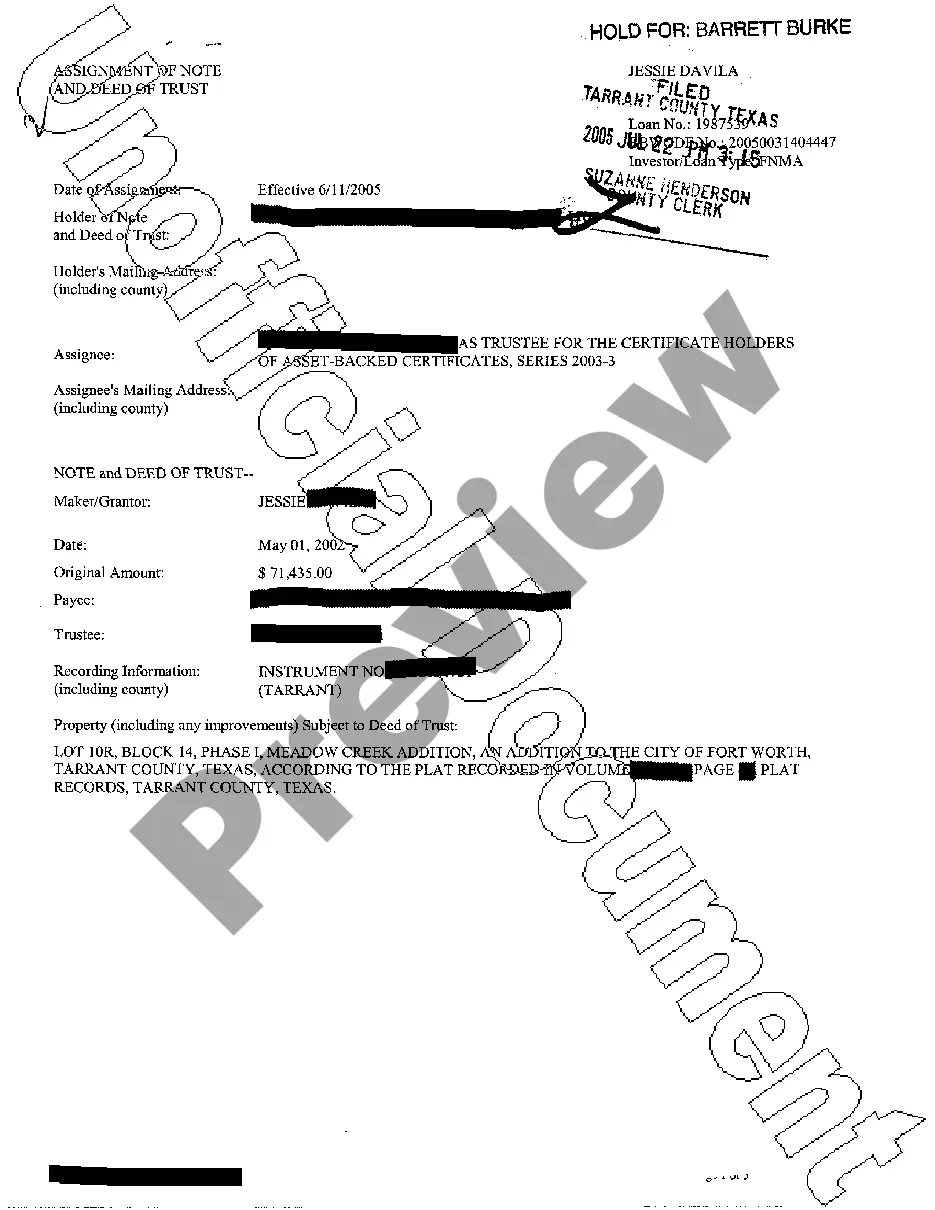

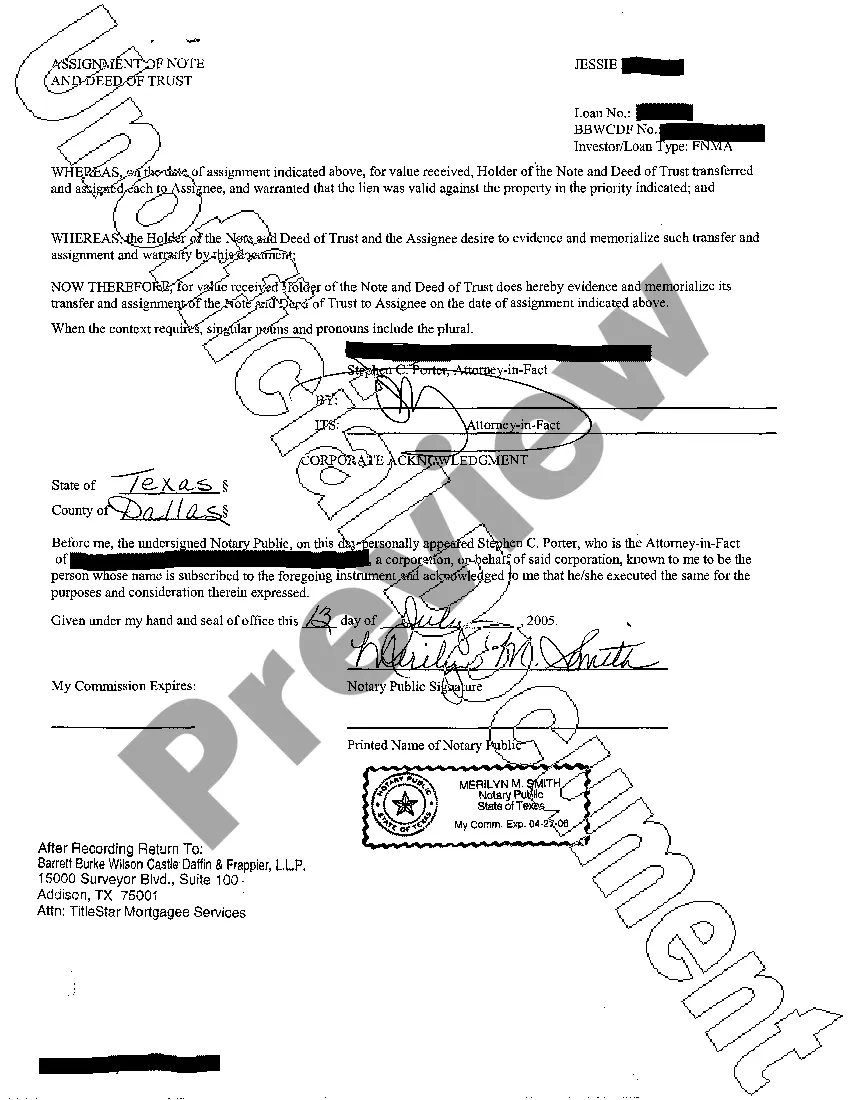

The Bexar Texas Assignment of Note and Deed of Trust is a legal document that pertains to real estate transactions in Bexar County, Texas. It involves the transfer of a promissory note (a written promise to repay a loan) and a deed of trust (a document that secures the loan with the property as collateral) from one party to another. This assignment is typically used when a lender decides to sell or transfer the rights to a loan or when the borrower refinances their mortgage and a new lender takes over. By assigning the note and deed of trust, the original lender transfers all their rights, title, and interest in the loan to the assignee. The Bexar Texas Assignment of Note and Deed of Trust is a crucial legal instrument in ensuring that the property's title remains clear and that the new lender or assignee becomes the rightful beneficiary of the loan. It is important to note that this document must be executed accurately, following the appropriate legal procedures, and recorded in the county's official records to ensure its validity and enforceability. There are different types of Bexar Texas Assignments of Note and Deed of Trust depending on the specific circumstances of the transaction. Some common types include: 1. Assignment of Note and Deed of Trust for Sale: In this scenario, the original lender may decide to sell the promissory note and deed of trust to another lender, which allows them to free up capital and transfer the risk associated with the loan. 2. Assignment of Note and Deed of Trust for Refinancing: When a borrower decides to refinance their mortgage with a new lender, an assignment is executed, transferring the note and deed of trust from the original lender to the new lender. 3. Assignment of Note and Deed of Trust with Assumption: In some cases, a borrower may want to transfer their loan obligation to a new buyer. In this situation, the assignment document would reflect the assumption of the note and deed of trust by the new borrower. 4. Assignment of Note and Deed of Trust with Modification: If there are changes to the terms of the loan, such as interest rate adjustments or loan term extension, the assignment document may include modifications made to the original agreement. It is essential to consult with a qualified real estate attorney or lender to ensure that the Bexar Texas Assignment of Note and Deed of Trust accurately reflects the intentions of the parties involved and complies with all applicable laws and regulations. Proper execution and recording of this document provide protection and clarity in real estate transactions within Bexar County, Texas.

Bexar Texas Assignment of Note and Deed of Trust

Description

How to fill out Bexar Texas Assignment Of Note And Deed Of Trust?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any legal background to draft such papers cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive catalog with over 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you need the Bexar Texas Assignment of Note and Deed of Trust or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Bexar Texas Assignment of Note and Deed of Trust in minutes employing our trusted service. In case you are already an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are unfamiliar with our platform, make sure to follow these steps before obtaining the Bexar Texas Assignment of Note and Deed of Trust:

- Ensure the template you have chosen is suitable for your area since the rules of one state or area do not work for another state or area.

- Preview the form and go through a brief description (if available) of cases the paper can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and choose the subscription plan you prefer the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment method and proceed to download the Bexar Texas Assignment of Note and Deed of Trust once the payment is completed.

You’re all set! Now you can go on and print the form or fill it out online. Should you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged.

§ 13.002). The Texas Property Code requires additional information to record a deed, including that the deed must: Be acknowledged or sworn to by the grantor before two credible witnesses, or a notary public, who also sign(s) the document (Tex. Prop.

Deed Copies To request a copy in person, visit the Bexar County Clerk's Deed Records Department in the Paul Elizondo Tower. To request a copy by mail, send the request to the County Clerk's Office in the courthouse. The fee is $1 per page and $5 per certification.

Purchase paper copies of documents without the unofficial watermark in person at any Annex Location. by fax: (713) 437-4868. by email to: ccinfo@cco.hctx.net. by mail to: Teneshia Hudspeth, Harris County Clerk. Attn: Information Department. P.O. Box 1525. Houston, TX. 77251. For Questions Call (713) 274-6390.

Despite the amounts involved, it is possible to transfer ownership of your property without money changing hands. This process can either be called a deed of gift or transfer of gift, both definitions mean the same thing. Executing a deed of gift can be a complex undertaking, but it isn't impossible.

You can do this through a transfer of equity. This is where a share of equity is transferred to one or multiple people, but the original owner stays on the title deeds. You'll need a Conveyancing Solicitor to complete the legal requirements for you in a transfer of equity.

The county clerk will charge a recording fee of about $30 to $40, depending on the county. The fee should be paid by a cashier's check or money order. Once a Deed has been recorded by the county clerk, the clerk's office will return the Deed to the new owner.

§ 13.002). The Texas Property Code requires additional information to record a deed, including that the deed must: Be acknowledged or sworn to by the grantor before two credible witnesses, or a notary public, who also sign(s) the document (Tex. Prop.

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).Create a new deed.Sign and notarize the deed.File the documents in the county land records.

The most common way of property transfer is through a sale deed. A person sells a property to another person, and then a sale deed is executed between the two parties. Once the sale deed is enlisted in sub-registrar office, the ownership gets transferred to the new owner.

Interesting Questions

More info

The homestead is only considered the primary residence for the purposes of administering homestead exemptions under Title 4, section The homestead exemption is applied to a homestead only if the homestead is the primary residence of the owner for the entire time it is owned in Texas. How can my homestead exemption be removed? The homestead exemption is only withdrawn when the owner dies and can only be removed by filing a Notice of Withdrawal Form with the Texas Office of the State Cleric. The homestead exemption of an owner of a property that is vacant or abandoned at the owner's death is not protected by the homestead exemption law. The property can still be claimed on the death or dissolution of the ownership of the property, but the owner is not protected by the homestead exemption law. The owner may wish to request the probate court to appoint the property guardian against any probate estate. The law does not require a probate court to appoint a property guardian.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.