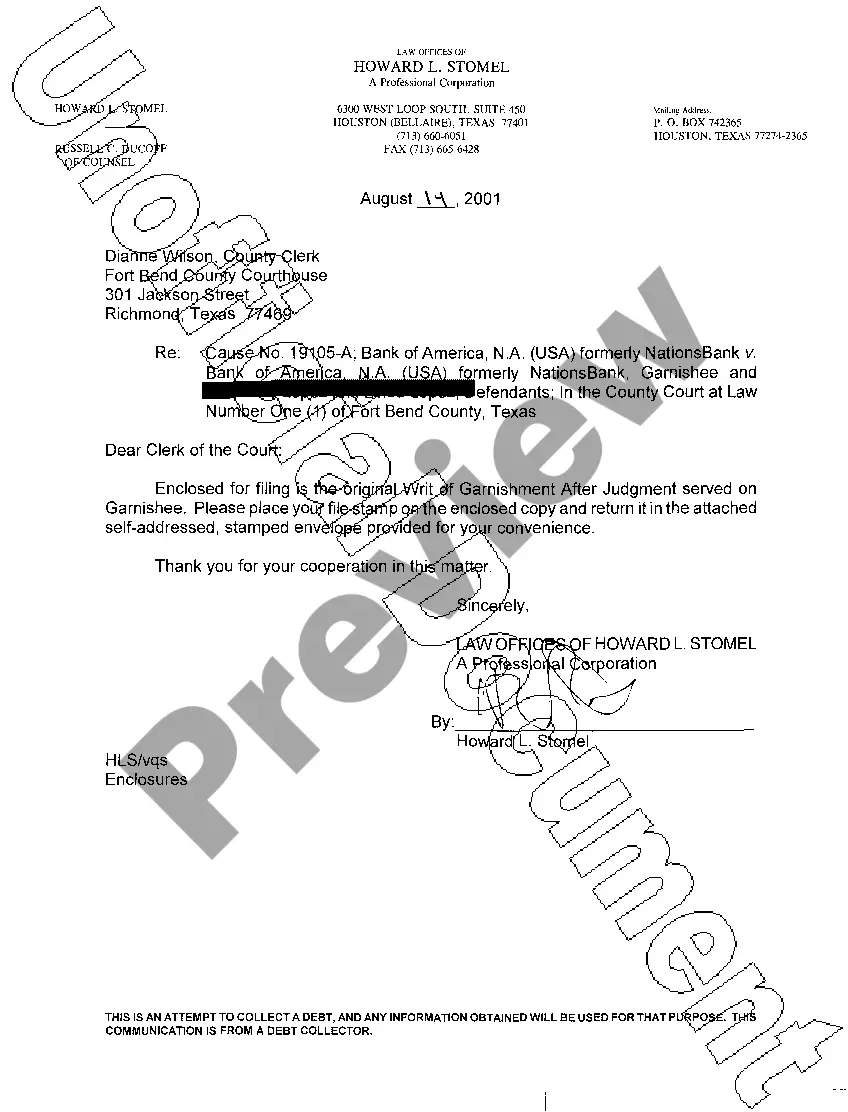

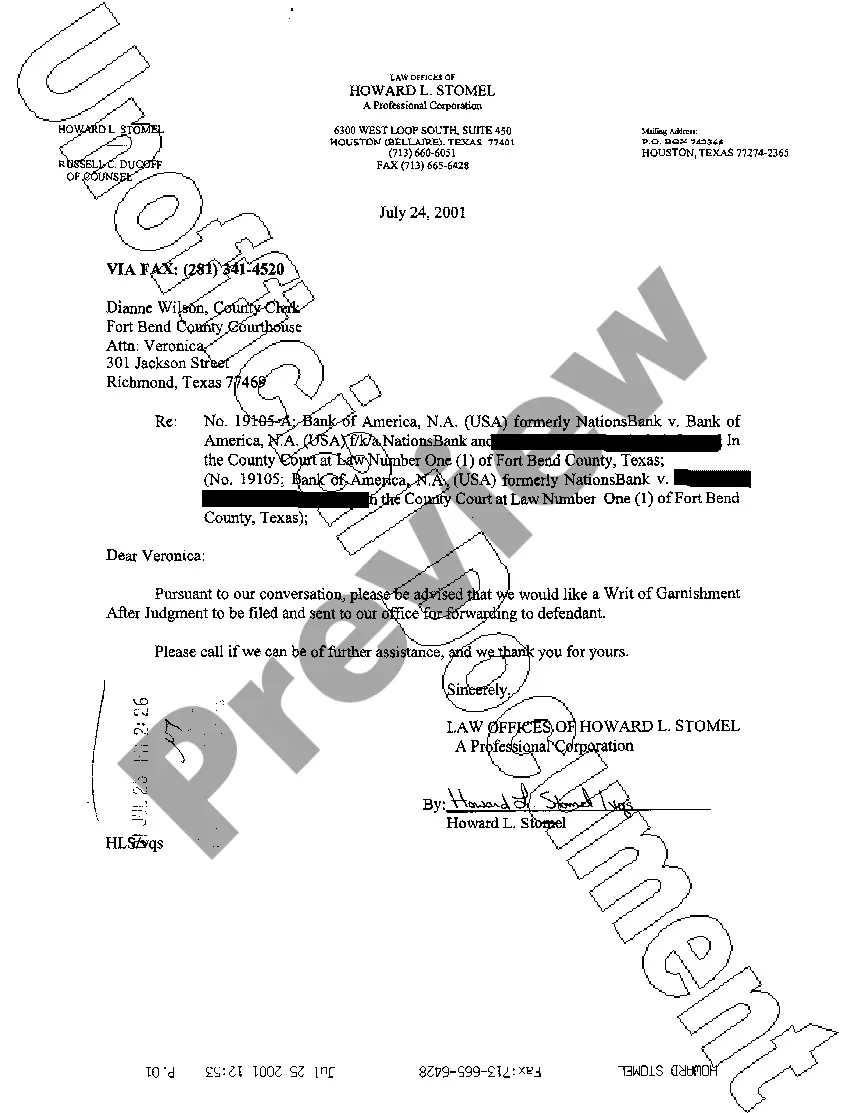

Fort Worth Texas Writ of Garnishment

Description

How to fill out Texas Writ Of Garnishment?

Take advantage of the US Legal Forms and gain immediate access to any document you need.

Our user-friendly website featuring thousands of papers enables you to locate and acquire nearly any document template you desire.

You can export, fill out, and sign the Fort Worth Texas Writ of Garnishment within minutes instead of spending hours online searching for the appropriate template.

Utilizing our directory is an excellent method to enhance the security of your form submission.

If you haven’t registered for an account yet, follow the steps outlined below.

US Legal Forms is one of the largest and most reliable document repositories online. Our team is always available to assist you with virtually any legal procedure, even if it is just downloading the Fort Worth Texas Writ of Garnishment.

- Our experienced legal experts routinely assess all documents to ensure that the templates are applicable to a specific state and adhere to new regulations and laws.

- How can you access the Fort Worth Texas Writ of Garnishment.

- If you possess an account, simply Log In to your account.

- The Download button will be visible on all the samples you examine.

- Additionally, you can retrieve all previously saved documents in the My documents section.

Form popularity

FAQ

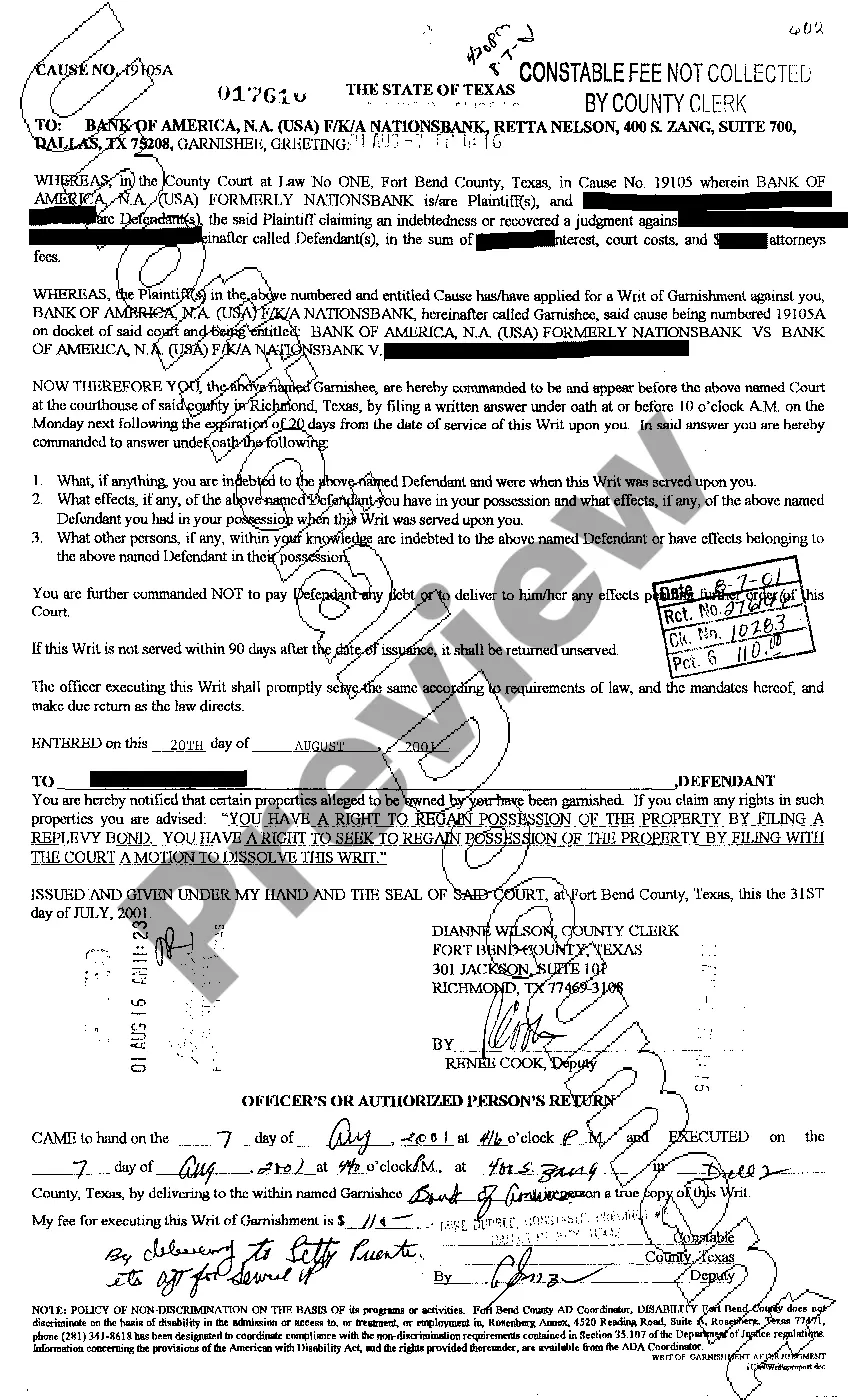

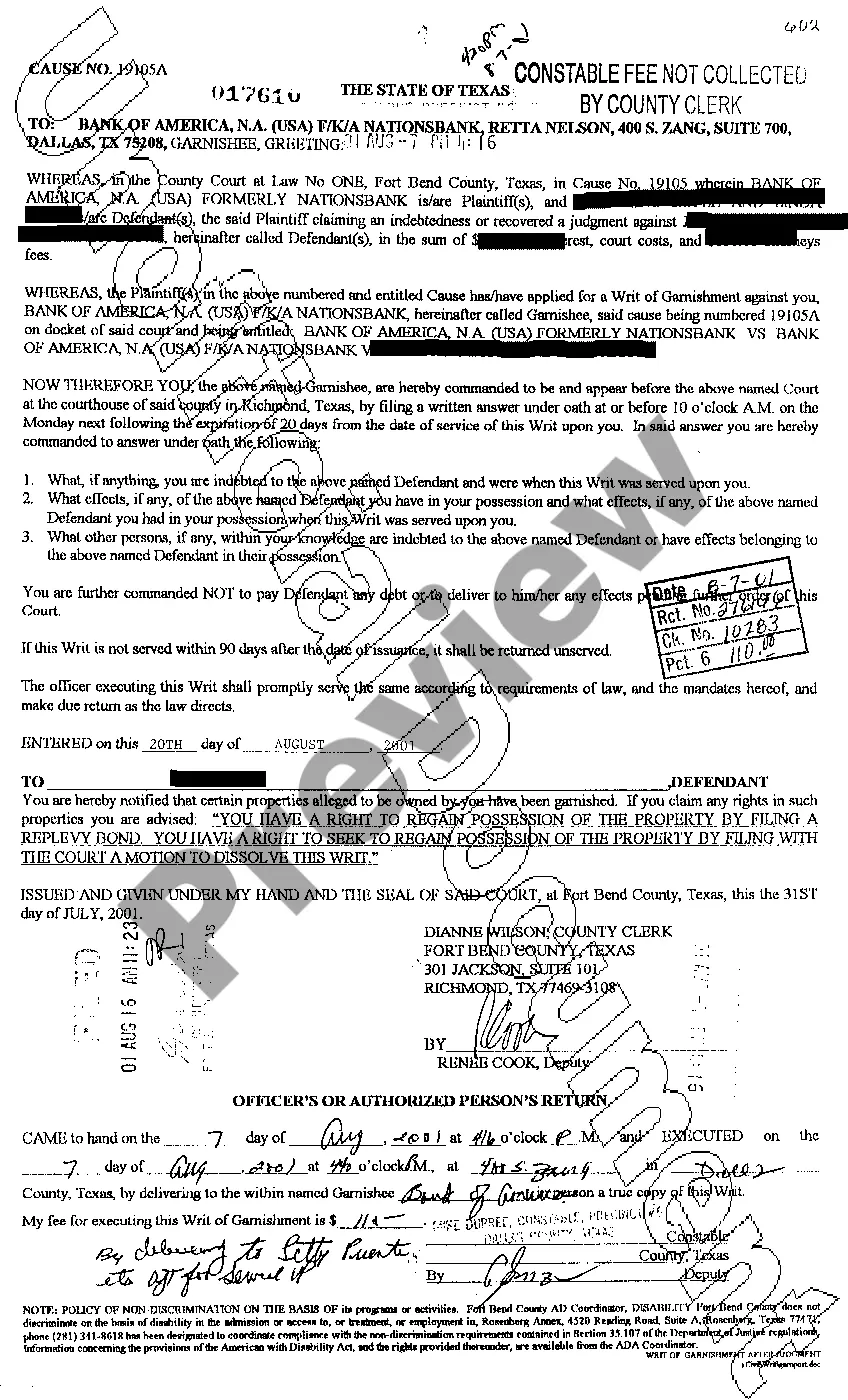

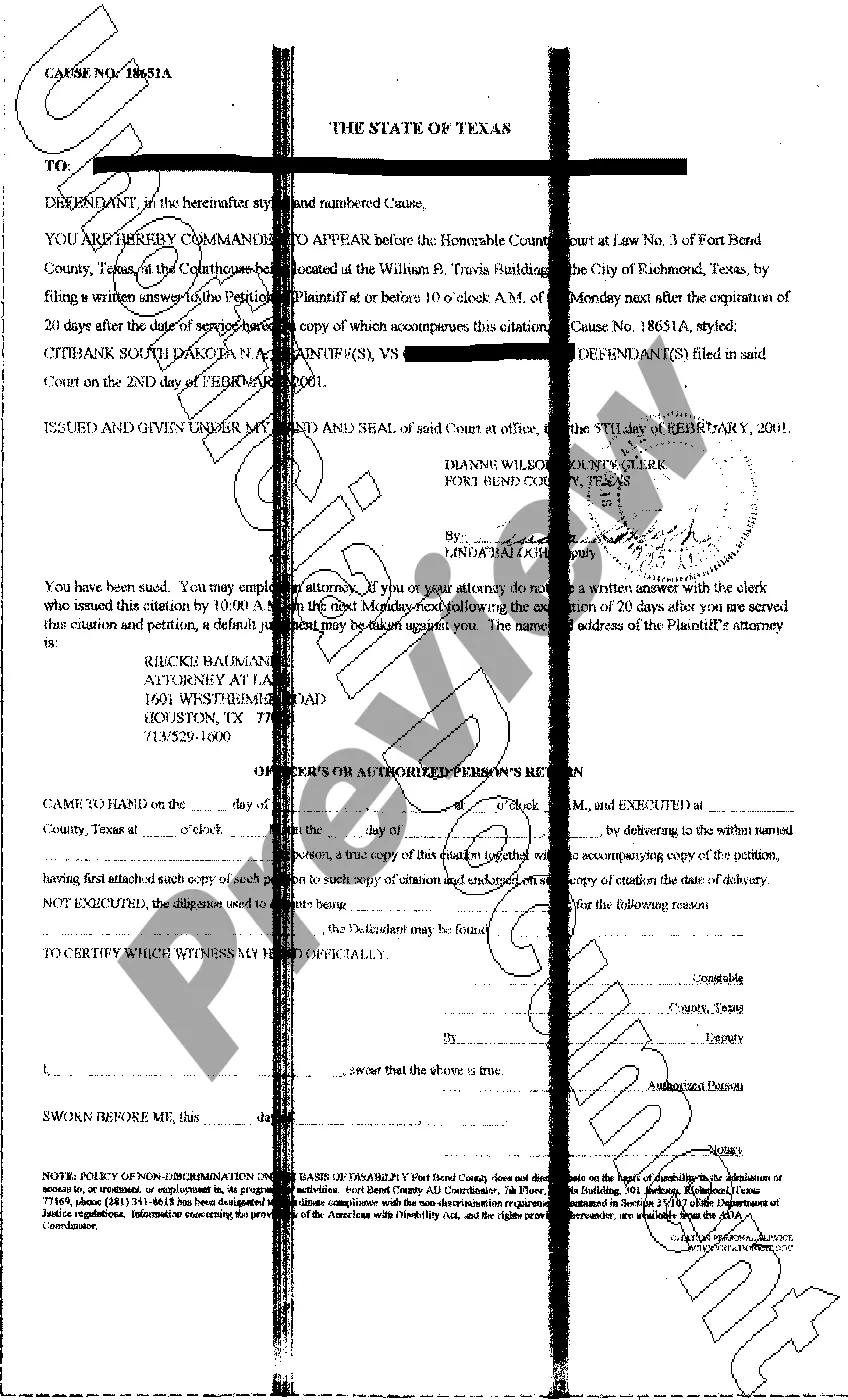

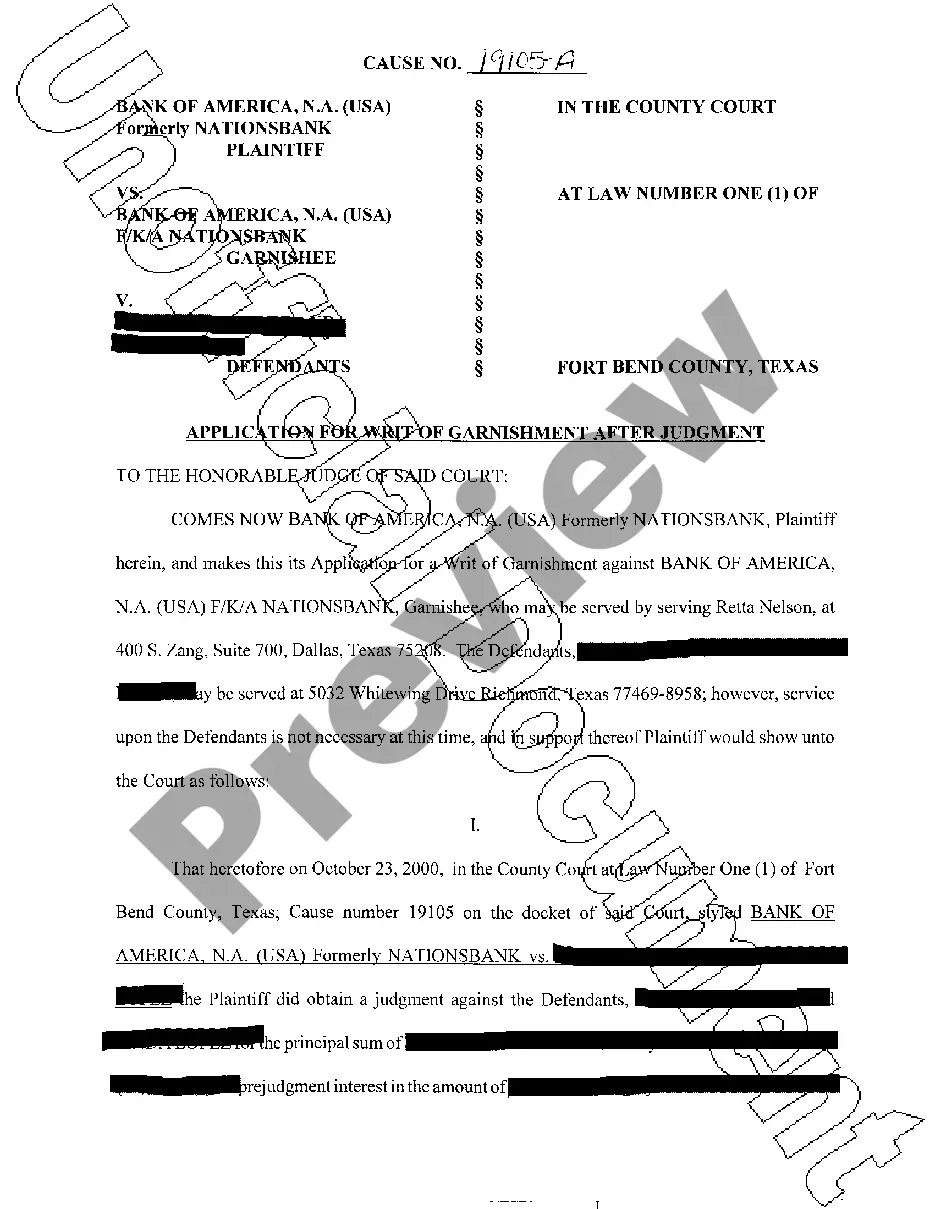

§§ 63.001-. 008 (Vernon 1986). In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor.

A sheriff or constable. A person over 18 years of age authorized by written order of the court. A person certified under order of the Supreme Court. The clerk of the court in which the case is pending (by certified mail, return receipt requested)

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

WHO MAY ISSUE. The clerk of a district or county court or a justice of the peace may issue a writ of garnishment returnable to his court. Acts 1985, 69th Leg., ch. 959, Sec.

The writ of garnishment orders the third party to surrender the defendant's assets to the court in order to satisfy a judgment against the defendant. With a writ of garnishment in place, creditors such as banks and credit cards can pull directly from defendants' bank accounts under Texas garnishment laws.

A judgment is valid for 10 years and can be enforced at any time during those that time. It is not uncommon for a creditor to seek to enforce a judgment that is close to ten years old. There are also ways to renew the judgment, so that it can be enforced for even longer than ten years.

Once issued, the writ of execution directs the sheriff to seize the non-exempt property and sell it. The proceeds of the sale are given to the creditor to satisfy all or part of the judgment.