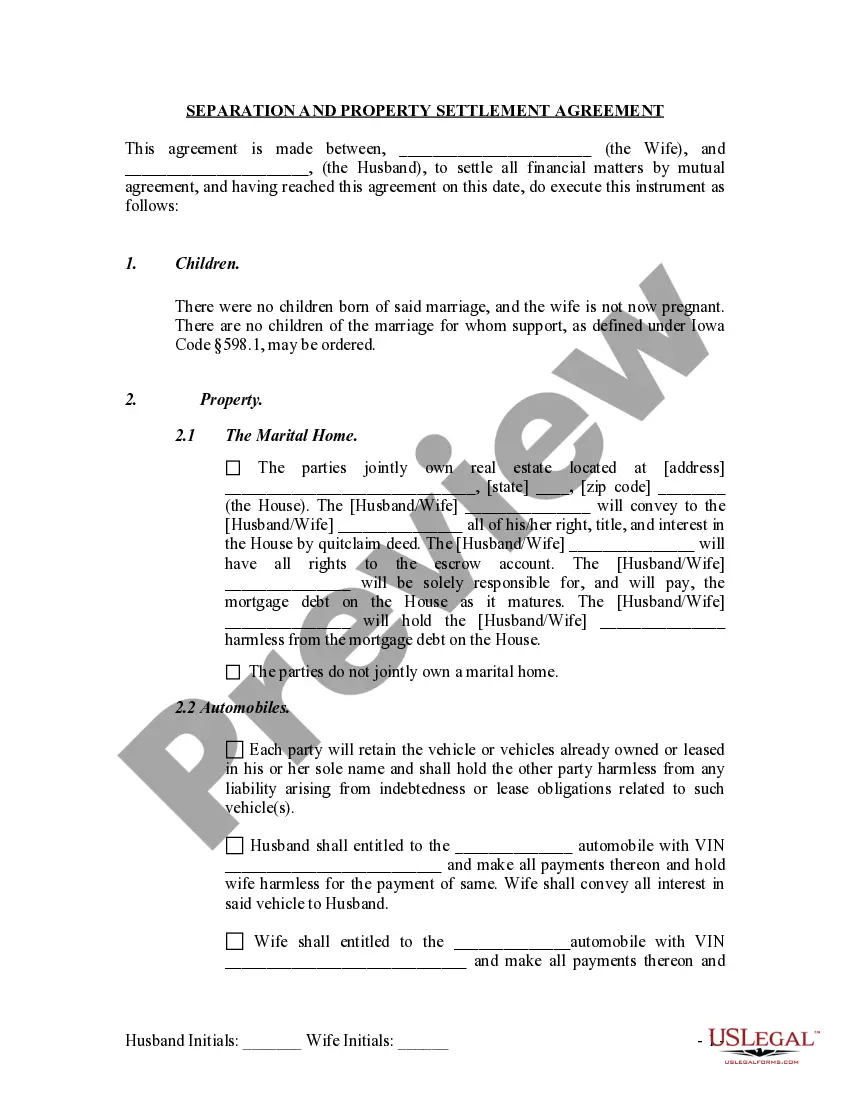

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Harris Texas Living Trust for Husband and Wife with One Child

Description

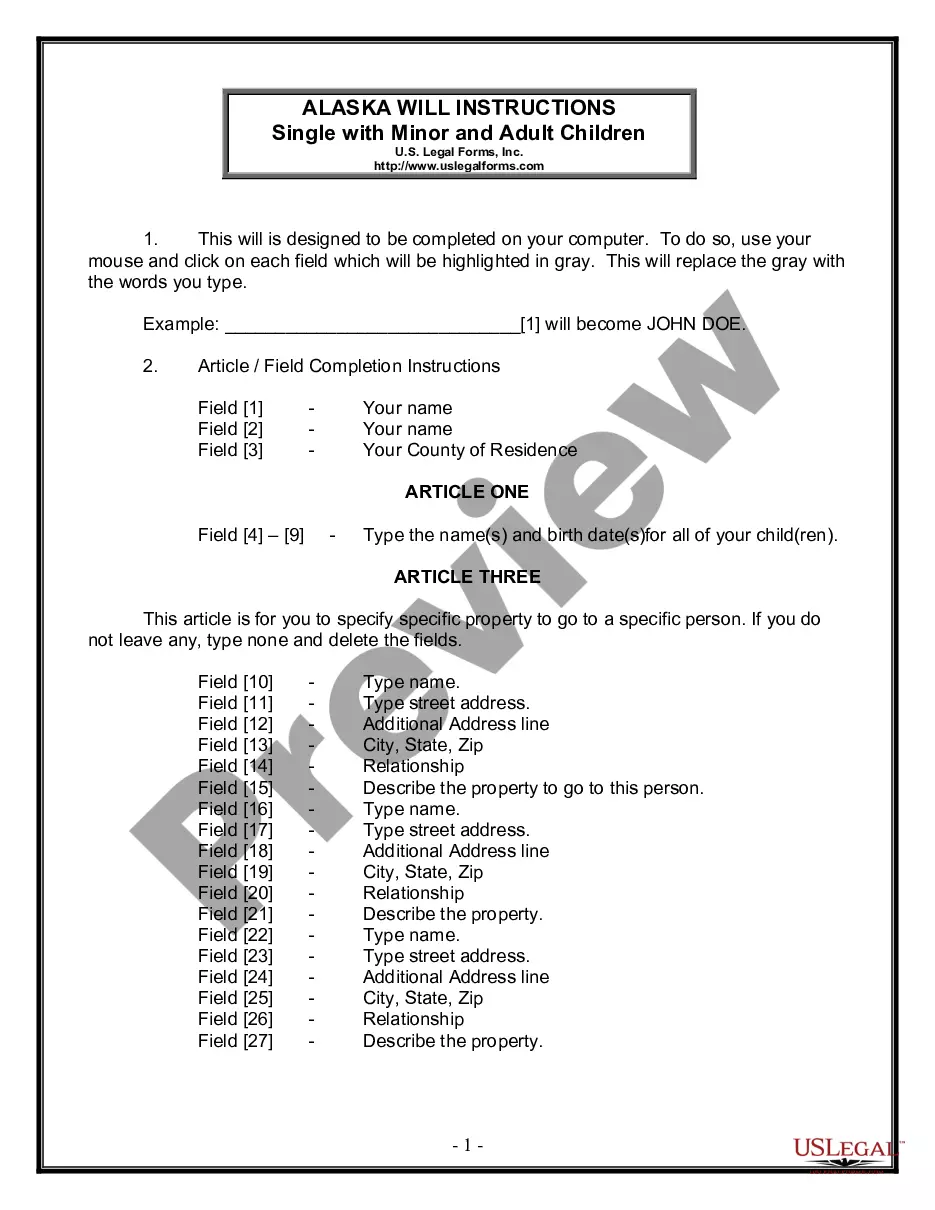

How to fill out Texas Living Trust For Husband And Wife With One Child?

If you have previously made use of our service, Log In to your account and store the Harris Texas Living Trust for Husband and Wife with One Child on your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have acquired: you can find it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Ensure you've located the correct document. Review the description and utilize the Preview option, if available, to confirm it satisfies your requirements. If it doesn't suit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Harris Texas Living Trust for Husband and Wife with One Child. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it or utilize professional online editors to complete it and sign it digitally.

Form popularity

FAQ

Whether a husband and wife should have separate living trusts depends on their financial and family goals. A Harris Texas Living Trust for Husband and Wife with One Child is beneficial, but separate trusts might be advantageous for those with significant individual assets or specific beneficiary wishes. By assessing your family's unique situation, you can determine the most effective approach. It’s vital to consult with an estate planning expert to make the best decision.

Yes, putting a house in a trust can provide several advantages for a married couple. A Harris Texas Living Trust for Husband and Wife with One Child can help avoid probate, ensuring that the home transfers to desired beneficiaries quickly and without complications. Additionally, it can offer protection against creditors and facilitate management of the property during incapacity. This step can strengthen your overall estate plan.

The best living trust for a married couple is one that fits their specific financial situation and goals. A Harris Texas Living Trust for Husband and Wife with One Child provides a flexible structure, accommodating shared assets while enabling individual preferences. Choosing an appropriate trust involves evaluating factors like asset composition and family size. A tailored trust ensures a smoother transition of assets while reflecting a couple's wishes.

Husbands and wives may choose to have separate trusts for various reasons, including distinct financial goals or asset protection. For instance, a Harris Texas Living Trust for Husband and Wife with One Child can benefit from separate trusts if each spouse wishes to support different beneficiaries or manage assets independently. Separate trusts allow each partner greater control over their individual assets. This approach can also simplify the estate planning process based on unique circumstances.

A significant mistake parents often make is failing to update the trust as their circumstances change. With a Harris Texas Living Trust for Husband and Wife with One Child, parents should regularly review and amend provisions to reflect life events such as births or marriages. Not doing so can lead to outdated directives that do not align with current family dynamics. Keeping the trust current ensures that it meets your family's needs.

While a living trust, such as the Harris Texas Living Trust for Husband and Wife with One Child, provides several benefits, it does have some downsides to consider. For instance, creating and maintaining a trust can involve upfront costs and ongoing administrative duties. Additionally, trusts do not protect assets from creditors or lawsuits. It's essential to weigh these factors and consult platforms like US Legal Forms for comprehensive guidance tailored to your situation.

The Harris Texas Living Trust for Husband and Wife with One Child is an excellent choice for many couples. This trust type facilitates joint management of assets while simplifying the process of passing them down to your child. It offers benefits such as reducing estate taxes and avoiding probate, which can be a lengthy and costly process. By choosing the right trust, you protect your family's financial future.

Married couples often wonder if they should establish separate living trusts. While having separate trusts is an option, many couples find that a Harris Texas Living Trust for Husband and Wife with One Child provides greater benefits. This type of trust allows both partners to manage assets together, ensuring a unified approach to estate planning. It simplifies the transfer of assets to your child, avoiding complications down the road.

One disadvantage of a family trust, such as a Harris Texas Living Trust for Husband and Wife with One Child, is the lack of flexibility once it is established. Changing the terms of the trust can require legal filings and can be a lengthy process. Furthermore, if not fund properly, the intended benefits may not be realized, leaving the family in a difficult position. Therefore, thorough planning and consideration are key when setting up a family trust.

While trust funds, including a Harris Texas Living Trust for Husband and Wife with One Child, can be beneficial, there are some drawbacks. Managing a trust fund can involve ongoing administrative costs and responsibilities, which may add up over time. Furthermore, if not structured properly, they can lead to family disputes or misunderstandings about the intended distribution of assets. It is essential to plan carefully to avoid these potential issues.