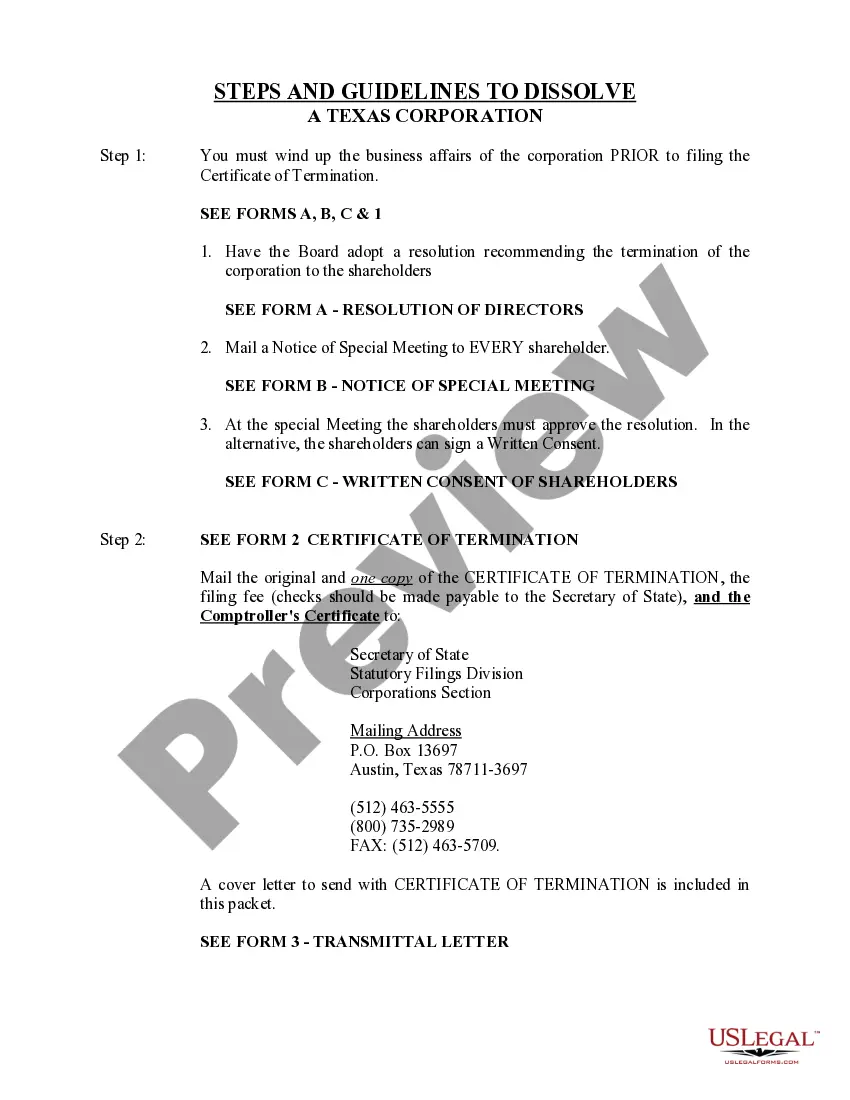

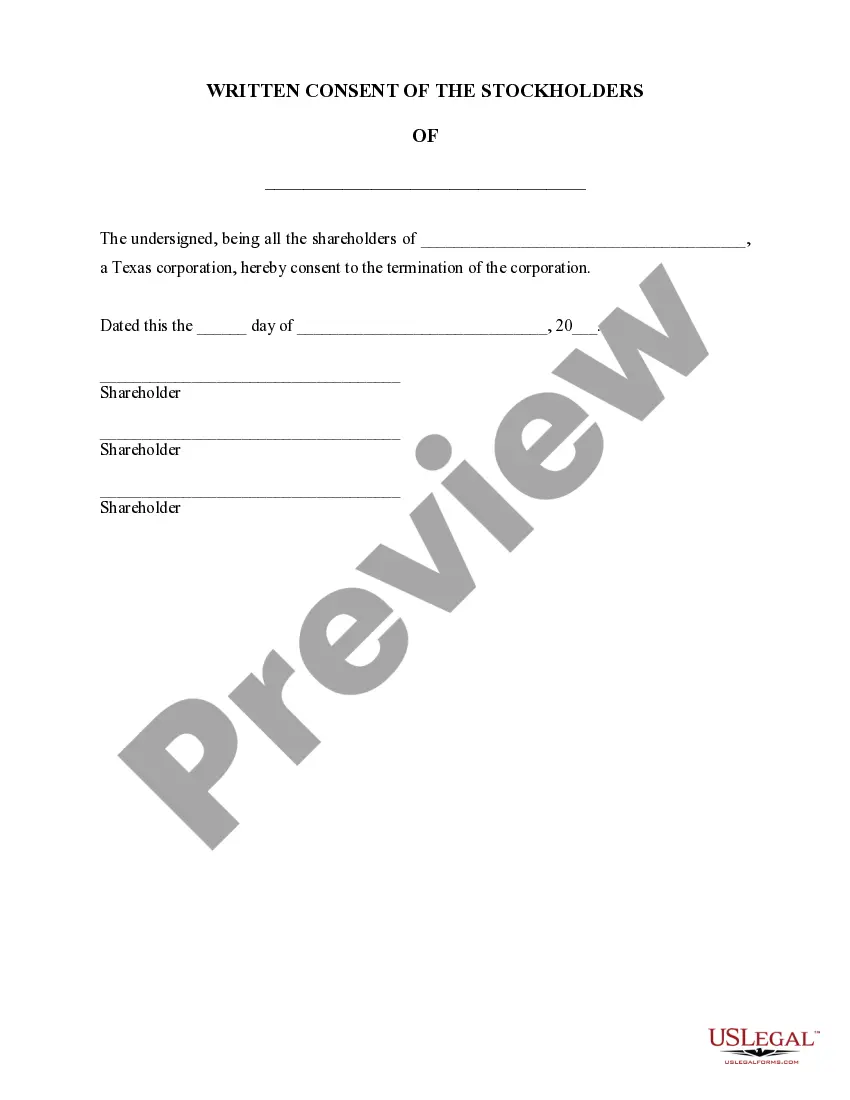

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

Travis Texas Dissolution Package to Dissolve Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

Utilize the US Legal Forms and gain instant access to any form example you need.

Our user-friendly website with a vast array of documents streamlines how to locate and acquire almost any document example you require.

You can download, fill out, and validate the Travis Texas Dissolution Package to Dissolve Corporation in just a few minutes instead of spending hours online looking for an appropriate template.

Using our collection is an excellent tactic to enhance the security of your record submissions. Our knowledgeable legal experts routinely review all documents to ensure that the templates are suitable for a specific state and adhere to the latest laws and regulations.

If you have not yet created a profile, follow the instructions below.

Access the page with the form you need. Confirm that it is the form you were looking for: verify its title and description, and use the Preview option when available. Otherwise, use the Search box to find the requisite one.

- How can you acquire the Travis Texas Dissolution Package to Dissolve Corporation.

- If you already possess a subscription, simply sign in to your account. The Download button will be activated on all samples you view.

- Additionally, you can retrieve all your previously saved documents in the My documents section.

Form popularity

FAQ

Yes, you can file Form 651 online in Texas, making the process of obtaining a Travis Texas Dissolution Package to Dissolve Corporation more efficient. By utilizing the online filing option, you streamline your submission while saving time and effort. This method is secure and allows for quick confirmation of your filing status. Additionally, US Legal Forms provides a straightforward platform to guide you through the process, ensuring you have all necessary documents ready.

Dissolving a nonprofit corporation in Texas requires following specific legal procedures. First, the board must pass a resolution to dissolve, and then the organization must file a certificate of dissolution with the Secretary of State. Additionally, it’s crucial to notify the IRS and manage any remaining assets appropriately. The Travis Texas Dissolution Package to Dissolve Corporation can assist you in ensuring all steps are followed correctly, making the process as smooth as possible.

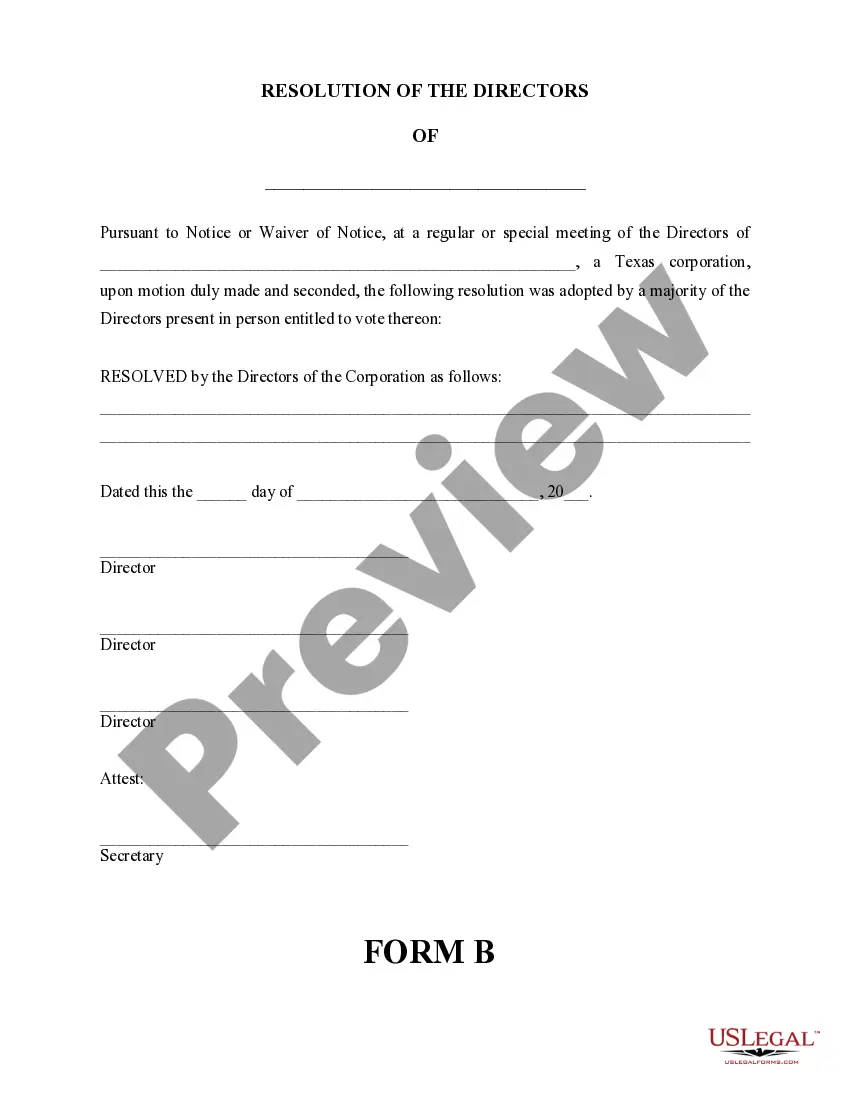

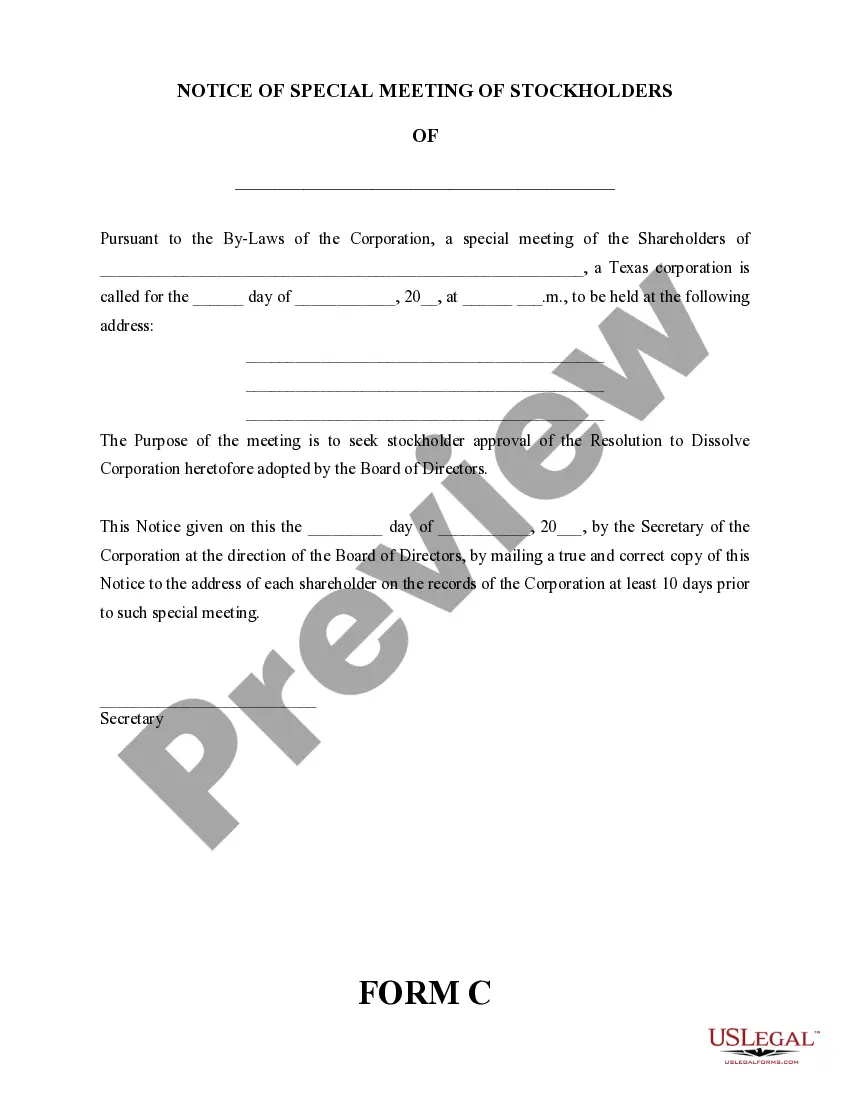

Dissolving a corporation involves several key steps. Begin by obtaining board approval and then filing a certificate of dissolution with the state. Afterward, notify creditors, settle debts, and distribute any remaining assets. Utilizing the Travis Texas Dissolution Package to Dissolve Corporation can streamline these steps and ensure that you don’t miss any important details.

To close your business with the Texas comptroller, you must first ensure that all tax obligations are satisfied. Next, file a final franchise tax report and mark it as such. Utilizing the Travis Texas Dissolution Package to Dissolve Corporation can simplify this process, ensuring compliance and making it easier to fulfill all requirements.

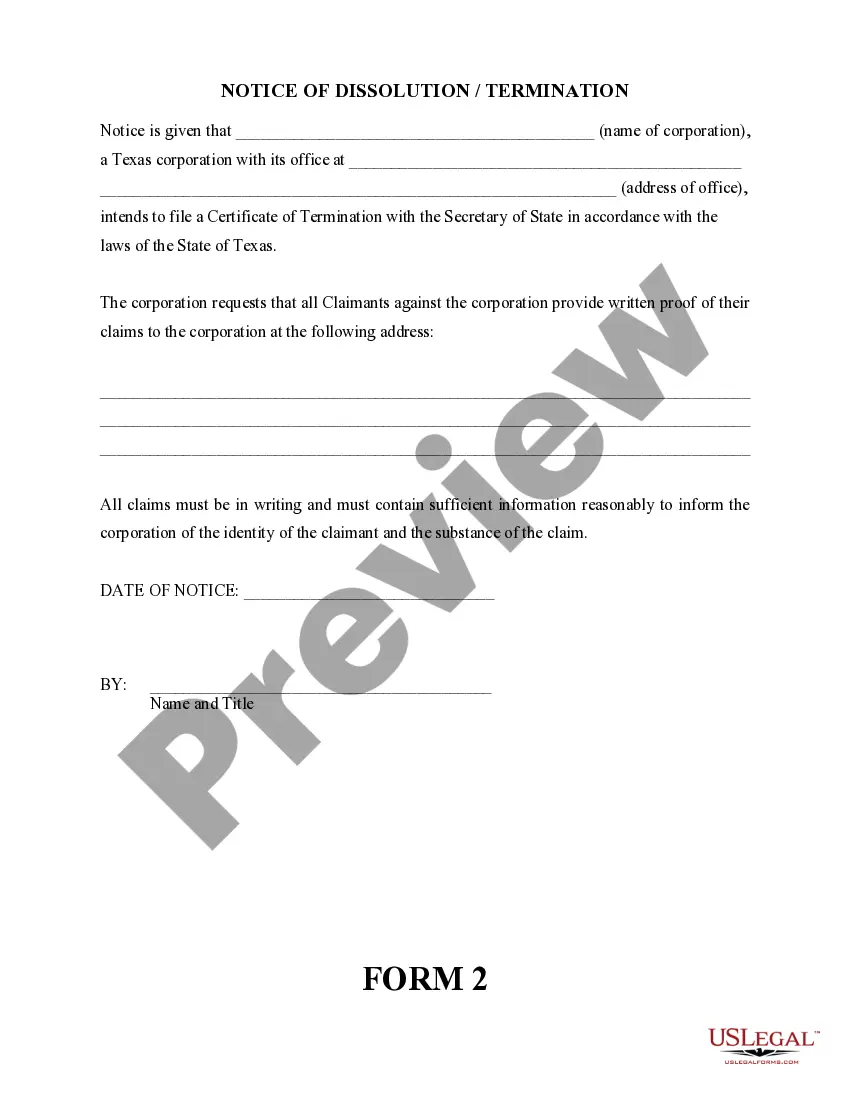

Difference Between Dissolution and Termination of a Partnership. In basic terms, the dissolution of a partnership refers to the steps involved in winding up the business, preparing for termination. Termination is the final result; the company has ceased all business activity and no longer exists.

To dissolve your Texas LLC, you must file a Certificate of Termination with the Secretary of State. There is a $40 filing fee.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

How much does it cost to dissolve a California business? There is no fee to file the California dissolution forms.

How do you dissolve a Texas corporation? To dissolve your Texas corporation, you file Form 651 Certificate of Termination of Domestic Entity and accompany that with a tax clearance certificate from the Texas Comptroller of Public Accounts indicating that all taxes have been paid by the entity.

In both voluntary and involuntary dissolution, a company must follow formal steps of asset liquidation, settling debts, and paying shareholders. Voluntary dissolution requires permission from a company's board and shareholders, while the government orders involuntary dissolution.