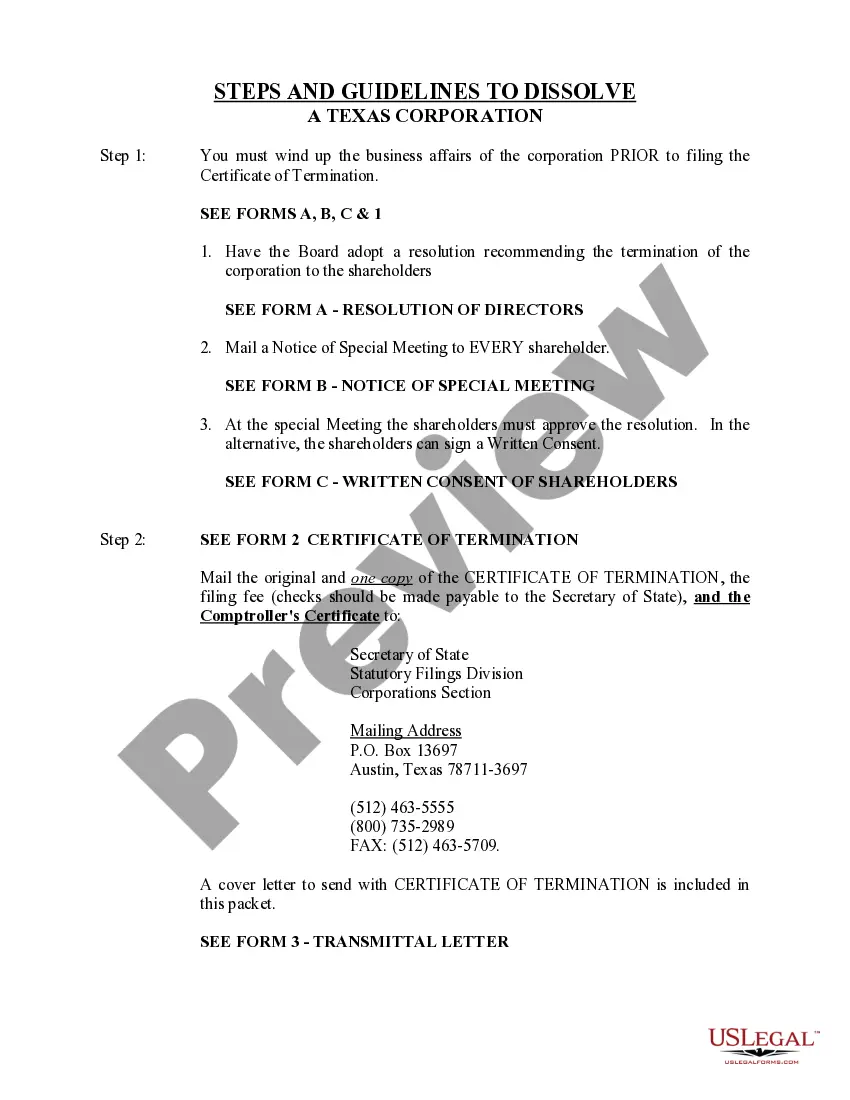

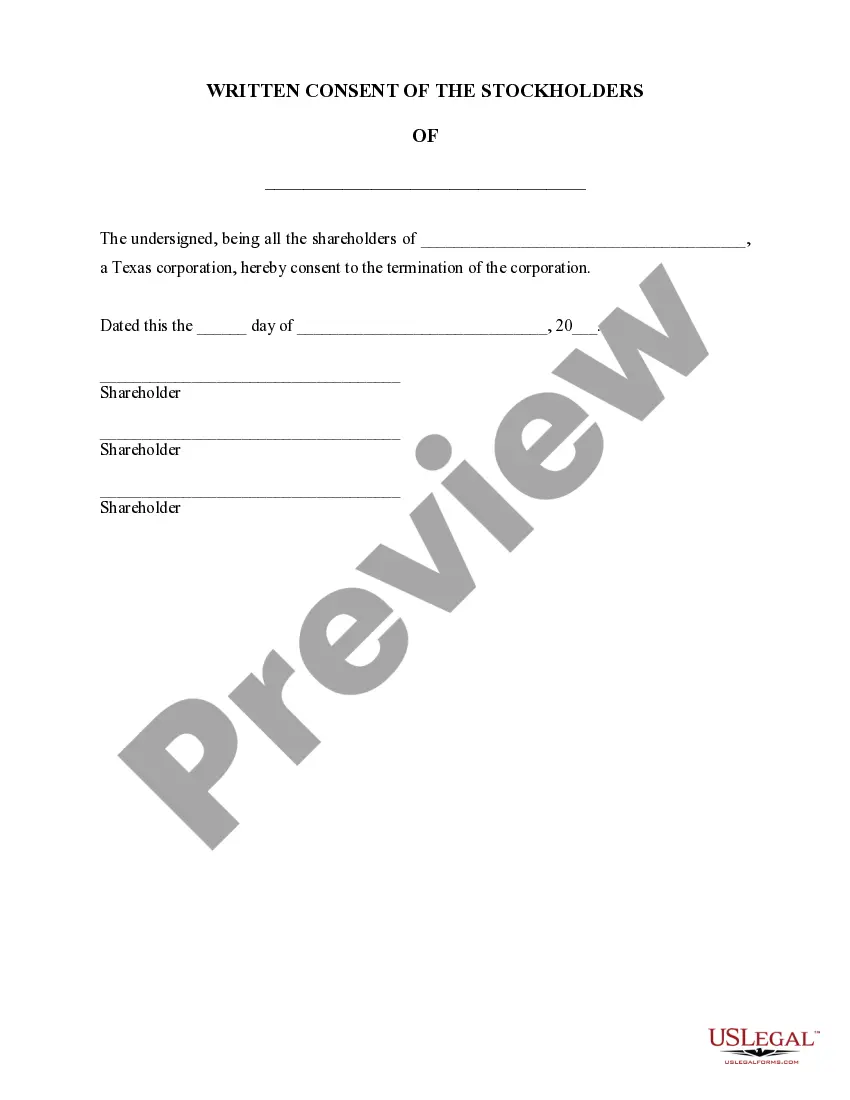

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

Irving Texas Dissolution Package to Dissolve Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

We consistently aim to reduce or avert legal complications when navigating complex law-related or financial matters.

To achieve this, we seek legal assistance that, typically, comes with a high cost.

However, not every legal matter is this intricate.

Many can be managed independently.

Utilize US Legal Forms anytime you need to obtain and download the Irving Texas Dissolution Package to Dissolve Corporation or any other form conveniently and securely.

- US Legal Forms is a digital repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and requests for dissolution.

- Our collection empowers you to handle your matters autonomously without relying on a lawyer's services.

- We provide access to legal form templates that aren’t always readily accessible.

- Our templates are tailored to specific states and regions, which significantly eases the search experience.

Form popularity

FAQ

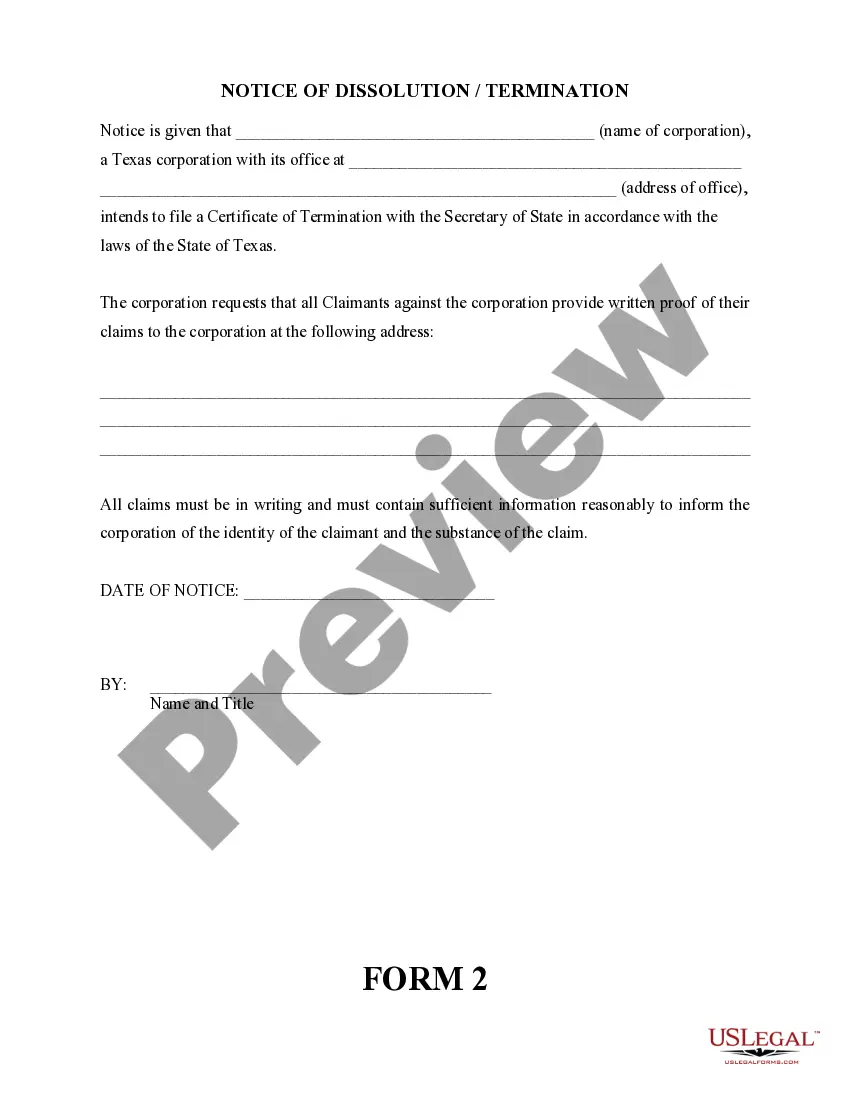

You can dissolve a corporation in the state where it was originally formed. Typically, this involves filing the necessary paperwork with the Secretary of State or the relevant state agency. To simplify this process and ensure compliance with state laws, consider utilizing the Irving Texas Dissolution Package to Dissolve Corporation. This package provides the tools and guidance you need to complete the dissolution properly.

When a corporation dissolves, it legally ceases to exist. This means that the corporation can no longer conduct business, own property, or enter into contracts. The assets of the corporation will be distributed to its shareholders after settling any outstanding liabilities. To navigate this process smoothly, consider using the Irving Texas Dissolution Package to Dissolve Corporation, which streamlines the necessary steps.

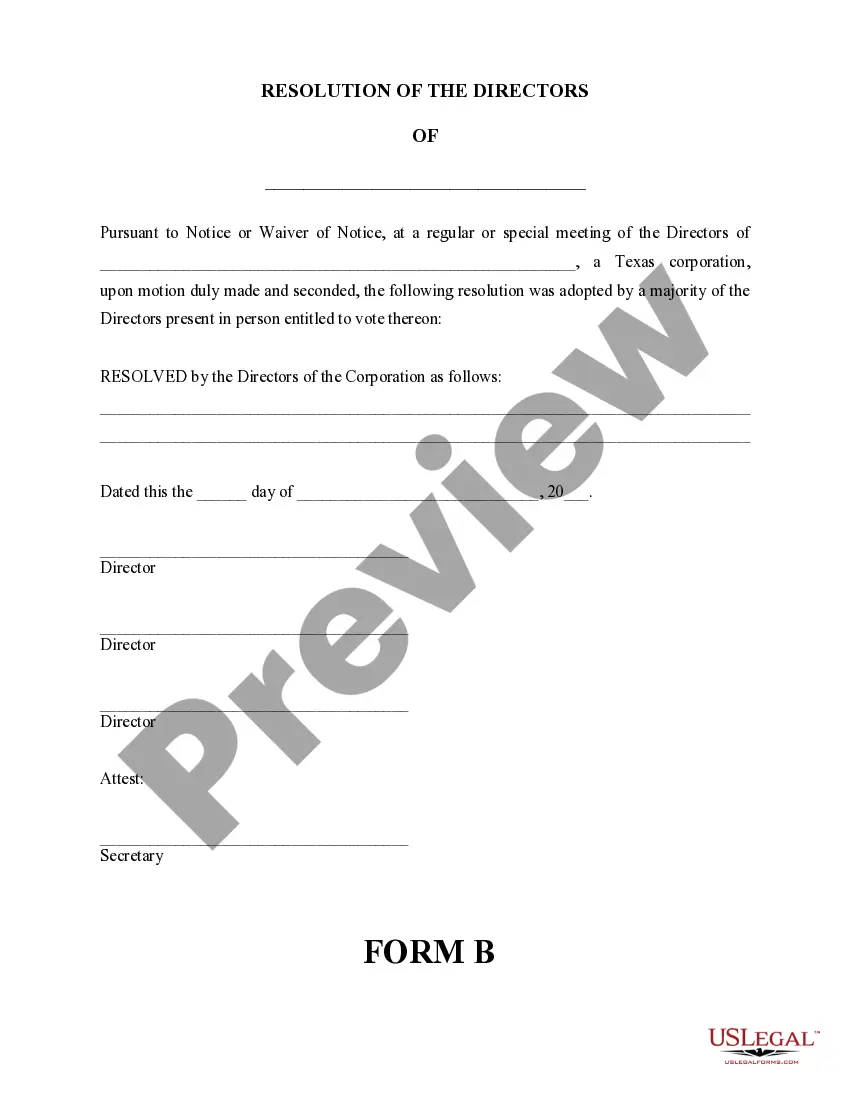

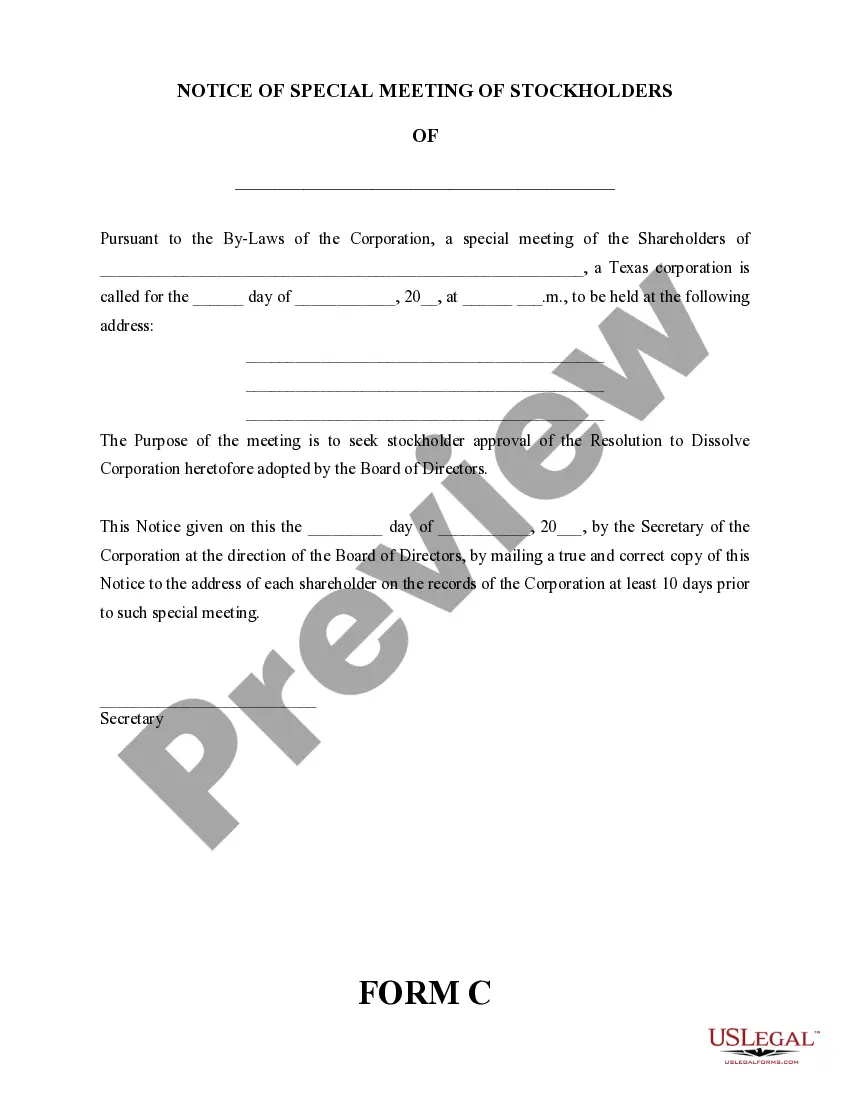

To dissolve a corporation in Texas, you need to file a Certificate of Termination with the Secretary of State and ensure all taxes and debts are cleared. First, hold a meeting with the board of directors to approve the dissolution. Then, file any final tax returns and obtain a tax clearance certificate if needed. Utilizing the Irving Texas Dissolution Package to Dissolve Corporation can streamline the entire process, ensuring that you complete every requirement.

After you dissolve your LLC, you must settle any remaining debts, distribute any remaining assets, and ensure that all tax obligations are met. Official dissolution protects you from further liabilities associated with the business. You will receive a Certificate of Termination from the state, confirming that your LLC is no longer active. To make this transition smoother, the Irving Texas Dissolution Package to Dissolve Corporation provides you with valuable resources and support.

Dissolving an LLC in Texas can take about five to ten business days once the Certificate of Termination is submitted to the Secretary of State. However, if any issues arise, such as outstanding debts or compliance problems, the process might take longer. By using the Irving Texas Dissolution Package to Dissolve Corporation, you can simplify this process, making it easier to ensure that all necessary documents are in order for timely dissolution.

If you fail to dissolve your LLC in Texas, you may still be liable for taxes and fees, even if the business is no longer operating. Continuing obligations can include annual reports and state compliance requirements, which may lead to penalties. Ignoring dissolution can also affect your credit and business reputation. It's wise to consider the Irving Texas Dissolution Package to Dissolve Corporation to avoid such complications.

Closing an LLC in Texas can typically take anywhere from a few days to several weeks, depending on various factors. You must file the necessary paperwork, such as the Certificate of Termination, and this can lead to a more extended process if there are unresolved issues. To speed things up, you can utilize the Irving Texas Dissolution Package to Dissolve Corporation, which provides clear guidance and efficient service. Completeness and accuracy in your paperwork will help expedite your closure.

The three modes of dissolving a corporation include voluntary dissolution, administrative dissolution, and judicial dissolution. Voluntary dissolution occurs when the owners decide to terminate the business. Administrative dissolution happens when a state agency dissolves the corporation for non-compliance with regulations, and judicial dissolution occurs through court action based on various legal issues. The Irving Texas Dissolution Package to Dissolve Corporation simplifies this process for business owners, ensuring a smooth transition.

Yes, you can file form 801 online in Texas through the Secretary of State’s online portal. This electronic filing system makes it easier and more efficient to submit your dissolution paperwork. By leveraging the Irving Texas Dissolution Package to Dissolve Corporation, you can access detailed guidelines and support for online filing, ensuring that the process is smooth and compliant with state regulations.

To shut down a corporation in Texas, you should follow specific steps set by the state. First, hold a meeting with your board of directors to approve the dissolution. After approval, you need to submit the required documents, including the Certificate of Termination, to the Secretary of State. Using the Irving Texas Dissolution Package to Dissolve Corporation can streamline this process and ensure you meet all legal requirements.