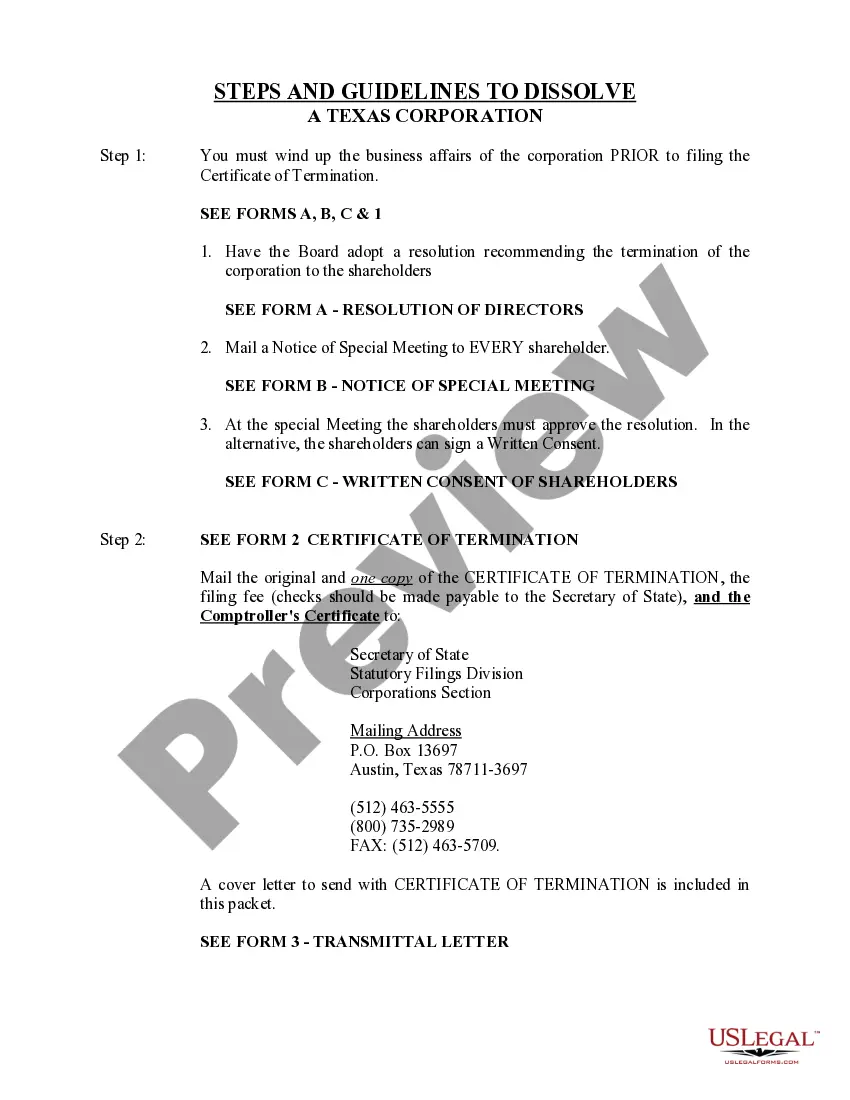

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

Dallas Texas Dissolution Package to Dissolve Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

If you’ve previously accessed our service, Log In to your account and download the Dallas Texas Dissolution Package to Dissolve Corporation to your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have continuous access to all documents you have purchased: you can find them in your profile within the My documents menu whenever you wish to reuse them. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or professional needs!

- Ensure you’ve identified an appropriate document. Browse the description and use the Preview option, if available, to verify if it fits your requirements. If it doesn’t meet your criteria, utilize the Search tab above to find the right one.

- Acquire the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Establish an account and process your payment. Input your credit card information or choose the PayPal option to finalize the purchase.

- Obtain your Dallas Texas Dissolution Package to Dissolve Corporation. Select the file format for your document and save it to your device.

- Complete your sample. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

To dissolve an LLC in Texas, you typically need to file a Certificate of Formation and possibly a Certificate of Termination with the state. It's crucial to also settle any outstanding obligations and notify creditors. To make this process easier, consider using a Dallas Texas Dissolution Package to Dissolve Corporation, which provides all necessary forms and detailed instructions for a smooth dissolution.

Shutting down a nonprofit organization requires careful planning and execution. You'll begin by notifying your board and members, followed by a proper vote to approve the shutdown. Subsequently, complete and submit the required dissolution documents to the state. A Dallas Texas Dissolution Package to Dissolve Corporation is an excellent resource to ensure you complete each step accurately.

To terminate a nonprofit organization in Texas, you will need to follow a structured process. Start by holding a meeting with your board of directors to pass a resolution for dissolution. After that, file a Certificate of Termination with the Texas Secretary of State. Utilizing a Dallas Texas Dissolution Package to Dissolve Corporation can simplify this process, providing you with the necessary forms and guidance.

Shutting down a corporation in Texas requires filing a Certificate of Termination with the Secretary of State, while addressing all outstanding debts and obligations. It’s crucial to follow the proper steps outlined in your corporate bylaws. Using the Dallas Texas Dissolution Package to Dissolve Corporation can simplify the process and make sure you adhere to all state regulations.

To shut down a company in Texas, you must formally dissolve the business by filing the appropriate documents with the state. Make sure to clear any debts and handle all tax obligations before proceeding. Many business owners use the Dallas Texas Dissolution Package to Dissolve Corporation to make this task easier and ensure they meet all legal requirements.

Dissolving a C Corporation in Texas involves filing a Certificate of Termination with the Secretary of State, after settling all corporate debts. You also need to follow your internal bylaws to ensure all actions have proper approval. Engaging the Dallas Texas Dissolution Package to Dissolve Corporation can help you navigate this process effectively, ensuring all steps are followed correctly.

To dissolve a nonprofit corporation in Texas, you must first ensure that all necessary debts are settled. Next, file a Certificate of Termination with the Texas Secretary of State. Additionally, if your organization has members, you need their approval to dissolve the corporation. Many find that the Dallas Texas Dissolution Package to Dissolve Corporation streamlines this entire process.

To dissolve a corporation in Texas, start with a board meeting to approve the decision. Afterward, complete and file Form 601, the certificate of termination, to initiate the process. Utilizing the Dallas Texas Dissolution Package to Dissolve Corporation can streamline this procedure, guiding you through the necessary steps and paperwork effectively.

If you choose not to dissolve a corporation, it remains legally active and incurs potential liabilities. This means your corporation can continue to accrue debts, file taxes, and maintain legal obligations. Additionally, not dissolving may prevent you from using the Dallas Texas Dissolution Package to Dissolve Corporation later, complicating your responsibilities as a business owner.

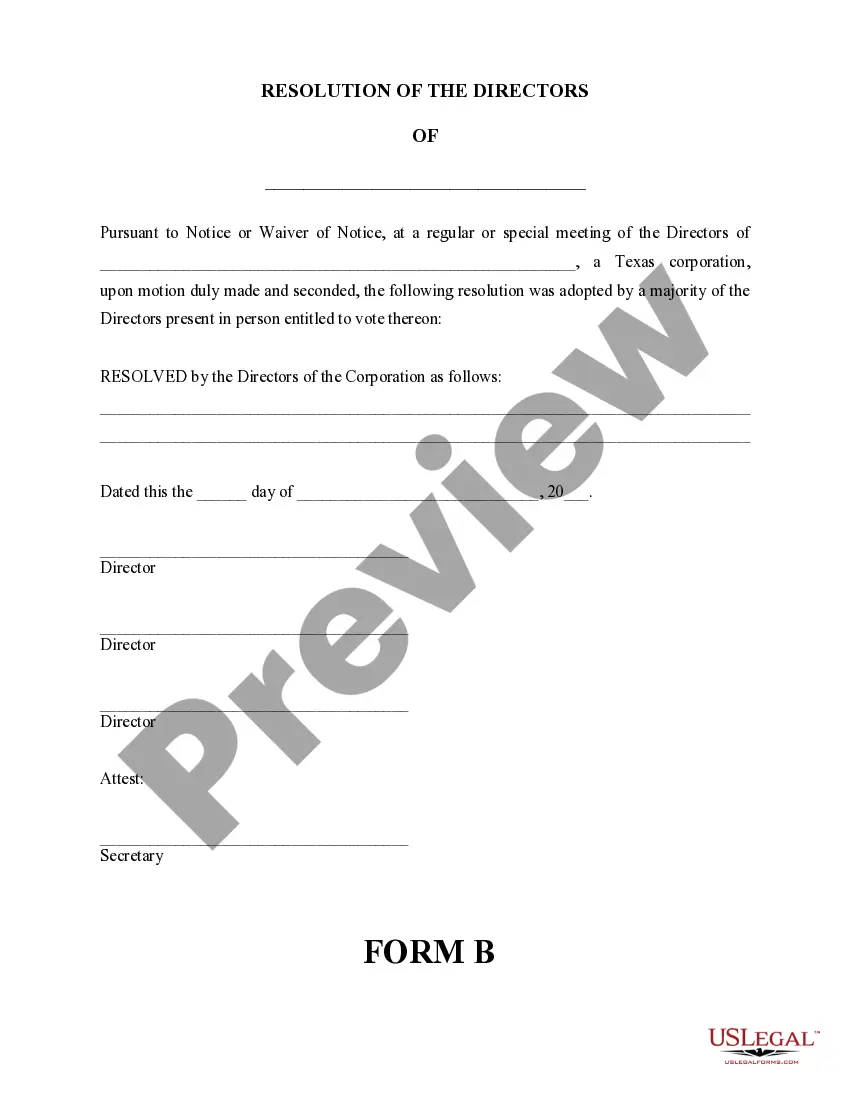

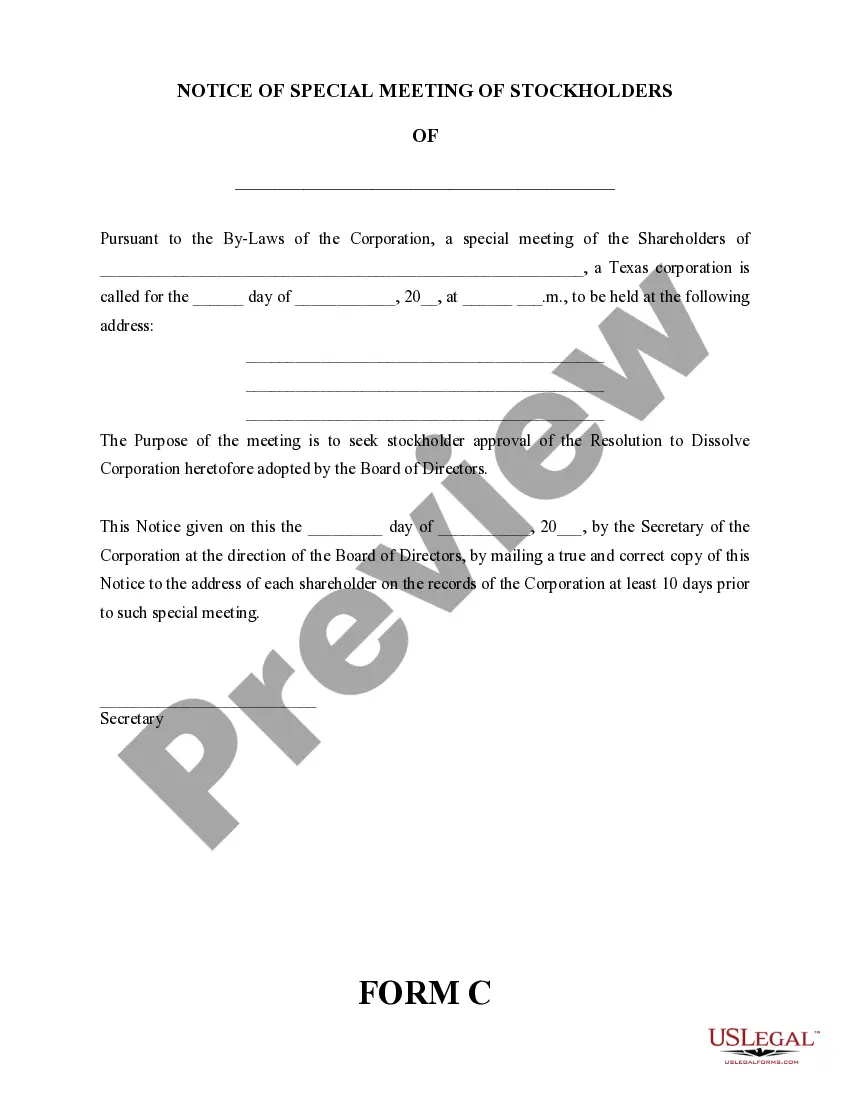

To dissolve a corporation, you need to follow a series of steps. First, hold a meeting with the board of directors to approve the dissolution. Next, file the necessary documents with the state, using the Dallas Texas Dissolution Package to Dissolve Corporation for an efficient process. Lastly, notify creditors and distribute any remaining assets according to the corporation's bylaws.