Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates

Description

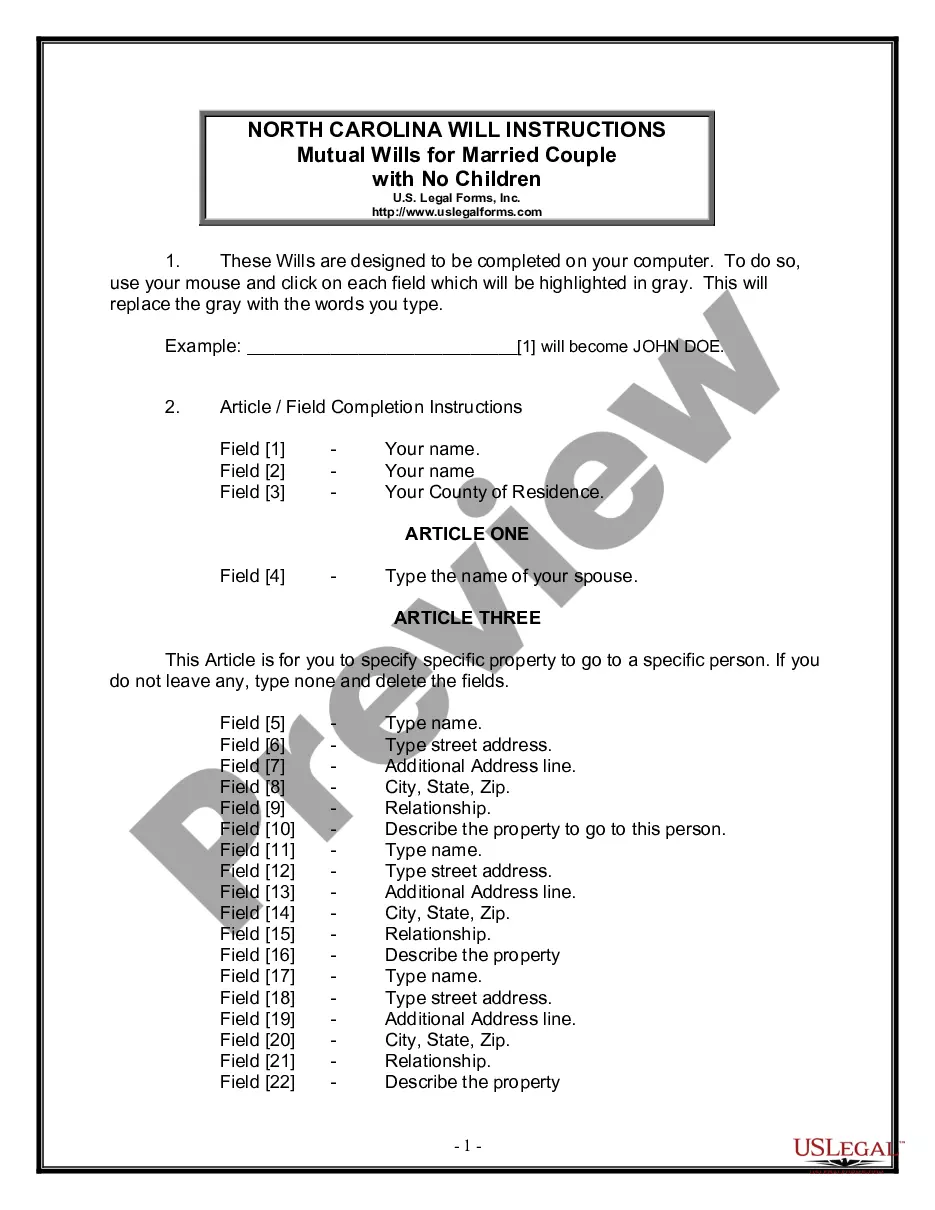

How to fill out Texas Complex Will With Credit Shelter Marital Trust For Large Estates?

If you have previously utilized our service, sign in to your account and store the Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it according to your payment schedule.

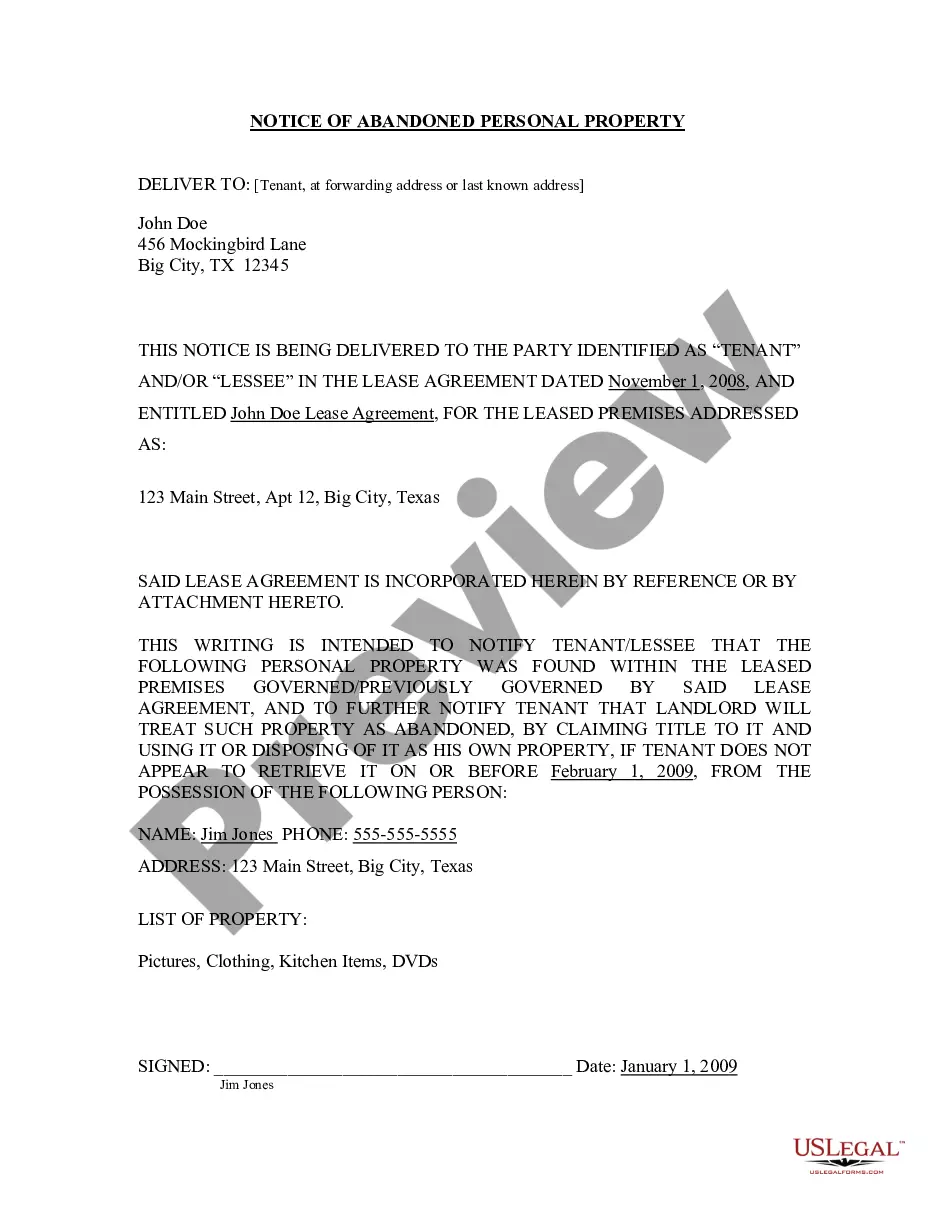

If this is your initial usage of our service, follow these straightforward steps to obtain your document.

You have perpetual access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to swiftly discover and store any template for your personal or business requirements!

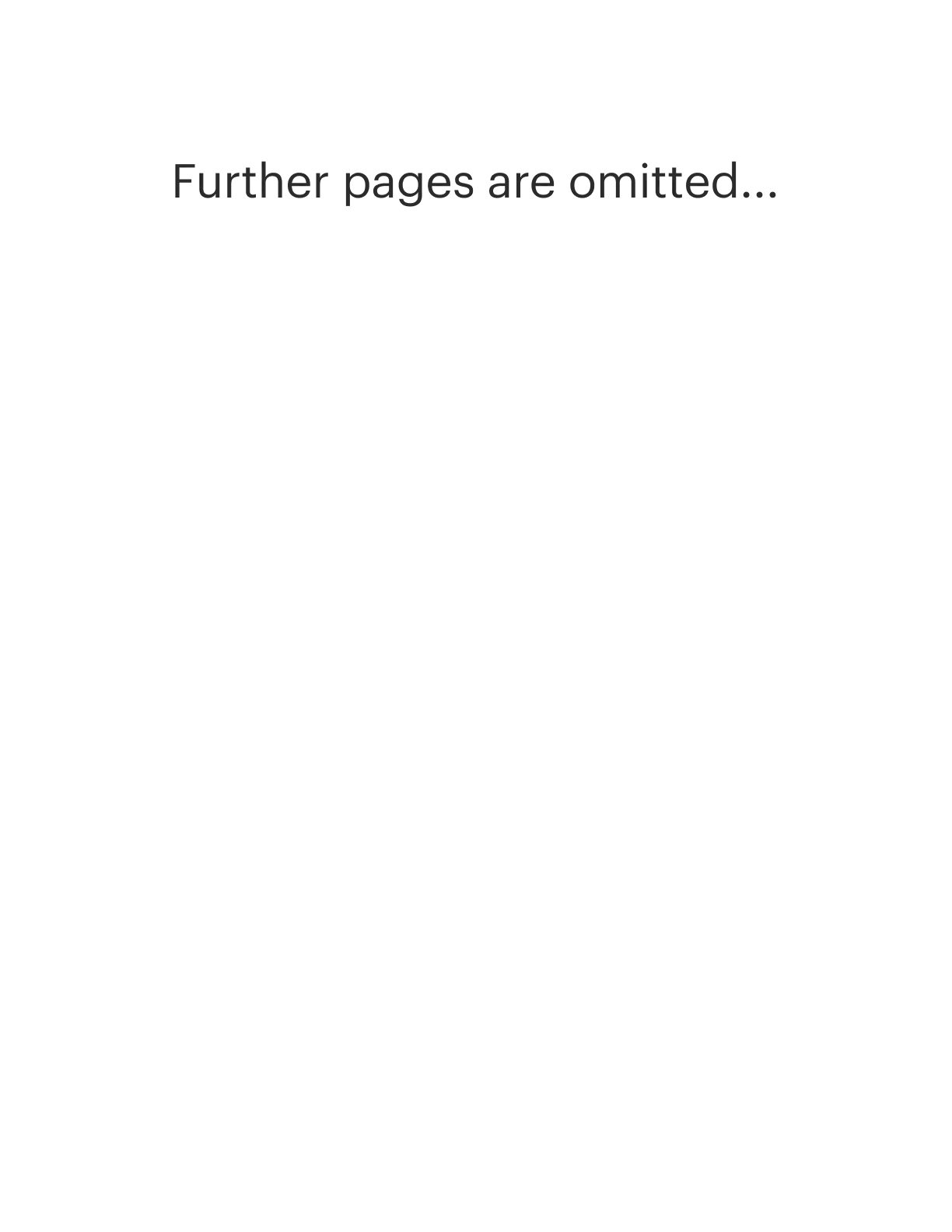

- Confirm that you’ve found the correct document. Review the description and utilize the Preview option, if available, to verify that it satisfies your requirements. If it doesn’t suit your needs, use the Search tab above to discover the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Set up an account and process the payment. Use your credit card information or the PayPal choice to finalize the transaction.

- Acquire your Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates. Choose the file format for your document and save it onto your device.

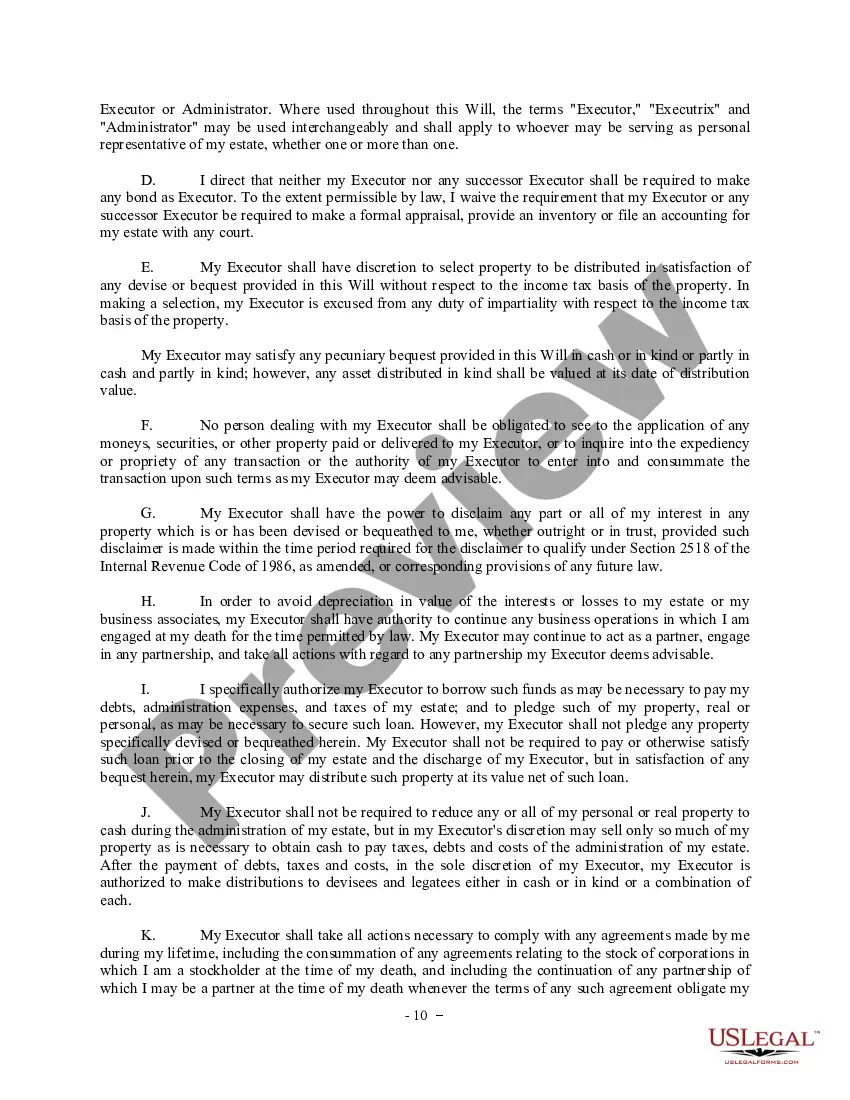

- Complete your template. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

While marital trusts offer benefits, they also have disadvantages. One key drawback is that all assets placed in a marital trust may not be exempt from estate taxes upon the surviving spouse's death. This situation can lead to larger tax liabilities for beneficiaries. When considering the Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates, it’s important to weigh these potential issues against the advantages to make informed decisions about your estate planning.

The primary purpose of a credit trust is to minimize estate taxes by sheltering assets from significant tax burdens upon the death of the first spouse. This type of trust allows for the strategic management of wealth, ensuring that more assets pass on to heirs rather than towards taxes. By utilizing the Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates, couples can maintain control over their assets while optimizing tax efficiency.

No, a marital trust and a credit shelter trust are not the same. A marital trust provides for the surviving spouse's needs, while a credit shelter trust primarily aims to preserve wealth for heirs and minimize taxes. When planning your estate, exploring the Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates can clarify how both options can be used effectively.

A credit trust, also known as a credit shelter trust, helps married couples protect assets from estate taxes by utilizing the estate tax exemption of the first spouse to die. In contrast, a marital trust allows the surviving spouse to access the trust's assets without incurring estate taxes immediately. Understanding these differences is crucial when considering the Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates, as it can significantly influence your estate planning strategy.

For married couples, a credit shelter marital trust is often the best option, especially when considering large estates. This trust allows couples to take advantage of tax exemptions while ensuring financial security for both partners. By using the Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates, you can structure your estate to provide for your spouse and minimize tax liabilities effectively.

The limit of a credit shelter trust is typically equal to the federal estate tax exemption amount, which changes periodically. In an Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates, this limit helps you shield assets from tax liabilities while ensuring they benefit your heirs. Be mindful that state laws may impact the specific exemption limits, so reviewing your personal circumstances with a legal expert is beneficial. This alignment can maximize the tax advantages for your estate plan.

While there is no one-size-fits-all answer, a revocable living trust or an Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates can efficiently manage assets and limit taxes. These trusts allow you to control your assets during your lifetime and offer flexibility for your heirs. Additionally, implementing certain strategies can help minimize taxes upon your passing, optimizing the inheritance for your beneficiaries. Consulting with an estate planning professional can help you design the best trust for your needs.

A credit trust, often included in an Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates, is a trust created to hold the deceased's assets up to the estate tax exemption limit. This structure aims to minimize estate taxes and secure financial benefits for the surviving spouse. The assets in this trust can provide income or support to beneficiaries without transferring ownership. It serves as a reliable strategy in comprehensive estate planning.

No, assets held in an Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates do not receive a step-up in basis when the first spouse passes away. The assets retained in the trust are typically not subject to estate taxes when the first spouse dies but are included in the surviving spouse's estate later. This means the beneficiaries may face capital gains tax upon liquidation of these assets. Understanding this aspect is crucial for effective estate planning.

In an Odessa Texas Complex Will With Credit Shelter Marital Trust For Large Estates, typically, the trust itself is responsible for paying taxes on its income. The grantor can structure the trust in such a way that it becomes a separate tax entity. Beneficiaries may face tax implications upon distribution, depending on the specific circumstances. It’s essential to consult an estate planning attorney to understand the tax obligations thoroughly.