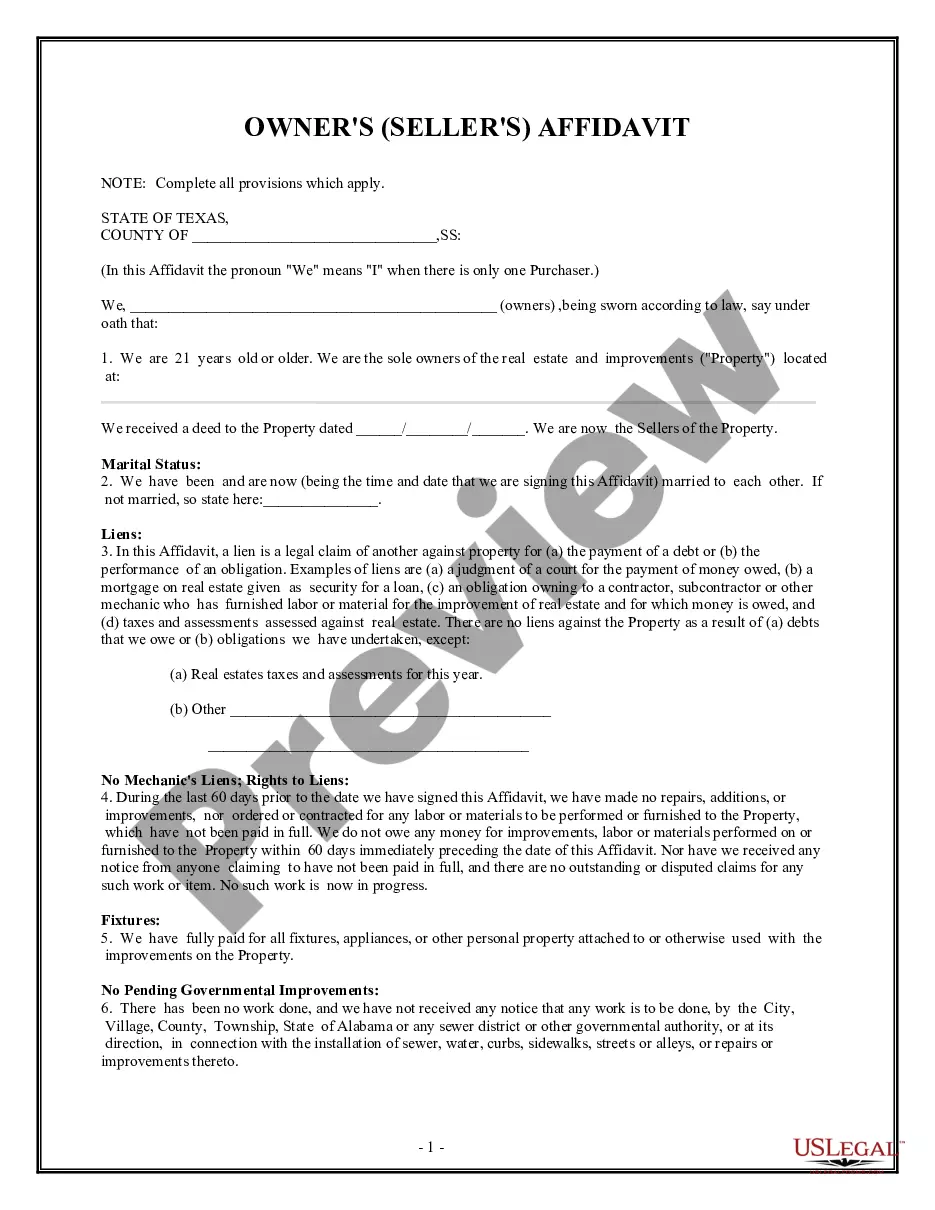

Dallas Texas Owner's or Seller's Affidavit of No Liens

Description

How to fill out Texas Owner's Or Seller's Affidavit Of No Liens?

If you’ve previously made use of our service, sign in to your account and save the Dallas Texas Owner's or Seller's Affidavit of No Liens to your device by clicking the Download button. Ensure that your subscription is active. If it’s not, renew it as per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have unlimited access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to retrieve it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business needs!

- Verify you’ve found the correct document. Read the description and utilize the Preview option, if available, to see if it satisfies your requirements. If it doesn’t meet your needs, employ the Search tab above to locate the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process the payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Dallas Texas Owner's or Seller's Affidavit of No Liens. Select the file format for your document and save it to your device.

- Fill out your sample. Print it or take advantage of professional online editors to complete it and sign it digitally.

Form popularity

FAQ

The T-47 is a Residential Real Property Affidavit. It's a notarized document that tells the buyer what the seller knows about the home's boundaries.

Before accepting the offer and signing the contract, a seller must make sure that they actually DO have an accurate survey in their possession, and have signed and notarized a T-47 Affidavit (the T-47 is a sworn statement of seller that the existing survey is still an accurate depiction of the property in its current

The T-47 is an affidavit that accompanies a survey in real estate transactions when the buyer and seller wish to use an existing survey rather than paying for a new one at the time of the transaction. The seller is responsible for filling out this form.

According to the Daily Herald, the only people who can place a lien on your home are those who have done work or otherwise contributed to the value of your home. For example, contractors and suppliers could place a lien if you do not pay them. Other creditors, though, usually cannot put a lien on your property.

How Does Someone Put a Judgment Lien on My Texas Home? A creditor can file a lien judgment with the county clerk in whichever Texas county the property is located or the debtor has real estate. A judgment lien will remain on the debtor's property for ten years, even if the property changes ownership.

How to Fill out the T 47 - YouTube YouTube Start of suggested clip End of suggested clip And it will say we legal description. And then you're going to put the state of Texas. And thenMoreAnd it will say we legal description. And then you're going to put the state of Texas. And then right here you're going to put we have the owners of the property.

4. How can I find out if there is a lien on my property? Information concerning liens recorded against a property may be researched by the public in the County Clerk's Deed Records Department located at 101 W. Nueva, Suite B109, San Antonio, TX 78205, or visit our website.

You can leave GF number blank ? this is a file number for use by the title company at which you sell your home. The description is a legal description. You can look that up in the tax records or ask your Realtor to tell you.

To check department records for tax liens, you may view homeownership records online or call our office at 1-800-500-7074, ext. 64471. Please be prepared to provide the complete serial number and HUD Label or Texas Seal number of the home.

How to Fill out the Texas Residential Property Affidavit Form? Put the date and File Number. Identify the Affiant(s) Provide the Affiant's Physical Address. Describe the Property and Its Location. Identify the Notary Public. State Your Ownership Rights Type. Put the Date of the Last Major Changes. Provide Details (If Any)