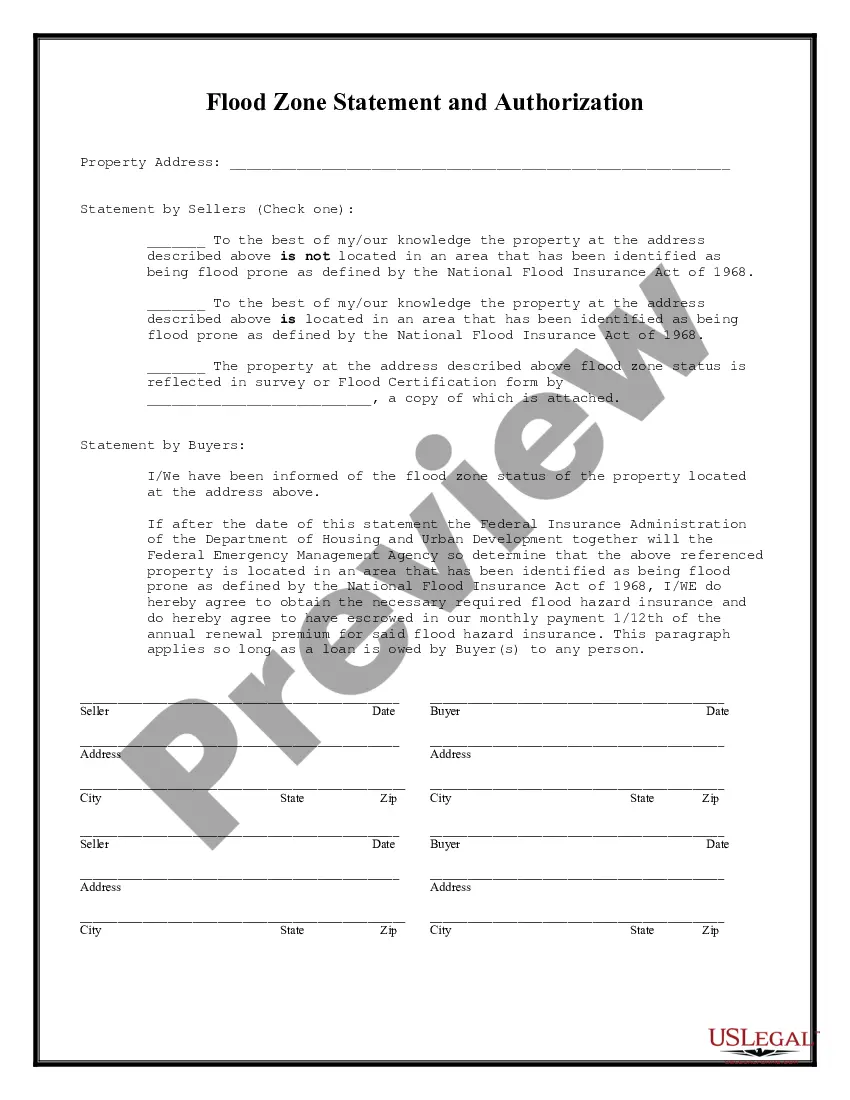

San Angelo Texas Flood Zone Statement and Authorization

Description

How to fill out Texas Flood Zone Statement And Authorization?

Regardless of one’s social or professional rank, filling out legal documents is an undesirable requirement in the contemporary professional landscape.

Frequently, it’s practically unfeasible for an individual without legal education to create this type of paperwork from scratch due to the intricate language and legal nuances involved.

This is where US Legal Forms can prove invaluable.

Verify that the template you selected is tailored to your region, as the laws of one state or county may not apply to another.

Review the form and read a brief summary (if provided) of situations for which the document can be utilized.

- Our platform offers an extensive library of over 85,000 ready-to-use state-specific templates suitable for nearly any legal situation.

- US Legal Forms is also a fantastic resource for assistants or legal advisors aiming to save time by using our DIY documents.

- Whether you need the San Angelo Texas Flood Zone Statement and Authorization or any other document appropriate in your jurisdiction, with US Legal Forms, you have everything at your disposal.

- Here’s how you can swiftly acquire the San Angelo Texas Flood Zone Statement and Authorization using our reliable platform.

- If you are already a subscriber, feel free to Log In to your account to access the desired form.

- If you are new to our collection, be sure to follow these steps before obtaining the San Angelo Texas Flood Zone Statement and Authorization.

Form popularity

FAQ

A flood certificate is usually prepared by a licensed surveyor or a floodplain management professional. These experts assess your property against local flood maps to determine its flood zone status. This assessment is essential for your San Angelo Texas Flood Zone Statement and Authorization. You can also utilize services like USLegalForms to help you find certified professionals who can issue these documents.

To obtain a flood insurance declaration page, you should contact your insurance provider directly. They will guide you through the necessary steps to secure your San Angelo Texas Flood Zone Statement and Authorization. Typically, you will need to provide them with property details and any relevant documentation. Once processed, they will issue you the declaration page for your records.

Acceptable proof of flood insurance includes your insurance policy declaration page, which details the coverage and expiration date. Additionally, a letter from your insurance provider can serve as documentation verifying the policy. It’s crucial to provide this proof when applying for your San Angelo Texas Flood Zone Statement and Authorization, as it ensures compliance with local regulations and protects your investment.

Removing flood insurance requirements usually involves obtaining an updated San Angelo Texas Flood Zone Statement and Authorization that indicates your property is no longer in a designated flood zone. This often requires elevating your home or making modifications to reduce flood risk. Additionally, working with a reliable platform like US Legal Forms can provide you with the necessary documentation and guidance to navigate this process efficiently.

When considering flood zones, Zone AE is often seen as more favorable than Zone A. Zone AE typically has defined base flood elevations, which can provide clearer guidelines for construction and insurance requirements. In contrast, Zone A lacks these elevations, creating uncertainty in flood risk assessment. Understanding your San Angelo Texas Flood Zone Statement and Authorization can help you determine the best approach for your property in either zone.

To challenge a flood zone determination, you need to submit a letter of map amendment (LOMA) request along with supporting documents to FEMA. Providing recent elevation data or flood studies can help strengthen your case. Refer to your San Angelo Texas Flood Zone Statement and Authorization for specific details that may assist in your challenge.

The flood zone of a property is typically determined by FEMA, based on a detailed analysis of flood risks in the area. Local government officials also play a role in making determinations and can provide insights related to your specific San Angelo Texas Flood Zone Statement and Authorization. It is important to stay informed about these changes, as they can affect your insurance requirements.

Getting past the FEMA 50% rule requires you to provide documentation that demonstrates your property's value and the costs of repairs. Ensure you maintain accurate records and consider appealing assessments made in your San Angelo Texas Flood Zone Statement and Authorization. You may also seek assistance from professionals familiar with FEMA regulations to navigate this challenge.

To maximize your flood insurance claim, document every aspect of the damage thoroughly and keep a detailed record of all repairs made. Review your San Angelo Texas Flood Zone Statement and Authorization to understand what is covered under your policy. Engaging professionals, such as contractors or public adjusters, can also help in effectively presenting your claim to the insurance company.

Filing a flood insurance claim starts with notifying your insurance company about the flood event as soon as possible. You will need to complete a Proof of Loss form and provide documentation of the damages. Make sure to refer to the details in your San Angelo Texas Flood Zone Statement and Authorization while filing, as it contains critical information related to your coverage.