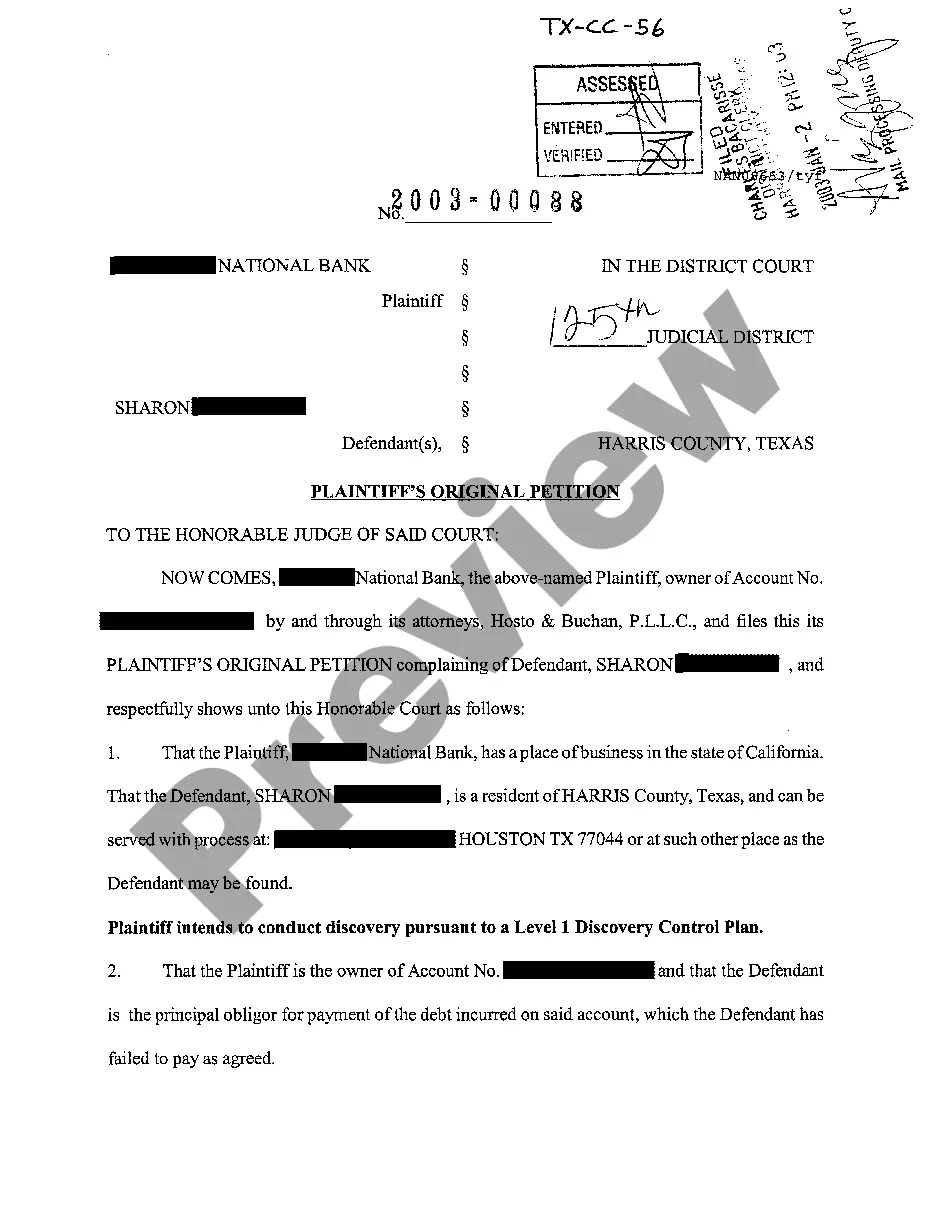

Irving Texas Plaintiff's Original Petition for Debt Collection

Description

How to fill out Texas Plaintiff's Original Petition For Debt Collection?

Locating trustworthy templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

It’s an online resource containing over 85,000 legal documents for personal and professional requirements, as well as various real-life situations.

All the forms are meticulously organized by usage area and jurisdiction, making it as straightforward as one-two-three to find the Irving Texas Plaintiff's Original Petition for Debt Collection.

Click the Buy Now button and select your preferred subscription plan. You will need to register for an account to access the library’s materials.

- Review the Preview mode and form details.

- Ensure you’ve selected the correct option that fits your needs and fully complies with your local jurisdiction's criteria.

- Look for another template, if necessary.

- If you identify any discrepancies, use the Search tab above to find the correct document. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

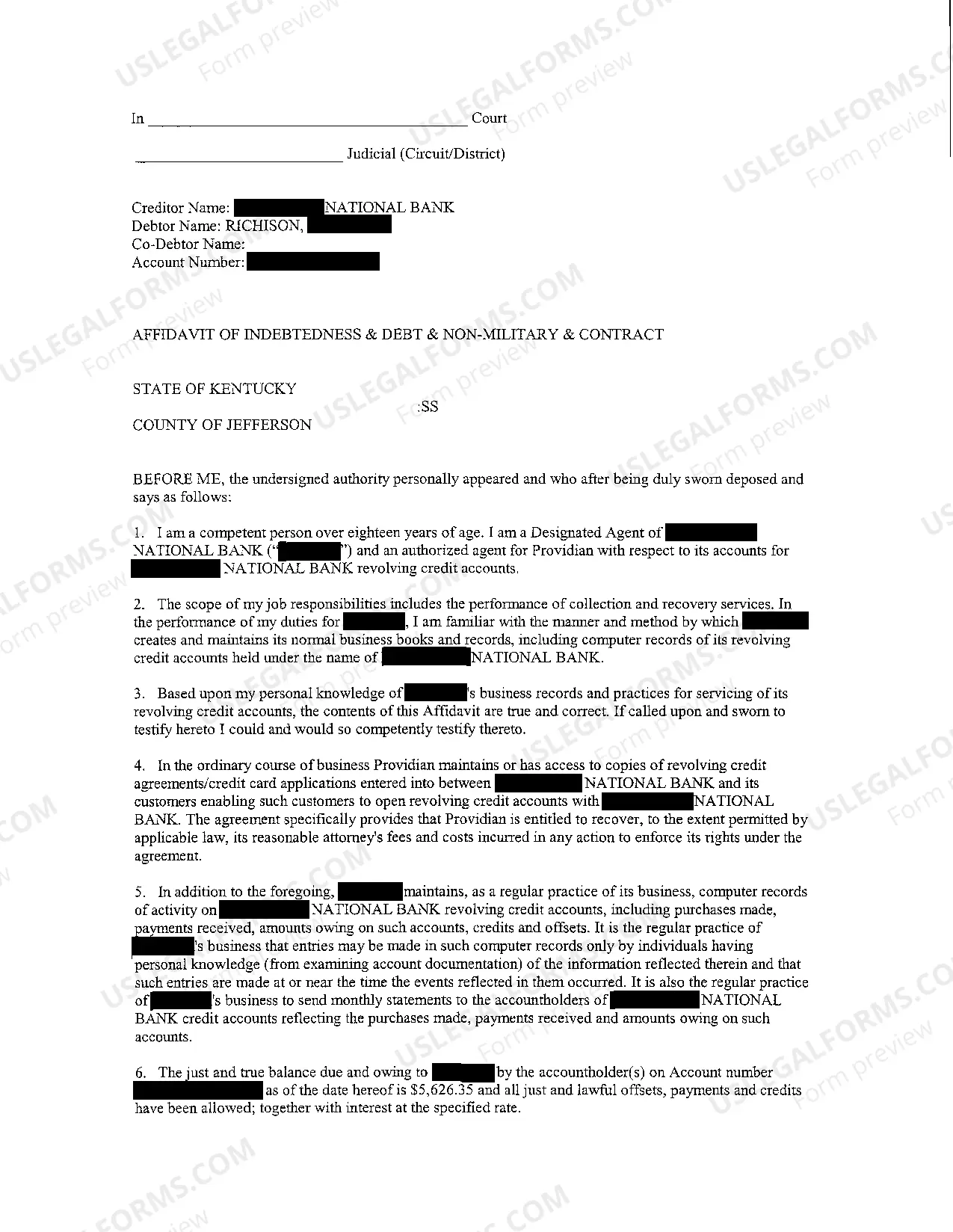

To write an effective debt settlement letter to a collection agency, begin by clearly stating your intention to settle the debt. Include your account number, the amount you owe, and any relevant details that establish your identity. Reference your rights under the Irving Texas Plaintiff's Original Petition for Debt Collection, as this will lend credibility to your request. Finally, propose a reasonable settlement offer, and make sure to include your contact information for any follow-up discussions.

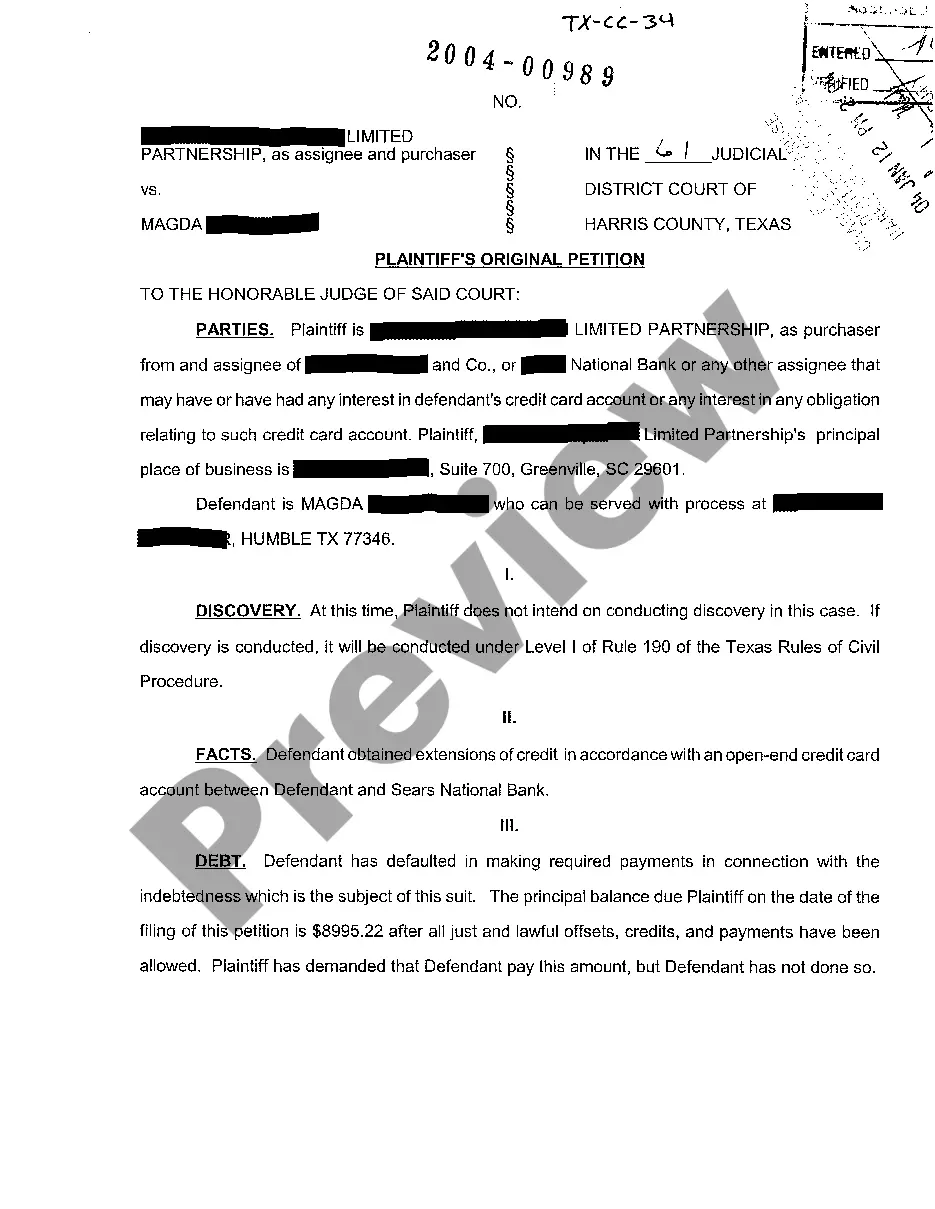

Yes, a debt collection agency can sue you in Texas if you default on a debt. They often file their claim under your Irving Texas Plaintiff's Original Petition for Debt Collection. It's vital to respond promptly to any legal actions taken against you to protect your rights. Ignoring the situation could lead to adverse judgments that further complicate your financial standing.

The best way to win a case involves thorough preparation, solid evidence, and effective communication. You should craft a compelling Irving Texas Plaintiff's Original Petition for Debt Collection that articulates your claims clearly. Collect relevant documents and witness statements to support your case. Engaging with evidence and presenting it confidently will strengthen your position in court.

If you lose in Small Claims Court in Texas, you may not recover any costs associated with your case. You might also face paying the opposing party’s legal fees if determined by the court. However, losing does not block you from pursuing further action, such as filing a different type of lawsuit. It is essential to assess what went wrong and consider options for improvement moving forward.

In Small Claims Court in Texas, you can seek damages related to debts, property loss, or personal injury. This includes amounts owed as stated in your Irving Texas Plaintiff's Original Petition for Debt Collection. It's important to provide evidence that clearly establishes your claim. Successfully proving these damages can help you secure the compensation you deserve.

Winning in small claims court in Texas requires preparation and clear presentation. Start by gathering all pertinent documents, such as your Irving Texas Plaintiff's Original Petition for Debt Collection. Practice your argument to ensure clarity, and be ready to confidently address any counterpoints. Remember that straightforward communication can make a strong impression on the judge.

In Texas, a lawsuit can remain open until resolved, which includes any appeals and post-judgment motions. Generally, the timeframe does not exceed 10 years unless specific circumstances apply. Being proactive with your Irving Texas Plaintiff's Original Petition for Debt Collection can help you navigate the legal timelines effectively and keep your case moving.

Answering a debt collection lawsuit in Texas requires you to file a written response with the court within a specified timeframe. Your answer should address each claim made by the creditor and can include defenses or counterclaims. Utilizing the Irving Texas Plaintiff's Original Petition for Debt Collection will guide you in drafting a comprehensive response that stands up in court.

Disputing a debt collection in Texas involves sending a written notice to the collector, stating why you believe the debt is invalid. Additionally, you can request validation of the debt under the Fair Debt Collection Practices Act, which is crucial during the Irving Texas Plaintiff's Original Petition for Debt Collection. USLegalForms offers resources to effectively manage communication with debt collectors and uphold your rights.

In Texas, a debt judgment typically lasts for 10 years. However, you can extend this period by filing for renewal before the original judgment expires. It's important to remember that the Irving Texas Plaintiff's Original Petition for Debt Collection will initiate this process, ensuring that you hold the necessary documentation for any legal actions taken.