Pasadena Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim

Description

How to fill out Texas Judicial Findings Regarding Instrument Purporting To Create A Lien Of Claim?

Finding reliable templates tailored to your local laws can be difficult unless you utilize the US Legal Forms collection.

It’s a digital repository of over 85,000 legal documents for both personal and business purposes, suitable for various real-world scenarios.

All documents are accurately sorted by their usage area and jurisdiction, making it easy to access the Pasadena Texas Judicial Findings concerning Instrument Purporting to Create a Lien of Claim.

Organizing documents appropriately and in compliance with legal standards is crucial. Make use of the US Legal Forms collection to ensure you always have vital document templates readily available!

- Check the Preview mode and document description.

- Ensure you have selected the appropriate one that aligns with your needs and fulfills your local jurisdiction criteria.

- Look for another template if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it fits your requirements, proceed to the next step.

- Complete the acquisition of the document.

Form popularity

FAQ

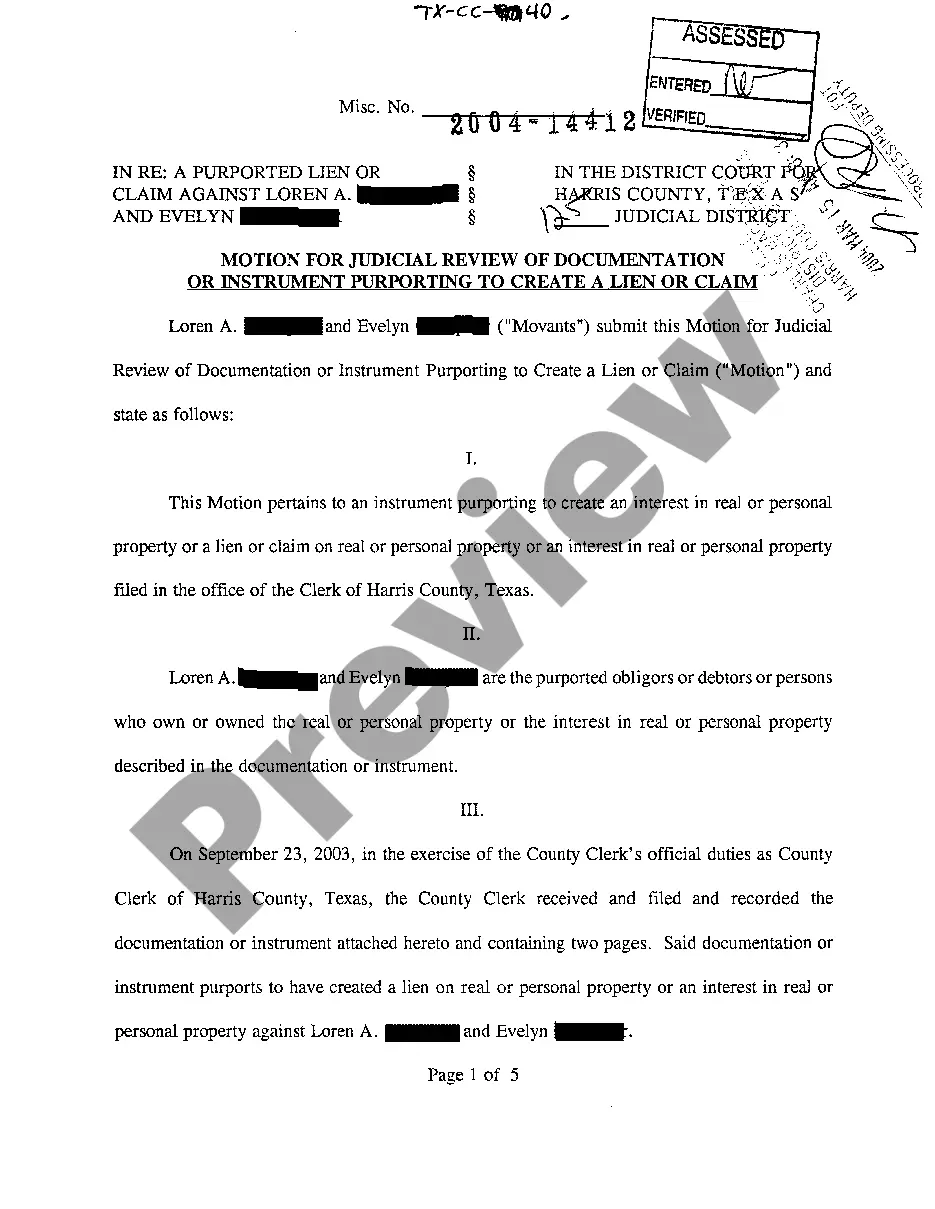

The timeline for a lien in Texas involves several key stages, starting from its creation to enforcement or expiration. Typically, the process begins with the filing of the lien, followed by the creditor's actions to maintain or enforce it within the applicable statute of limitations. To navigate this timeline effectively, consulting resources on Pasadena Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim can provide valuable insights and help protect your interests.

The statute of limitations on a property lien in Texas generally lasts for four years, depending on the type of claim involved. After this period, the lien may not be enforceable, which means the creditor may lose the right to pursue the debt. For effective management of your property, it’s beneficial to grasp Pasadena Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim to know when liens may no longer be valid.

The new lien law in Texas emphasizes transparency and accountability in the lien filing process. Recent updates aim to enhance protection for property owners by requiring clearer documentation and adherence to specific guidelines. By understanding the implications of Pasadena Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim, you can better defend your property rights.

The duration a lien can remain on a property in Texas depends on the type of lien and the actions taken by the lienholder. In most cases, a lien can last for several years, specifically until the debt is settled or until it expires under the law. It's crucial for property owners to be aware of Pasadena Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim to avoid unexpected repercussions.

Yes, property liens can expire in Texas under certain conditions. Generally, a lien may become void after a specific period, typically four years, if the creditor does not take legal action to enforce it. Therefore, staying informed about Pasadena Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim can help you understand your rights and options regarding any existing liens.

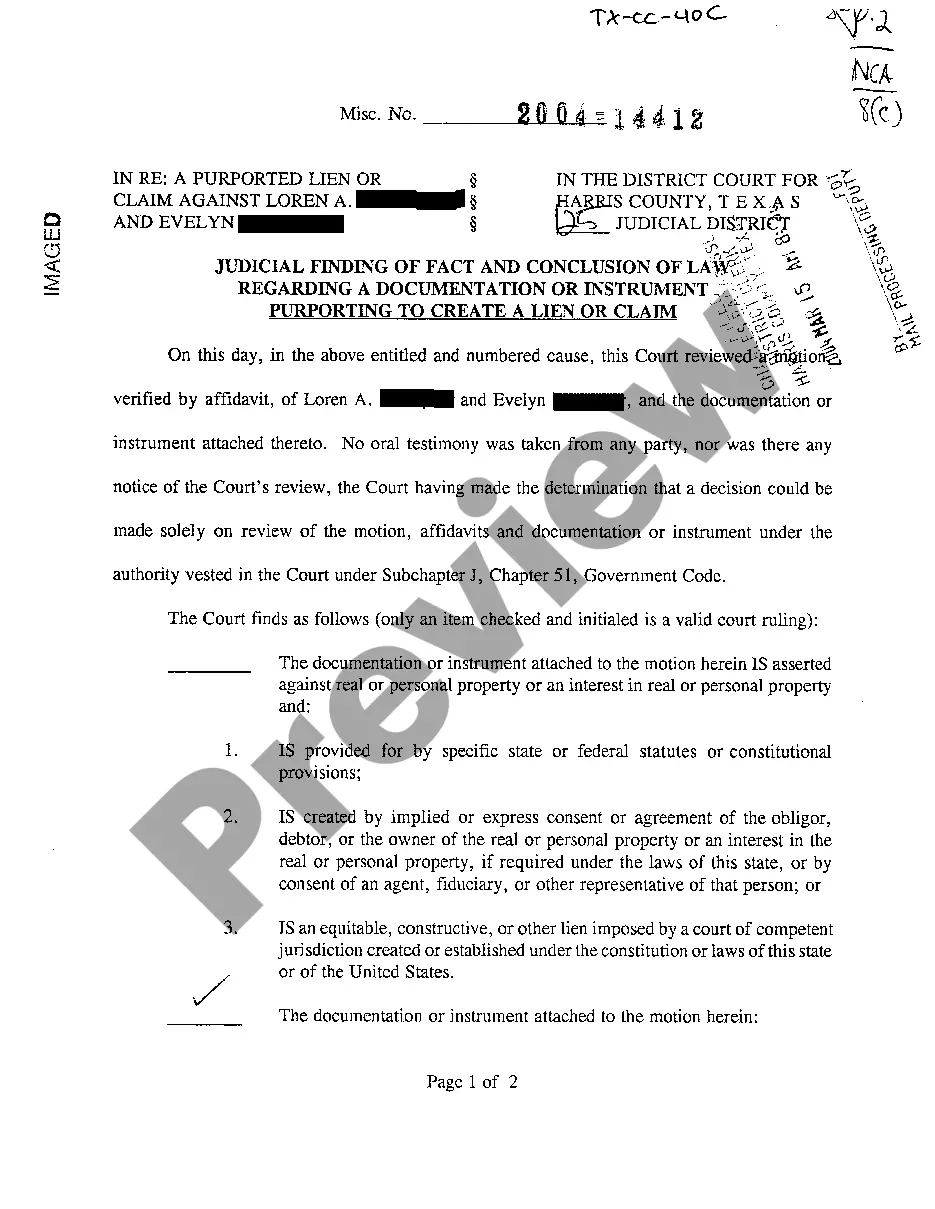

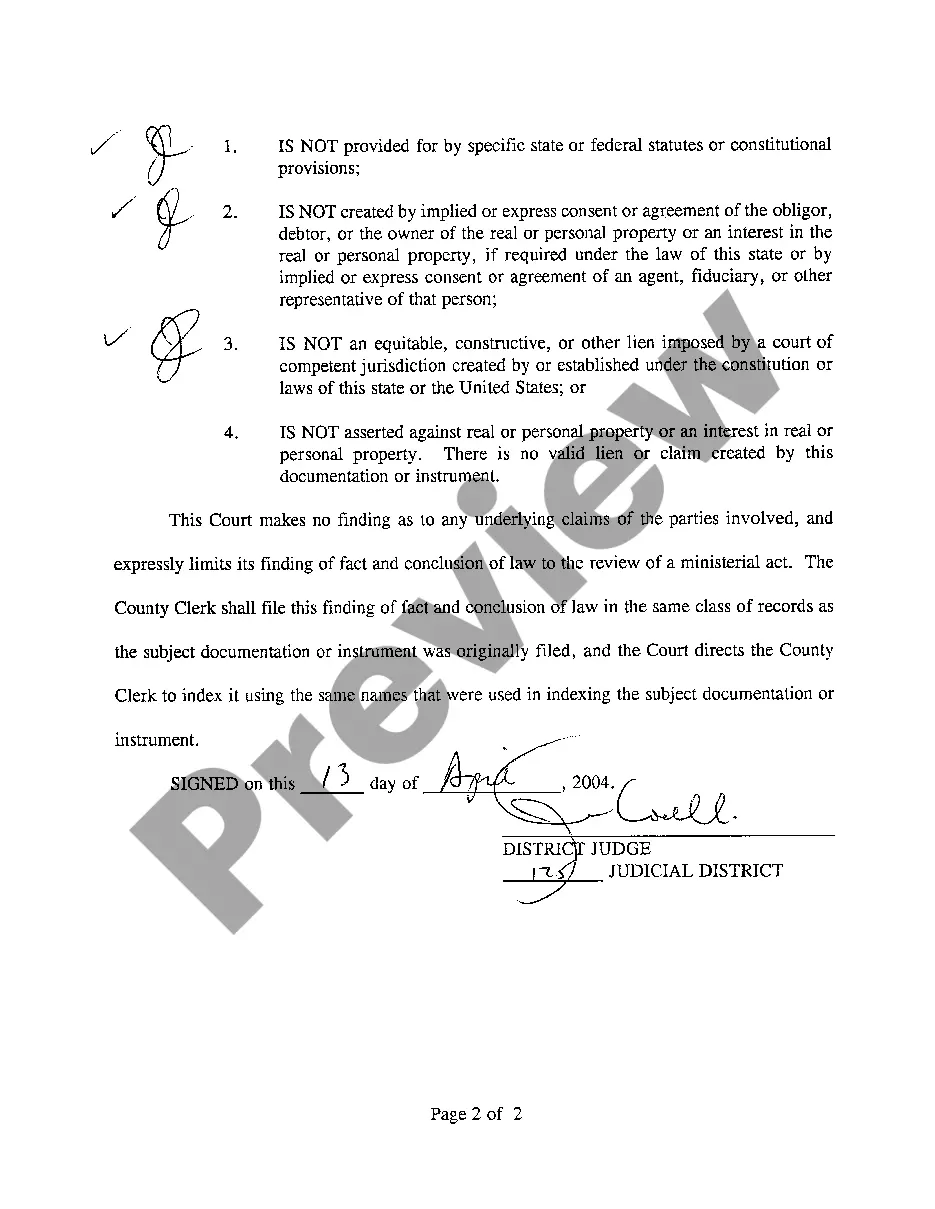

Section 12.002 in Texas law addresses the requirements and legal ramifications concerning an instrument that purports to create a lien or claim on property. This section specifically outlines what constitutes a valid lien and helps protect property owners against fraudulent claims. Understanding Pasadena Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim is essential for property owners to safeguard their rights.

In Texas, the statute of limitations to file a lien typically ranges from four to ten years, depending on the specific type of lien. This timeline is crucial for anyone considering a lien, as failing to file within this period can result in losing the right to assert it. By being aware of the Pasadena Texas judicial findings regarding instruments purporting to create a lien of claim, you can better navigate these legal timelines.

Code 51.903 in Texas pertains specifically to the recording of liens and the necessary judicial findings associated with them. This law defines how courts should evaluate these instruments to protect all parties involved. Without a clear understanding of the Pasadena Texas judicial findings regarding instruments purporting to create a lien of claim, one might face legal issues when trying to enforce or challenge a lien.

Section 51.903 of the Texas Government Code lays out the requirements for judicial findings related to instruments that purport to create a lien or claim. This section aims to clarify the legitimacy of such documents, which is vital for anyone dealing with Pasadena Texas judicial findings regarding an instrument purporting to create a lien of claim. Understanding this section helps individuals and businesses ensure they follow the proper legal procedures when handling liens in Texas.

The Prompt Payment Act, found in the Texas Government Code, ensures timely payments for goods and services provided to state agencies. This law helps protect vendors and fosters transparency in state transactions. Understanding the implications of this act can aid those researching Pasadena Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim, particularly in related contractual disputes.