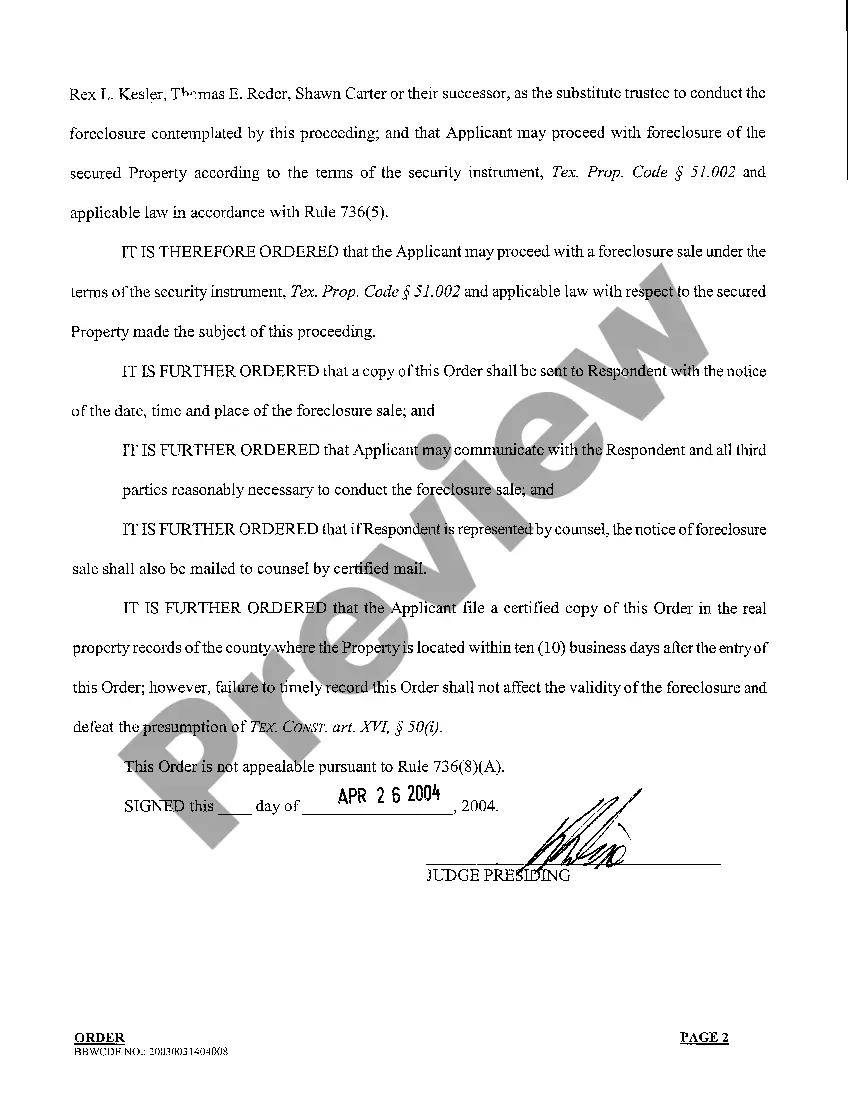

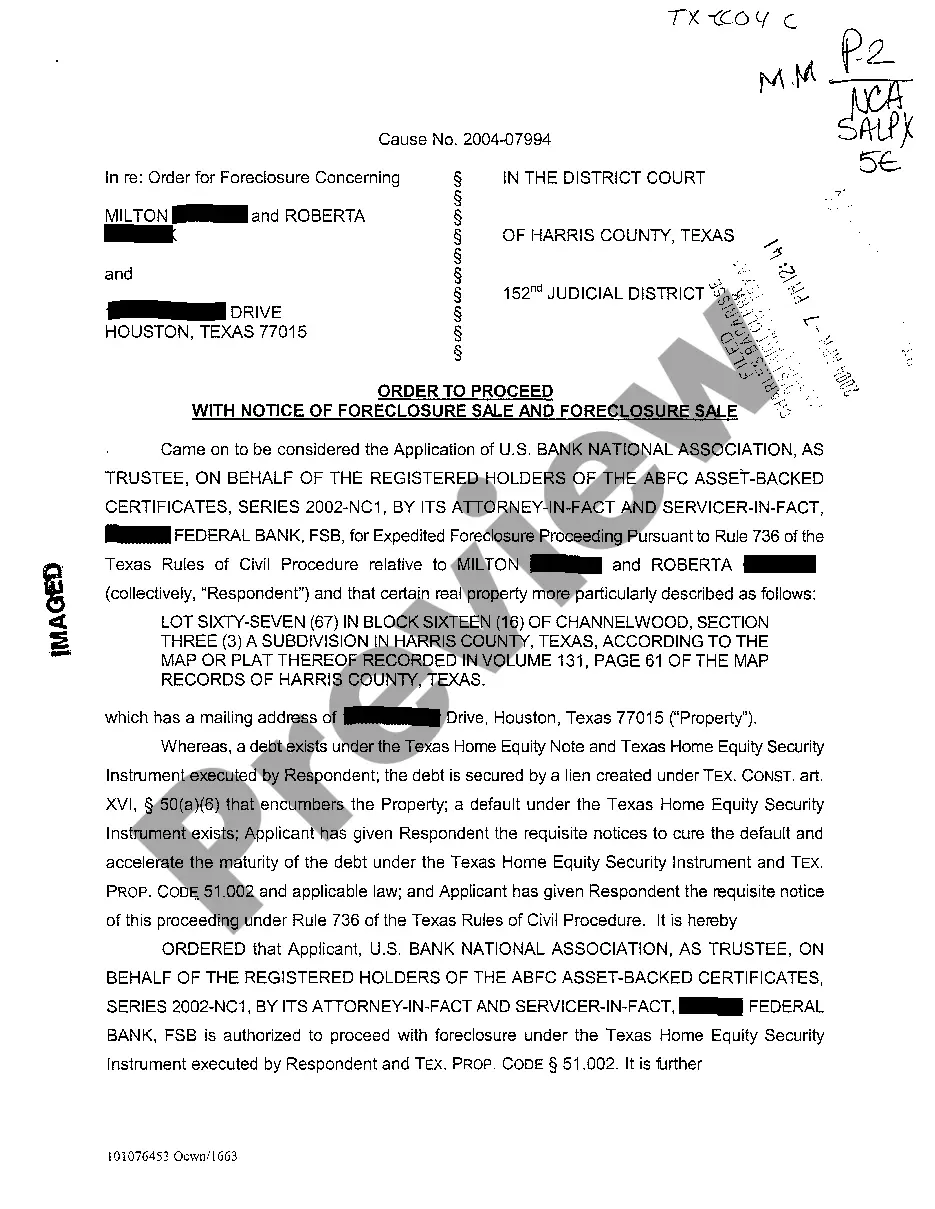

Pearland Texas Home Equity Foreclosure Order

Description

How to fill out Texas Home Equity Foreclosure Order?

If you are in search of a pertinent form template, it's exceptionally challenging to discover a more suitable platform than the US Legal Forms website – likely the most extensive collections available online.

Here you can access thousands of templates for business and personal uses categorized by types, regions, or keywords.

With the enhanced search feature, locating the latest Pearland Texas Home Equity Foreclosure Order is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

Receive the form. Select the format and download it to your device. Make modifications. Complete, adjust, print, and sign the acquired Pearland Texas Home Equity Foreclosure Order.

- Furthermore, the validity of each document is confirmed by a team of skilled attorneys who consistently review the templates on our site, updating them to comply with the latest state and county regulations.

- If you are familiar with our platform and possess a registered account, all you need to do to acquire the Pearland Texas Home Equity Foreclosure Order is to Log In to your account and select the Download option.

- If this is your first experience with US Legal Forms, simply follow the steps outlined below.

- Ensure you have selected the form you need. Review its description and utilize the Preview feature to examine its content. If it doesn't meet your requirements, use the Search bar at the top of the page to find the correct file.

- Confirm your choice. Click on the Buy now option. After that, pick your desired subscription plan and enter your details to create an account.

Form popularity

FAQ

To claim a foreclosure overage in Texas, you must assess any surplus that remains after the foreclosure sale. You'll need to file for these funds typically through the court where the foreclosure took place. It's vital to gather necessary documentation that proves your claim and ownership. The US Legal Forms platform can help streamline your claim process by offering the necessary resources and forms tailored for your situation.

To claim surplus funds from a foreclosure in Texas, start by identifying the excess amounts available following the sale. You will need to file a claim with the appropriate court that handled the foreclosure. In many cases, the process may involve filling out specific forms and providing documentation of your identity and ownership. The US Legal Forms platform can assist you in understanding the necessary steps and forms required for this process.

In a Pearland Texas Home Equity Foreclosure Order, any excess funds generated from a foreclosure sale typically belong to the homeowner. After the sale, the proceeds first cover the outstanding mortgage debt and related expenses. If any funds remain after these debts are settled, they will revert to the homeowner. It's crucial to keep track of these funds and their rightful ownership.

Yes, Texas allows a 120-day period following a missed payment during which lenders must offer homeowners a chance to remedy the default before initiating foreclosure. This timeframe is crucial to understand if you're dealing with a Pearland Texas Home Equity Foreclosure Order. During this period, consider reaching out to your lender to discuss payment options. Resources like uslegalforms can provide valuable assistance in navigating this process.

The 120-day rule for foreclosure in Texas provides protections for homeowners, offering a grace period before the foreclosure process can commence. This rule allows you to avoid foreclosure if you communicate with your lender and work towards an agreement within this time frame. If you're facing a Pearland Texas Home Equity Foreclosure Order, understanding this rule can empower you to take action. Utilize resources like uslegalforms to learn more about your rights and options.

Foreclosure in Texas usually takes about 60 to 90 days after you default on your mortgage payments. The exact duration may vary, depending on various factors, including the lender’s policies and whether the property is contested. If you face a Pearland Texas Home Equity Foreclosure Order, knowing the timeline can help you prepare for your next steps. It’s advisable to consult uslegalforms for guidance to address your concerns timely.

In Texas, you can typically miss two to three mortgage payments before the foreclosure process begins. Once you fall behind, your lender must send you a notice providing you with an opportunity to catch up on your payments. If you are facing a Pearland Texas Home Equity Foreclosure Order, it is essential to understand your options and the timeline involved. You can seek help from resources like uslegalforms to navigate this situation effectively.

In Texas, you typically can miss 3 payments without triggering foreclosure; however, this can differ based on your lender's policies. Foreclosure can start earlier if the lender feels the risk is high or if several payments are missed over time. It’s advisable to act quickly if you anticipate challenges making payments. Being informed about options like a Pearland Texas Home Equity Foreclosure Order can make a significant difference in your situation.

In Texas, you may miss up to 3 mortgage payments before the foreclosure process starts. However, your lender might choose to act sooner, depending on your payment history and the terms of your agreement. Understanding your rights and the process is essential, especially if you find yourself falling behind. To gain peace of mind about a Pearland Texas Home Equity Foreclosure Order, consider utilizing resources like USLegalForms.

In general, you can miss a few mortgage payments before facing foreclosure, but it varies based on your lender's policy. Many lenders consider foreclosure after you have missed about 3 to 6 consecutive payments. Keep in mind, the process can begin earlier if you fall behind in your payments. To avoid a Pearland Texas Home Equity Foreclosure Order, staying in contact with your lender is crucial.