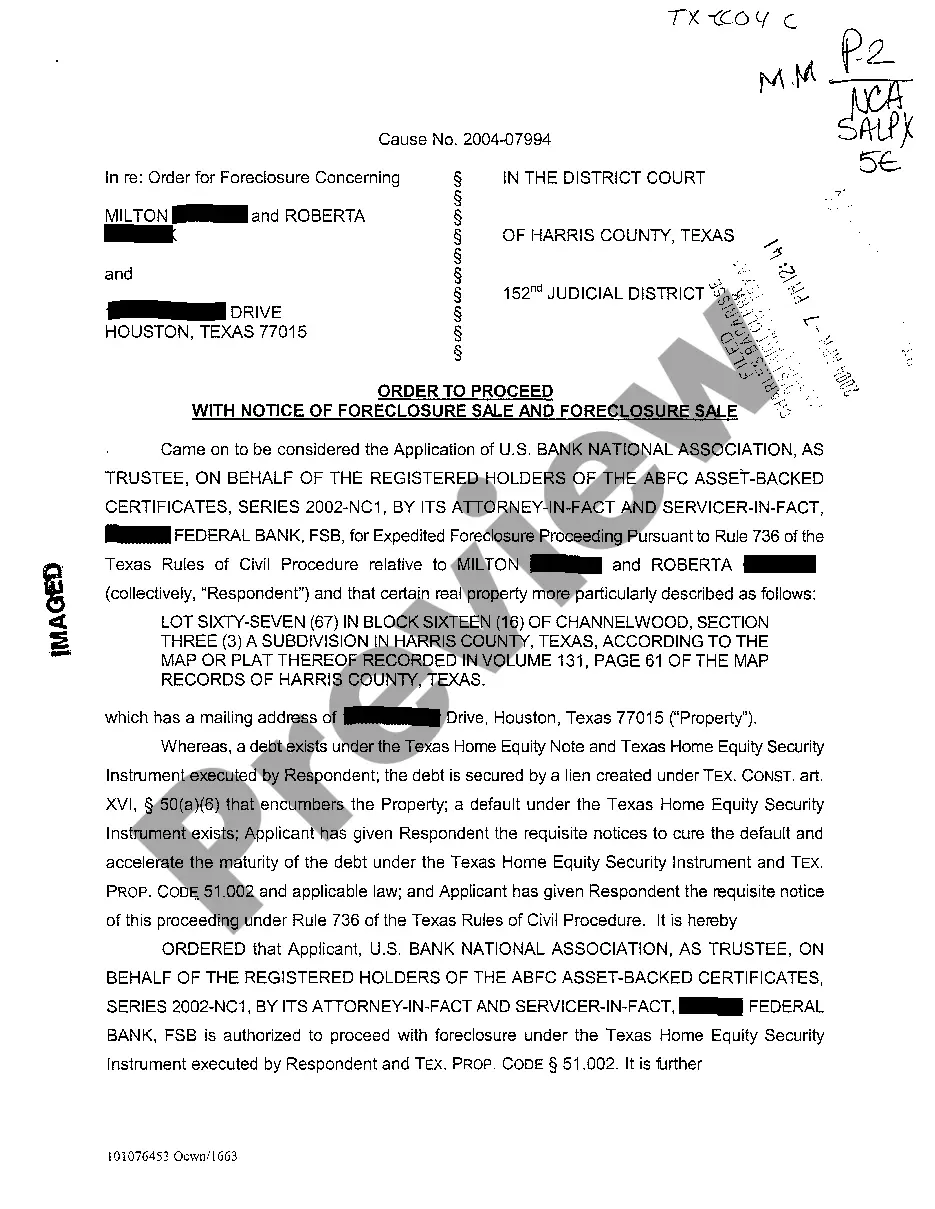

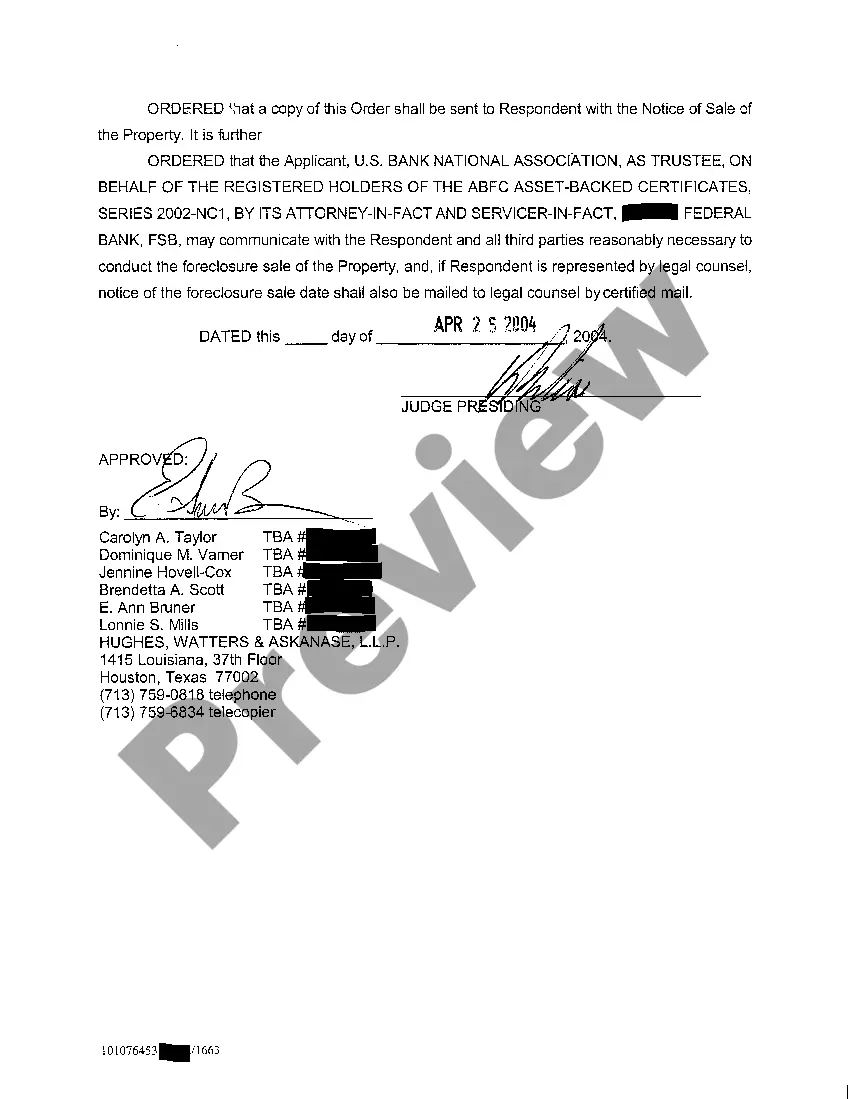

Title: Understanding the Plano Texas Order to Proceed with Notice of Foreclosure Introduction: The Plano Texas Order to Proceed with Notice of Foreclosure serves as a crucial legal document that initiates foreclosure proceedings on a property located in Plano, Texas. This article aims to provide a comprehensive overview of this order, its significance, and the possible variations that may exist within it. Types of Plano Texas Order to Proceed with Notice of Foreclosure: 1. Judicial Foreclosure: In cases where a lender pursues foreclosure through judicial means, a Plano Texas Order to Proceed with Notice of Foreclosure may be obtained. This type of foreclosure involves the lender filing a lawsuit against the homeowner in order to obtain a court order authorizing the foreclosure sale. 2. Non-Judicial Foreclosure: Alternatively, Plano Texas allows for non-judicial foreclosures, which bypass the court process. In this scenario, the lender follows specific statutory procedures outlined in the Deed of Trust or Mortgage in order to initiate foreclosure. A Plano Texas Order to Proceed with Notice of Foreclosure is still required but typically involves fewer legal formalities compared to a judicial foreclosure. Key Elements of the Plano Texas Order to Proceed with Notice of Foreclosure: 1. Information about the Borrower: The order includes details about the borrower(s) involved in the foreclosure process, including their full names, contact information, and the property's address in Plano, Texas. 2. Lender Details: The order specifies the lender's name, contact information, and their legal representation (if applicable). It may also include the lender's loan number and any relevant reference numbers. 3. Property Description: A precise description of the property subject to foreclosure is provided, including the physical address, legal description, and any additional information necessary for accurate identification. 4. Cause for Foreclosure: The order outlines the specific reason(s) for initiating foreclosure, such as default on mortgage payments, breach of contract, or failure to fulfill loan obligations. 5. Timeline and Key Dates: The order defines important milestones related to the foreclosure process, including deadlines for responding to the notice, potential hearings or court dates, and the scheduled foreclosure sale date. 6. Rights and Alternatives for the Borrower: To ensure fairness throughout the foreclosure process, the order also highlights the borrower's rights, such as the opportunity to cure the default, request mediation, or explore alternatives to foreclosure through loan modification or refinancing options. Conclusion: The Plano Texas Order to Proceed with Notice of Foreclosure plays a crucial role in initiating the foreclosure process within Plano, Texas. By adhering to legal procedures and timelines, this order stipulates the rights and responsibilities of both the lender and borrower, creating a fair process that allows for potential resolution or sale of the property. It is essential for all parties involved to consult legal professionals to understand their options and obligations under the Plano Texas Order to Proceed with Notice of Foreclosure.

Plano Texas Order To Proceed With Notice of Foreclosure

Description

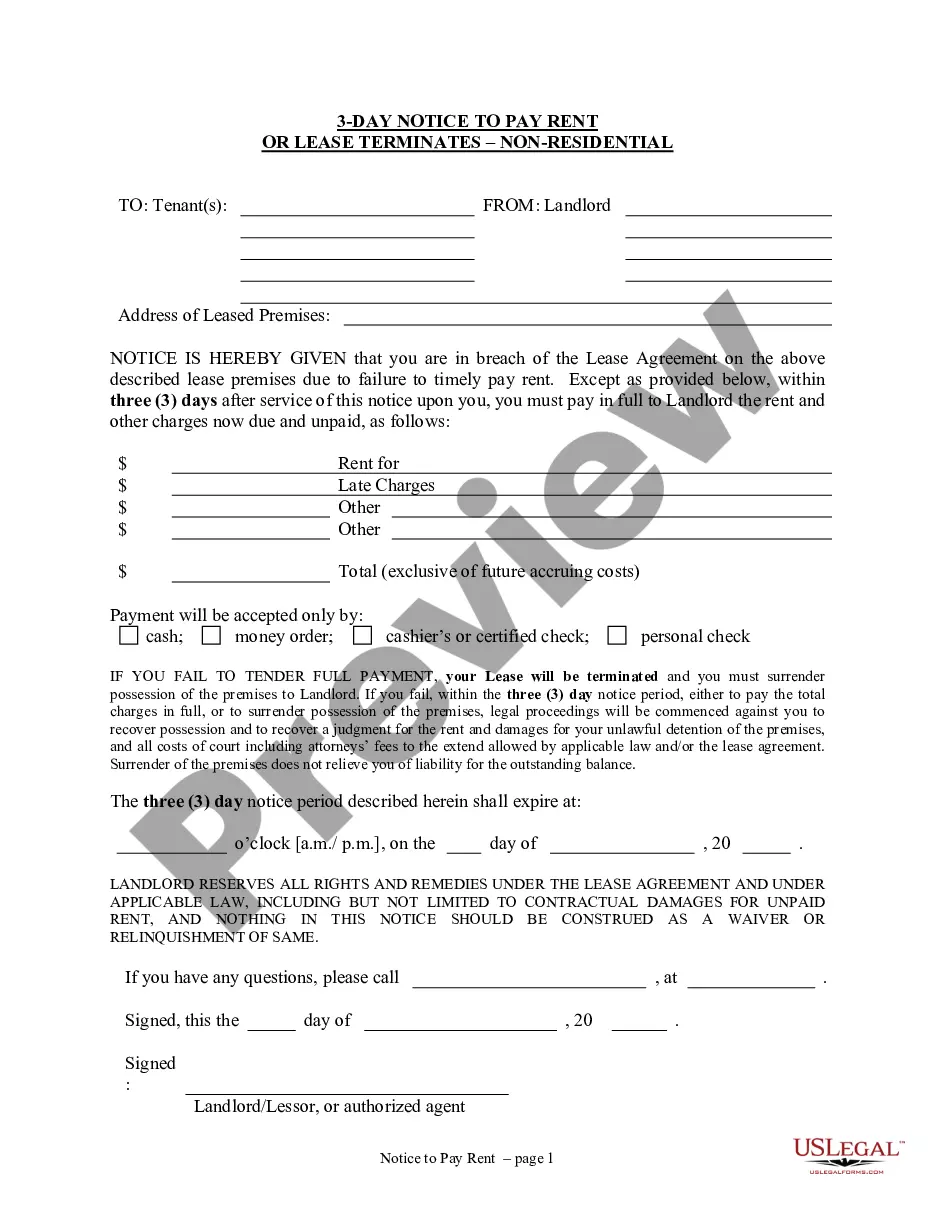

How to fill out Plano Texas Order To Proceed With Notice Of Foreclosure?

Finding validated templates tailored to your local laws can be challenging unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents for both individual and professional purposes and various real-life scenarios.

All the paperwork is accurately classified by usage area and jurisdictional domains, making the search for the Plano Texas Order To Proceed With Notice of Foreclosure as simple and quick as counting to three.

Maintaining organized paperwork that complies with legal standards is crucial. Leverage the US Legal Forms library to readily access essential document templates for any requirements at your convenience!

- Verify the Preview mode and document description.

- Ensure you’ve selected the accurate one that fulfills your requirements and completely aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, employ the Search tab above to find the correct one. If it matches your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. Foreclosure and COVD-19 Relief. The Bottom Line.

Federal regulation issued by the Consumer Financial Protection Bureau that states the mortgage loan obligation must be over 120 days delinquent before initiating a foreclosure action.

You do not have to move out on the sale date. If you are still living in the home after a foreclosure, the new owner will have to evict you. You'll get a notice to vacate (usually giving 3 days) before an eviction is filed.

Texas foreclosures occur quickly. In just 60 days an uncontested foreclosure can be completed. If the lender seeks a delay or if the borrower contests the foreclosure or files for bankruptcy then it will take longer to foreclose on the property.

Under Texas law, a lender has to use a quasi-judicial process to foreclose a home equity loan. In this process, the lender must get a court order approving the foreclosure before conducting a nonjudicial foreclosure. Also, Texas law doesn't allow deficiency judgments following the foreclosure of a home equity loan.

The results showed that the time period for completing a foreclosure was shortest in Texas. It was an average of 159 days, compared to 166 days in Virginia, the next speediest state. This is very fast compared to the national average.

The most common foreclosure process in Texas is non-judicial foreclosure, which means the lender can foreclose without going to court so long as the deed of trust contains a power of sale clause. Non-judicial foreclosure is most common with purchase money loans as well as rate-and-term refinances.

The Texas foreclosure process has roughly 160 days from start to finish until a home goes into auction, so knowing where you stand can help you decide what might be the next best course of action. Foreclosure is awful, to say the least.