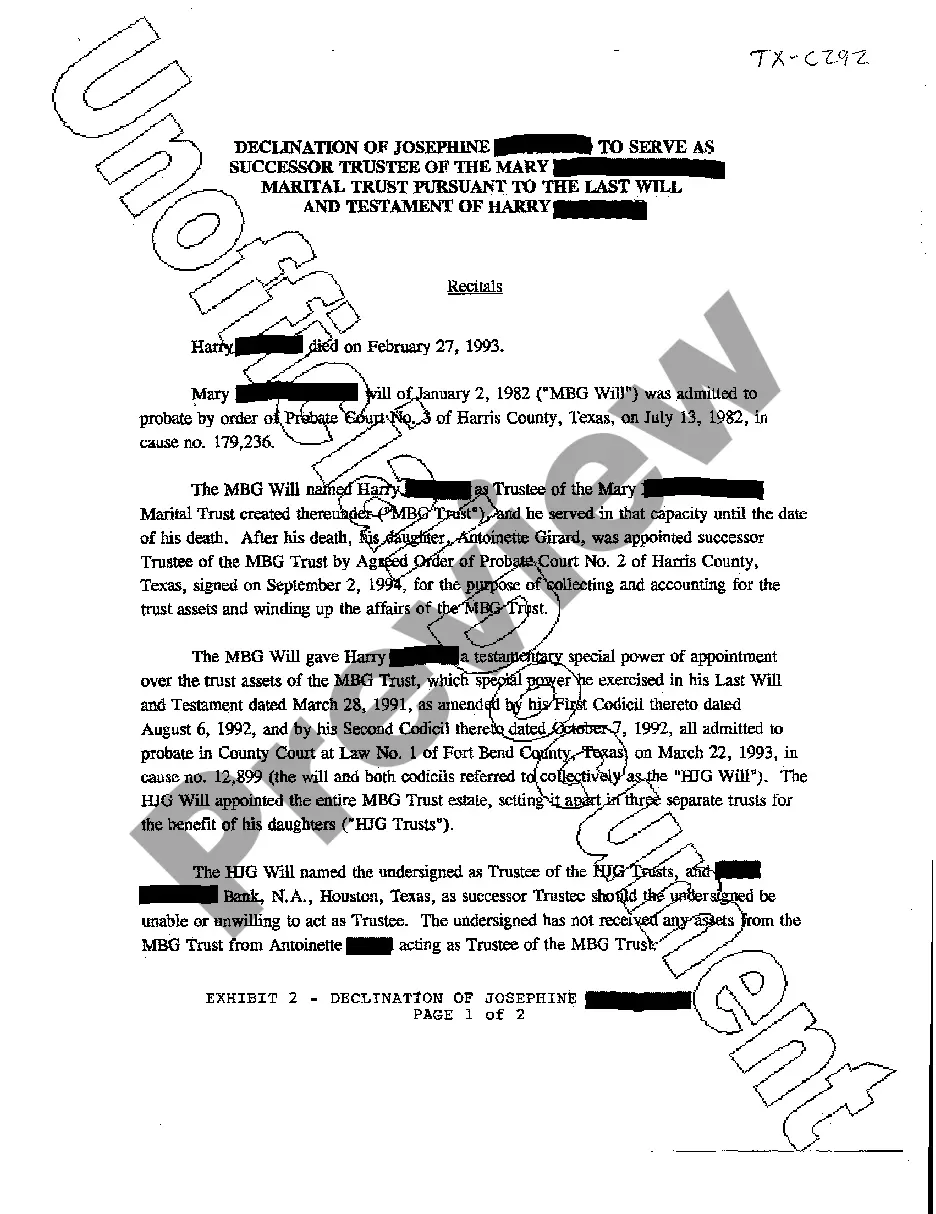

Pearland Texas Recitals regarding Declination to Serve as Successor Trustee refer to legally binding documents that outline an individual's decision to refuse or decline the role of successor trustee in a trust agreement established in Pearland, Texas. These recitals serve as an important part of the trust document and help to clarify the intentions and desires of the granter (the person who established the trust) and the appointed trustee. In these Pearland Texas Recitals, specific details related to the trustee's declination to serve are mentioned. These may include the trustee's personal reasons for declining the appointment, such as health issues, lack of expertise in trust administration, or the existence of conflicts of interest that could potentially impair their ability to act in the best interest of the trust and its beneficiaries. Depending on the circumstances, there might be different types or variations of Pearland Texas Recitals regarding Declination to Serve as Successor Trustee. These variations could include: 1. Voluntary Declination Recital: This type of recital is used when a potential successor trustee voluntarily decides to decline the trustee appointment. They may express their reasons for declining and their acknowledgement that they are aware of the implications of their decision. 2. Incapacity Declaration Recital: If the individual declines to serve due to a mental or physical incapacity, this recital specifies the reasons for their incapacity and provides evidence supporting their inability to fulfill the responsibilities of the trustee. 3. Conflict of Interest Recital: In some cases, a potential successor trustee may decline the role due to potential conflicts of interest that could compromise their impartiality. This recital would highlight the specific conflicts of interest and the potential negative impact they may have on the trust administration. 4. Lack of Expertise Recital: A potential successor trustee who lacks the necessary expertise or knowledge required to effectively administer the trust may include this recital, explaining their decision to decline the appointment on the grounds of inadequate qualifications. 5. Other Specific Circumstances Recital: This category covers any other unique circumstances that lead to the declination of the appointment, such as personal commitments, overwhelming time constraints, or any other valid reasons that the trustee deems appropriate. In conclusion, Pearland Texas Recitals regarding Declination to Serve as Successor Trustee documents provide clarity and transparency regarding an individual's decision to refuse the role of trustee in a trust agreement established in Pearland, Texas. The variations mentioned above help address different scenarios where an individual may decline the appointment due to personal or legal considerations.

Pearland Texas Recitals regarding Declination to Serve as Successor Trustee

Description

How to fill out Pearland Texas Recitals Regarding Declination To Serve As Successor Trustee?

If you’ve previously utilized our service, Log Into your account and download the Pearland Texas Recitals concerning Refusal to Act as Successor Trustee onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have purchased: you can find them in your profile under the My documents section whenever you need to use them again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or business requirements!

- Ensure you’ve located a suitable document. Review the description and take advantage of the Preview option, if available, to verify if it satisfies your requirements. If it doesn't, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete a payment. Provide your credit card information or choose the PayPal option to finalize the transaction.

- Retrieve your Pearland Texas Recitals regarding Refusal to Act as Successor Trustee. Select the file format for your document and store it on your device.

- Complete your form. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

Declination to serve as successor trustee refers to the formal decision made by an individual to not accept the role of trustee when appointed. This decision must be documented using specific legal forms that comply with local laws, such as those found in Pearland Texas. By making this declination, individuals can avoid potential legal complications, ensuring their choice is officially recognized and respected.

To decline a successor trustee position, you need to fill out and submit a declination to serve as trustee form. It’s essential to inform the current trustee and any interested parties about your decision. Utilizing platforms like USLegalForms can simplify this process by providing templates and guidance specifically tailored for Pearland Texas recitals regarding declination to serve as successor trustee.

A declination to serve as trustee form is a legal document used when an individual chooses not to accept the role of trustee. It clearly states the individual's refusal to act in this capacity, thereby protecting their interests and legal responsibilities. In Pearland Texas, this form plays a vital role in estate planning, ensuring that both trustees and beneficiaries understand the intentions of all parties involved.

Selecting a successor trustee is a crucial step in estate planning, especially in light of the Pearland Texas Recitals regarding Declination to Serve as Successor Trustee. Begin by considering individuals who demonstrate trustworthiness and responsibility. Evaluate their financial acumen, as well as their understanding of your wishes and family dynamics. You may also explore the option of appointing a professional trustee or a trust company, which often provides impartiality and expertise in managing the trust assets.

It is common for trust deeds to provide, for instance, that in the case of death of one of the trustees, the other trustees can appoint the next trustee or that it would be one of the heirs of the family of the author, say legal experts.

An executor operates under the supervision of the probate court. A successor trustee is answerable to the beneficiaries of the trust.

Successor Trustee is the person or institution who takes over the management of a living trust property when the original trustee has died or become incapacitated. The exact responsibilities of a successor trustee will vary depending on the instructions left by the creator of the trust (called the Grantor).

7 Different Types of Trustees Administrative Trustee. Independent Trustee. Investment Trustee. Successor Trustee. Charitable Trustee. Corporate Trustee. Bankruptcy Trustee.

A trustee, who can either be the trustor or another responsible party, may be appointed while the trustor is still alive; a successor trustee is charged with administering a trust after the trustor or the appointed trustee (if they are different from the trustor) becomes incapacitated or dies.

You also need to understand that there is a distinction to be made between who inherits a trust when someone dies (the beneficiaries) and who shall have the responsibility of administering the trust, paying the bills and taxes, and distributing what's left to the beneficiaries (the successor trustees).