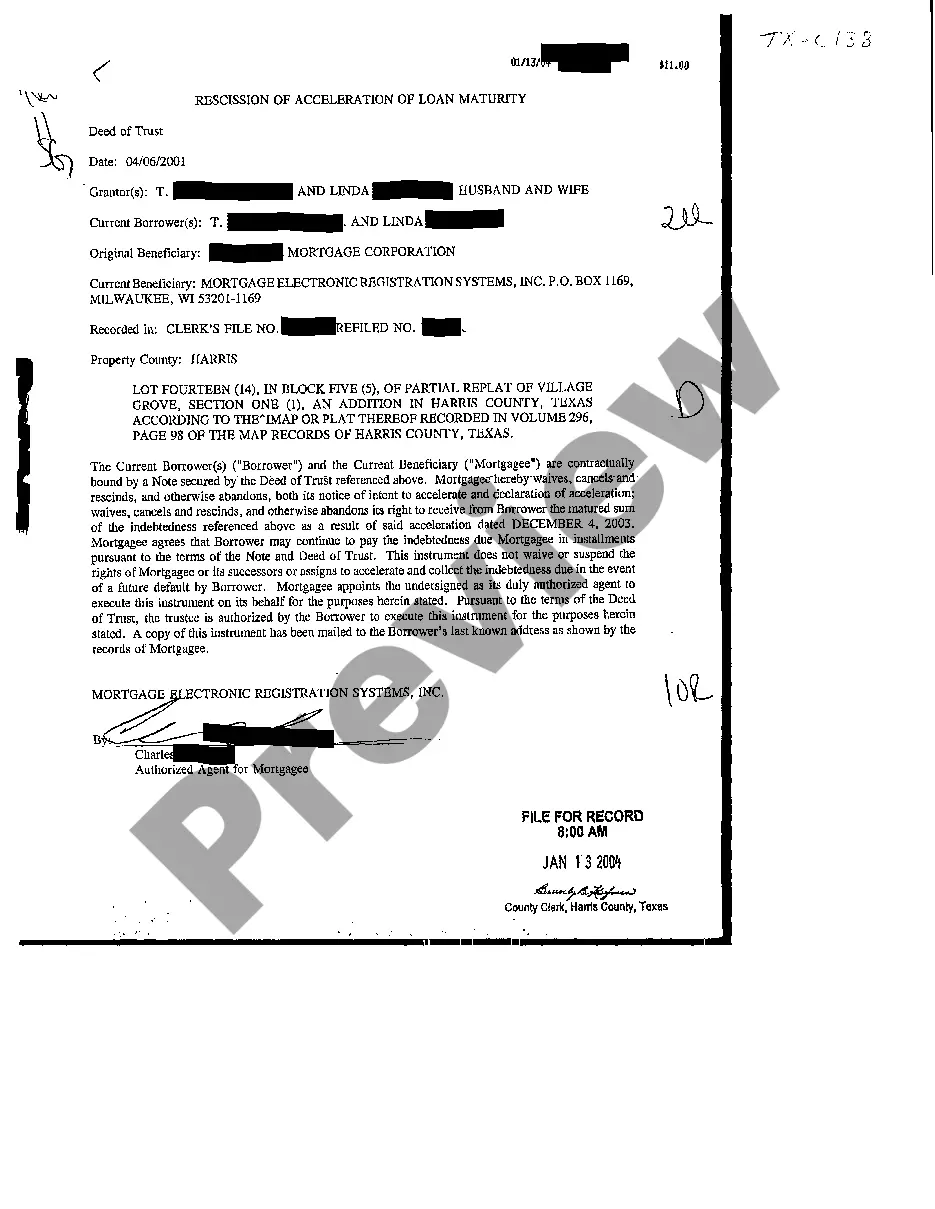

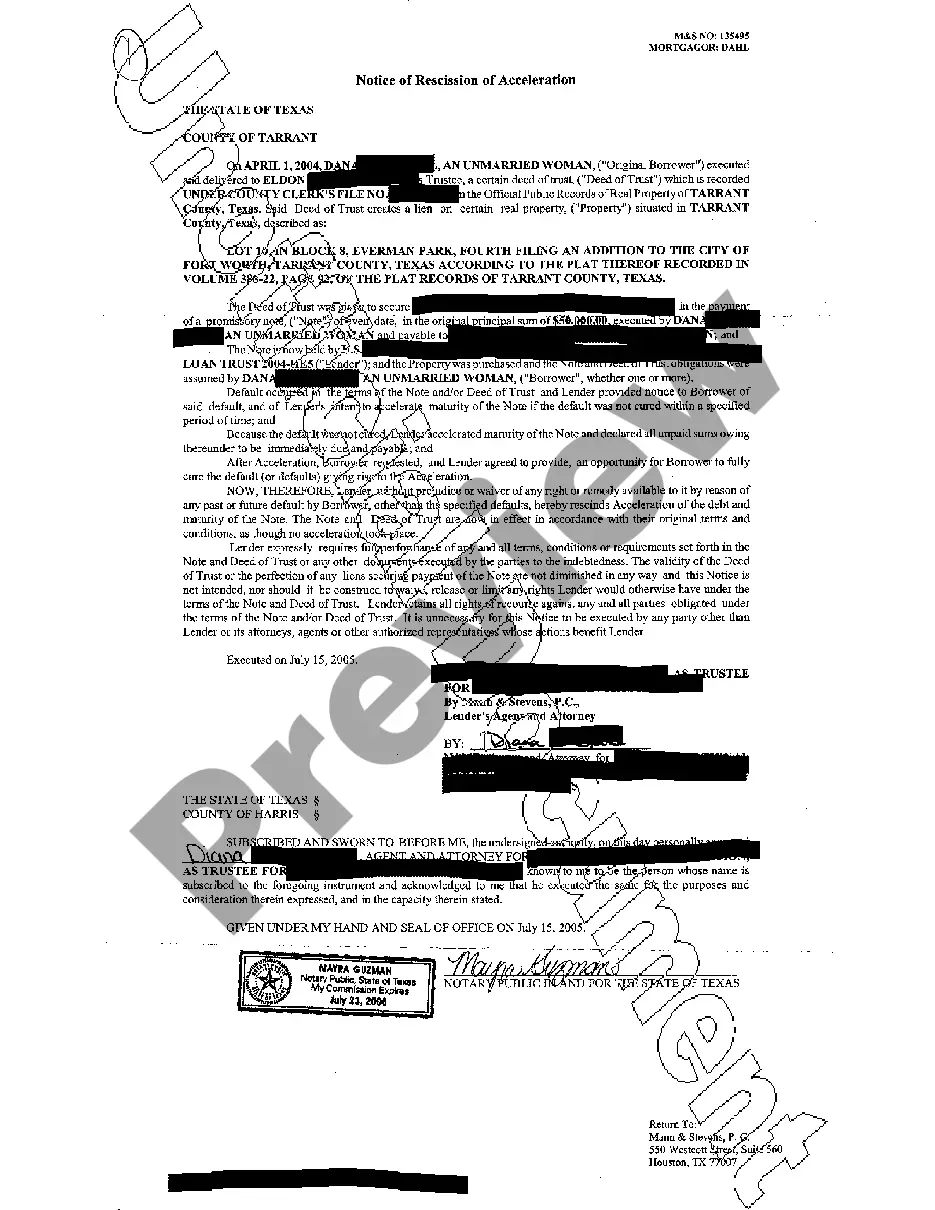

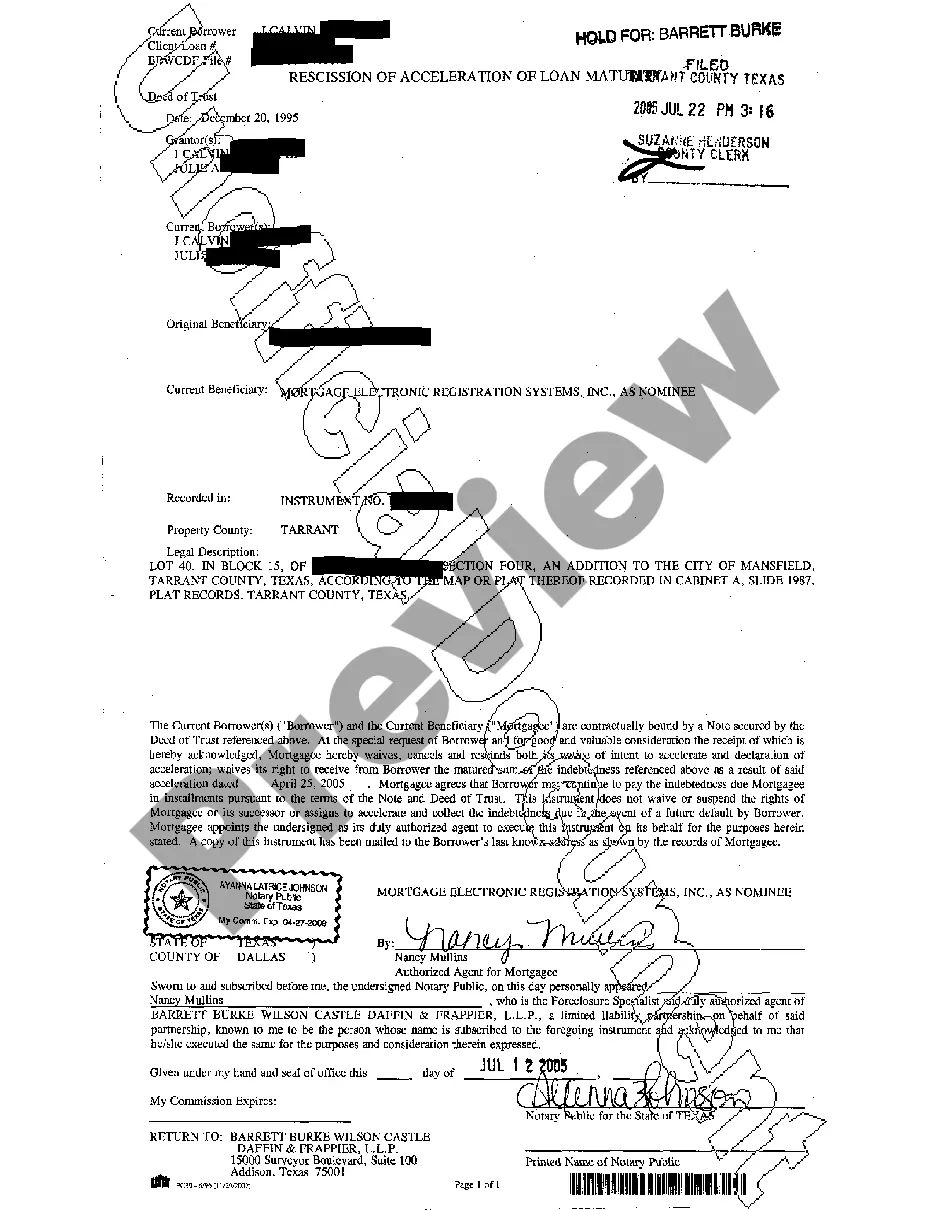

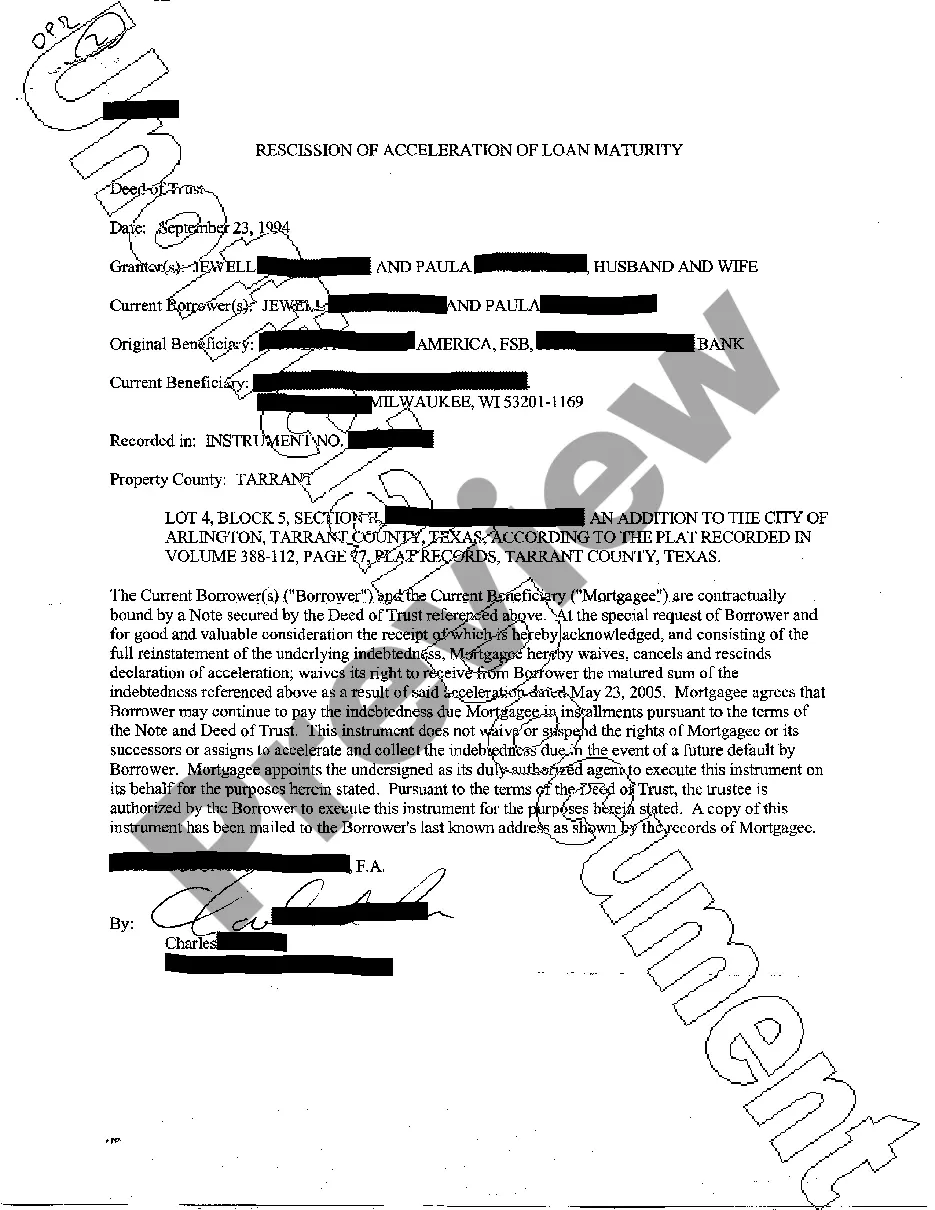

Edinburg Texas Rescission of Acceleration of Loan Maturity

Description

How to fill out Texas Rescission Of Acceleration Of Loan Maturity?

Utilize the US Legal Forms for immediate access to any form template required.

Our user-friendly platform offers a vast array of document templates, streamlining the process of locating and acquiring nearly any document sample you require.

You can save, complete, and sign the Edinburg Texas Rescission of Acceleration of Loan Maturity in a matter of minutes instead of spending hours online finding a suitable template.

Using our repository is an excellent method to enhance the security of your record submissions.

US Legal Forms is arguably the largest and most reliable form repository online.

We are always eager to assist you with any legal matter, even if it merely involves downloading the Edinburg Texas Rescission of Acceleration of Loan Maturity. Feel free to take advantage of our form catalog and optimize your document experience!

- Our qualified attorneys frequently examine all documents to ensure that the templates are suitable for a specific jurisdiction and adhere to the latest laws and regulations.

- How can you obtain the Edinburg Texas Rescission of Acceleration of Loan Maturity.

- If you already have an account, simply Log In to your profile. The Download option will be available for all the samples you view.

- You can also access all your previously saved documents in the My documents section.

- If you do not possess an account yet, follow the guidelines below.

- Access the page with the required template. Confirm that it is the document you are looking for: check its title and description, and utilize the Preview option if available. Alternatively, use the Search field to find the required one.

- Initiate the download process. Click Buy Now and select the pricing plan that fits your needs best. Then, create an account and complete your order using a credit card or PayPal.

- Download the file. Choose the format to obtain the Edinburg Texas Rescission of Acceleration of Loan Maturity, then modify and fill or sign it as necessary.

Form popularity

FAQ

After the loan is accelerated, the borrower can no longer pay off the loan in installments; the loan changes from an installment contract to a debt that's due in a single, lump-sum payment.

For mortgages that have an acceleration clause (most do), that means that, after breaching your contract by missing payments, your lender can demand that you either pay off the entire balance of your mortgage or be foreclosed upon.

An acceleration clause is often part of a loan contract, and it allows a lender to require you to immediately repay all of your outstanding loan balance if you don't meet certain conditions. A lender may take advantage of this clause if you miss too many payments or breach the contract in some other way.

Delayed or Missed Payments ? Repeated missed payments may force the lender to effectuate an acceleration clause. Thankfully, making full mortgage payments before can reverse the process.

An acceleration clause is usually based on payment delinquency, however the number of delinquent payments can vary. Some acceleration clauses may invoke immediate payoff after one payment is missed while others may allow for two or three missed payments before demanding that the loan be paid in full.

An accelerated clause is typically invoked when the borrower materially breaches the loan agreement. For example, mortgages generally have an acceleration clause that is triggered if the borrower misses too many payments. Acceleration clauses most often appear in commercial mortgages and residential mortgages.

When a loan defaults, it is sent to a debt collection agency whose job is to contact the borrower and receive the unpaid funds. Defaulting will drastically reduce your credit score, impact your ability to receive future credit, and can lead to the seizure of personal property.

The notice of acceleration cuts off the borrower's right to cure the default after the 20-day notice of default period expires. If the borrower fails to cure the default, the foreclosure sale proceeds unless the borrower pays: The full (accelerated) amount of the loan.

As mentioned above, a lender can theoretically call your loan due for just one missed payment, depending on the terms of your mortgage agreement. However, commonly, you have to miss two or three mortgage payments before a lender decides to take this step.

The Notice of Acceleration is just one name for a document from your lender which advises you that ALL of your mortgage payments, including past missed payments, will be due within the next 30 to 90 days.