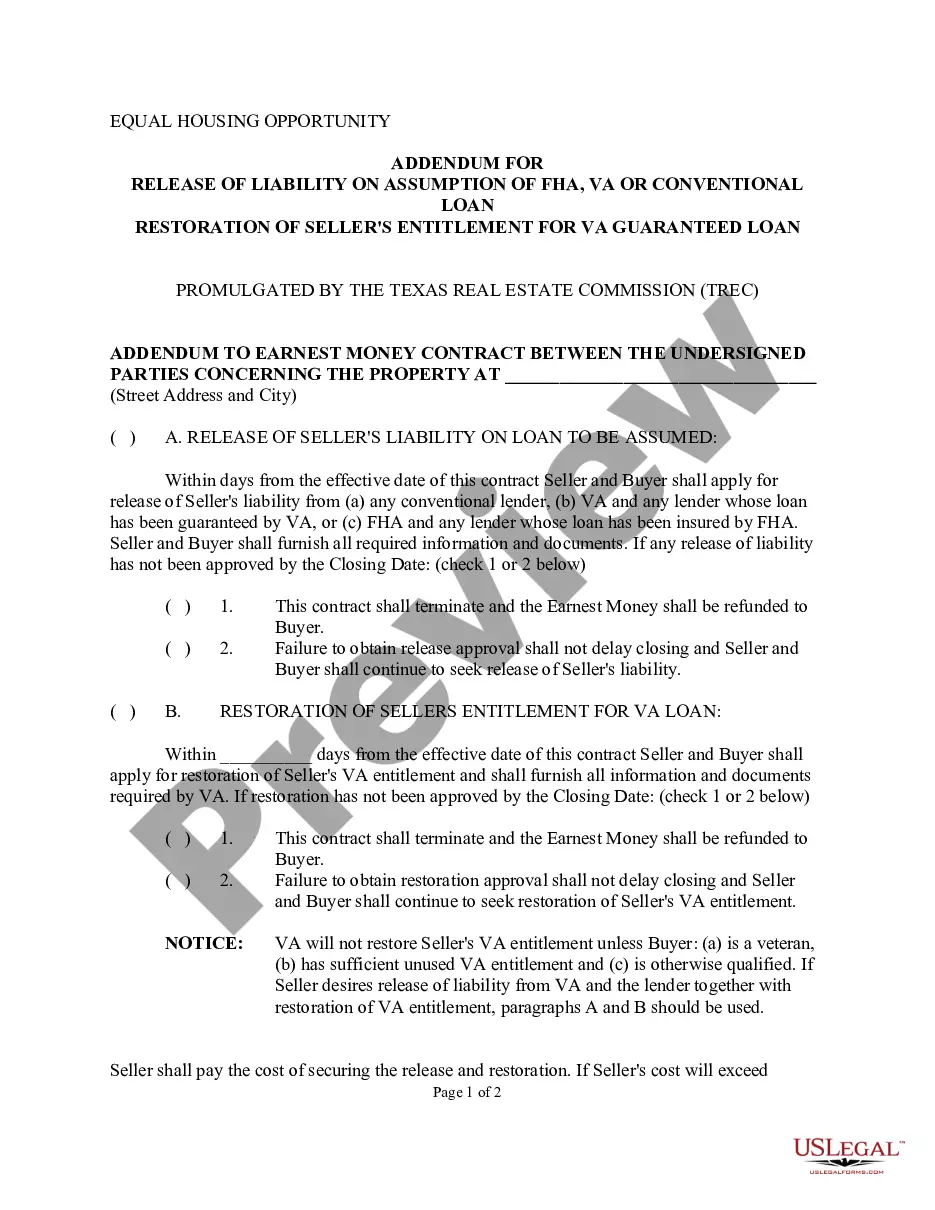

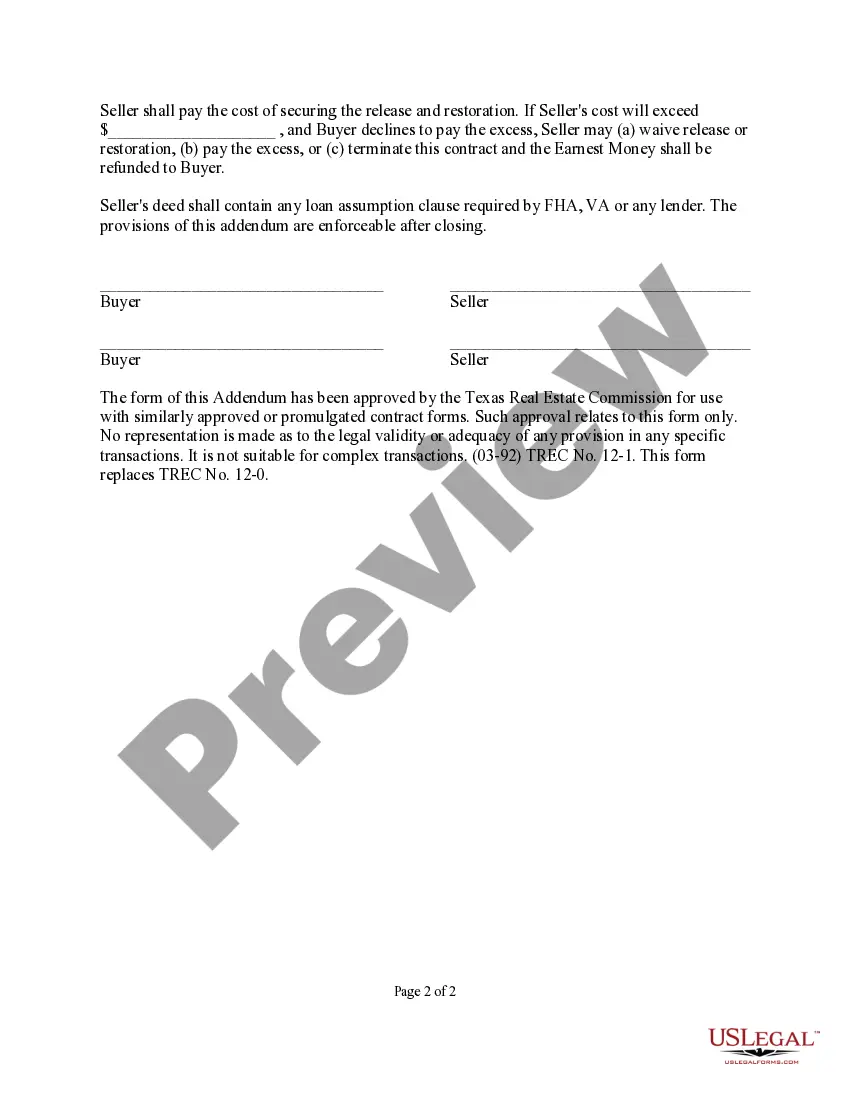

This detailed sample Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Austin Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Texas Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

Irrespective of social or occupational standing, finalizing legal documents is an unfortunate requirement in the current professional landscape.

Frequently, it’s almost unfeasible for someone lacking legal education to produce such paperwork from scratch, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms comes into play.

Confirm that the form you have selected is appropriate for your locality, as the laws of one state or region may not apply to another.

Examine the document and read through a concise description (if available) of the situations for which the paper can be utilized.

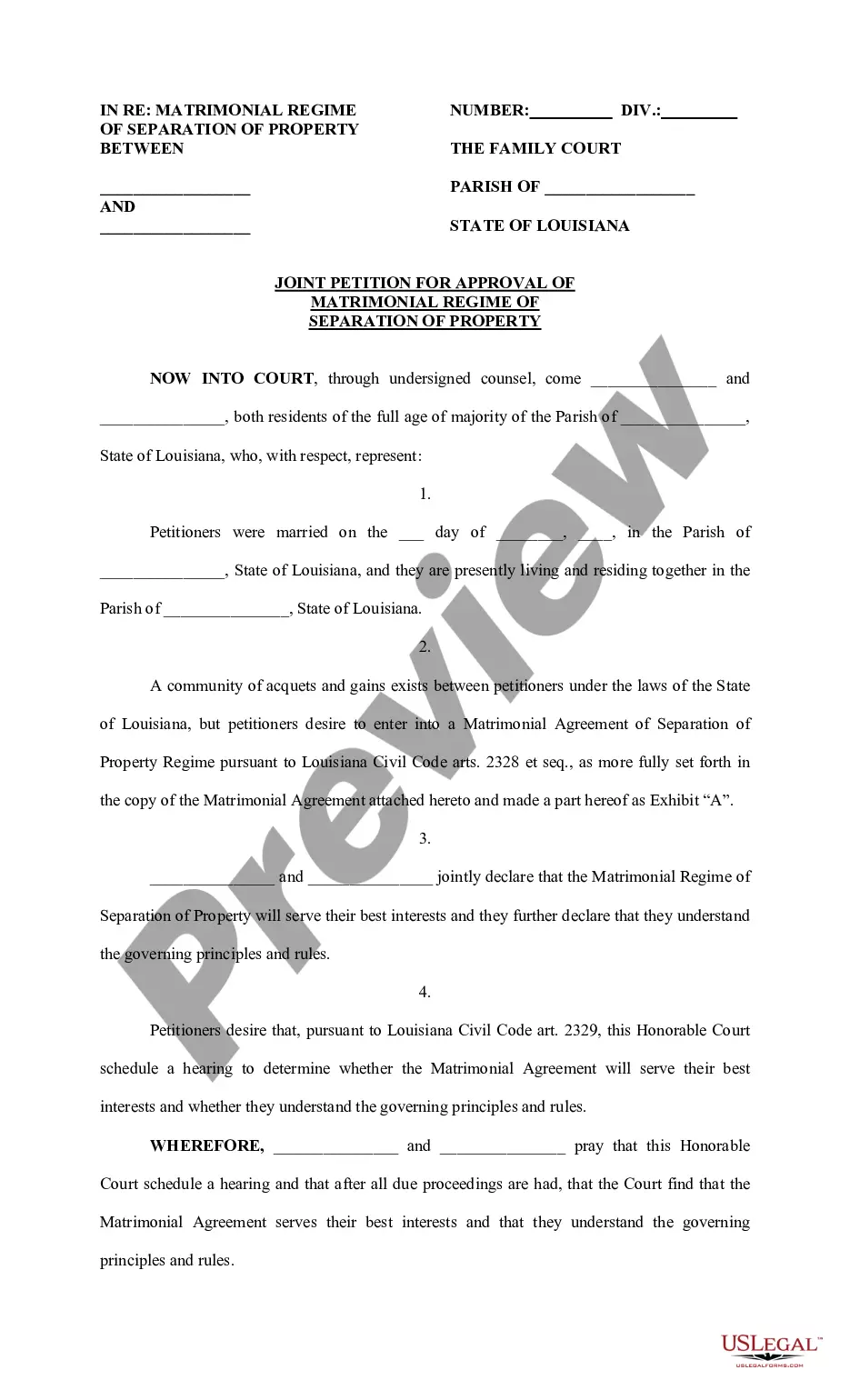

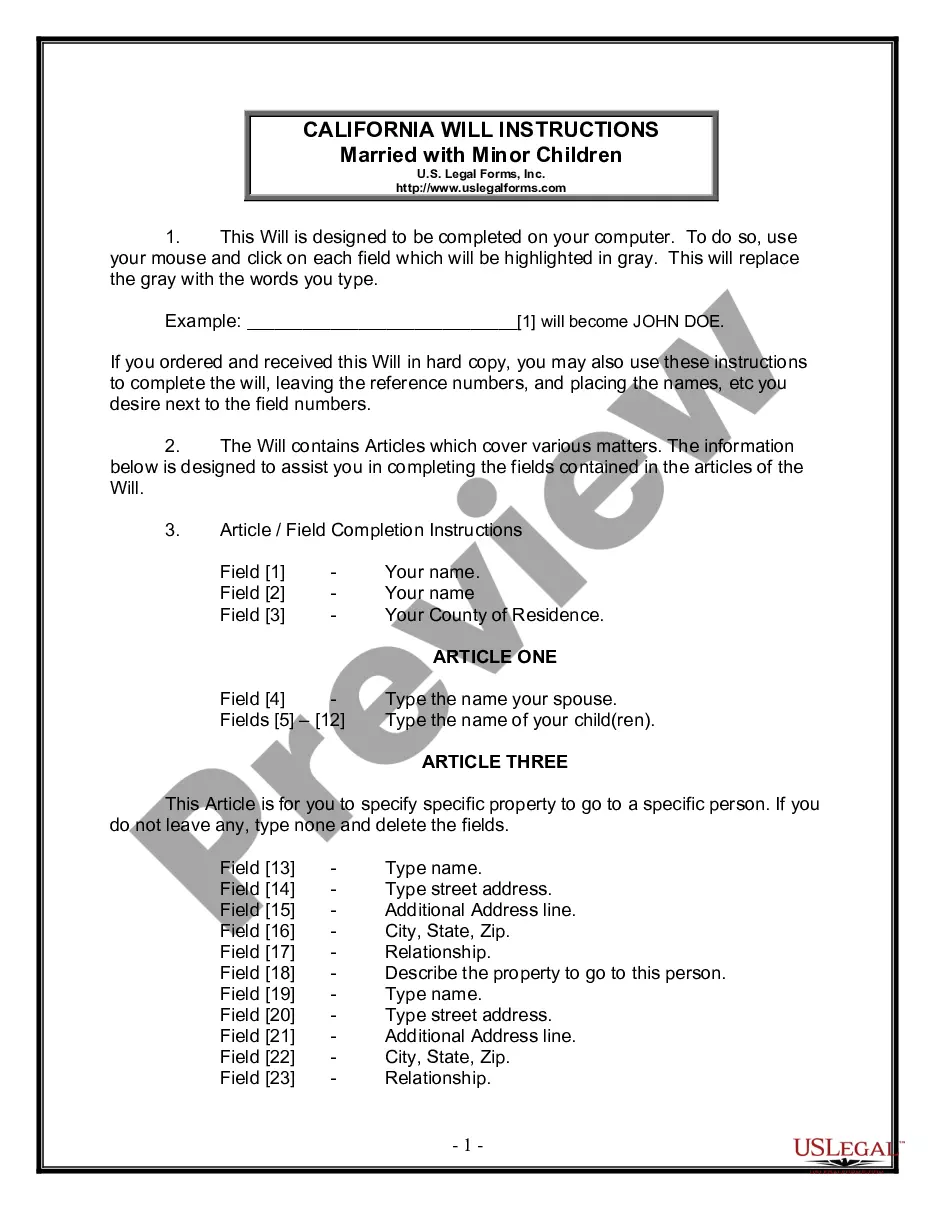

- Our platform features an extensive library of over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also an invaluable resource for associates or legal advisors seeking to save time with our DIY papers.

- Whether you require the Austin Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan, or any other document applicable in your state or locality, US Legal Forms puts everything at your disposal.

- Here's how to obtain the Austin Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan in minutes using our trusted platform.

- If you're already a subscriber, you can simply proceed to Log In to your account to download the requisite form.

- However, if you are new to our library, be sure to follow these instructions before downloading the Austin Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan.

Form popularity

FAQ

An addendum may include any written item added to an existing piece of writing. The addition often applies to supplemental documentation that changes the initial agreement that forms the original contract.

A VA restoration of entitlement allows borrowers who have previously utilized their VA loan entitlement to purchase another home with the VA's guaranty again.

If you sell the property which secures your VA loan, you will still be legally liable to the government unless one of the following conditions is met: -Your loan is paid in full. -The VA releases you in writing from liability on the loan.

An addendum is used to clarify and add things that were not initially part of the original contract or agreement. Think of addendums as additions to the original agreement (for example, adding a deadline where none existed in the original version).

The loan assumption addendum is a piece of paperwork that will be provided to the individual that is assuming the loan. This paperwork is going to provide them with important information about assuming the loan and how the process will work.

An addendum is an addition to a finished document, such as a contract. The most common addendum is an attachment or exhibit at the end of such a document. For example, a contract to manufacture widgets may have an addendum listing the specifications for said widgets.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

Assumption Loans: An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process. The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility.

Tips for Home Loan Assumptions Until the seller is released from liability by the lender, they are responsible for the debt, and nonpayment by the would-be assumer of the loan could negatively impact their credit score. It's also important to accurately value the property before assuming the loan.