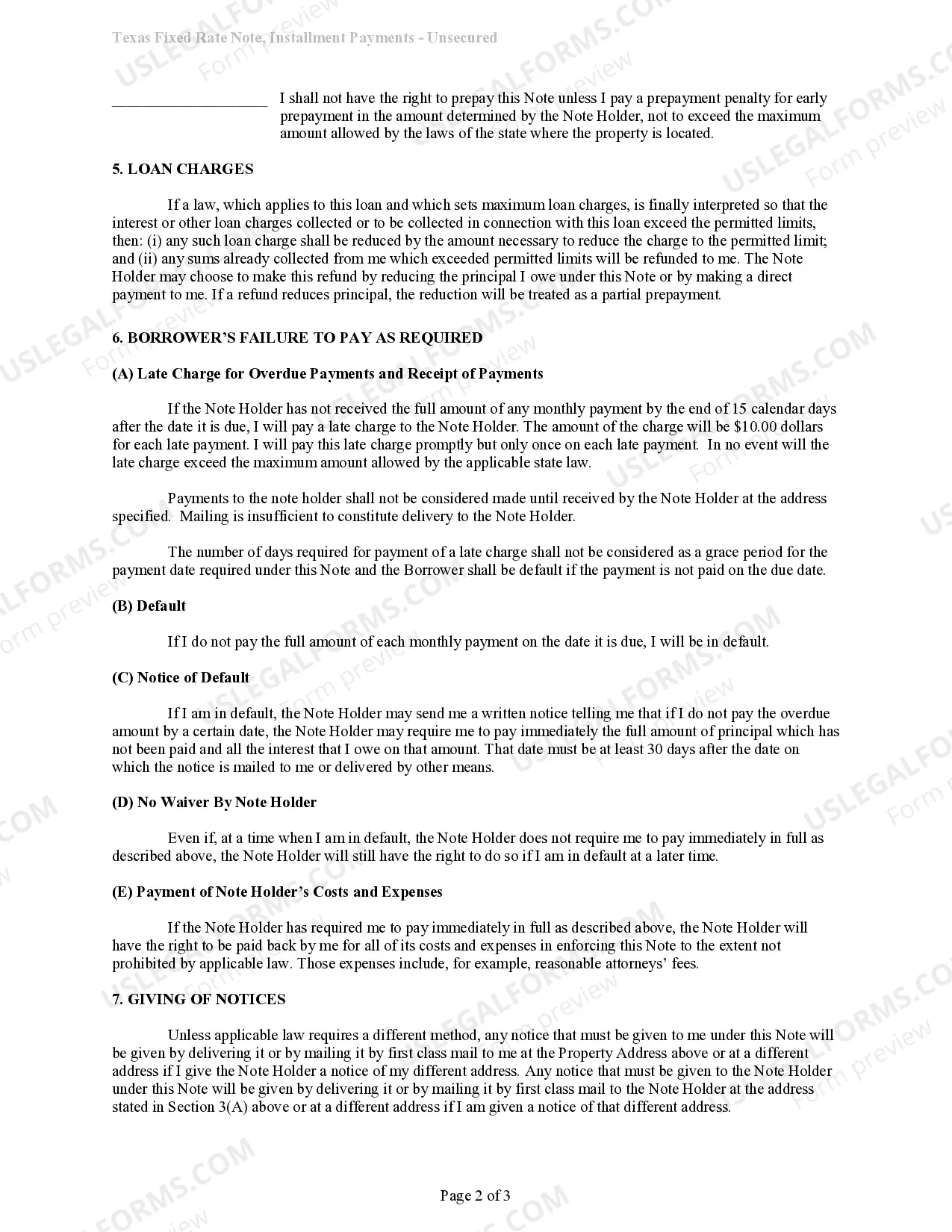

This detailed sample Promissory Note complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Harris Texas Unsecured Promissory Note with Installment Payments - Fixed Rate - Personal Signature Loan

Description

How to fill out Texas Unsecured Promissory Note With Installment Payments - Fixed Rate - Personal Signature Loan?

Regardless of social or career standing, completing legal documents is a regrettable obligation in the current professional landscape.

Often, it is nearly impossible for an individual without legal training to generate this kind of paperwork from scratch, largely due to the complex language and legal nuances involved.

This is where US Legal Forms steps in to assist.

Ensure the template you select is appropriate for your area, as the laws of one region do not apply to another.

Examine the document and check a brief overview (if accessible) of the situations for which the document can be utilized.

- Our platform offers a vast library of over 85,000 ready-to-use documents tailored to specific states, applicable for nearly all legal scenarios.

- US Legal Forms is also a fantastic tool for associates or legal advisors striving for greater time efficiency with our DIY forms.

- Whether you need the Harris Texas Unsecured Promissory Note with Installment Payments - Fixed Rate - Personal Signature Loan or any other document that is valid for your region, US Legal Forms has you covered.

- Here’s how to quickly obtain the Harris Texas Unsecured Promissory Note with Installment Payments - Fixed Rate - Personal Signature Loan using our trusted platform.

- If you are a current user, simply Log In to your account to download the desired form.

- However, if you are new to our platform, follow these steps before acquiring the Harris Texas Unsecured Promissory Note with Installment Payments - Fixed Rate - Personal Signature Loan.

Form popularity

FAQ

Signature Loans vs Installment Loans But signature loans are not the same as installment loans. Usually installment loans offer larger loan amounts than signature loans, which usually offer smaller loan amounts. Signature loans usually come with a shorter loan term and a shorter payment plan.

A signature loan is an unsecured personal loan. Unlike a secured loan, this type of loan doesn't require you to pledge collateral ? something of value, like a bank account or house ? a lender can seize if you fail to repay the loan.

Signature loans are typically smaller than other types of loans, such as mortgages and auto loans, and have shorter repayment terms. Signature loans also tend to have lower interest rates than credit cards.

Anyone lending money can issue a promissory note (like home sellers, credit unions, FinTech solutions, and nonmortgage-related banks, for instance) but specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

A signature loan is a fixed-rate, unsecured personal loan offered by an online lender, bank or credit union. It's called a signature loan because it's secured by your signature instead of collateral, like a car or an investment account. Getting approved for a signature loan will likely depend on your creditworthiness.

Collecting on an unsecured promissory note through the courts is a two-step process. First, you need to go through the court process to obtain a judgment against the borrower. Then you need to try to attach the borrower's wages, bank accounts, or other assets in order actually get paid.

The most common example of a signature loan is an unsecured personal loan. Many banks and lenders offer small loans to customers without requiring collateral. Instead, they look at the customer's credit history and use that to decide on maximum loan amounts and interest rates.

Signature loans can hurt your credit score if the lender does a hard inquiry into your credit history, which will drop your score by about 5 - 10 points. Your credit score will also go down if you do not make the payments on time.