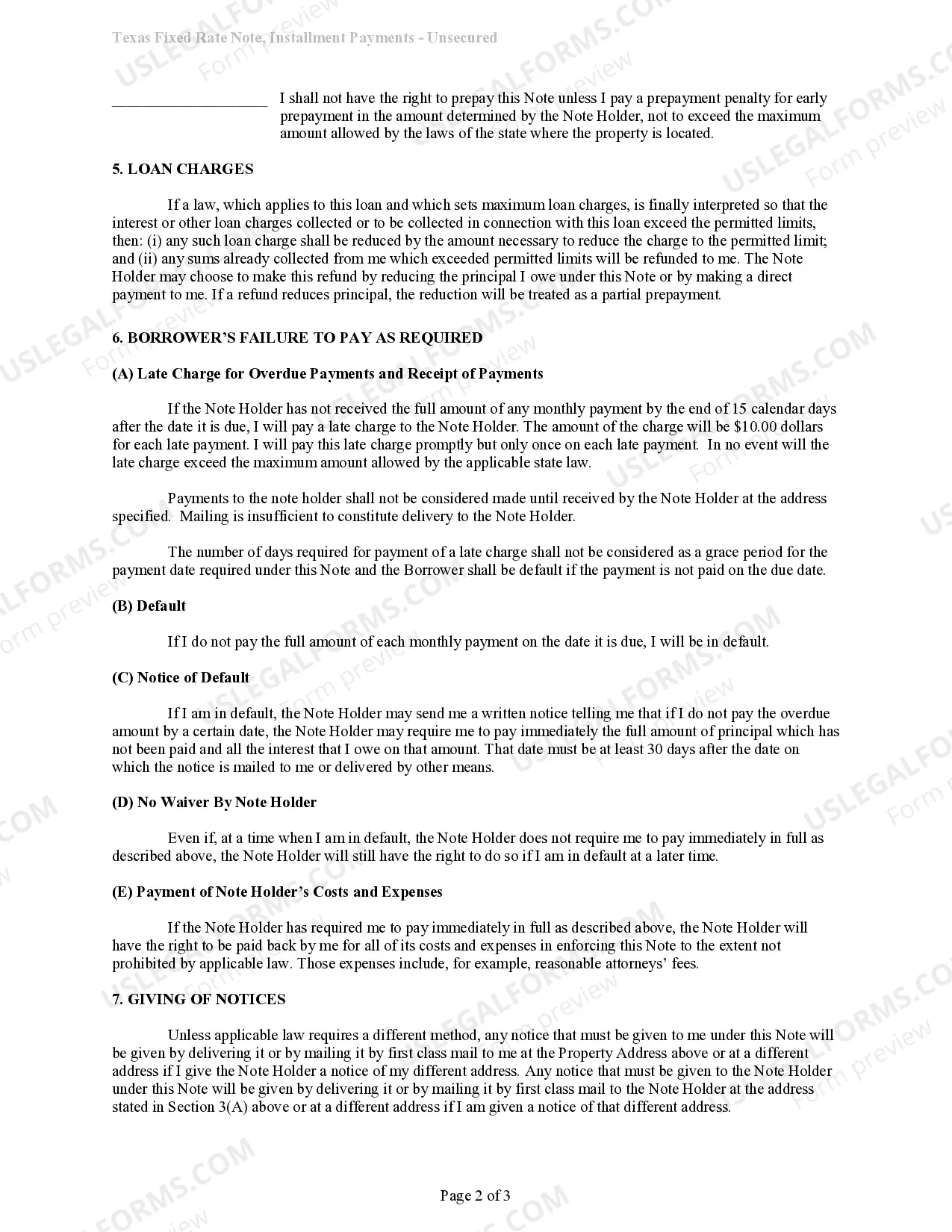

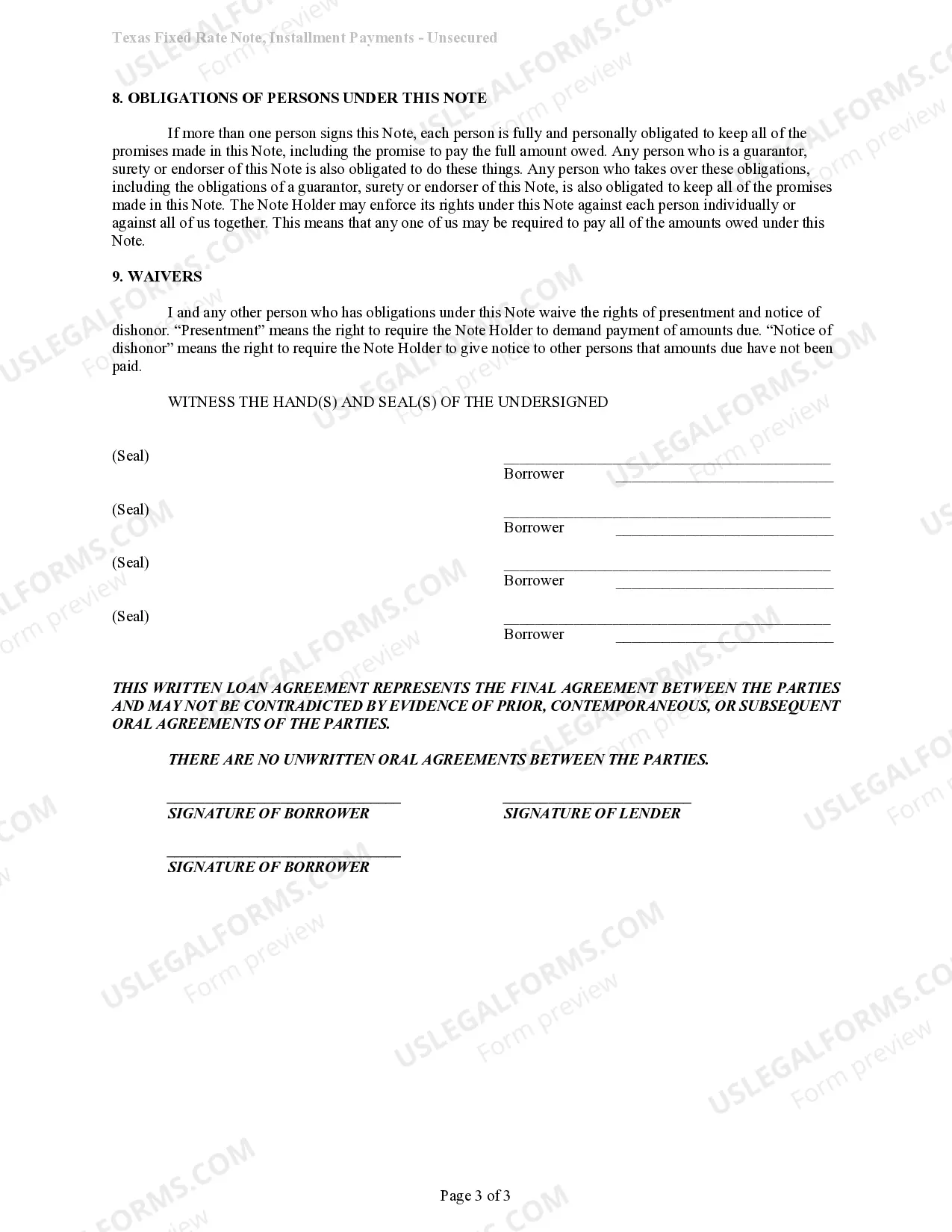

This detailed sample Promissory Note complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Carrollton Texas Unsecured Promissory Note with Installment Payments - Fixed Rate - Personal Signature Loan

Description

How to fill out Texas Unsecured Promissory Note With Installment Payments - Fixed Rate - Personal Signature Loan?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our beneficial platform featuring a vast array of document templates makes it easy to locate and acquire almost any document sample you might need.

You can export, fill out, and sign the Carrollton Texas Unsecured Promissory Note with Installment Payments - Fixed Rate - Personal Signature Loan in merely a few minutes instead of spending countless hours searching online for the appropriate template.

Leveraging our catalog is an excellent way to enhance the security of your document filing.

Locate the template you require. Ensure it is the template you were looking for: confirm its title and description, and take advantage of the Preview option if it is available. Otherwise, use the Search field to find the necessary one.

Initiate the downloading procedure. Click Buy Now and select the pricing plan that best fits you. Then, register for an account and pay for your order using a credit card or PayPal.

- Our knowledgeable attorneys frequently examine all documents to ensure the forms are applicable to a specific area and adhere to new laws and regulations.

- How do you access the Carrollton Texas Unsecured Promissory Note with Installment Payments - Fixed Rate - Personal Signature Loan.

- If you already have a membership, simply Log In to your account. The Download button will be active on all the documents you view.

- Furthermore, you can locate all your previously saved records in the My documents section.

- If you do not have an account yet, follow the steps listed below.

Form popularity

FAQ

Signature loans are typically smaller than other types of loans, such as mortgages and auto loans, and have shorter repayment terms. Signature loans also tend to have lower interest rates than credit cards.

Signature loans can hurt your credit score if the lender does a hard inquiry into your credit history, which will drop your score by about 5 - 10 points. Your credit score will also go down if you do not make the payments on time.

A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral.

A promissory note is a written promise, basically an IOU, to pay money to someone. The note document serves as written evidence of the amount of the debt. To start, decide how much money you'll lend, the amount of interest you'll charge, if any, and the type of repayment schedule.

The most common example of a signature loan is an unsecured personal loan. Many banks and lenders offer small loans to customers without requiring collateral. Instead, they look at the customer's credit history and use that to decide on maximum loan amounts and interest rates.

A signature loan is a fixed-rate, unsecured personal loan offered by an online lender, bank or credit union. It's called a signature loan because it's secured by your signature instead of collateral, like a car or an investment account. Getting approved for a signature loan will likely depend on your creditworthiness.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

Signature Loans vs Installment Loans But signature loans are not the same as installment loans. Usually installment loans offer larger loan amounts than signature loans, which usually offer smaller loan amounts. Signature loans usually come with a shorter loan term and a shorter payment plan.

A signature loan is an unsecured personal loan. Unlike a secured loan, this type of loan doesn't require you to pledge collateral ? something of value, like a bank account or house ? a lender can seize if you fail to repay the loan.

A promissory note is a written promise, basically an IOU, to pay money to someone. The note document serves as written evidence of the amount of the debt. To start, decide how much money you'll lend, the amount of interest you'll charge, if any, and the type of repayment schedule.