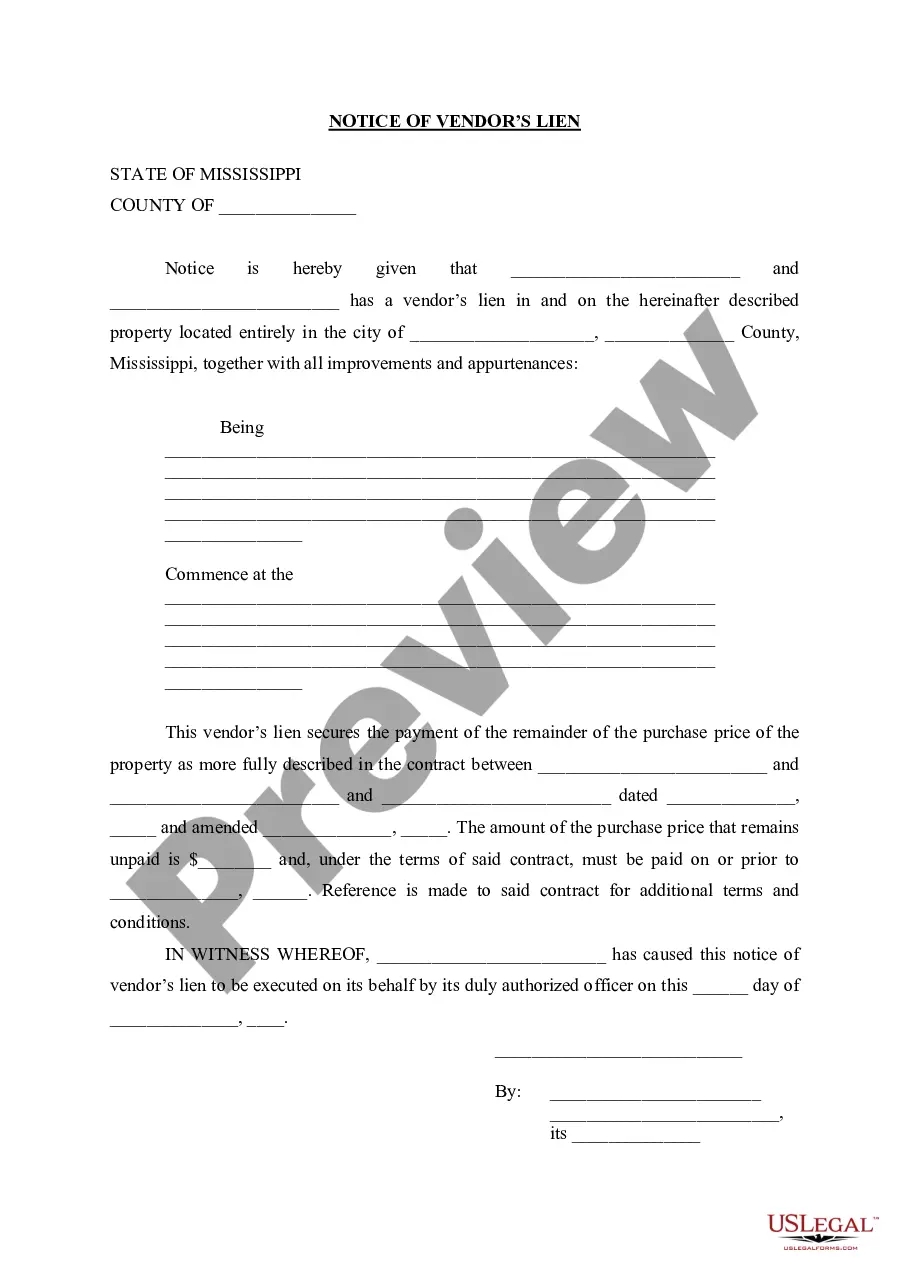

This form is a Renunciation and Disclaimer of Life Insurance or Annuity Contract proceeds, where the beneficiary gained an interest in the proceeds upon the death of the decedent, but, pursuant to the Texas Statutes, Chapter II, has decided to disclaim his/her interest in the proceeds. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify the delivery of the document.

Edinburg Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Texas Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our beneficial platform with a vast array of documents streamlines the process of locating and acquiring nearly any document sample you need.

You can download, fill out, and sign the Edinburg Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract in mere minutes instead of scouring the internet for hours in search of a suitable template.

Employing our catalog is an excellent approach to enhance the security of your document submissions.

If you do not have an account yet, follow these steps.

Access the page with the template you need. Ensure it is the document you were looking for: check its title and description, and utilize the Preview feature if available. Otherwise, use the Search bar to find the correct one.

- Our experienced attorneys frequently review all records to ensure that the templates are suitable for a specific area and adhere to new laws and regulations.

- How do you obtain the Edinburg Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

- If you already possess a subscription, simply Log In to your account.

- The Download button will be visible on all the samples you view.

- Furthermore, you may locate all previously saved records in the My documents section.

Form popularity

FAQ

In a life estate in Texas, the life estate holder possesses the property for their lifetime, but the remainderman holds the future interest in the property. Once the life estate holder passes away, ownership transfers to the remainderman automatically. Understanding this distinction is vital when considering the Edinburg Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract to ensure a smooth transition of ownership.

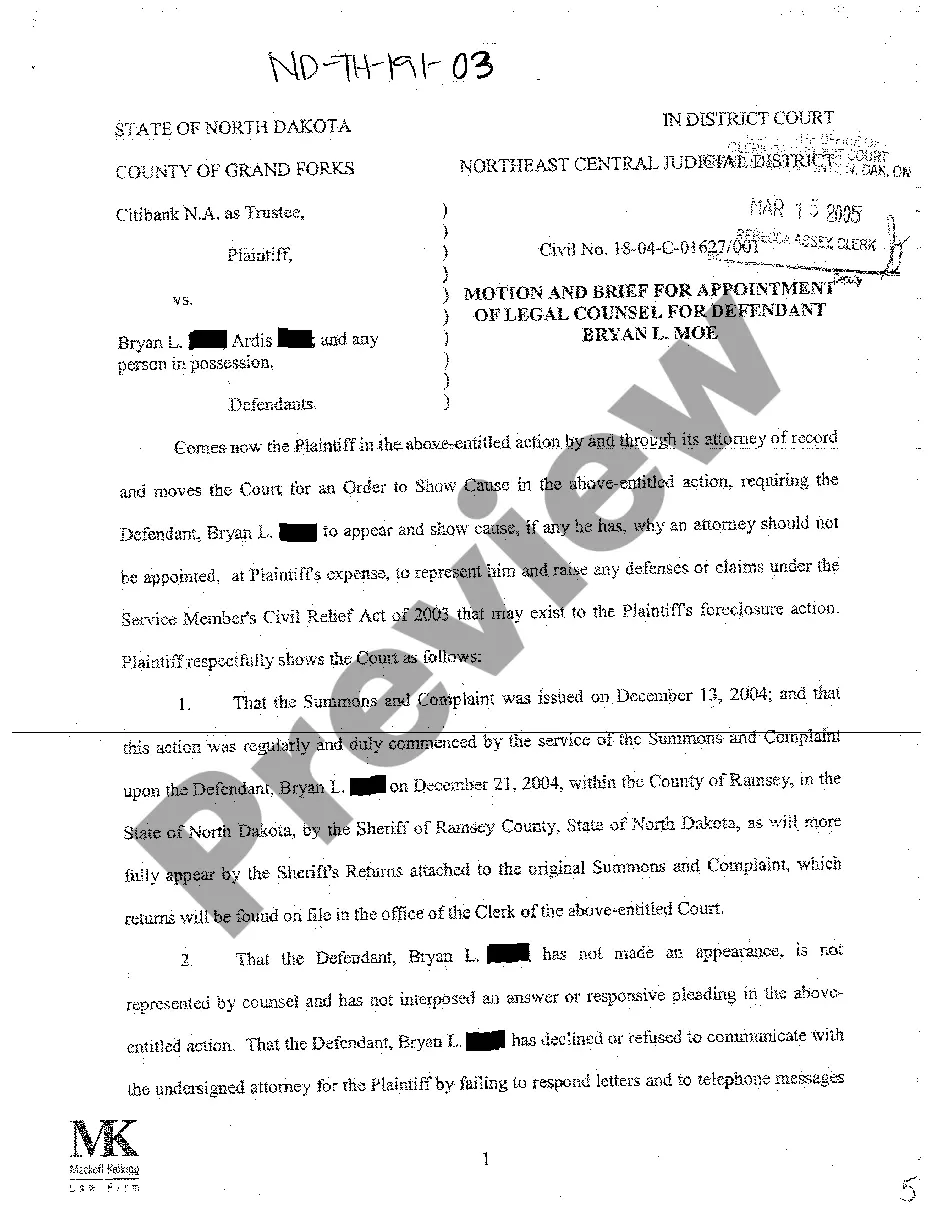

To disclaim an inheritance in Texas, you must submit a written disclaimer to the appropriate representative of the estate within the stipulated nine-month period. The disclaimer needs to meet specific legal requirements, making it essential to follow the right procedures. Utilizing the Edinburg Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can provide clarity and assistance in this process.

In Texas, the life estate holder is responsible for paying property taxes on the property. Since the holder has the right to use and benefit from the property, this obligation falls on them. It is crucial to understand this responsibility, as it relates to the Edinburg Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract and the associated tax implications.

In Texas, a beneficiary must disclaim an inheritance within a nine-month period from the date of the decedent's death or the date of the distribution of the property. This process allows beneficiaries to renounce rights to inheritances that may not be beneficial for them. If you're considering this option, the Edinburg Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can guide you through the necessary steps.

A significant disadvantage of a life estate is that it can limit the life estate holder's control over the property. The holder cannot sell or encumber the property without the consent of the remainderman. This restriction often complicates estate planning and transactions, highlighting the importance of knowing about the Edinburg Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract to manage these issues effectively.

In Texas, a life estate holder has the right to use and benefit from the property during their lifetime. They can live in, rent out, or sell the property, but cannot damage it or waste its value. Upon the holder's death, the property passes to the remainderman. Understanding these rights is essential for effective Edinburg Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

A disclaimer of interest in property in Texas allows an individual to refuse acceptance of an inherited asset. This legal mechanism ensures that the individual does not take on any responsibilities or liabilities associated with the inheritance. It’s advisable to consult with professionals familiar with Edinburg Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract to understand the implications fully.

If a beneficiary declines an inheritance in Edinburg Texas, the property or asset typically passes to the next beneficiary in line, as determined by the will or state law. This process can help avoid complications in distributing assets and ensures that the deceased's intentions are honored. Utilizing USLegalForms can streamline this process for beneficiaries.

An inherited disclaimer letter should clearly state your decision to disclaim the inheritance. Begin with your name, the decedent's name, and the specific property you are declining. Be direct about your intent and include a date for reference. Lastly, ensure your letter aligns with Edinburg Texas regulations for disclaimers.

The timeframe to disclaim an inheritance in Edinburg Texas is generally nine months from the decedent's death. It is crucial to act within this period to ensure your disclaimer is recognized legally. Consultation with a legal expert or using platforms like USLegalForms can provide you with guidance tailored to your situation.