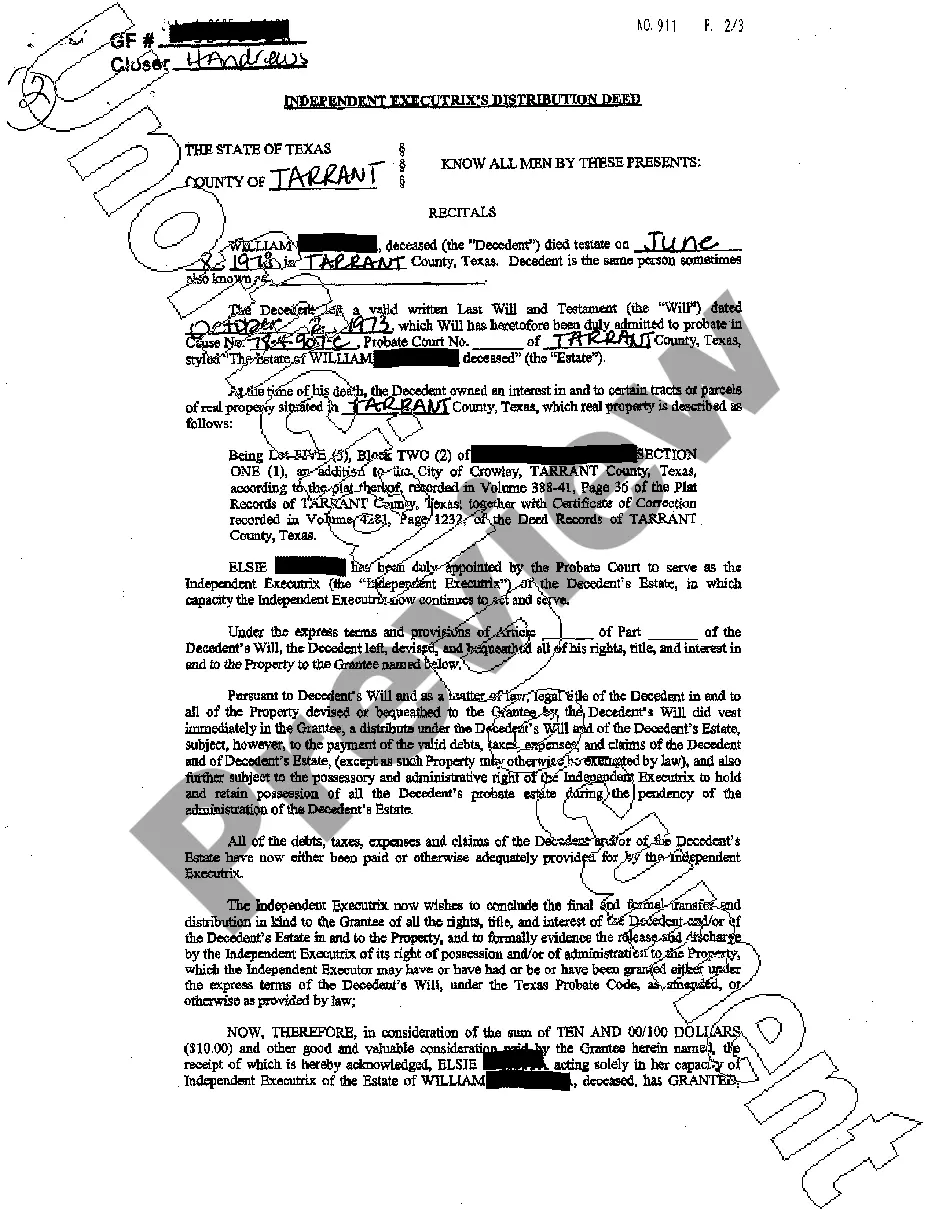

This form is a Distribution Deed whereby Joint Independent Executors transfer real property from the estate of the decedent to the Grantee. This deed complies with all state statutory laws.

McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary

Description

How to fill out Texas Distribution Deed - Joint Independent Executors To An Individual Beneficiary?

Utilize the US Legal Forms to gain instant access to any document you need.

Our user-friendly website featuring numerous templates streamlines the process of locating and obtaining nearly any document sample you require.

You can export, fill out, and notarize the McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary in just a few minutes instead of spending hours online searching for a suitable template.

Employing our collection is an excellent approach to enhance the security of your document submissions.

Access the page with the form you seek. Ensure that it is the template you desire: check its title and description, and take advantage of the Preview option if available. If not, use the Search bar to find the necessary one.

Initiate the download procedure. Click Buy Now and select the pricing plan that fits you best. Then, create an account and complete your order using a credit card or PayPal.

- Our experienced legal professionals routinely review all documents to ensure that the templates are applicable for a specific jurisdiction and adhere to current laws and regulations.

- How can you obtain the McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary.

- If you have a subscription, simply sign in to your account. The Download button will be activated for all the samples you access.

- Moreover, you can retrieve all previously saved documents from the My documents section.

- If you haven't set up an account yet, follow these steps.

Form popularity

FAQ

Transferring ownership from a deceased owner in Texas requires several documents, including the death certificate and the McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary. You will also need the will, if one exists, to confirm the distribution instructions. Utilizing uslegalforms can help ensure that you gather the necessary documents and complete the process properly.

To transfer ownership of a property after death in Texas, you typically need to file a Texas Distribution Deed. This deed is crucial, especially when dealing with joint independent executors. They can facilitate the transfer smoothly to an individual beneficiary. Moreover, using a trusted platform like uslegalforms can simplify the process, ensuring all legal requirements are met efficiently.

In Texas, an executor generally has the authority to sell estate property, but this action often requires the approval of all beneficiaries, especially when dealing with significant assets. The McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary may simplify this process, allowing executors to clarify their responsibilities and the consent needed from beneficiaries. It is crucial to check the specific terms of the will and consult legal counsel if necessary, as individual situations may vary. Utilizing platforms like US Legal Forms can help navigate the complexities of estate management effectively.

In Texas, independent co-executors typically cannot act alone unless they are authorized to do so by the will or a court. This requirement promotes collaboration and ensures that decisions reflect the collective interests of the estate. Having a clearly defined McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can help establish the rules governing co-executors' authority.

Absolutely, a person can be both an executor and a beneficiary in Texas. This dual role can streamline the estate management process but requires careful handling of responsibilities. It is crucial to ensure that one acts in accordance with the will’s directives and the law. Clarifying these roles using a McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can safeguard against common pitfalls.

Yes, the executor and beneficiary can be the same person in Texas. This often simplifies the administration of an estate since the appointed executor is also someone with a vested interest. However, one must maintain transparency and adhere to the obligations prescribed by the will. Leveraging a McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary ensures clarity in these combined roles.

An executor can indeed be a beneficiary in a will in Texas. This scenario is common and can work well if the executor fulfills their duty impartially. However, potential conflicts of interest should be managed carefully. Utilizing a McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can provide a clear path forward for individuals in such situations.

No, a beneficiary does not override an executor. The executor holds the responsibility to manage the estate according to the terms of the will. Beneficiaries can express preferences, but they cannot compel the executor to act against the will's instructions. Therefore, clear understanding of a McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can resolve many disputes.

Yes, an executor can also be a beneficiary in Texas. This dual role often occurs when the individual named in the will to manage the estate also inherits from it. However, it is essential to note that the executor’s duties must be performed impartially. When considering a McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary, having a knowledgeable executor can streamline the process.

In Texas, an executor cannot act outside the authority given by the will or the court. For instance, an executor cannot distribute assets before obtaining court approval or without following the stipulated judicial process. Additionally, an executor is barred from using estate assets for personal gain. Understanding the limitations set forth in a McAllen Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can help clarify these restrictions.