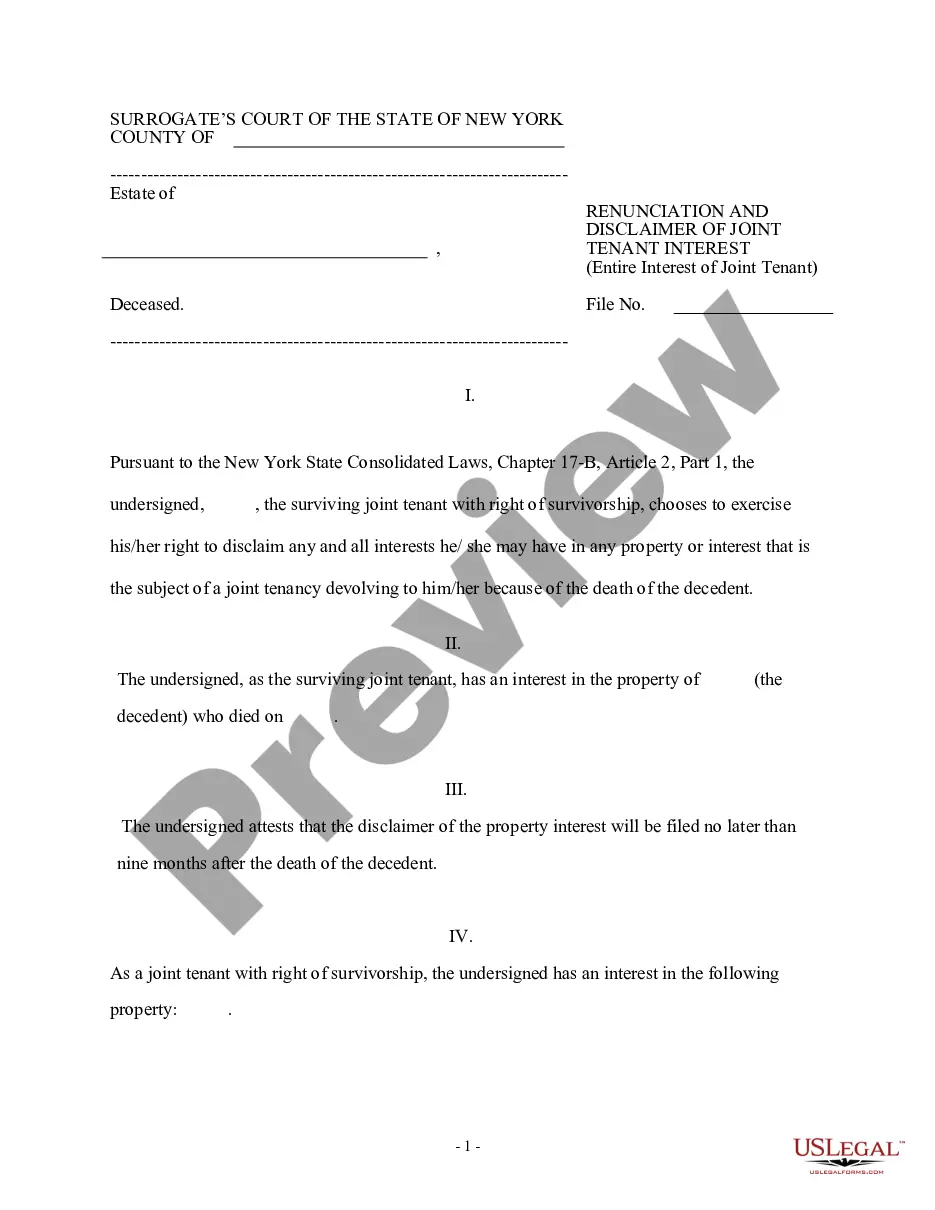

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Travis Texas Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Texas Renunciation And Disclaimer Of Property Received By Intestate Succession?

Make use of the US Legal Forms and obtain instant access to any form template you need.

Our convenient platform with a plethora of templates enables you to locate and acquire nearly any document example you may require.

You can save, complete, and sign the Travis Texas Renunciation And Disclaimer of Property received by Intestate Succession in just a few minutes instead of spending countless hours online searching for an appropriate template.

Using our collection is an excellent method to enhance the security of your document submissions.

If you haven't created an account yet, follow the steps below.

Access the page with the form you need. Ensure that it is the template you were seeking: verify its title and description, and use the Preview feature when available. Otherwise, utilize the Search bar to locate the required one.

- Our expert legal professionals consistently review all documents to ensure that the forms are applicable for a specific state and compliant with current laws and regulations.

- How can you access the Travis Texas Renunciation And Disclaimer of Property received by Intestate Succession.

- If you possess a subscription, simply Log In to your account.

- The Download feature will be activated for all documents you view.

- Additionally, you can retrieve all previously saved files in the My documents section.

Form popularity

FAQ

In Texas, a beneficiary generally has nine months from the date of the decedent's death to disclaim an inheritance. This timeframe is crucial to observe as failing to disclaim within this period can result in an automatic acceptance of the property. If you're considering the Travis Texas Renunciation And Disclaimer of Property received by Intestate Succession, timely action ensures your intentions are legally recognized.

To write an inherited disclaimer letter, start by stating your intention to disclaim any interest in the inheritance. Include specific details about the decedent, the property involved, and your relationship to the decedent. Using a platform like US Legal Forms can provide you with a template that aligns with Texas laws on the Travis Texas Renunciation And Disclaimer of Property received by Intestate Succession, ensuring you cover all necessary elements.

An example of a disclaimer of inheritance rights is when a beneficiary chooses to refuse their share of an estate. This could occur if the beneficiary has financial or personal reasons to decline the inheritance. By executing a formal Disclaimer in relation to the Travis Texas Renunciation And Disclaimer of Property received by Intestate Succession, the beneficiary legally forfeits any claim to the property, allowing it to pass to the next eligible heir.

In Texas, intestate succession rules dictate how a deceased person's property is distributed when there is no will. Typically, the spouse and children receive the majority of the estate, but the specific distribution depends on the family structure. Understanding these rules is crucial if you are involved in the Travis Texas Renunciation And Disclaimer of Property received by Intestate Succession, as it can help guide your decisions.

To create a Disclaimer for an inheritance in the context of the Travis Texas Renunciation And Disclaimer of Property received by Intestate Succession, start by clearly stating your intent to disclaim. You should include your personal information, the description of the property you wish to disclaim, and sign the document. It’s important to follow Texas law, so consulting resources like US Legal Forms can help ensure that your Disclaimer meets all legal requirements.

Transferring property without a will in Texas typically involves the process of intestate succession. This means that the state laws will determine how the property is divided among the heirs. To ensure that everything is handled correctly, you may need to file an affidavit of heirship, which confirms the rightful heirs. Utilizing a Travis Texas Renunciation and Disclaimer of Property received by Intestate Succession can clarify any complexities in the transfer process.

In Texas, you generally have nine months from the date of the decedent's death to file a Travis Texas Renunciation and Disclaimer of Property received by Intestate Succession. This timeframe is crucial, as missing it could result in unwanted inheritance acceptance. It's important to act promptly to ensure that you maintain your intentions regarding the property. Consulting with an attorney can help you navigate this process effectively.

To disclaim an inheritance in Texas, first familiarize yourself with the specific assets included in the intestate estate. Prepare a disclaimer document outlining your decision and the details of the property you wish to renounce. After submission to the estate’s representative, ensure you keep a copy for your records. Consider using UsLegalForms to access templates to make this process straightforward and legally sound.

The process to disclaim an inheritance includes reviewing the inheritance details, writing a formal disclaimer, and submitting it to the estate’s administrator. You must act promptly to meet Texas timeline requirements for disclaiming property received under intestate succession. Utilizing the resources on UsLegalForms can help you navigate these steps efficiently and securely.

In Texas, a disclaimer of inheritance does not need to be notarized for it to be valid; however, it is advisable to have it notarized to prevent future disputes. A properly prepared disclaimer, along with supporting documentation from intestate succession, will solidify your intentions. Using UsLegalForms can provide you with the templates that simplify notarization requirements and enhance your disclaimer's validity.