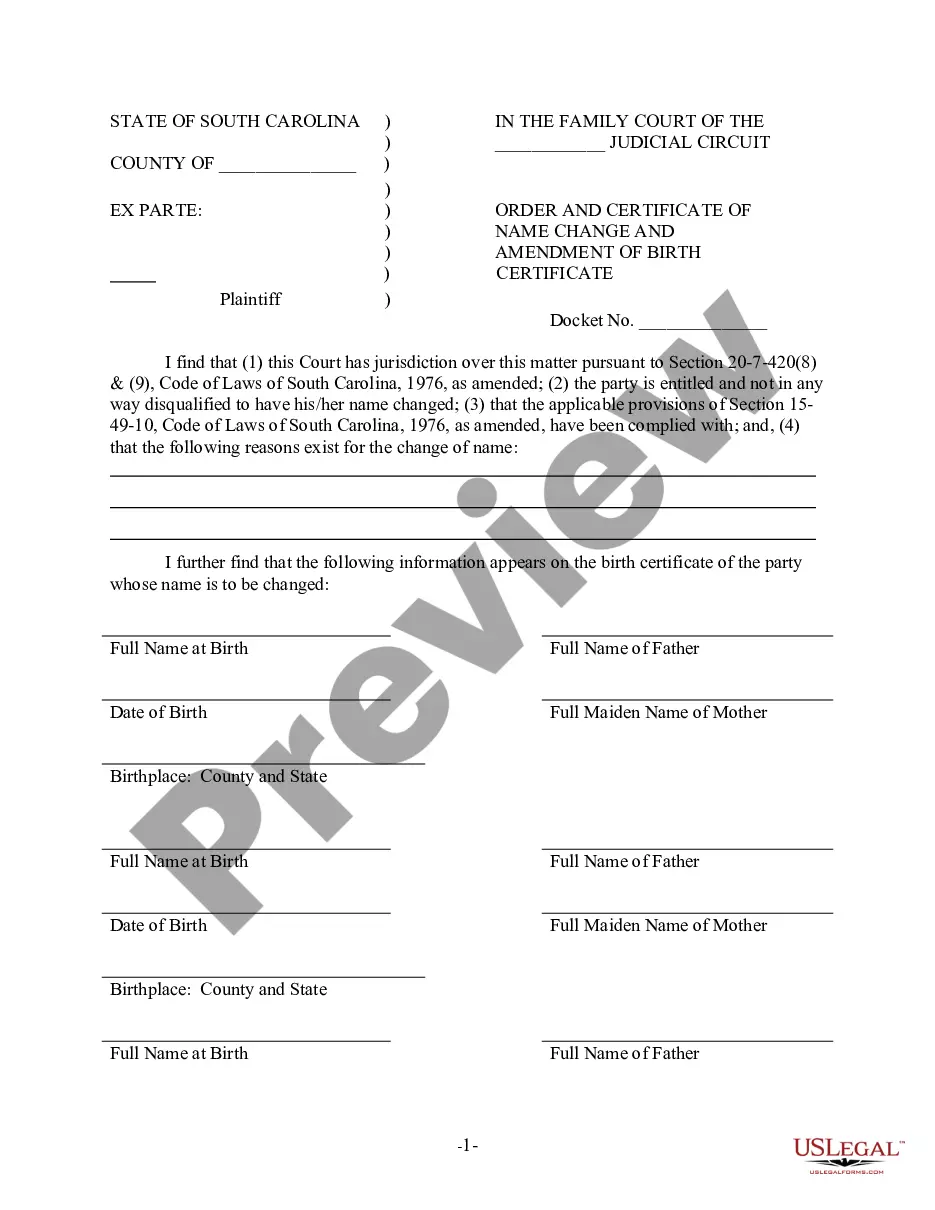

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Grand Prairie Texas Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Texas Renunciation And Disclaimer Of Property Received By Intestate Succession?

Take advantage of the US Legal Forms and gain instant access to any document you require.

Our advantageous website with a vast selection of templates simplifies the process of locating and acquiring nearly any document sample you need.

You can download, complete, and validate the Grand Prairie Texas Renunciation And Disclaimer of Property acquired through Intestate Succession in just a few minutes rather than spending hours online searching for the right template.

Leveraging our collection is an excellent method to enhance the security of your form submissions.

If you do not yet have a profile, follow the instructions listed below.

Navigate to the form page you require. Ensure that it is the template you were looking for: review its title and description, and use the Preview feature if available. Otherwise, utilize the Search bar to find the necessary one.

- Our skilled legal experts consistently evaluate all the documents to guarantee that the forms are suitable for a specific state and comply with current laws and regulations.

- How can you fetch the Grand Prairie Texas Renunciation And Disclaimer of Property obtained through Intestate Succession.

- If you already have an account, simply Log In to your profile.

- The Download option will appear on every template you browse.

- Additionally, you can access all the previously stored documents in the My documents section.

Form popularity

FAQ

To disclaim part of an inheritance in Grand Prairie, Texas, you will need to follow specific legal procedures outlined in the Texas Estates Code. First, you should create a written renunciation or disclaimer that specifies the property you wish to decline. This document must be signed and filed with the appropriate court, ensuring it is done within nine months of the inheritance event. For precise guidance, consider using US Legal Forms, which can help simplify the process of Grand Prairie Texas Renunciation And Disclaimer of Property received by Intestate Succession.

A beneficiary might choose to disclaim property for various reasons, including avoiding debt associated with the inheritance or reducing tax liabilities. Additionally, disallowing an inheritance can steer the property to another family member who may need it more or can manage the associated responsibilities. Understanding the motivations behind disclaiming property is essential when considering Grand Prairie Texas Renunciation And Disclaimer of Property received by Intestate Succession.

When writing a disclaimer of interest, include your name, a clear statement of your intent to disclaim, and specific details about the property being disclaimed. Make sure to follow the legal requirements set forth by Texas law to ensure the document is valid. After drafting the disclaimer, submit it to the appropriate parties, such as the executor of the estate. Familiarizing yourself with the process enhances your understanding of Grand Prairie Texas Renunciation And Disclaimer of Property received by Intestate Succession.

To disclaim inherited property in Texas, the beneficiary should prepare a written disclaimer that adheres to state laws. This document must express the intent to reject the inheritance and must be filed within nine months of the death of the decedent. Completing this process correctly ensures that you are legally relinquishing your rights to the property, which can have a significant impact on the distribution of the estate. For assistance, USLegalForms offers valuable resources to guide you through this procedure.

A disclaimer of interest in probate in Texas refers to the refusal of a beneficiary to accept an inheritance or share of an estate. This refusal must be documented through a formal disclaimer to be recognized legally. This option can be especially beneficial in specific situations, such as when the inherited property may incur debt or tax responsibilities. Understanding this concept is vital for anyone navigating Grand Prairie Texas Renunciation And Disclaimer of Property received by Intestate Succession.

A disclaimer in probate is a legal document that allows a beneficiary to refuse an inheritance. This process can help individuals avoid certain tax implications or complications associated with the inherited property. It ensures that the property passes to another designated beneficiary, maintaining the estate's efficient distribution. Knowing how to handle disclaimers is crucial for successful Grand Prairie Texas Renunciation And Disclaimer of Property received by Intestate Succession.

Section 122.201 of the Texas Estates Code addresses the formal process of disclaiming property inherited through intestate succession. This section outlines the necessary procedures and criteria for beneficiaries wishing to renounce their rights. Familiarity with this section is vital for anyone involved in Grand Prairie Texas Renunciation And Disclaimer of Property received by Intestate Succession. It ensures that individuals understand their options and obligations.

To disclaim an inheritance in Texas, a beneficiary must provide a written disclaimer to the executor of the estate or the appropriate court. This document should clearly state the intention to renounce the inheritance, including details about the property disclaimed. It is essential to act promptly after the inheritance is received to ensure the disclaimer is valid. Utilizing resources such as USLegalForms can help simplify this process.

In Texas, intestate succession occurs when a person dies without a valid will. The state's laws determine how the deceased's property will be distributed among surviving family members. Typically, the closer the relationship, the higher the share of the estate they receive. Understanding intestate succession is crucial for individuals considering Grand Prairie Texas Renunciation And Disclaimer of Property received by Intestate Succession.

Intestate succession laws in Texas dictate how a deceased person's estate is distributed when that person has not left a will. Instead of a predetermined plan, the assets pass according to state law. Generally, in Grand Prairie, Texas, if a person dies intestate, their property first goes to surviving spouses and children. Understanding the Grand Prairie Texas Renunciation And Disclaimer of Property received by Intestate Succession can provide clarity on how you might choose to renounce your rights to inherit under these laws.