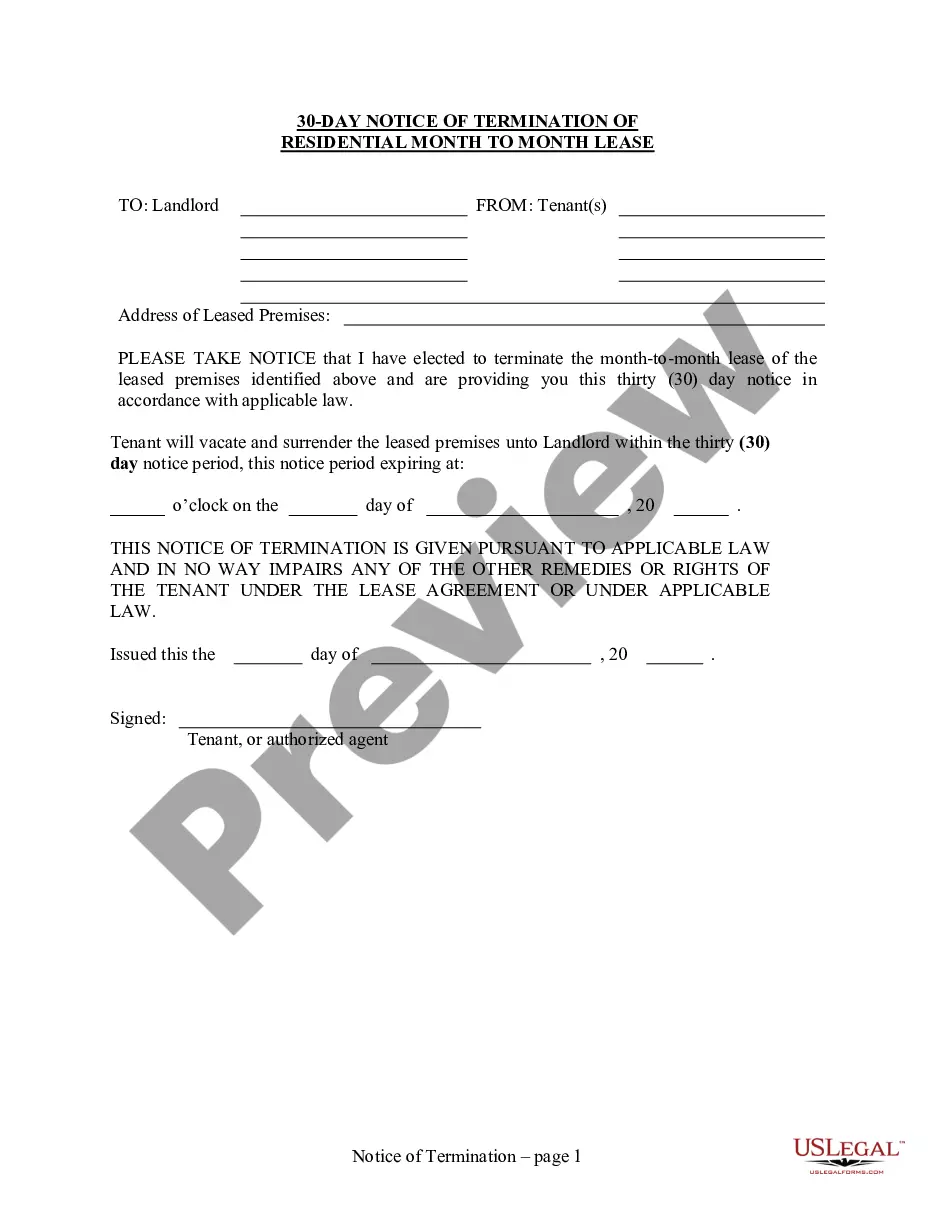

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Texas Renunciation And Disclaimer Of Property Received By Intestate Succession?

Do you require a trustworthy and affordable legal documents provider to obtain the Frisco Texas Renunciation And Disclaimer of Property issued by Intestate Succession? US Legal Forms is your preferred choice.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a collection of forms to facilitate your divorce through the courts, we have you covered. Our platform provides more than 85,000 current legal document templates for personal and business applications. All templates available are not generic and tailored to meet the regulations of specific states and counties.

To obtain the document, you must Log In to your account, locate the required form, and click the Download button adjacent to it. Please keep in mind that you can access your previously acquired document templates at any time in the My documents section.

Are you unfamiliar with our platform? No problem. You can create an account in just a few minutes, but before that, ensure you do the following: Check if the Frisco Texas Renunciation And Disclaimer of Property issued by Intestate Succession complies with the legislation of your state and locality. Read the document's description (if available) to understand who and what the document is meant for. Restart the search if the form does not fit your legal circumstances.

Finding current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time navigating legal paperwork online.

- Now you can register for your account.

- Next, select the subscription plan and move forward with payment.

- Once payment is completed, download the Frisco Texas Renunciation And Disclaimer of Property issued by Intestate Succession in any format available.

- You can return to the website at any moment and download the document again at no cost.

Form popularity

FAQ

In Texas, the distribution of assets for a surviving spouse depends on various factors, including whether the deceased had a will. Generally, under Texas intestacy laws, a surviving spouse does not automatically inherit everything if there are surviving children. In cases involving a Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession, the distribution may vary. It is crucial to understand your rights and options, and platforms like US Legal Forms can guide you through the complexities of property inheritance in these situations.

You can disclaim a portion of an inheritance through a formal disclaimer process. Under the Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession, the procedure must comply with specific legal standards. This allows you to retain certain assets while renouncing others without complications. Utilize platforms like uslegalforms to navigate this process and ensure your decisions are documented appropriately.

Yes, you have the right to reject part of an inheritance with a formal disclaimer. The Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession allows you to specify which assets you wish to decline while accepting others. This helps in managing your estate efficiently and according to your personal preferences. It's recommended to use services like uslegalforms for ensuring that your disclaimer adheres to legal requirements.

To disclaim part of an inheritance, you must provide a written declaration stating your wishes. This declaration should clearly indicate the specific property or amount you wish to renounce. Following the guidelines for the Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession ensures your disclaimer is legally valid. For additional assistance, consider using uslegalforms to access templates and legal advice.

Yes, you can turn down part of an inheritance under the Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession. You need to clearly state your intention to disclaim a specific portion of the inheritance in a legal document. This process helps you manage the assets you want to decline while retaining control over other parts of the estate. Consulting uslegalforms can guide you in preparing the necessary documents for this process.

If you choose to refuse your inheritance under the Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession, that property will pass to the next beneficiary as specified by law. This means it does not revert to the estate or stay unclaimed. By formally disclaiming the inheritance, you help ensure that your decision is honored without complications. Be sure to document your decision correctly through a disclaimer form, which you can find on platforms like uslegalforms.

Intestate succession in Texas refers to the legal process that dictates how a deceased person's assets are distributed when there is no valid will. The state's laws prioritize relatives, determining the order of distribution based on familial relationships. Learning about the Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession can shed light on how these laws apply to individual situations, ensuring a smoother probate process.

In Texas, the rules for disclaiming an inheritance require the disclaimer to be in writing and filed with the appropriate estate representative. You must act within nine months of the decedent’s death to ensure that the disclaimer is valid. Understanding the Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession can be a crucial resource in navigating these regulations.

To disclaim inherited property in Texas, you must deliver a written disclaimer to the personal representative of the estate. This document should express your desire not to accept the inheritance and be done within a specific timeframe. Utilizing services related to the Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession allows you to ensure this process is legally sound and compliant.

Transferring property after death without a will in Texas is done through probate court that follows intestate succession laws. This means the state determines how the deceased’s assets are distributed among heirs. To streamline this process, you may explore the Frisco Texas Renunciation And Disclaimer of Property received by Intestate Succession, which provides essential resources and guidance.