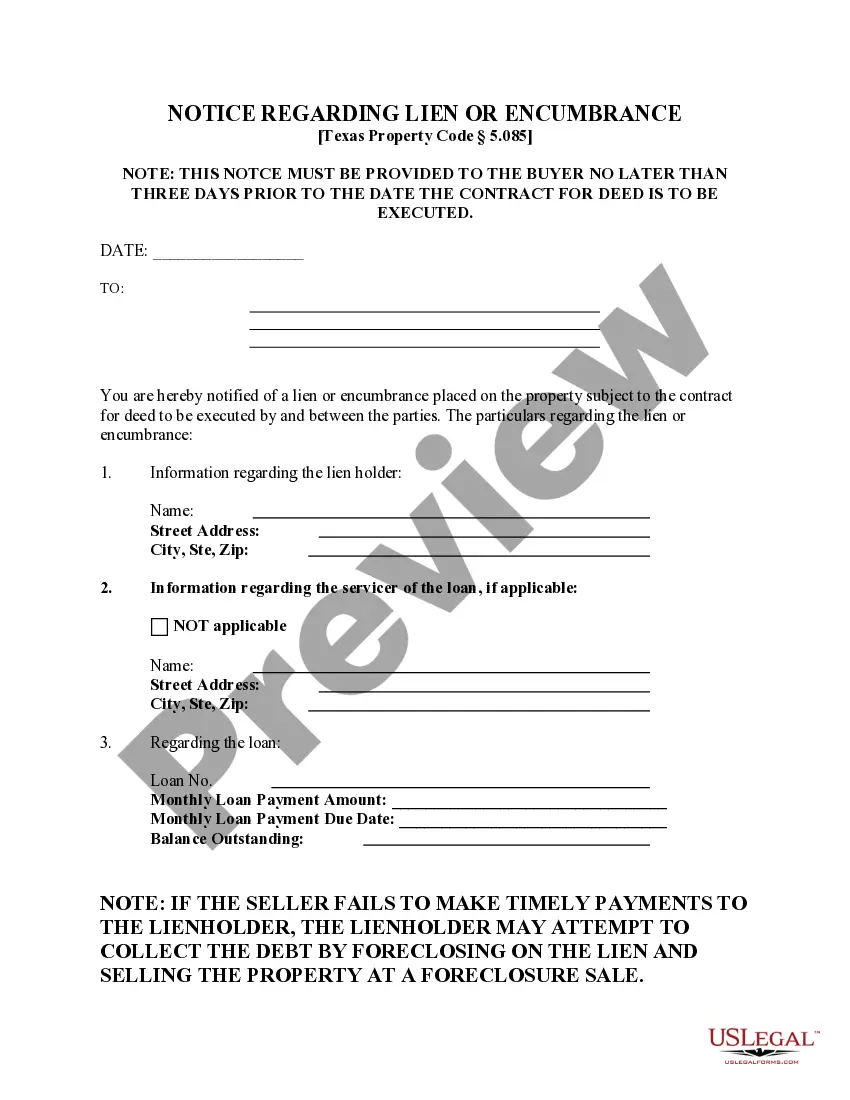

Texas Contract for Deed related forms. This particular form is used to notify the Buyer of the particulars regarding a lien or encumbrance on the property and it is used prior to execution of the contract. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

Dallas Texas Notice Regarding Lien or Encumbrance is a crucial legal document that property owners or potential buyers need to be aware of when dealing with real estate transactions in the Dallas area. This notice provides valuable information about any existing liens or encumbrances on a property, which could potentially affect its marketability and ownership. Liens and encumbrances are legal claims against a property by creditors or other parties, and they can have a significant impact on a property's value and its transferability. There are several types of liens and encumbrances that could be included in the notice, including: 1. Mechanic's Liens: This type of lien arises when a contractor or supplier is not paid for work or materials provided for the improvement of the property. It is important to be aware of any outstanding mechanic's liens, as they can result in legal action against the property and affect its marketability. 2. Mortgage Liens: These liens are created when a property owner takes out a mortgage loan against the property. The mortgage holder will have a legal claim on the property until the loan is paid off in full. It is important for potential buyers to know if there are existing mortgage liens on the property they are interested in, as it may affect their ability to secure financing or negotiate the purchase price. 3. Tax Liens: When property taxes are not paid, the local government can place a tax lien on the property. This type of lien is given priority over other liens and can result in the forced sale of the property to recover the unpaid taxes. Prospective buyers should be aware of any outstanding tax liens on a property, as they can become responsible for paying off the lien if they decide to purchase it. 4. Judgment Liens: These liens are usually the result of a court judgment against a property owner. They can arise from unpaid debts, child support obligations, or other legal judgments. Judgment liens can affect the property owner's ability to sell or refinance the property, and potential buyers need to be aware of any existing judgment liens before finalizing a purchase. The Dallas Texas Notice Regarding Lien or Encumbrance provides transparency and protects both buyers and sellers in real estate transactions. It is essential for property owners and potential buyers to thoroughly review this notice to ensure there are no surprises or legal issues surrounding a property's title. By being fully informed about any liens or encumbrances, parties can make more informed decisions and protect their interests during the property transfer process.Dallas Texas Notice Regarding Lien or Encumbrance is a crucial legal document that property owners or potential buyers need to be aware of when dealing with real estate transactions in the Dallas area. This notice provides valuable information about any existing liens or encumbrances on a property, which could potentially affect its marketability and ownership. Liens and encumbrances are legal claims against a property by creditors or other parties, and they can have a significant impact on a property's value and its transferability. There are several types of liens and encumbrances that could be included in the notice, including: 1. Mechanic's Liens: This type of lien arises when a contractor or supplier is not paid for work or materials provided for the improvement of the property. It is important to be aware of any outstanding mechanic's liens, as they can result in legal action against the property and affect its marketability. 2. Mortgage Liens: These liens are created when a property owner takes out a mortgage loan against the property. The mortgage holder will have a legal claim on the property until the loan is paid off in full. It is important for potential buyers to know if there are existing mortgage liens on the property they are interested in, as it may affect their ability to secure financing or negotiate the purchase price. 3. Tax Liens: When property taxes are not paid, the local government can place a tax lien on the property. This type of lien is given priority over other liens and can result in the forced sale of the property to recover the unpaid taxes. Prospective buyers should be aware of any outstanding tax liens on a property, as they can become responsible for paying off the lien if they decide to purchase it. 4. Judgment Liens: These liens are usually the result of a court judgment against a property owner. They can arise from unpaid debts, child support obligations, or other legal judgments. Judgment liens can affect the property owner's ability to sell or refinance the property, and potential buyers need to be aware of any existing judgment liens before finalizing a purchase. The Dallas Texas Notice Regarding Lien or Encumbrance provides transparency and protects both buyers and sellers in real estate transactions. It is essential for property owners and potential buyers to thoroughly review this notice to ensure there are no surprises or legal issues surrounding a property's title. By being fully informed about any liens or encumbrances, parties can make more informed decisions and protect their interests during the property transfer process.