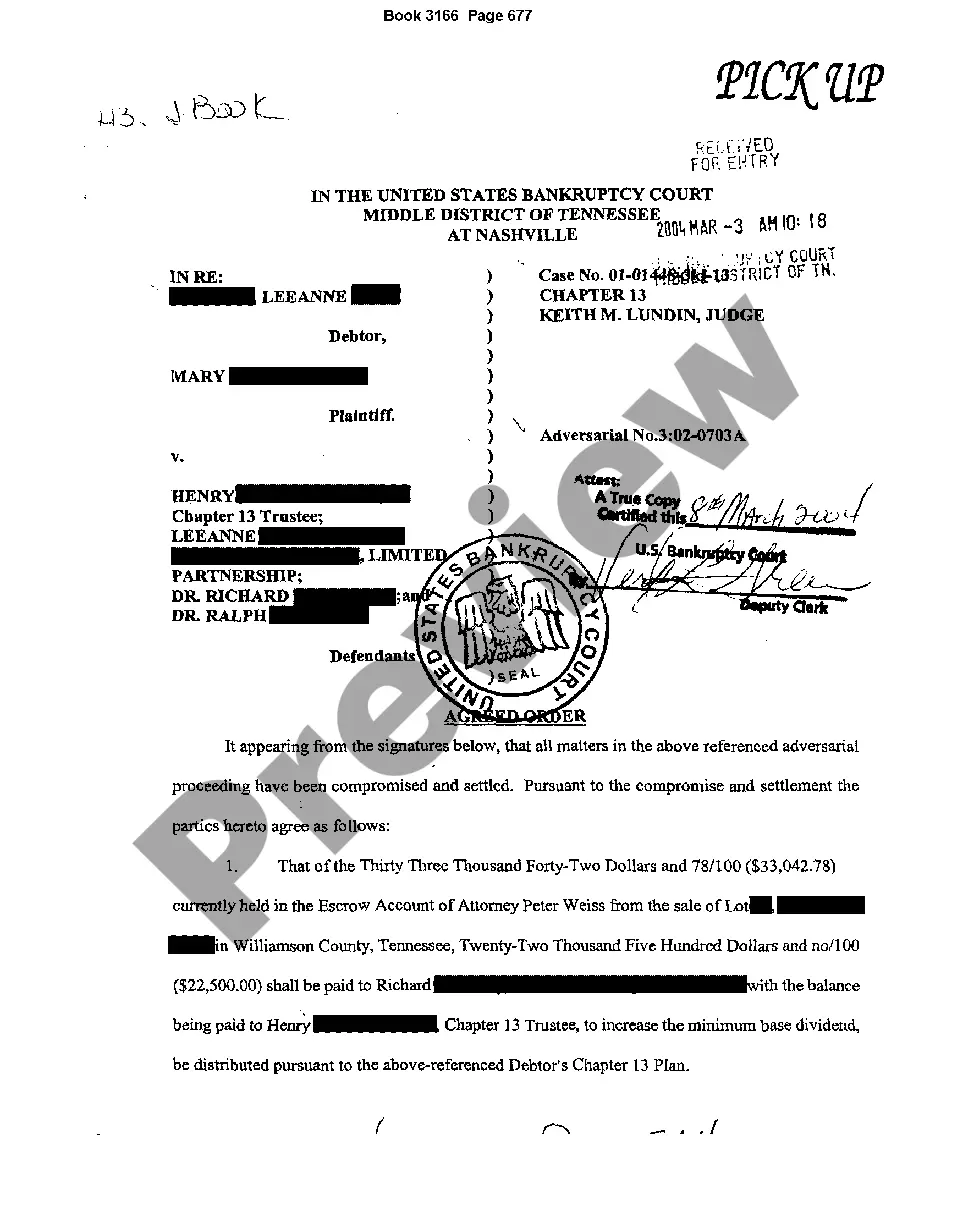

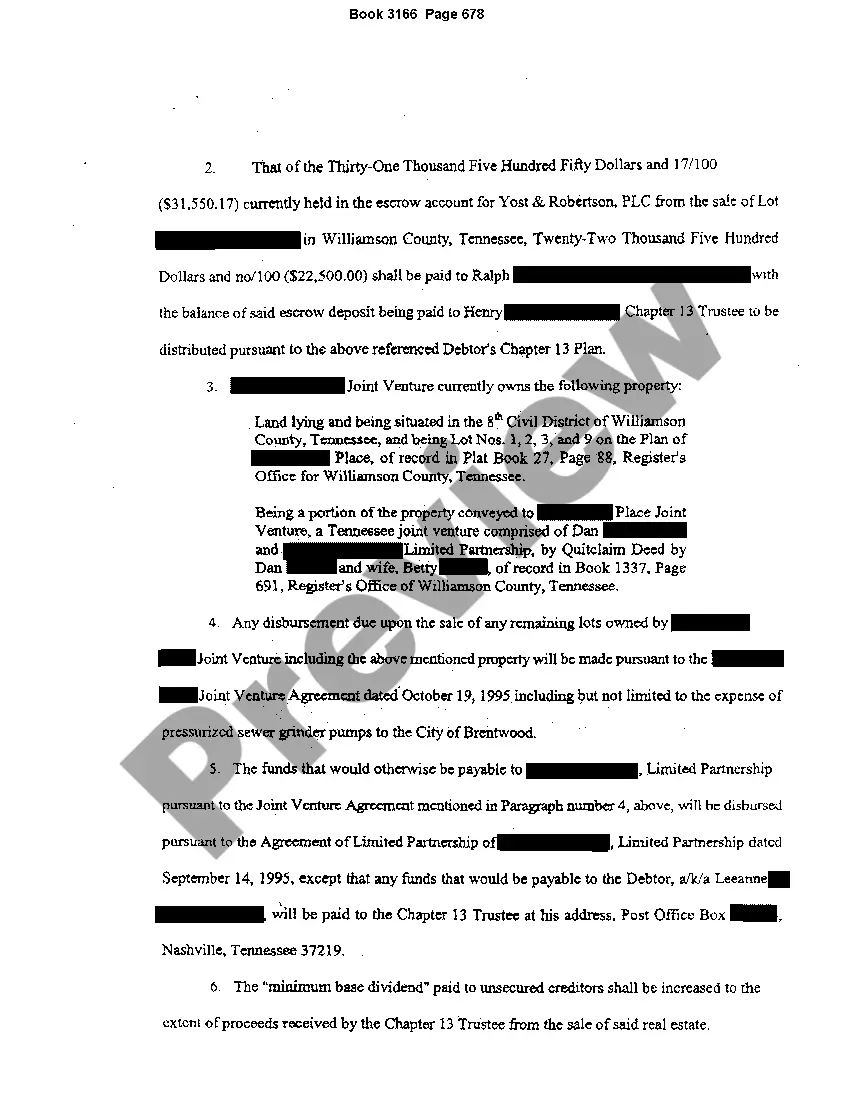

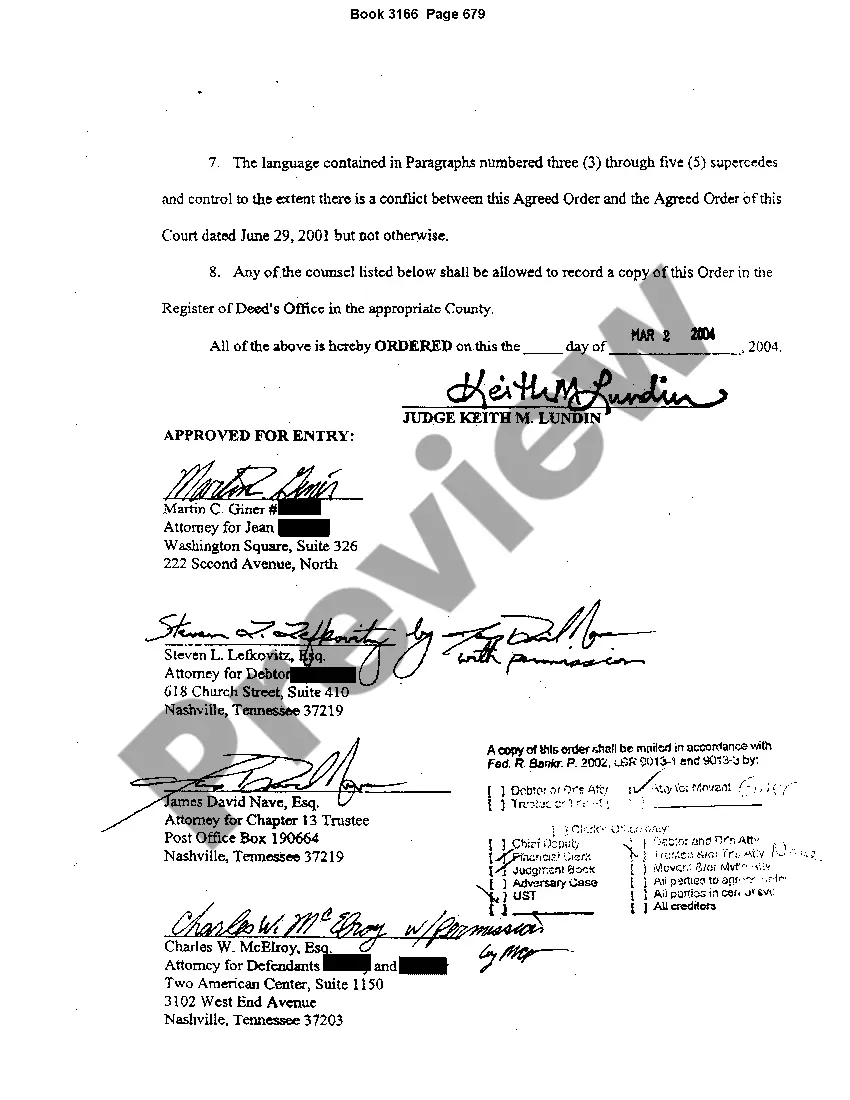

Nashville Tennessee Agreed Order for Chapter 13 Settlement with claimants

Description

How to fill out Tennessee Agreed Order For Chapter 13 Settlement With Claimants?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our advantageous website with an extensive array of files simplifies the process of locating and obtaining nearly any document sample you need.

You can download, complete, and sign the Nashville Tennessee Agreed Order for Chapter 13 Settlement with claimants in just a few minutes rather than spending several hours searching online for a suitable template.

Employing our collection is an excellent method to enhance the security of your record submission.

- Our skilled attorneys routinely examine all documents to ensure that the forms are suitable for a specific state and adhere to current laws and regulations.

- When it comes to obtaining the Nashville Tennessee Agreed Order for Chapter 13 Settlement with claimants, if you possess an account, simply Log In to your account.

- The Download option will be active on all the documents you access.

- You can also locate all previously saved documents in the My documents section.

Form popularity

FAQ

8 Recommendations for Surviving Chapter 13 Bankruptcy Create a Support Network.Pay Attention to the Paperwork.Stick to a Budget.Pay the Bills on Time.Stay on Top of Notifications.Keep Your Lawyer Up to Date.Complete Credit Counseling and Debtor Education.Don't Create New Debt.

So, creditors may be more likely to extend credit to you because you are less of a risk than someone who can decide tomorrow they want to file bankruptcy. Either way, once you get your discharge in a Chapter 7 bankruptcy or a Chapter 13 bankruptcy, you will get credit again and be able to increase your score.

Steps in a Tennessee Bankruptcy learn about Chapters 7 and 13. check whether bankruptcy will erase debt. find out if you can keep property. determine whether you qualify. consider hiring a bankruptcy lawyer. stop paying qualifying debts. gather necessary financial documents. take a credit counseling course.

When you complete your Chapter 13 repayment plan, you'll receive a discharge order that will wipe out the remaining balance of qualifying debt. In fact, a Chapter 13 bankruptcy discharge is even broader than a Chapter 7 discharge because it wipes out certain debts that aren't nondischargeable in Chapter 7 bankruptcy.

After the meeting of creditors, the debtor, the chapter 13 trustee, and those creditors who wish to attend will come to court for a hearing on the debtor's chapter 13 repayment plan.

An order confirming the chapter 13 plan is a Bankruptcy judge's approval of the Debtor's proposed chapter 13 repayment plan.

Pre-petition debts can also be added to Chapter 13 bankruptcy after you file, but again, you will want to notify your attorney of the missed creditor as soon as possible. Adding debts to Chapter 13 is possible, but if certain deadlines have come and gone in the case, a debt can be found to be non-dischargeable.

A stipulation in Chapter 13 bankruptcy law states that you, as a debtor, are not allowed to increase any debt without receiving the permission of your bankruptcy trustee. If you do apply for a credit card, your bankruptcy payment plan will be canceled and the bankruptcy proceedings will be stopped.

The debtor may be allowed to retain the increase in income unless the increase is significant and there are no offsetting increases in expenses. The Bankruptcy Code requires that the debtor contribute his or her projected disposable income toward the plan payments for the first three years (36 months) of the plan.

There are only two ways to pay off a Chapter 13 bankruptcy early: pay 100% of the allowed claims filed in your case, or. qualify for a hardship discharge.