Clarksville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal for Payment and Costs Awarded Principal

Description

How to fill out Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal For Payment And Costs Awarded Principal?

Obtaining validated forms tailored to your local laws can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents for both personal and professional requirements as well as various real-life scenarios.

All the files are accurately categorized by usage area and jurisdictional domains, making the process of finding the Clarksville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal for Payment and Costs Awarded Principal straightforward and effortless.

Maintaining organized paperwork that complies with legal mandates is extremely crucial. Leverage the US Legal Forms library to always possess essential document templates for any needs conveniently at your fingertips!

- Familiarize yourself with the Preview mode and form details.

- Ensure that you have selected the correct one that aligns with your needs and fully adheres to your local regulatory criteria.

- If necessary, look for another template.

- Should you encounter any discrepancies, utilize the Search tab above to find the appropriate document.

- If it meets your requirements, advance to the subsequent step.

Form popularity

FAQ

Tennessee Supersedeas Bond (Appeal Bond ~ Tennessee) A judicial bond is a type of financial assurance filed with the court that guarantees that should the appellant NOT prevail that he or she will comply with the original judgment and with any other orders issued by the court pertaining to the same.

To get a Tennessee surety bond, people generally go to a surety bonding company. You are able to get a surety bond through a general insurance company, but choosing a surety bond company often means you can get better quotes.

Appeal to High Court - 90 days from the date of decree Or order. Appeal to any other court - 30 days from the date of Decree or order. In case there are more than one plaintiffs or defendants, then any one of them can file on appeal against all of them respectively.

Created by the General Assembly in 1925, the Court of Appeals hears appeals in civil?or non-criminal?cases from trial courts and certain state boards and commissions. The court has 12 members who sit in panels of three. The panels meet monthly in Jackson, Knoxville and Nashville.

The short answer? It can take years ? but the length of the appeal is largely determined by the resources of the courts. Once a notice of appeal is filed, the court clerk has 60 days to prepare the records. Then, each side has 30 days to present their briefs.

An appeal bond, sometimes called a supersedeas bond, is required when a defendant wants to appeal an adverse judgment or order. The bond guarantees that if the defendant (principal) loses the appeal, the amount of the judgment and, in some cases, accrued interest, expenses and legal fees, will be paid.

You only have 60 days to appeal after you find out that there is a problem. You can ask someone to help you file an appeal. Usually, your appeal is decided within 90 days after you file it.

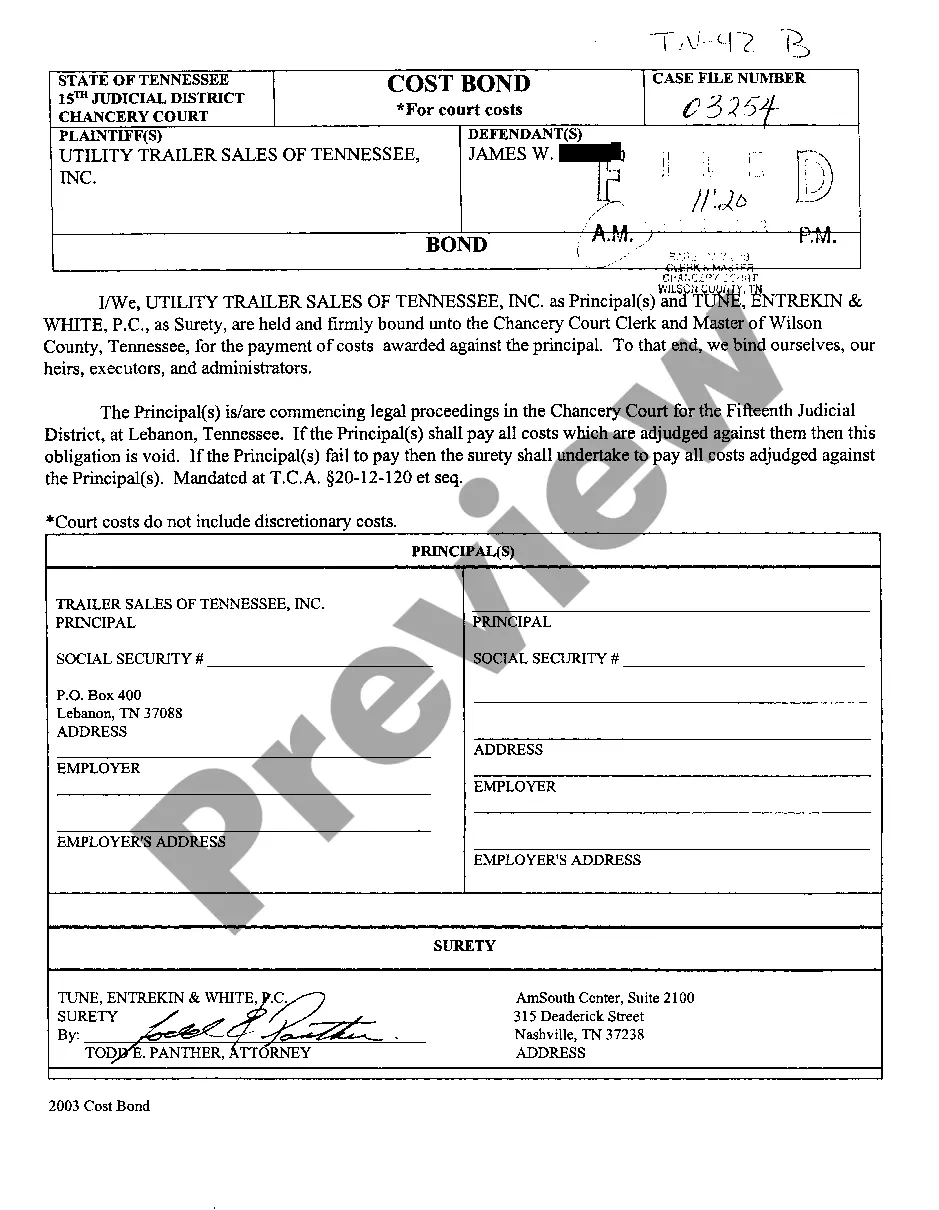

COST BOND. as Surety, are held and firmly bound unto the Circuit Court Clerk of Davidson County, Tennessee, for the payment of all costs awarded against the Principal(s). To that end, we bind ourselves, our heirs, executors, and administrators.

A cost bond is a kind of surety bond that guarantees payment of court expenses. Generally speaking, surety bonds form a legally binding contract, involving three parties: the principal, the obligee, and the surety. The party requesting the bond is the obligee. The party obligated to buy the bond is the principal.

- The appeal to the Court of Appeals in cases decided by the Regional Trial Court in the exercise of its original jurisdiction shall be taken by filing a notice of appeal with the court which rendered the judgment or final order appealed from and serving a copy thereof upon the adverse party.