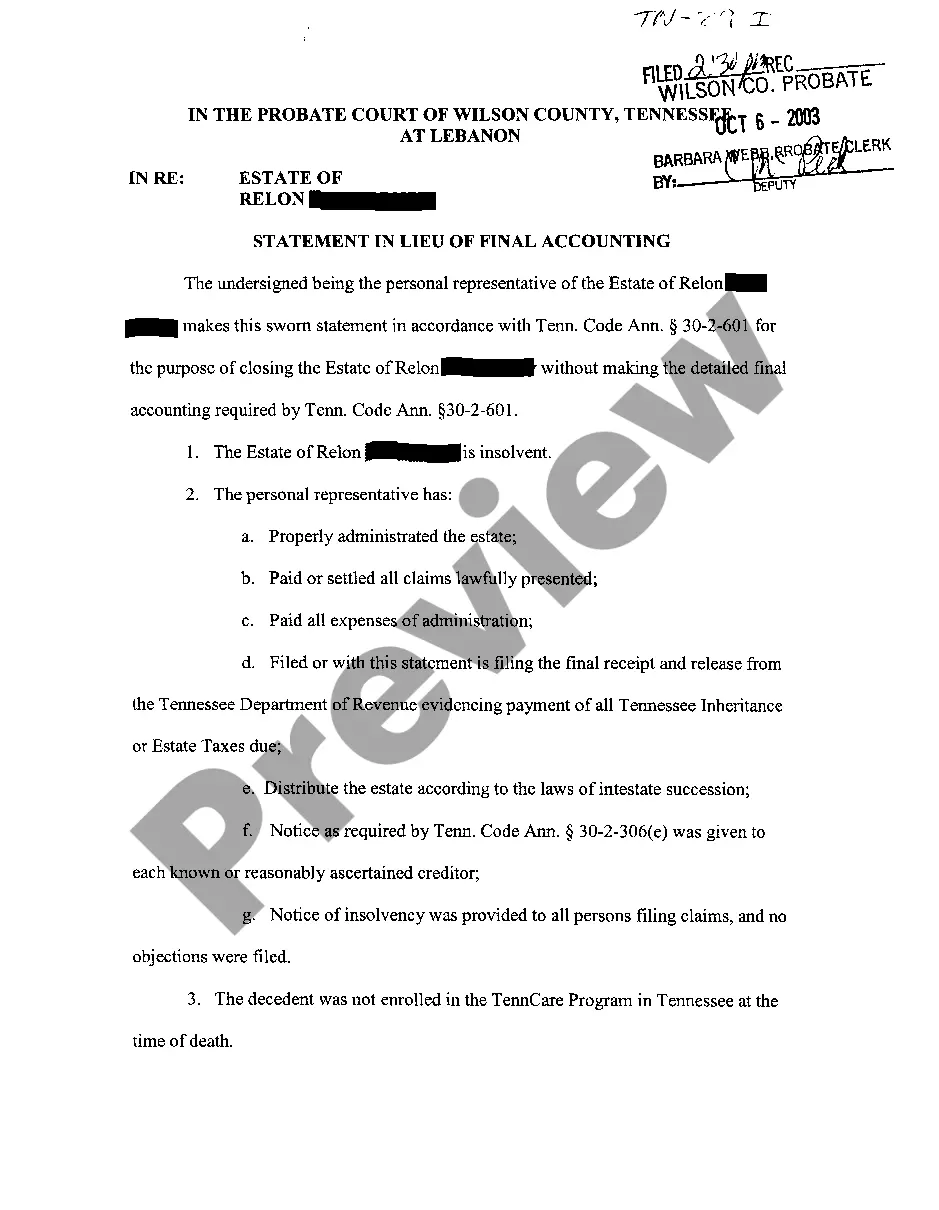

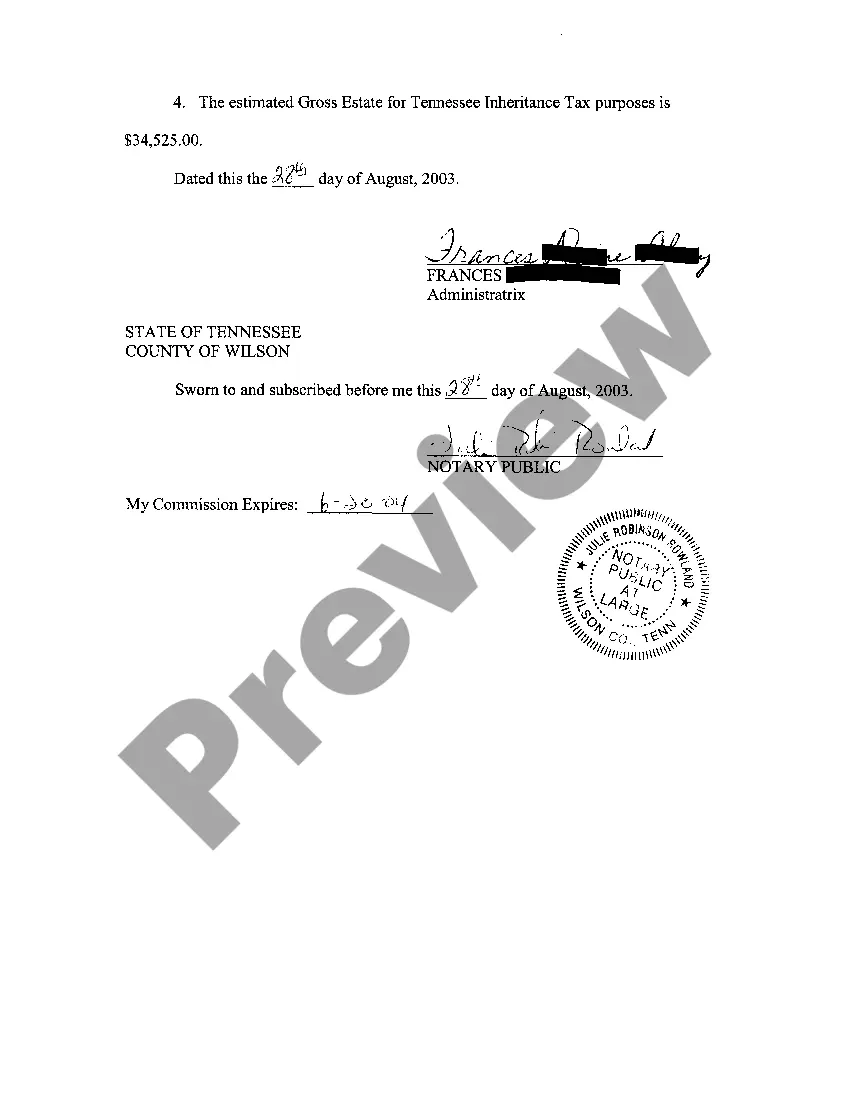

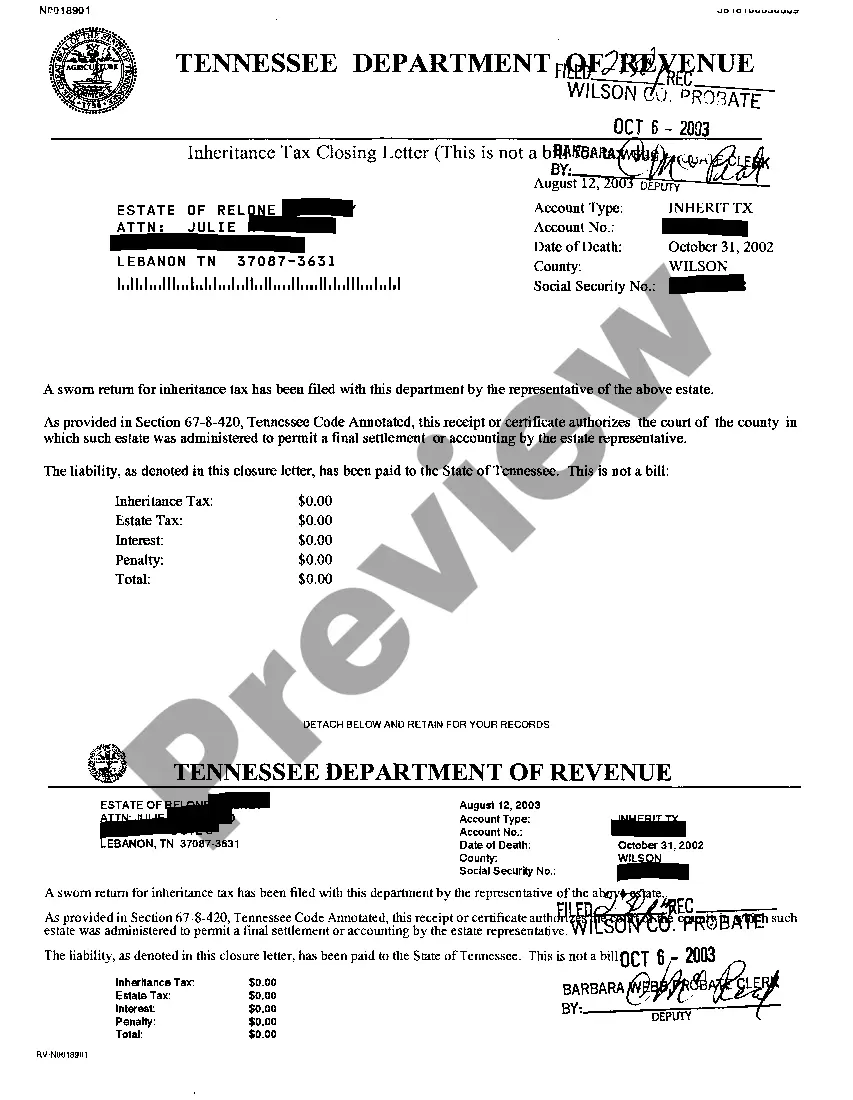

The Chattanooga Tennessee Statement In Lieu of Final Accounting is a legal document that serves as an alternative to a final accounting report typically required in the probate process. It provides a comprehensive summary of an estate's financial transactions and distributions, allowing for a simplified approach to estate administration. This statement is particularly significant when dealing with smaller estates or situations where a traditional final accounting may be overly burdensome or time-consuming. By electing to file a Statement In Lieu of Final Accounting, individuals or executors can efficiently settle an estate, saving valuable time and resources. Keywords: Chattanooga Tennessee, Statement In Lieu of Final Accounting, legal document, probate process, estate administration, financial transactions, distributions, simplified approach, smaller estates, traditional final accounting, executors, settle estate, time-consuming, resources. Different Types of Chattanooga Tennessee Statement In Lieu of Final Accounting: 1. Individual Statement In Lieu of Final Accounting: This type relates to a single individual who wishes to administer their estate without the need for a traditional final accounting. It is commonly used when the estate value is relatively small or when the deceased has specifically chosen this alternative method. 2. Executor's Statement In Lieu of Final Accounting: Executors, who are appointed to manage and distribute the assets of an estate, may file this type of statement if they believe it is a more appropriate and efficient way to settle the estate. It requires the executor to provide a comprehensive overview of the estate's financial activities and distributions. 3. Joint Statement In Lieu of Final Accounting: This category refers to situations where multiple beneficiaries or co-executors collectively choose to file a Statement In Lieu of Final Accounting. This type allows for simplified estate administration by consolidating financial information and streamlining the distribution process. 4. Small Estate Statement In Lieu of Final Accounting: In cases where the estate's value falls below a specific threshold defined by Tennessee law, individuals or executors may file this type of statement. It is designed to simplify the probate process for estates of minimal value, minimizing administrative burden and costs. Keywords: Chattanooga Tennessee, Statement In Lieu of Final Accounting, individual, executor, joint, small estate, estate value, beneficiaries, co-executors, simplified administration, financial activities, distribution process, probate process, administrative burden, costs.

Chattanooga Tennessee Statement In Lieu of Final Accounting

Description

How to fill out Chattanooga Tennessee Statement In Lieu Of Final Accounting?

We consistently aim to minimize or evade legal repercussions when handling intricate legal or financial matters.

To achieve this, we enroll in legal options that, typically, are exceptionally expensive. However, not every legal issue is equally complicated. Most of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions. Our platform empowers you to handle your affairs autonomously without needing a lawyer's assistance.

We offer access to legal document samples that aren’t universally accessible. Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Ensure that the Chattanooga Tennessee Statement In Lieu of Final Accounting adheres to the laws and regulations relevant to your location. Additionally, it’s crucial that you review the form’s description (if available) and if you find any inconsistencies with your initial needs, look for an alternate form. Once you’ve confirmed that the Chattanooga Tennessee Statement In Lieu of Final Accounting is appropriate for your situation, you can choose the subscription plan and proceed with the payment. You can then download the form in any available file format. For more than 24 years in the industry, we’ve assisted millions of individuals by offering ready-to-edit and up-to-date legal documents. Utilize US Legal Forms today to conserve time and resources!

- Take advantage of US Legal Forms whenever you need to acquire and download the Chattanooga Tennessee Statement In Lieu of Final Accounting or any other document swiftly and securely.

- Simply Log In to your account and click the Get button next to it.

- If you happen to misplace the form, you can always download it again in the My documents tab.

- The procedure is equally simple if you’re new to the website!

Form popularity

FAQ

While it is not mandatory to hire a lawyer for probate in Tennessee, doing so can simplify the process and provide valuable legal insight. A lawyer can help you navigate complex situations like disputes or challenges to the will. If hiring an attorney feels overwhelming, using the uslegalforms platform can give you the necessary tools and documents to file probate successfully on your own.

Yes, Tennessee law permits a time frame for probate, generally requiring that probate occurs within four years of the decedent's death. However, it is advisable to begin this process as soon as possible to avoid complications. Should you need guidance on filing, you can explore the uslegalforms platform, which provides resources for timely and accurate probate filings.

In Tennessee, an executor typically has up to 12 months to settle an estate, though this period can vary based on the complexity of the estate. It is essential to complete all required tasks, such as paying debts and distributing assets, within this timeframe. If you need assistance in managing this process, the uslegalforms platform offers valuable resources to help you stay organized and on track.

To obtain a letter of testamentary in Tennessee, you need to submit a probate petition to the appropriate court along with the deceased's will and supporting documents. After the court reviews and validates the documents, you will be appointed as the executor, granting you authority to manage the estate. It’s a straightforward process, and you can find helpful tools on uslegalforms to assist with preparing the necessary paperwork.

The probate process in Tennessee involves several key steps, starting with the filing of the will and a petition to open probate. The court will then validate the will and appoint an executor or administrator to oversee the estate. Throughout this process, it’s essential to handle assets, settle debts, and ultimately distribute property to beneficiaries as per the will. For a smoother experience, the uslegalforms platform offers resources and templates tailored for the Tennessee probate process.

To obtain letters of testamentary in Tennessee, you must first file a petition for probate in the local probate court. This petition includes necessary documents such as the decedent's will and a death certificate. Once the court reviews and approves your request, you will receive the letters, allowing you to manage the estate. For detailed guidance, consider using the uslegalforms platform, which can help you navigate this process efficiently.

Probate law in Tennessee outlines how a deceased person's estate is managed after their death. This includes validating wills, clearing debts, and distributing assets. Understanding these laws can prevent potential disputes among heirs. Utilizing documents like the Chattanooga Tennessee Statement In Lieu of Final Accounting can streamline the probate process and ensure compliance with state requirements.

Yes, there is a time limit to file for probate in Tennessee. Generally, you should file the probate petition within four months from the date of death. If you fail to file within this timeframe, you may face complications in administering the estate. For a smooth process, consider using the Chattanooga Tennessee Statement In Lieu of Final Accounting, which can simplify your obligations.

Tenn Code 30-2-601 pertains to the filing and requirements for a Statement of Opening of an Estate in Tennessee. It outlines how to officially open an estate and what documentation is needed. Understanding this code is essential for anyone preparing a Chattanooga Tennessee Statement In Lieu of Final Accounting, as it guides the initial steps of the probate process.

Tenn Code 30-1-106 establishes the powers and duties of an executor or administrator in Tennessee. This section specifies the responsibilities your appointed personal representative holds, thus shaping the probate process. Knowing these duties helps you navigate the estate settlement process more effectively, especially around the Chattanooga Tennessee Statement In Lieu of Final Accounting.