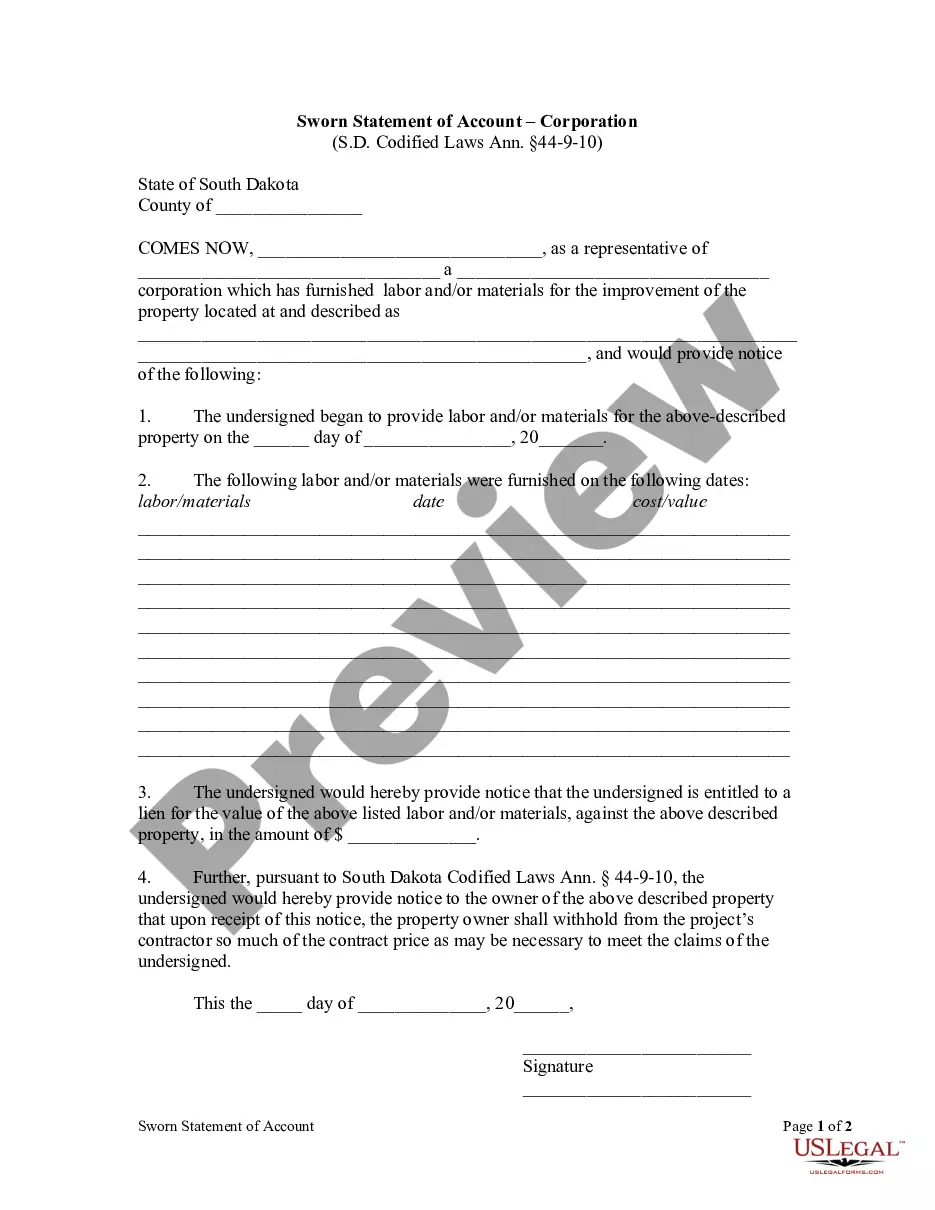

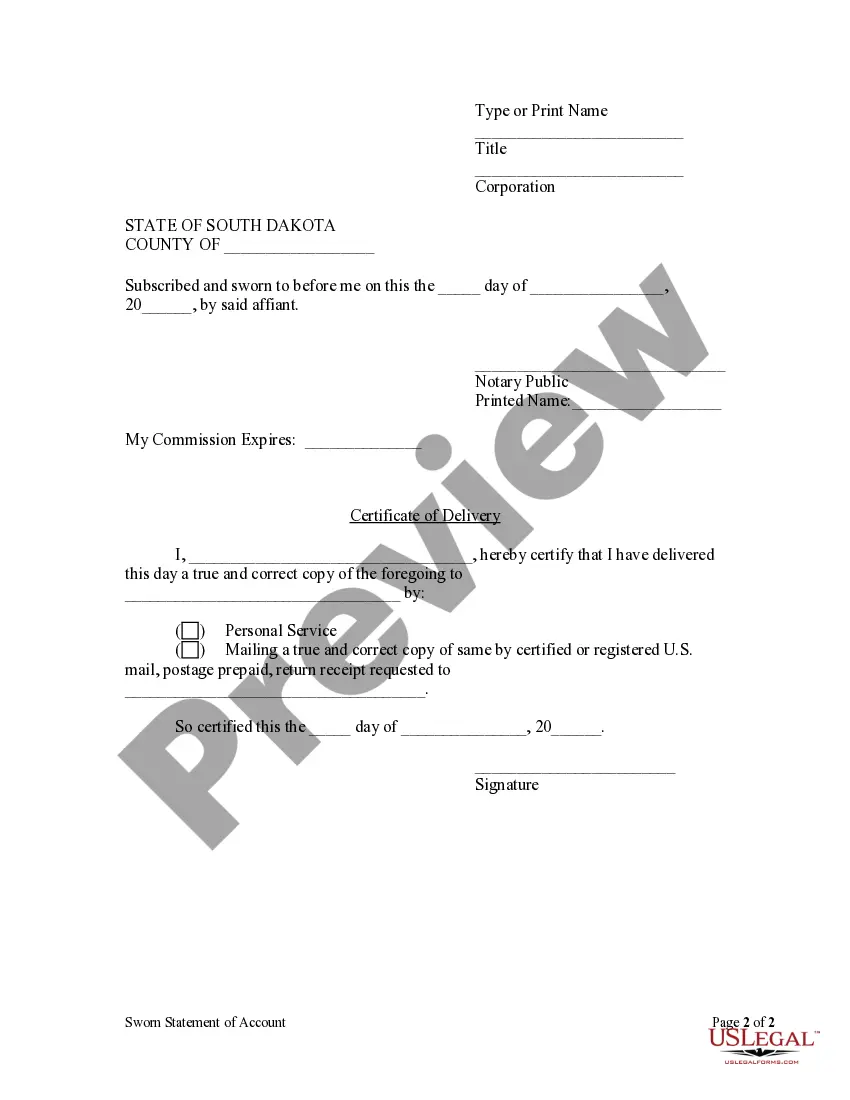

Any person furnishing any of the items for which a lien may be claimed under the provisions of § 44-9-1 under a contract, either express or implied between the owner of the property or his duly authorized agent or representative, and any contractor working upon or about such property may serve upon the owner, or his duly authorized agent or representative at any time, a sworn account and notice of his claim showing the items and amounts and the dates that the same were furnished, and thereupon the owner shall withhold from his contractor so much of the contract price as may be necessary to meet the claims of persons who have served such accounts and notices.

Sioux Falls South Dakota Statement of Account by Corporation

Description

How to fill out South Dakota Statement Of Account By Corporation?

Obtaining authenticated templates suited to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It is a digital collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the files are accurately categorized by usage area and jurisdiction regions, making it simple and quick to find the Sioux Falls South Dakota Statement of Account by Corporation or LLC.

Maintaining documentation organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to keep vital document templates for any requirements readily available!

- Examine the Preview mode and form details.

- Confirm you’ve picked the correct one that fulfills your needs and completely aligns with your local jurisdiction standards.

- Look for another template if necessary.

- If you detect any discrepancies, use the Search tab above to locate the proper one. If it's suitable for you, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

Incorporating in South Dakota offers a number of benefits like limited liability, perpetual existence, ease of ownership transfer, and easy accessibility to investment.

Business Corporations - Domestic & Foreign ServiceFeeLimited Liability Company (LLC) - Domestic & ForeignDomestic Articles of OrganizationFiled Electronically online$150Filed via Paper (includes paper filing fee)$165114 more rows

To dissolve your corporation in South Dakota, you must submit the completed Articles of Dissolution form by mail or in person, in duplicate, to the Secretary of State along with the filing fee.

How do you dissolve/terminate a South Dakota Limited Liability Company? To dissolve/terminate your domestic LLC in South Dakota, you must submit the completed Articles of Termination form to the South Dakota Secretary of State by mail or in person and in duplicate along with the filing fee.

Just follow these six steps, and you'll be on your way. Name Your South Dakota LLC.Choose Your Registered Agent.Prepare and File Articles of Organization.Receive a Certificate From the State.Create an Operating Agreement.Get an Employer Identification Number.

Delaware is the most common state to incorporate in. The State of Delaware is a leading home for both domestic and international corporations. More than 1,000,000 businesses have made Delaware their home.

Dissolving your business with the state will end these obligations. Step 1: Get approval of the owners of the corporation or LLC.Step 2: File the Certificate of Dissolution with the state.Step 3: File federal, state, and local tax forms.Step 4: Wind up affairs.Step 5: Notify creditors your business is closing.

No tax avoidance. When you do business in a state other than the one where you incorporated (registered) your business, you will not avoid paying taxes and registration fees in the state where you do business.

Benefits of incorporating provincially and federally Easier access to capital. Corporations can borrow money at lower rates.Lower tax rates. Corporations are taxed separately from their owners.Limited liability. Shareholders are not responsible for a corporation's debts.Separate legal entity.Continuous existence.

Nevada often tops the list as places to incorporate for tax considerations given that it has no taxes on corporate income, corporate shares, franchises, or personal income. Be aware though that most states require you to pay taxes on any income generated within that state.