Pittsburgh Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will

Description

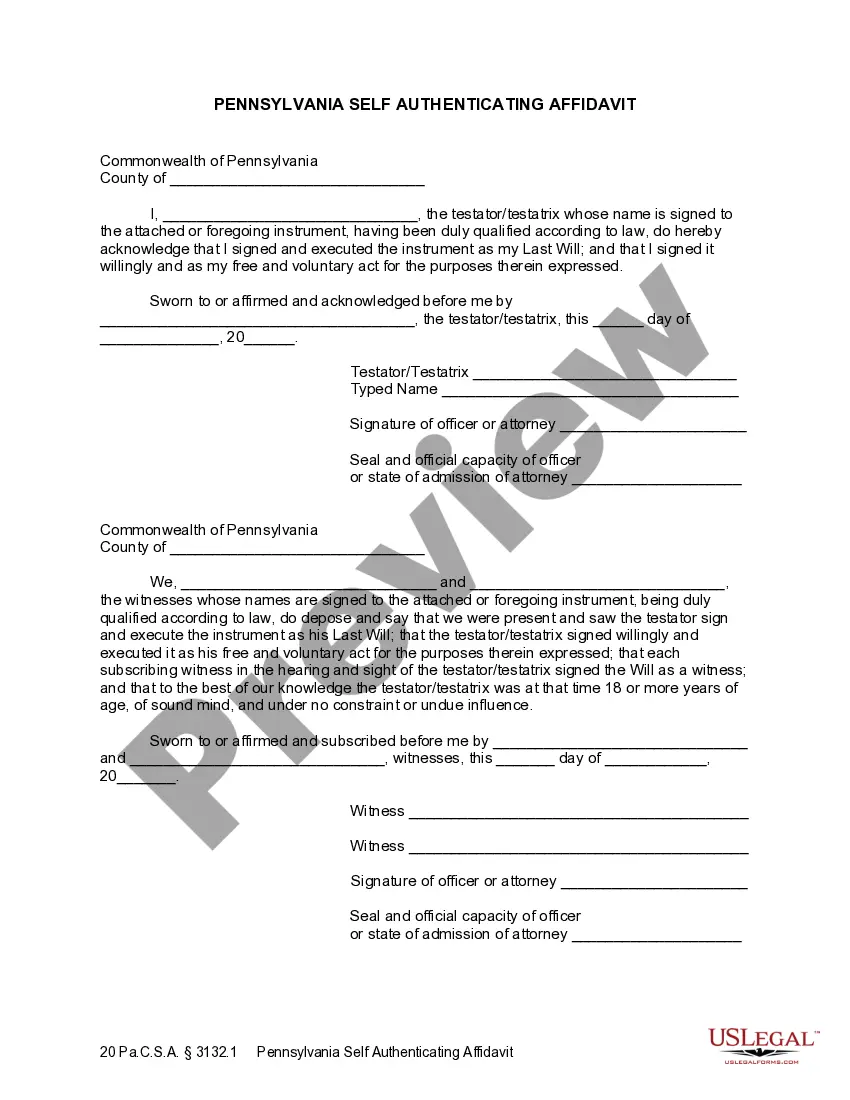

How to fill out Pennsylvania Last Will And Testament With All Property To Trust Called A Pour Over Will?

Are you searching for a trustworthy and affordable legal documents provider to obtain the Pittsburgh Pennsylvania Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a bundle of papers to facilitate your divorce process through the court, we have you covered. Our site offers over 85,000 current legal document templates for individual and corporate use. All templates we provide are not generic but tailored to the specifications of unique states and regions.

To download the document, you must Log In to your account, locate the required template, and click the Download button next to it. Please note that you can access your previously purchased document templates anytime from the My documents section.

Are you a newcomer to our service? No problem. You can easily create an account, but first, make sure to do the following: Check if the Pittsburgh Pennsylvania Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will aligns with the legal requirements of your state and locality. Review the details of the form (if available) to understand its intended purpose and audience. If the template does not suit your particular needs, restart your search.

Try US Legal Forms today, and eliminate the frustration of spending hours searching for legal documents online once and for all.

- Now you can register for an account.

- Next, select a subscription plan and move on to the payment.

- Once the payment is completed, download the Pittsburgh Pennsylvania Legal Last Will and Testament Form with All Property to Trust designated as a Pour Over Will in any available file format.

- You can revisit the site any time and re-download the document at no additional cost.

- Accessing current legal documents has never been simpler.

Form popularity

FAQ

You may want a pour-over will to simplify the distribution of your estate and ensure that your assets transfer to your trust automatically. A Pittsburgh Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will provides peace of mind, knowing your assets will be managed as you intended. Additionally, this approach can help eliminate confusion among beneficiaries during a difficult time.

One of the biggest mistakes in a will is failing to update it regularly. When life changes occur, such as marriage, divorce, or the birth of children, your Pittsburgh Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will may no longer reflect your wishes. Regular updates ensure your estate plan aligns with your current situation and beneficiaries’ needs.

An example of a drawback of a pour-over will is the potential for unexpected tax implications. Since the will must go through probate, any assets included may be subject to probate taxes and fees before transferring to the trust. This can diminish the overall estate value, impacting what your beneficiaries ultimately receive.

The key difference between a pour-over will and a standard will lies in how they handle assets after death. A standard will distributes assets directly to beneficiaries, while a Pittsburgh Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will directs assets into a pre-established trust. This trust can then manage and distribute assets according to your wishes, providing better control and privacy.

One notable drawback of a pour-over will is the probate requirement for the will before the trust receives the assets. Although the pour-over will directs assets into a trust, beneficiaries cannot access those assets until the completion of the probate process. This can create delays and additional expenses during estate settlement.

over will does not fully avoid probate in Pennsylvania. When you create a Pittsburgh Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will, your assets transfer to a trust upon your death. However, the will itself must go through the probate process initially. It is important to understand this process for effective estate planning.

Generally, a will does not override a trust once it is established and funded. The assets held within a trust will follow the trust's directives, while the will addresses assets not included in the trust. The Pittsburgh Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will bridges this gap by ensuring that any remaining assets pour over into your trust. This seamless process protects your wishes and secures your legacy.

A last will and testament does not override a trust; instead, both work together to fulfill your estate planning goals. If assets are in the trust, they will be distributed according to the trust terms, regardless of what the will states. The Pittsburgh Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will complements your trust by capturing any leftover assets, ensuring they comply with your overall estate plan. This structure minimizes potential conflicts and clarifies your intentions.

over will works in tandem with your trust by capturing any assets you may not have transferred to the trust before your passing. Upon death, the pourover will transfers these assets directly into your trust. This ensures that your wishes are honored as outlined in the Pittsburgh Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will. Ultimately, all your property ends up managed as per your final directions.

Distributing trust property to beneficiaries happens according to the terms set in the trust document. Trustees have the responsibility to manage the trust and follow these directions carefully. The Pittsburgh Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will does not alter these provisions but ensures that any assets not previously included in the trust get added seamlessly. This approach minimizes confusion and maximizes the effective transfer of wealth.