Philadelphia Pennsylvania Satisfaction Piece of Mortgage - by Corporate Lender

Description

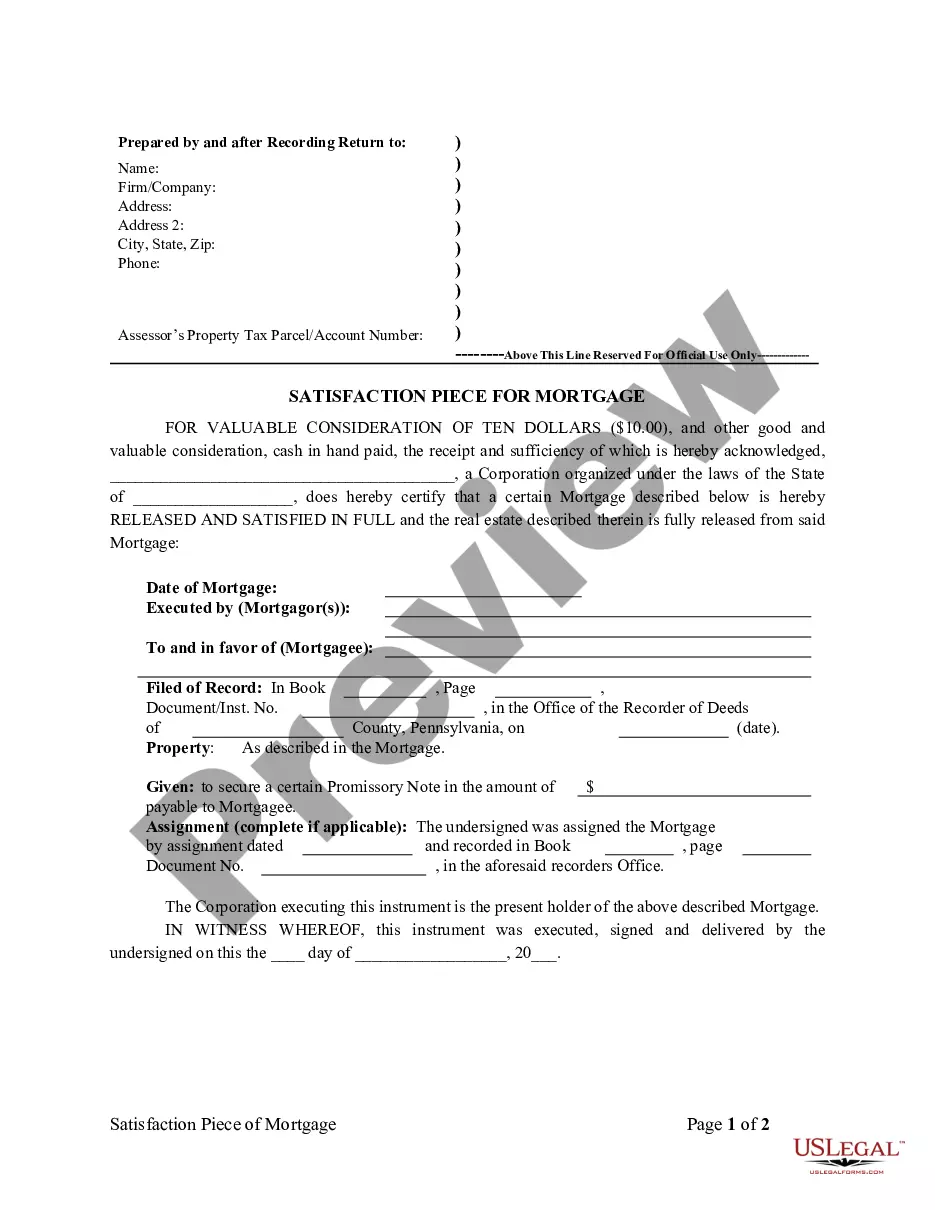

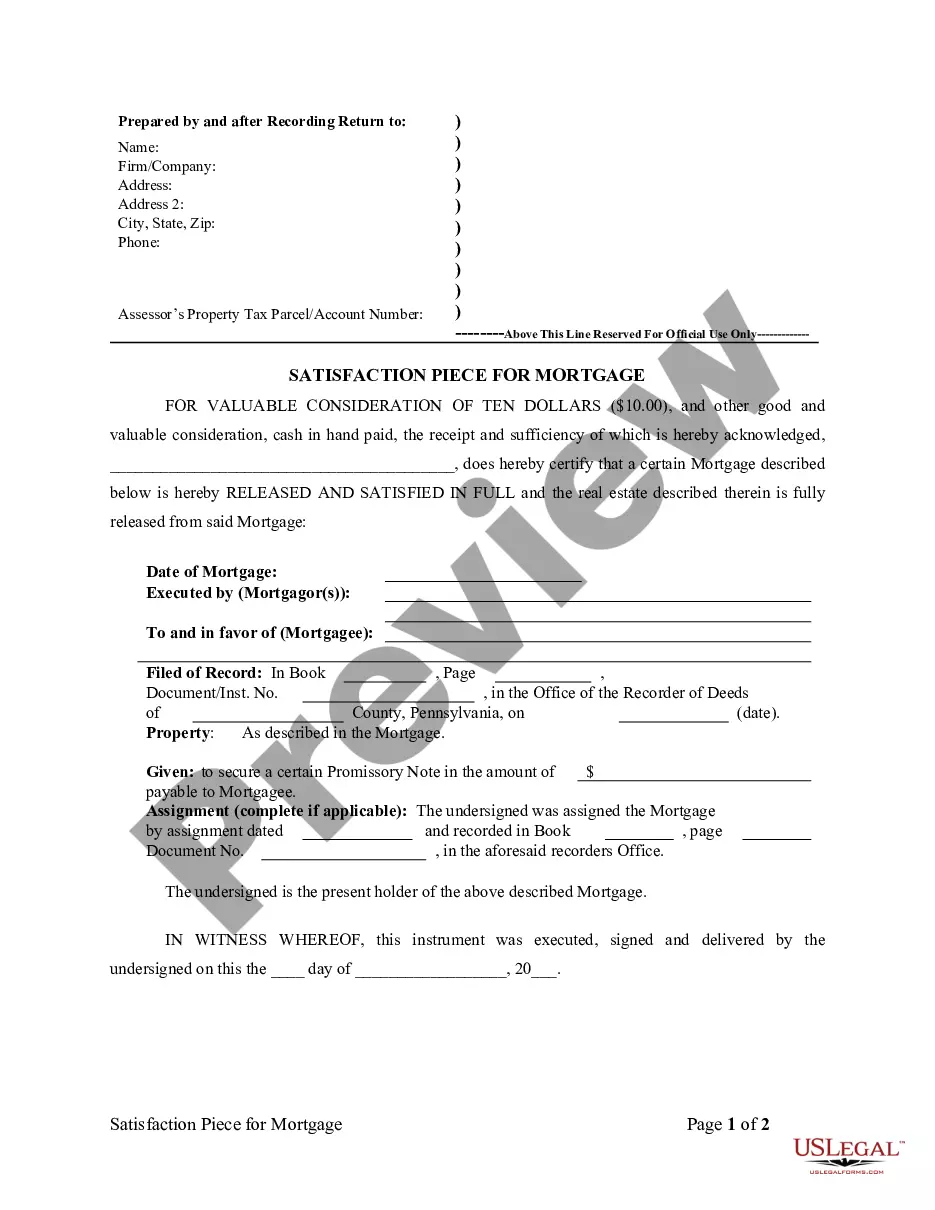

How to fill out Pennsylvania Satisfaction Piece Of Mortgage - By Corporate Lender?

Acquiring validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online compilation of over 85,000 legal paperwork for both personal and business purposes and various real-world situations.

All the documents are appropriately categorized by functional area and jurisdictional domains, so finding the Philadelphia Pennsylvania Satisfaction Piece of Mortgage - by Corporate Lender becomes as simple as pie.

- Familiarize yourself with the Preview mode and document description.

- Ensure you've selected the right document that aligns with your requirements and fully complies with your local jurisdiction stipulations.

- Search for an alternative template if necessary.

- If you detect any discrepancies, use the Search tab above to find the accurate one.

- If it meets your standards, proceed to the following step.

- Purchase the document by clicking the Buy Now button and selecting the subscription plan that suits you. You will need to register for an account to access the library’s materials.

- Complete your purchase by providing your credit card information or utilizing your PayPal account for the subscription payment.

- Download the Philadelphia Pennsylvania Satisfaction Piece of Mortgage - by Corporate Lender to save it to your device, allowing for its completion and access in the My documents menu of your profile whenever you need it again.

Form popularity

FAQ

The timeline for receiving a satisfaction of a mortgage can vary, but it typically ranges from a few weeks to a couple of months. After your final payment, your lender must send the necessary paperwork to the appropriate county office in Philadelphia. Once recorded, you will receive your Philadelphia Pennsylvania Satisfaction Piece of Mortgage - by Corporate Lender, complete with all legal confirmations.

When no satisfaction of a mortgage is recorded, the mortgage legally remains on your property records. This can create complications if you seek to sell your property or refinance, as the lender may still have a claim. It's crucial to address this issue promptly, and the US Legal Forms platform can assist by providing the necessary documents to formally request the recording of satisfaction.

Writing a satisfaction of mortgage letter is straightforward. Begin by including your name, address, and the mortgage details in the letter. Clearly state that you are seeking confirmation of the mortgage satisfaction and provide any necessary account numbers or reference information. Should you require a template or further guidance, the US Legal Forms platform can provide valuable tools to help you effectively draft this letter.

To find the satisfaction of your mortgage in Philadelphia, Pennsylvania, start by checking your county's property records. You can often find this information online or by visiting your local recorder of deeds office. Ensure you have your mortgage details handy, as this will help in your search. If you need assistance, consider using the US Legal Forms platform, which offers resources and templates to help you in this process.

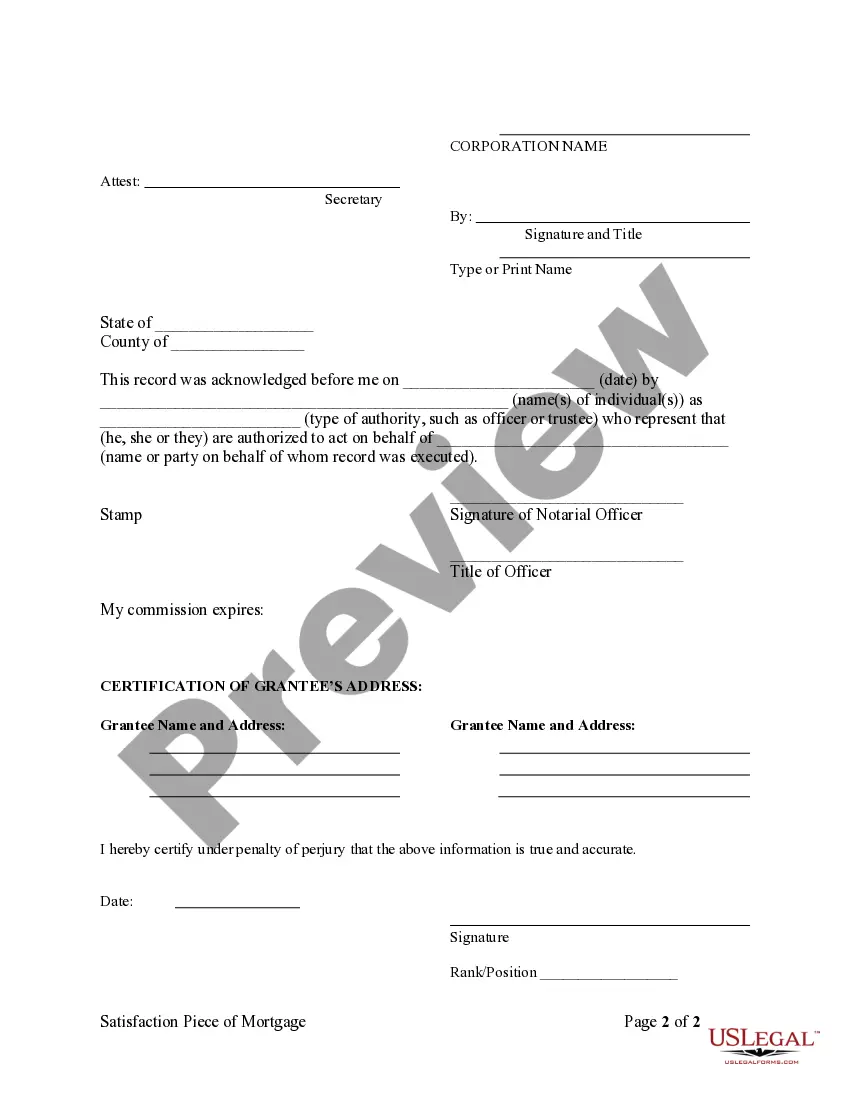

To record a satisfaction of your mortgage, you need to file the satisfaction document with the appropriate county office. This typically involves submitting the notarized form along with any required fees. For a seamless experience, consider utilizing uslegalforms to guide you through recording your Philadelphia Pennsylvania Satisfaction Piece of Mortgage - by Corporate Lender.

Filling out a satisfaction of mortgage form is straightforward. First, you should enter the borrower’s name, the lender’s information, and details of the mortgage. After that, include the property description and sign the document. Using uslegalforms can simplify this process and guide you through the necessary steps for your Philadelphia Pennsylvania Satisfaction Piece of Mortgage - by Corporate Lender.

Yes, a satisfaction of mortgage usually requires notarization to ensure its authenticity. This process helps verify the identity of the signer and adds a layer of legal protection. By notarizing this document, you enhance the validity of the Philadelphia Pennsylvania Satisfaction Piece of Mortgage - by Corporate Lender.