Philadelphia Pennsylvania Statement of Wages - for Injuries Occurring On and After June 24, 1996 for Workers' Compensation

Description

How to fill out Pennsylvania Statement Of Wages - For Injuries Occurring On And After June 24, 1996 For Workers' Compensation?

Take advantage of the US Legal Forms and gain instant access to any document you require.

Our convenient platform featuring thousands of document templates streamlines the process of locating and acquiring nearly any document sample you might need.

You can save, complete, and sign the Philadelphia Pennsylvania Statement of Wages - for Injuries Occurring On and After June 24, 1996 for Workers' Compensation in just a few minutes instead of spending hours online searching for a suitable template.

Using our library is an excellent method to enhance the security of your record filing.

If you do not have an account yet, follow the instructions below.

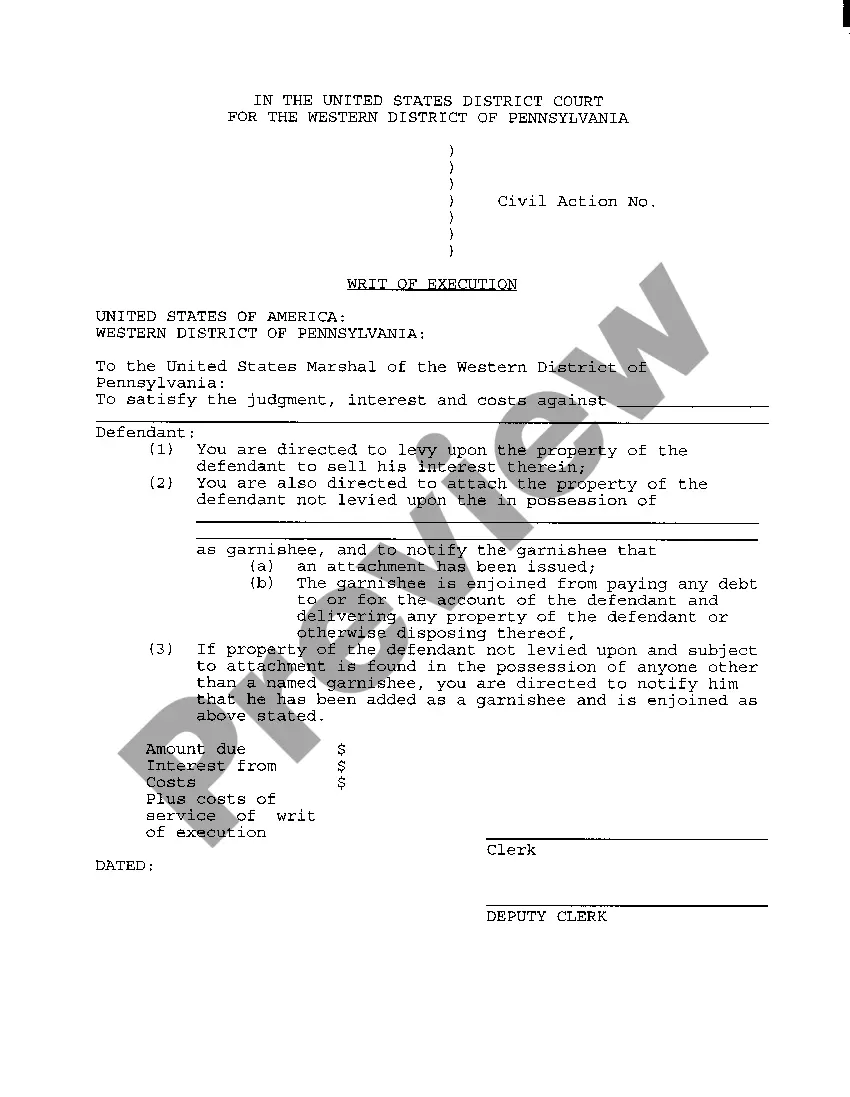

Open the page with the template you require. Verify that it is the correct template: check its title and description, and utilize the Preview feature when available. Otherwise, use the Search field to find the required one.

- Our qualified attorneys regularly examine all documents to ensure that the templates are suitable for a specific region and adhere to new laws and regulations.

- How can you access the Philadelphia Pennsylvania Statement of Wages - for Injuries Occurring On and After June 24, 1996 for Workers' Compensation.

- If you have an account, simply Log In to your profile.

- The Download option will be visible on all the samples you view.

- Additionally, you can locate all previously saved documents in the My documents section.

Form popularity

FAQ

2022 Pennsylvania Workers' Compensation Rate Schedules 1, 2022 shall be $1205.00 per week. For purposes of calculating the update to the payments for medical treatment rendered on and after Jan. 1, 2022, the percentage increase in the statewide average weekly wage is 6.6 percent.

But if your injury means that your conditions are not going to get better and you won't be able to work again, you can negotiate a comp settlement based on two-thirds of your average weekly wage and the 500-week period (about nine and a half years) for which you are eligible to receive benefits in Pennsylvania.

A workers' compensation settlement, sometimes referred to as a ?buyout,? may involve a one-time payment or a structured settlement that's paid to the injured worker over time. In exchange for this payment or series of payments, the worker relinquishes their right to receive future workers' compensation benefits.

Workers' compensation payments are not a fixed amount. Instead, they are calculated based on a workers' average weekly wage. An average weekly wage generally amounts to about two-thirds the amount a worker earned before their injury. There are exemptions made during the calculation of a worker's average weekly wage.

How Long Does It Take to Reach a Settlement for Workers' Comp? The entire settlement process?from filing your claim to having the money in your hands?can take around 12-18 months depending on the details of your case and whether or not you have legal representation.

Workers' Compensation is tax-free. In Pennsylvania, the weekly compensation rate amounts to 66% of the injured worker's average weekly wage if they earned between $810.76 and $1,621.50 prior to the injury. For workers who earn between $600.56 and $810.75, the weekly compensation rate is $540.50.

If the insurance company or employer accepts your claim, then you can expect workers' compensation checks within roughly 28 days of your date of injury.

Yes, you can reopen a closed workers' compensation case to get more benefits under specific circumstances in Pennsylvania. In general, your condition must have gotten worse to be able to open your case. That decrease in function or ability must be the result of the original work injury, too.

The employee does not report the worker's compensation payments, but does report the full amount of his or her regular salary. All other payments received under workers compensation acts is not taxable compensation. Occupational disease acts are not taxable.