Philadelphia Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

How to fill out Pennsylvania Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With No Children?

Acquiring approved templates tailored to your local laws can be challenging unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for personal and professional requirements and various real-life scenarios.

All the paperwork is systematically organized by field of application and jurisdictional areas, making it as straightforward as possible to search for the Philadelphia Pennsylvania Living Trust for Individuals Who are Single, Divorced, or Widows (or Widowers) Without Children.

Purchase the document. Click on the Buy Now button and choose your desired subscription plan. You will need to register for an account to gain access to the library’s offerings.

- For those already familiar with our catalog and who have used it previously, accessing the Philadelphia Pennsylvania Living Trust for Individuals Who are Single, Divorced, or Widows (or Widowers) Without Children requires only a few clicks.

- Simply Log In to your account, choose the document, and click Download to store it on your device.

- New users will have to complete a few additional steps to finish the process.

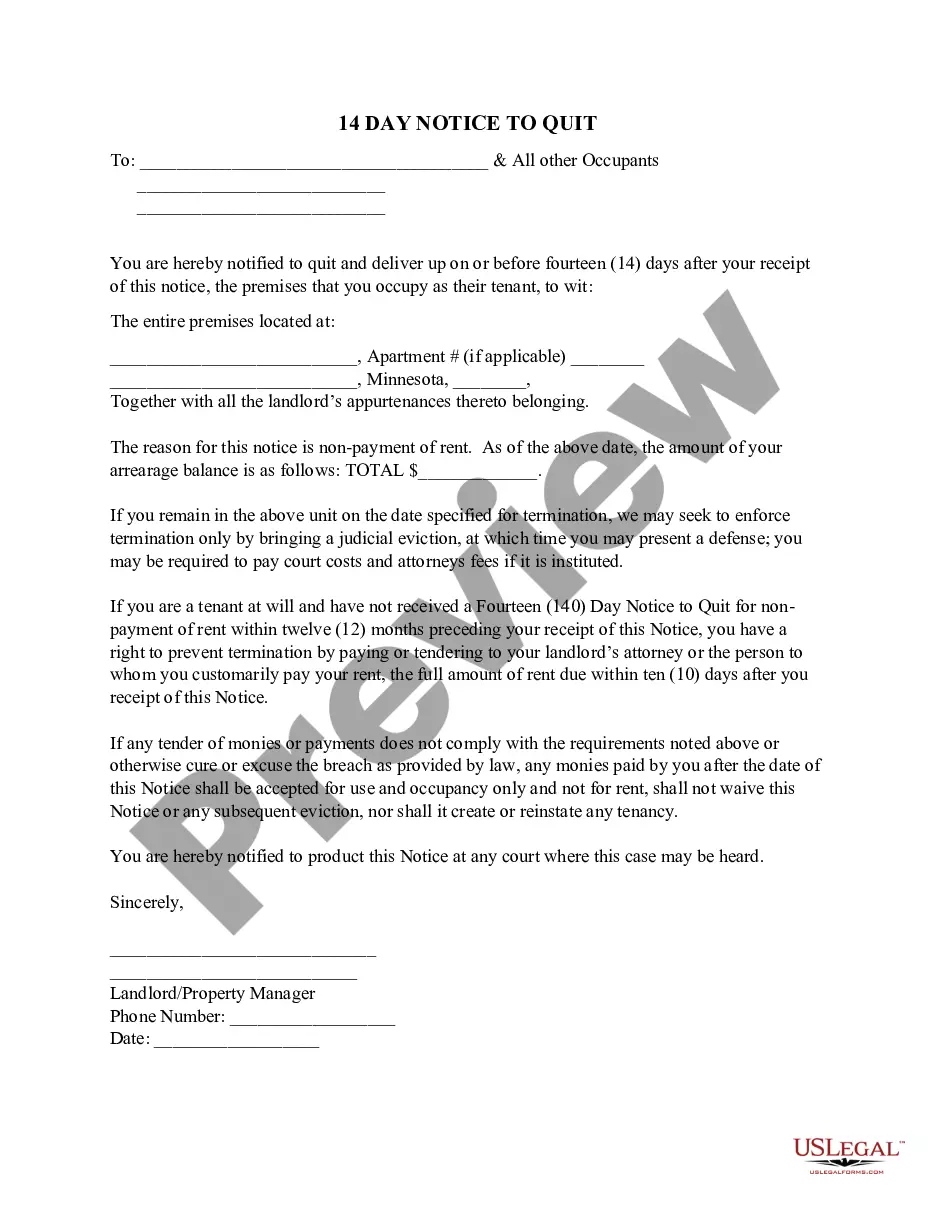

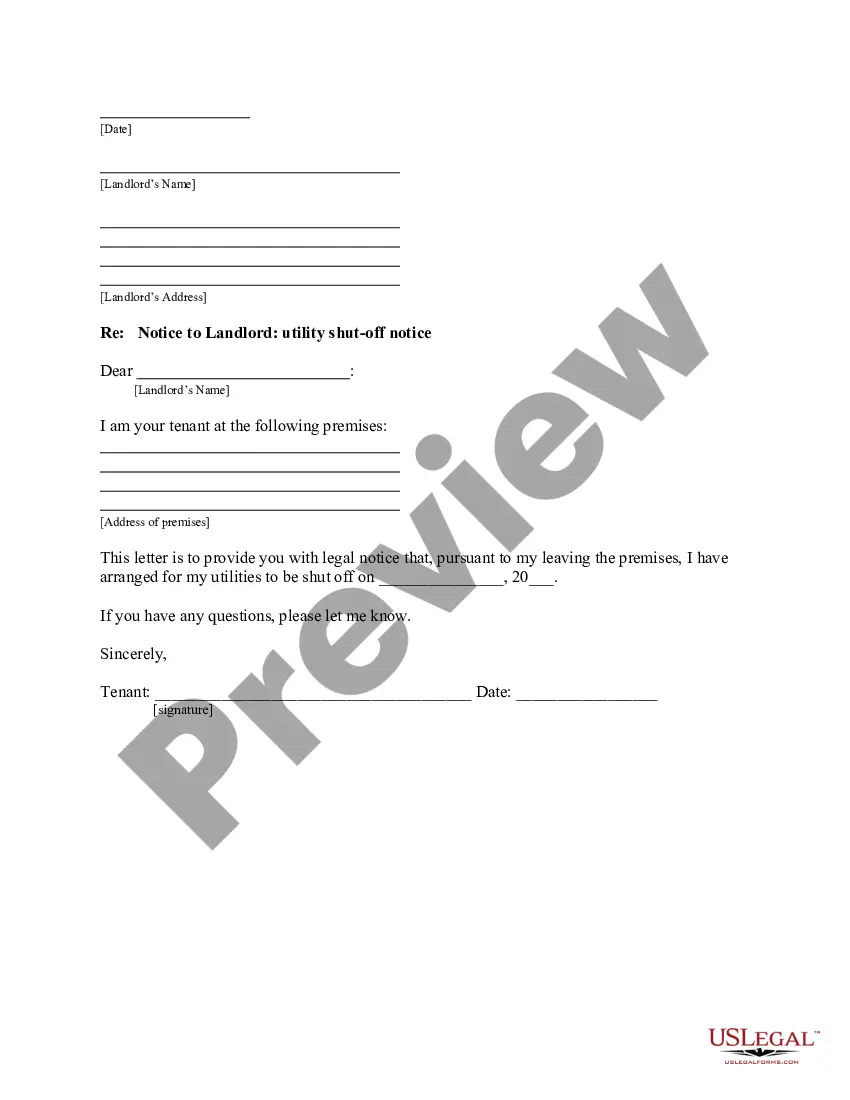

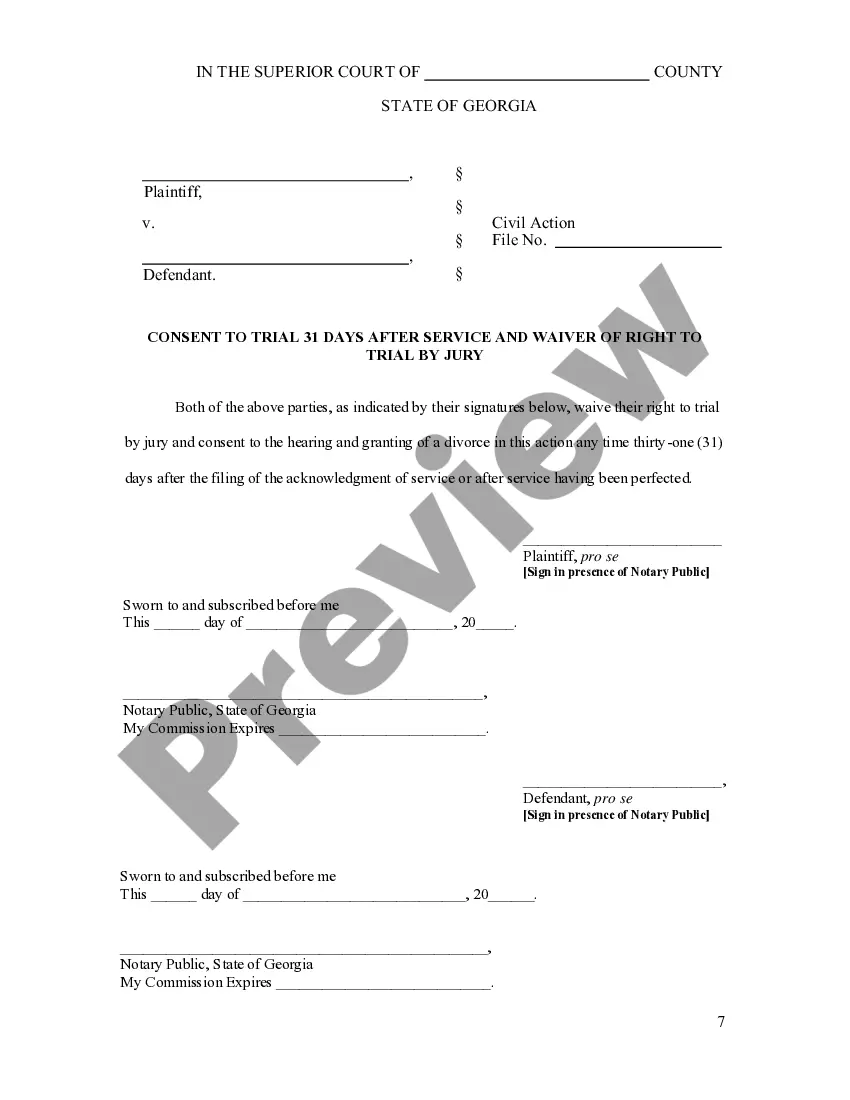

- Review the Preview mode and form description. Ensure you’ve chosen the correct version that aligns with your needs and fully complies with your local jurisdiction standards.

- Search for another template, if necessary. If you encounter any discrepancies, use the Search tab above to locate the appropriate one. If it fits your requirements, proceed to the next step.

Form popularity

FAQ

A Philadelphia Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children can provide important benefits. Even without children, a trust allows you to clearly define how your assets should be distributed upon your passing. This can help avoid probate, save time, and offer your loved ones peace of mind. Additionally, having a trust ensures that your wishes are honored, offering you control over your estate plan.

Filling out a certificate of trust for your Philadelphia Pennsylvania Living Trust for Individuals Who are Single, Divorced or Widows (or Widowers) with No Children is relatively straightforward. This document typically includes trust details such as the trust's name, date of creation, and the trustee's name and responsibilities. Make sure to keep it concise and clear to serve as a reliable reference. Platforms like uslegalforms can assist by providing templates that adhere to state-specific regulations.

In a Philadelphia Pennsylvania Living Trust for Individuals Who are Single, Divorced or Widows (or Widowers) with No Children, the living trust usually remains intact when one spouse dies. If you have created a joint trust, the surviving spouse would continue to manage the trust and its assets. Conversely, if it is an individual trust, the assets you left in the trust will be distributed according to your instructions, ensuring a seamless transition and adherence to your wishes.

Writing a trust document for a Philadelphia Pennsylvania Living Trust for Individuals Who are Single, Divorced or Widows (or Widowers) with No Children requires careful planning. Begin by outlining your goals for the trust, such as asset distribution and management. Include key provisions like the trust's name, the grantor's details, and the specific obligations of the trustee. Using platforms like uslegalforms can streamline the process, guiding you through the necessary components to include.

Filling out trust paperwork for a Philadelphia Pennsylvania Living Trust for Individuals Who are Single, Divorced or Widows (or Widowers) with No Children involves a few clear steps. Start by obtaining the correct forms, which are often available through legal websites like uslegalforms. Next, clearly outline your assets and beneficiaries, making sure to adhere to any specific requirements indicated on the forms. Lastly, ensure that all signatures are in place to validate your trust agreement.

To establish a valid Philadelphia Pennsylvania Living Trust for Individuals Who are Single, Divorced or Widows (or Widowers) with No Children, you need four essential elements. First, you require a grantor, which is you, the person creating the trust. Second, there must be a designated trustee who will manage the assets. Third, a valid purpose for the trust is necessary, outlining how the assets should be used. Finally, the trust should hold identifiable assets to ensure it serves its intended purpose.

Some people view trusts as less favorable due to misconceptions about their complexity and costs. As you consider a Philadelphia Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children, it’s important to recognize that while there are costs associated with establishing a trust, they often outweigh the long-term benefits. Additionally, poorly drafted trusts can lead to disputes and confusion, which heightens the negative perception. Properly set up, however, trusts can be a valuable tool in estate planning.

Whether your parents should put their assets in a trust largely depends on their specific financial situation and goals. If they are exploring options like a Philadelphia Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children, a trust can provide advantages such as avoiding probate and maintaining privacy regarding their assets. It is crucial that they consider how it aligns with their estate planning objectives. Consulting with an estate planning professional can help them make an informed decision.

A common mistake many parents make when setting up a trust fund is failing to adequately communicate their intentions and wishes to their heirs. While considering a Philadelphia Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children, it's crucial to outline how you want your assets to be managed and distributed. Without clear communication, misunderstandings and disputes may arise after your passing. Therefore, transparency and clarity in your trust documents can help ensure that your wishes are honored.

One disadvantage of a family trust is the complexity involved in managing it. As you consider a Philadelphia Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children, keep in mind that trust administration can require ongoing documentation and legal compliance. Additionally, family trusts may create conflicts among beneficiaries who might not agree on how assets should be distributed. It's essential to weigh these factors against the unique benefits that a living trust can offer.