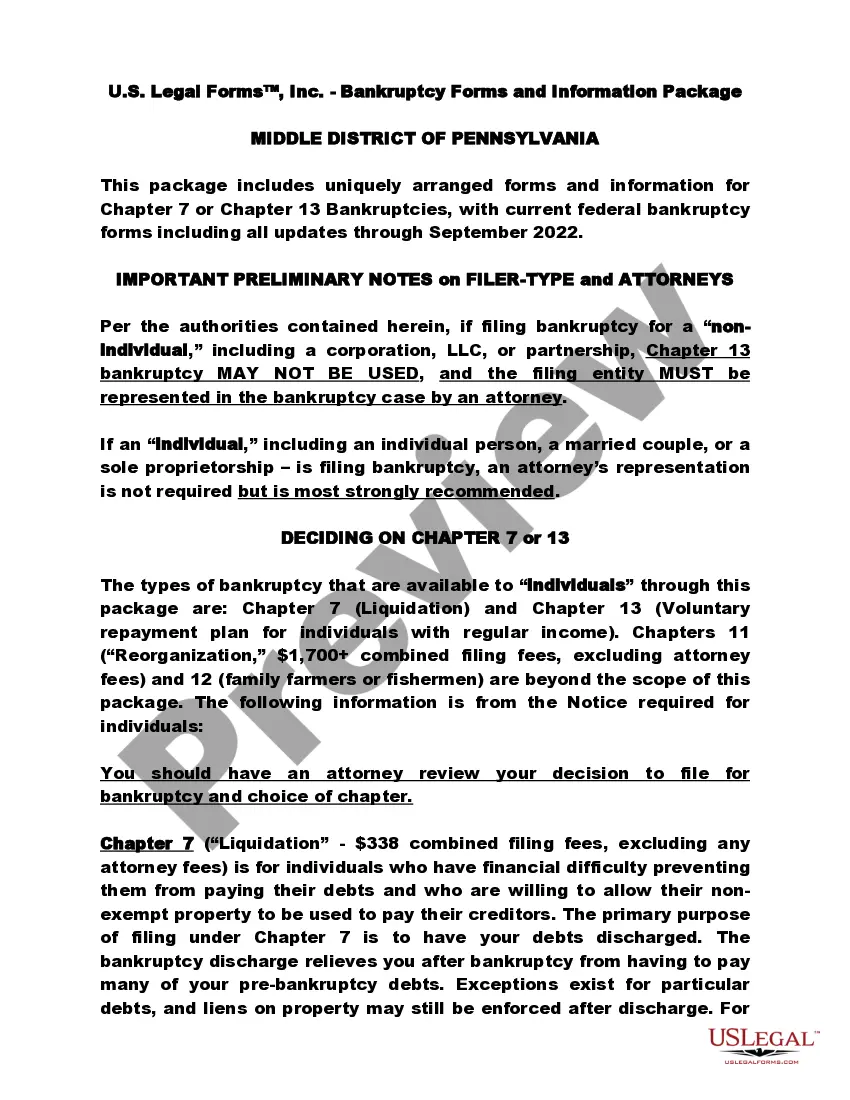

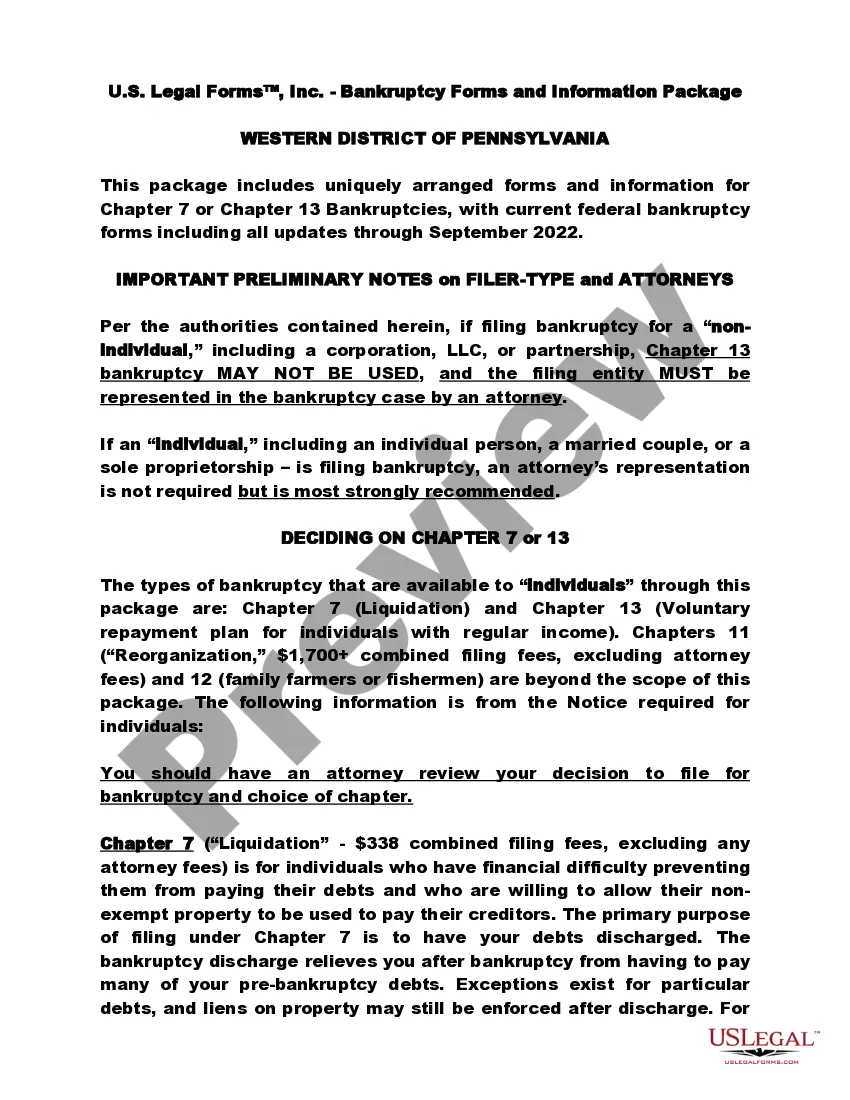

Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13

Description

How to fill out Pennsylvania Eastern District Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

If you have previously engaged our service, Log In to your profile and acquire the Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 on your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it in accordance with your payment schedule.

If this is your initial experience with our service, follow these straightforward steps to retrieve your document.

You have continuous access to each document you have purchased: you can find it in your profile under the My documents section whenever you need to reuse it. Utilize the US Legal Forms service to effortlessly find and download any template for your personal or professional requirements!

- Ensure you’ve located the correct document. Review the description and utilize the Preview option, if available, to verify if it aligns with your requirements. If it does not fulfill your needs, use the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and select a monthly or annual subscription option.

- Establish an account and process a payment. Provide your credit card information or utilize the PayPal option to finalize the transaction.

- Receive your Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13. Select the file format for your document and download it to your device.

- Complete your sample. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To file for Chapter 7 bankruptcy in the Allegheny Pennsylvania Eastern District, you should ideally have unsecured debt exceeding $15,000. This can include credit card debt, medical bills, and personal loans. However, it's important to note that there are no strict minimum debt requirements; your overall financial situation plays a crucial role. The Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 can help you understand your options better and navigate the necessary paperwork.

To fill out Chapter 13, begin by gathering your financial documents, including income statements and a list of debts. Next, carefully follow the instructions within the Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13, as it provides essential details on every required form. Take your time to ensure accuracy, as mistakes can delay your process. Lastly, consider using our US Legal Forms platform for additional support and resources, making your Chapter 13 filing smoother.

The income limit for Chapter 7 bankruptcy in Pennsylvania is based on the median income of a household of your size. These figures are updated periodically, so staying informed is essential. Exceeding this limit could prevent you from qualifying for Chapter 7. The Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 is an excellent resource to determine your eligibility and ensure compliance with the latest regulations.

Generally, if your income exceeds the Pennsylvania median income for your household size, you may not qualify for Chapter 7 bankruptcy. It's determined by assessing your average monthly income over the past six months. If you find yourself in this situation, consider exploring Chapter 13 as an alternative. The Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 can offer clarity on your options and guide you through the process.

The first step in filing Chapter 7 is to gather all relevant financial documents and records. This includes debts, assets, and income details. Completing a credit counseling course is also a prerequisite before filing. To assist in this process, the Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 offers comprehensive tools and resources to help you navigate your bankruptcy journey.

Filing Chapter 7 requires various documents, including schedules of assets and liabilities and your statement of financial affairs. Additionally, you must submit income documentation and any other financial records. Ensuring you have everything organized reduces stress and speeds up the process. The Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 simplifies this process by providing necessary forms and clear instructions.

In Pennsylvania, the income limit for Chapter 7 bankruptcy depends on your household size and the state median income. As these figures can fluctuate, it is crucial to stay updated. If your income is above the median, you may need to pursue alternative options, like Chapter 13. The Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 provides specific income thresholds relevant to your situation.

Yes, Chapter 7 can get denied under certain circumstances. Common reasons include failure to meet the eligibility requirements or failure to cooperate with the bankruptcy trustee. It's important to provide complete and accurate information in your application. Utilizing the Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 can help ensure that you are well-prepared, thus minimizing the risk of denial.

Several factors can disqualify you from filing for Chapter 7 bankruptcy. If you have filed for bankruptcy in the past eight years, or if your income exceeds the state median income based on your household size, you may be prevented from qualifying. Furthermore, any fraudulent behavior in previous filings may affect your eligibility. For those needing clarity on their situation, the Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 provides useful insights.

To file for Chapter 7 bankruptcy, you will need to provide several forms of documentation. The Allegheny Pennsylvania Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 includes vital forms such as the voluntary petition, schedules of assets and liabilities, and your most recent tax returns. Additionally, be prepared with income statements and proof of any other financial obligations. Organizing this paperwork can streamline your filing process and improve your chances of approval.