Allentown Pennsylvania Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

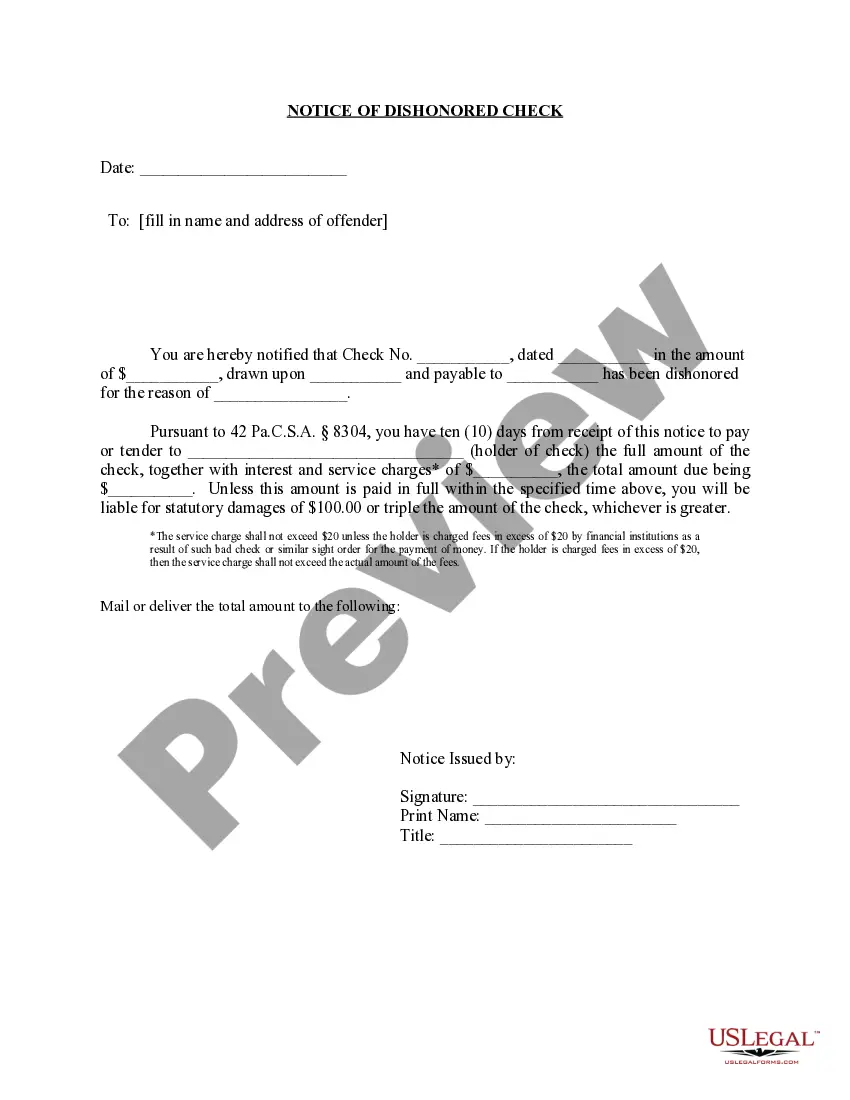

How to fill out Pennsylvania Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

We constantly seek to lessen or circumvent legal repercussions when addressing subtle legal or financial issues. To achieve this, we enlist legal services that are typically highly priced. However, not every legal situation is this intricate. Many can be managed by ourselves.

US Legal Forms is an online repository of current DIY legal documents that includes everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform enables you to take control of your issues without relying on a lawyer. We provide access to legal document templates that are not always publicly available.

Make use of US Legal Forms whenever you need to locate and retrieve the Allentown Pennsylvania Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other document swiftly and securely. Simply Log In to your account and click the Get button next to it. If you accidentally misplaced the document, you can always re-download it from the My documents section.

The process is equally simple if you’re not familiar with the site! You can set up your account in just a few minutes.

For over 24 years in the market, we’ve assisted millions of individuals by supplying ready-to-customize and current legal documents. Maximize the benefits of US Legal Forms now to conserve time and resources!

- Ensure that the Allentown Pennsylvania Notice of Dishonored Check - Civil - Keywords: bad check, bounced check adheres to your state's and area's laws and regulations.

- Furthermore, it’s essential to review the form’s outline (if available), and if you detect any inconsistencies with what you intended to find, look for an alternative form.

- Once you’ve confirmed that the Allentown Pennsylvania Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is suitable for you, you can choose the subscription option and proceed with payment.

- You can then download the document in any preferred format.

Form popularity

FAQ

If a post-dated check bounces, it is treated like any other bounced check. The bank will not honor the payment, and it can lead to fees and potential legal issues for the issuer. Since dealing with issues such as these requires careful attention, utilizing resources like uslegalforms can be beneficial for understanding your rights and obligations when handling an Allentown Pennsylvania Notice of Dishonored Check - Civil.

The term 'bounced check' is used because it reflects the action that occurs when a bank rejects a cheque. The cheque metaphorically 'bounces' back to the issuer rather than clearing through the banking system. This term is crucial for anyone dealing with financial matters, especially when navigating the complexities of the Allentown Pennsylvania Notice of Dishonored Check - Civil.

Another name for a dishonored check is a bad check. This term is commonly used to describe a cheque that the bank has returned due to various reasons, such as insufficient funds. Both terms relate directly to financial accountability, emphasizing the importance of understanding the implications when dealing with an Allentown Pennsylvania Notice of Dishonored Check - Civil.

A dishonored check is often called a bounced check because when the bank refuses to process it, the check 'bounces' back to the issuer. This term vividly illustrates the action of returning the check due to insufficient funds. Using accurate terminology is crucial in discussions regarding the Allentown Pennsylvania Notice of Dishonored Check - Civil, as it sets clear expectations for both parties involved.

Yes, there is a statute of limitations regarding bounced checks in Pennsylvania. Typically, the timeframe is three years from the date of the incident. This means you have a limited period to take legal action for bad checks. Therefore, it is essential to act promptly if you've received a bounced check to avoid missing your chance for recovery.

Yes, you can sue someone for writing you a bad check in Pennsylvania. Under state law, you have the right to seek damages for the payment you did not receive from the bad check. If you find yourself in this situation, it's wise to gather all relevant documentation and consider using a platform like uslegalforms to assist you with the legal process. This can ensure that you file the necessary claims correctly and promptly.

Yes, writing bad checks can lead to serious legal consequences in Pennsylvania. If the amount of the bad check exceeds a specific threshold, the act can be classified as a criminal offense. In such cases, you might face fines or even jail time based on the severity of the offense. Therefore, it is essential to manage your finances effectively to avoid issues related to revoked Allentown Pennsylvania Notice of Dishonored Check - Civil.

A bounced cheque and a dishonoured cheque refer to the same issue. Both terms describe a situation where a bank does not process a cheque due to insufficient funds in the issuer's account. This results in the recipient not receiving the expected payment. Understanding terms like these is crucial, especially when dealing with the Allentown Pennsylvania Notice of Dishonored Check - Civil, especially concerning bad checks.

A dishonored check is typically returned to the sender, along with a notice explaining why it could not be processed. The drawee may also notify the issuer about the bad check, leading to possible fees. After a check bounces, the recipient may choose to pursue legal actions or request payment again. Knowing the steps involved in managing an Allentown Pennsylvania Notice of Dishonored Check can streamline the process.

The wrongful dishonor of a check can result in significant consequences for the bank and businesses involved. If a check is unfairly declared bounced, it can harm the issuer's credit and reputation. Moreover, the affected party can potentially seek damages. Utilizing resources like uslegalforms can provide guidance in navigating the complexities of issues surrounding an Allentown Pennsylvania Notice of Dishonored Check.