Allentown Pennsylvania Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Pennsylvania Quitclaim Deed From Husband And Wife To LLC?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our user-friendly website with a vast array of templates enables you to locate and acquire nearly any document template you need.

You can download, fill out, and sign the Allentown Pennsylvania Quitclaim Deed from Husband and Wife to LLC in just a few moments instead of spending hours searching online for a suitable template.

Using our collection is an excellent method to enhance the security of your form submission. Our experienced attorneys routinely assess all the documents to ensure that the forms are applicable for a specific state and adhere to current laws and regulations.

If you don't have an account yet, follow these steps.

Open the page with the template you need. Verify that it is the form you were looking for: check its title and description, and utilize the Preview feature when available. Otherwise, use the Search field to locate the necessary one.

- How can you obtain the Allentown Pennsylvania Quitclaim Deed from Husband and Wife to LLC.

- If you already possess an account, simply Log In to your profile. The Download button will be available on all the templates you view.

- Moreover, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

People often put their property in an LLC to protect their personal assets from liability and to manage property ownership more efficiently. An LLC can also provide tax benefits and streamline the process of transferring ownership. In Allentown Pennsylvania, this approach can help individuals safeguard their investments and simplify estate planning.

Yes, you can complete a quit claim deed yourself in Allentown Pennsylvania. Simply obtain the correct form, fill in the necessary information, and sign it in front of a notary. However, using a service like USLegalForms can simplify the process and ensure that all legal requirements are met.

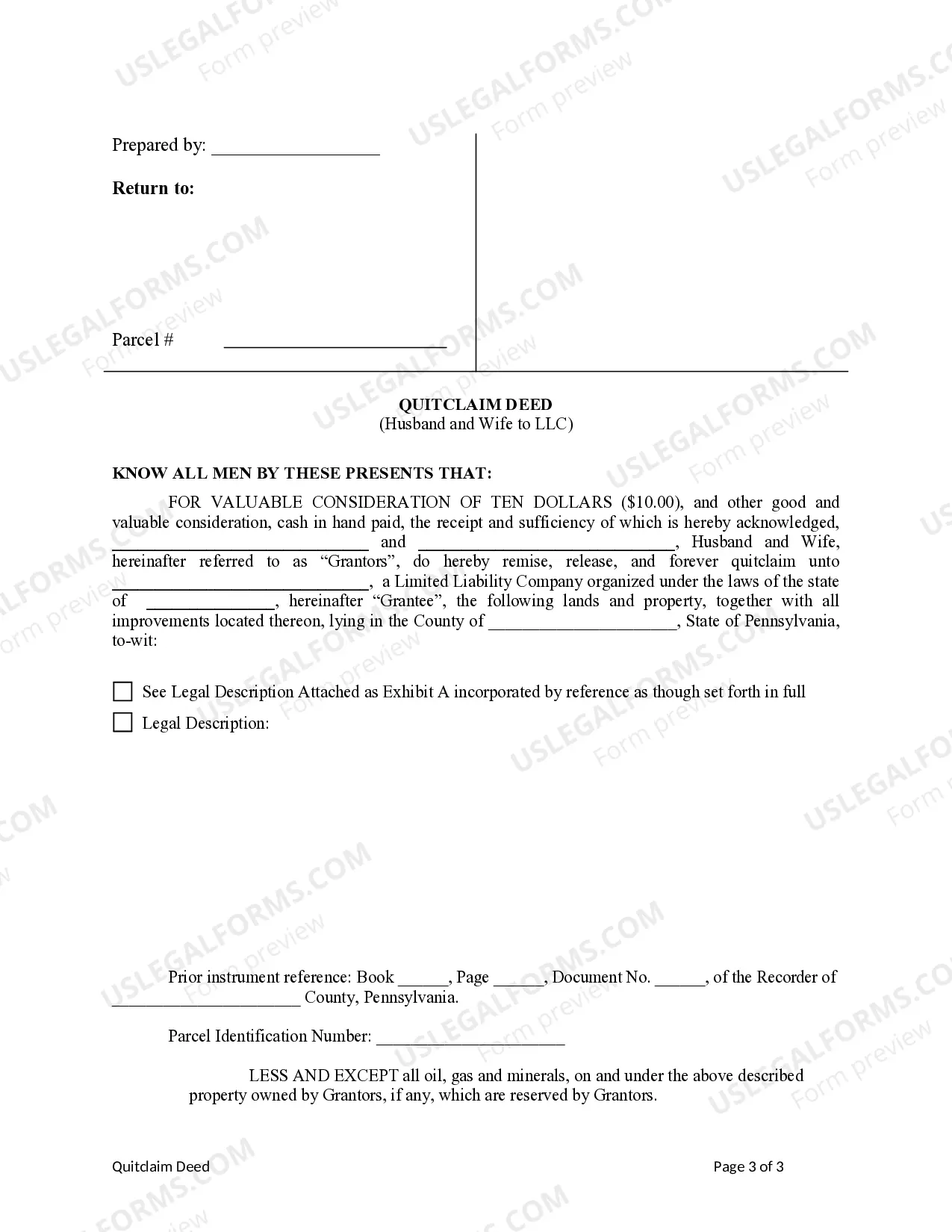

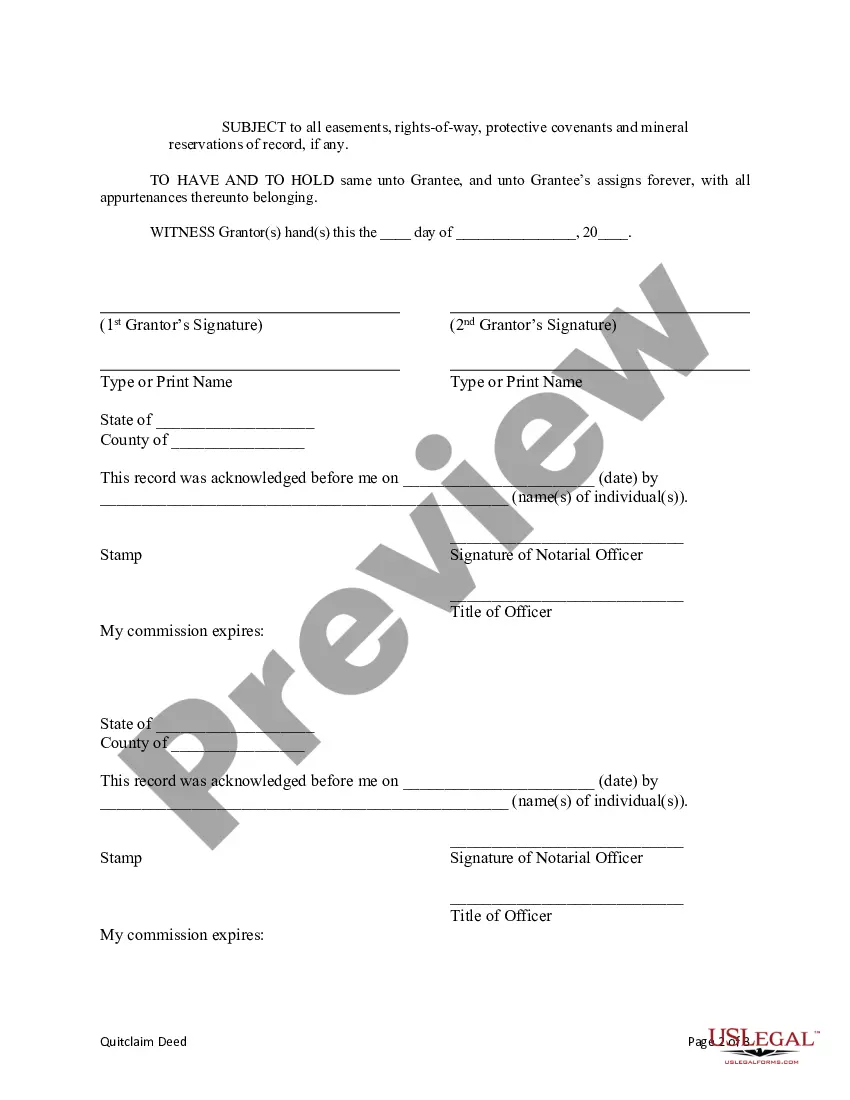

To transfer a deed from an individual to an LLC, you'll need to draft a new deed that clearly indicates the transfer. Specify the LLC as the grantee, ensure it's signed by the current owner, and have it notarized. Lastly, file the deed with the appropriate county office in Allentown Pennsylvania to make the transfer legally binding.

Selling your house to your own LLC for the purpose of avoiding capital gains tax is not advisable and may lead to legal issues. The IRS considers this a taxable event, and you must report any gain on the sale. In Allentown Pennsylvania, consulting a tax professional before attempting such a transaction is wise.

One disadvantage of putting a property in an LLC is the potential for increased costs. Operating an LLC may require filing fees, and there may be additional tax implications, especially in Allentown Pennsylvania. Additionally, you could face challenges when trying to obtain financing for a property held by an LLC.

To transfer a deed to an LLC, you typically need to complete a new deed document that specifies the LLC as the grantee. In Allentown Pennsylvania, ensure the deed includes the legal description of the property and is signed by the current owner. Once prepared, you need to have it notarized and then filed with the county recorder.

To fill out a quitclaim deed to add a spouse, begin by downloading the appropriate form for Allentown Pennsylvania. You'll need to include both parties' names, the property’s legal description, and specify the nature of the ownership transfer. After filling it out, make sure to sign the document before a notary public, then record it with your local county office.

Transferring a deed, such as an Allentown Pennsylvania Quitclaim Deed from Husband and Wife to LLC, does not legally require a lawyer. However, hiring a lawyer can simplify the process and ensure all documents are correctly filled out. A lawyer can also help you understand any legal implications of the transfer to an LLC. If you prefer a do-it-yourself approach, platforms like USLegalForms provide detailed templates and guidance to assist you.

Quitclaim deeds can benefit various parties, but they are particularly advantageous for individuals seeking to transfer ownership efficiently. For instance, married couples might use an Allentown Pennsylvania Quitclaim Deed from Husband and Wife to LLC to streamline property transfers without complex legal processes. Additionally, those looking to clarify ownership interests can find this method beneficial. Understanding the implications can enhance your experience with property transactions.

Transferring a deed from personal ownership to an LLC involves drafting a new deed that reflects this change. Begin by preparing a quitclaim deed that identifies you as the grantor and your LLC as the grantee. You must also sign the deed in front of a notary and record it with the county. For the smoothest process, use services like US Legal Forms to ensure all necessary documents are properly completed for an Allentown Pennsylvania Quitclaim Deed from Husband and Wife to LLC.