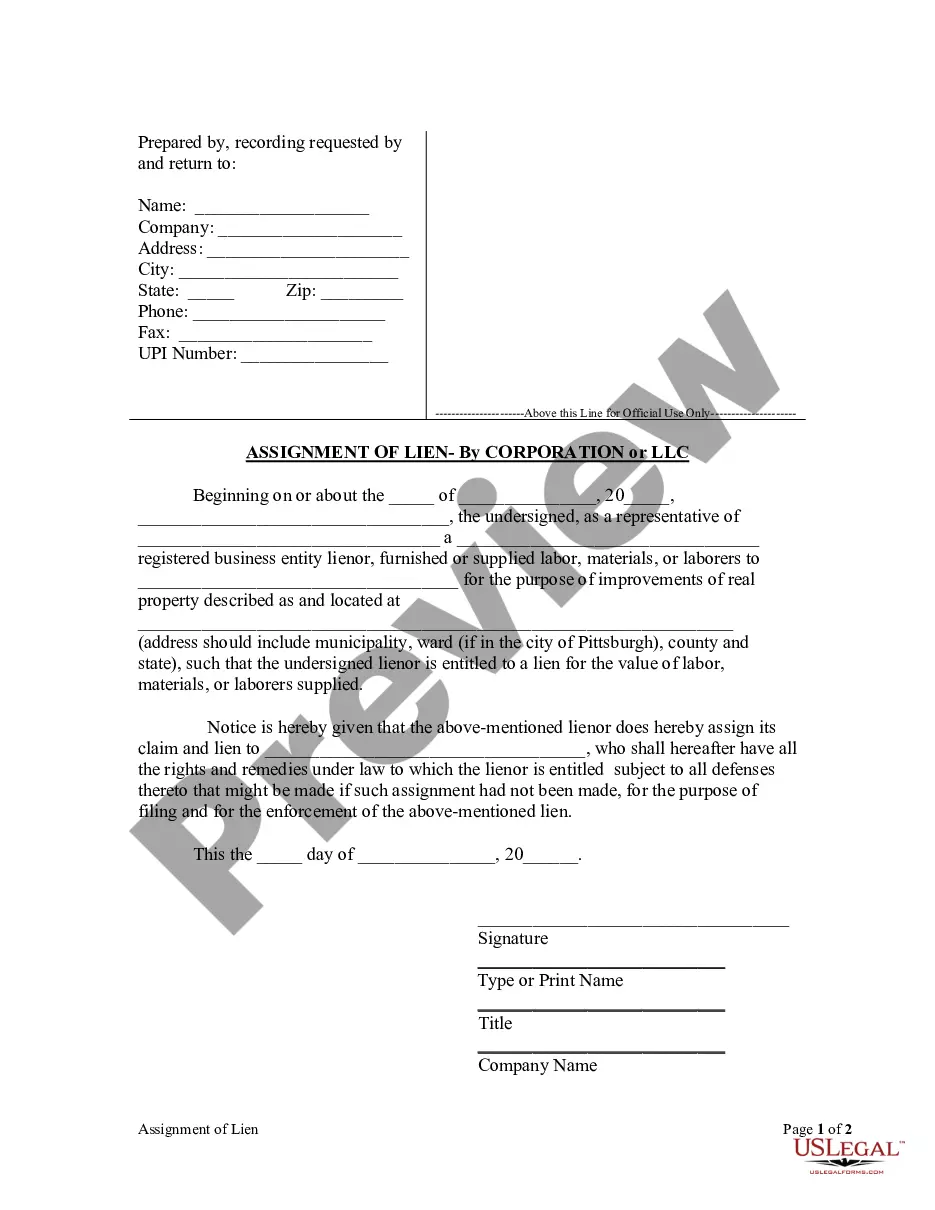

This Assignment of Lien form is for use by a corporate lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements to real property to provide notice that the lienor assigns the lienor's claim and lien for the value of labor, materials, or laborers supplied to a designated person who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

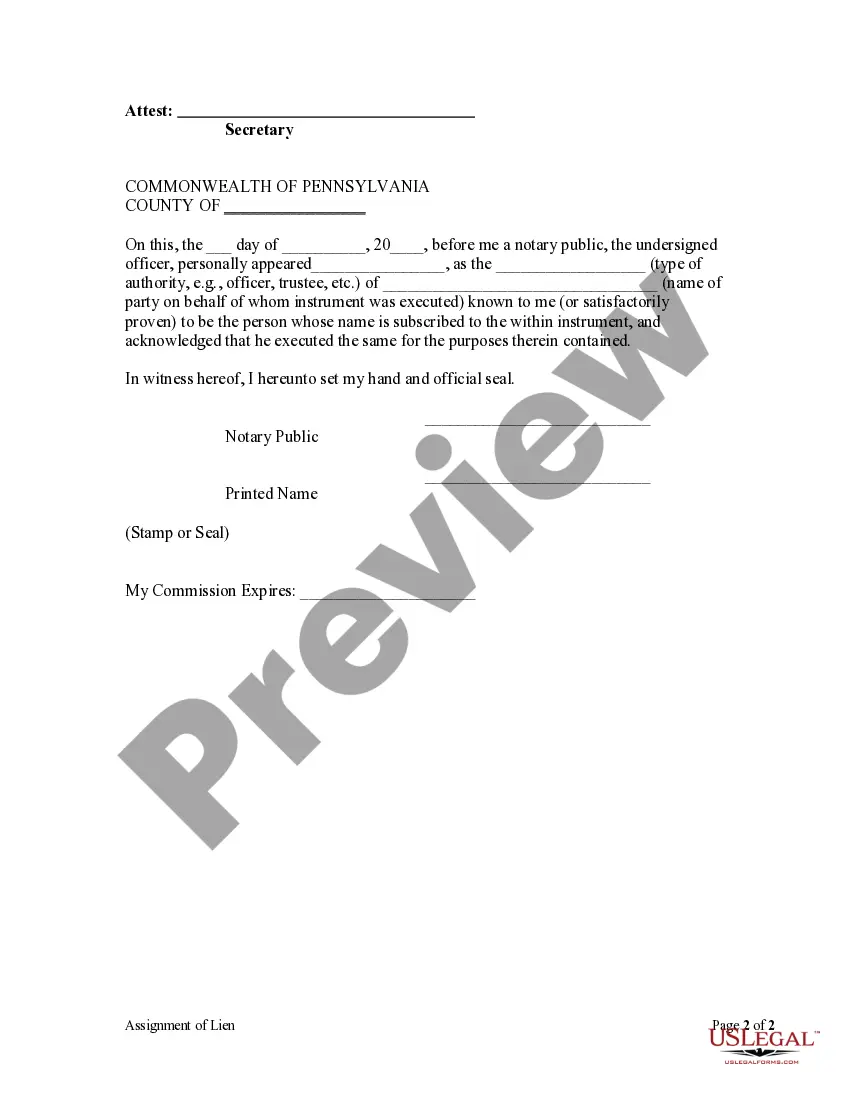

Allegheny Pennsylvania Assignment of Lien — Corporation or LLC refers to the legal process through which a corporation or limited liability company (LLC) transfers its rights to a lien held on a property to another party or entity. This assignment is commonly used when businesses wish to transfer their claim on a property or debt secured by a property to another business or individual. In Allegheny County, Pennsylvania, there are mainly two types of Assignment of Lien — Corporation or LLC: 1. Assignment of Lien — Corporation: This type of assignment involves a corporation transferring its lien rights to another party or entity. A corporation, as a legal entity separate from its owners, can hold a lien on a property or a debt secured by a property. Through an assignment, the corporation can transfer those rights to another entity, which then assumes the rights and responsibilities associated with the lien. 2. Assignment of Lien — LLC: Similar to a corporation, an LLC is a separate legal entity from its owners and can also hold a lien on a property. By using an Assignment of Lien — LLC, the LLC can transfer its rights to another party or entity, allowing them to assume the lien's rights and obligations. Both types of assignments typically involve documentation specifying the details of the transfer, including the parties involved, the property subject to the lien, the outstanding debt (if any), and any additional terms or conditions. A properly executed assignment is important to ensure a valid transfer, protect the rights of all parties involved, and maintain the priority of the lien. When dealing with Allegheny Pennsylvania Assignment of Lien — Corporation or LLC, it is essential to consult legal professionals experienced in real estate law to ensure compliance with local regulations and to accurately draft the required documentation. They can provide guidance on the specific requirements and procedures for completing the assignment, ensuring that the process is lawful and binding.