Allentown Pennsylvania Renunciation And Disclaimer of Property from Will by Testate

Description

How to fill out Pennsylvania Renunciation And Disclaimer Of Property From Will By Testate?

If you have previously employed our service, sign in to your account and store the Allentown Pennsylvania Renunciation And Disclaimer of Property from Will by Testate on your device by selecting the Download button. Ensure your subscription is active. If it isn’t, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to utilize it again. Leverage the US Legal Forms service to swiftly locate and save any template for your personal or professional use!

- Ensure you’ve located an appropriate document. Review the description and use the Preview feature, if available, to confirm it aligns with your needs. If it’s not suitable, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Allentown Pennsylvania Renunciation And Disclaimer of Property from Will by Testate. Choose the file format for your document and save it to your device.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

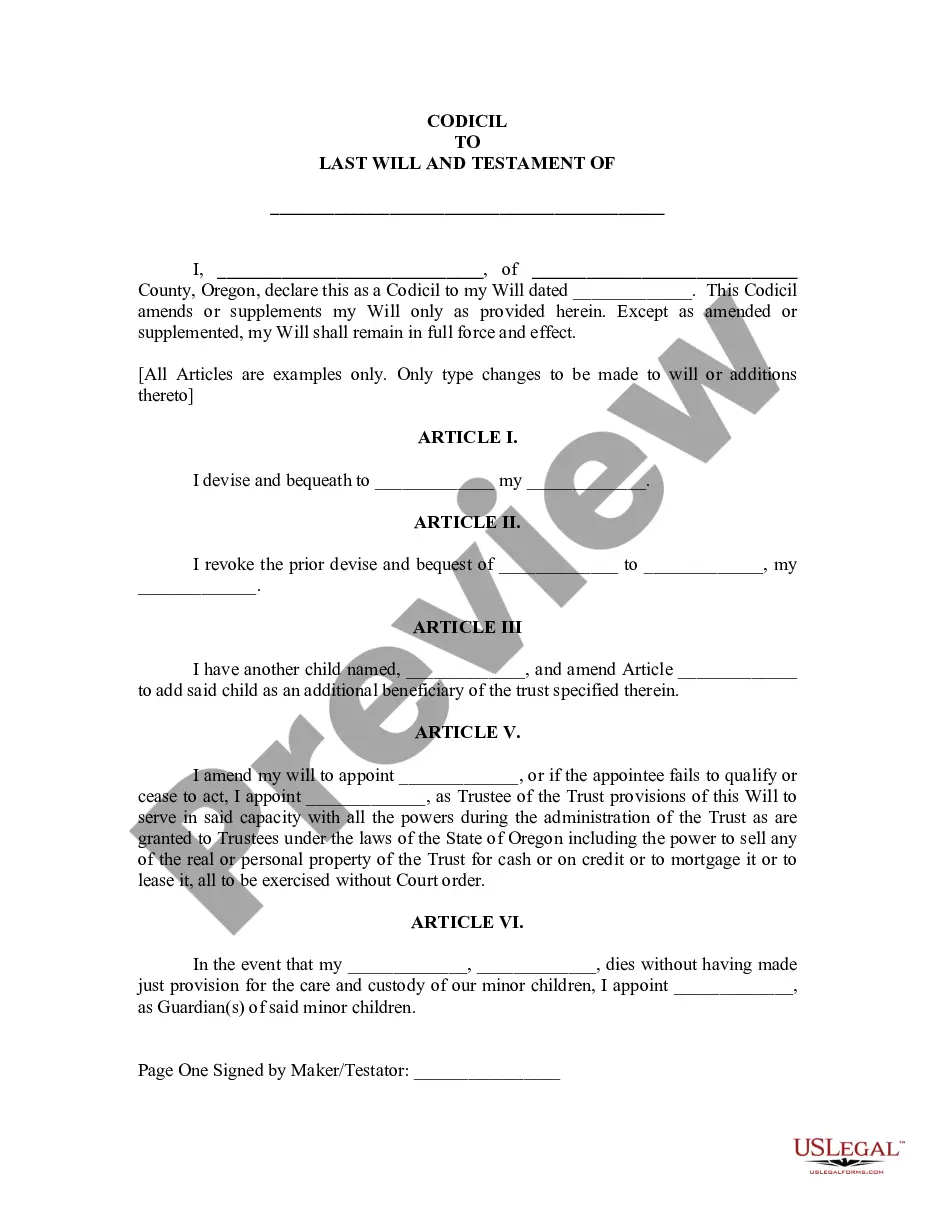

Renunciation in a will refers to the act of rejecting an inheritance or interest in the estate. When a beneficiary chooses to renounce their share, the property then passes to other designated heirs. This action can streamline the distribution process and may help avoid conflicts among family members. If you are considering this option in Allentown, Pennsylvania, utilizing resources from uslegalforms can simplify your decision-making.

When someone passes away in Pennsylvania without a will, the property transfers through intestate succession laws. These laws dictate how the estate is divided among surviving relatives, starting from the closest relatives, such as spouses and children. In Allentown, the court oversees this process to ensure compliance with state regulations. For those facing this situation, understanding the intestacy laws is crucial, and platforms like uslegalforms can provide valuable guidance.

After renunciation of property in Allentown, Pennsylvania, the renouncing party formally declines their inheritance. This action allows the property to pass to the next beneficiaries according to the will or Pennsylvania intestacy laws. It's essential to submit a legal document to ensure the renunciation is recorded properly. By choosing to renounce, you can avoid potential disputes and clarify the distribution of the estate.

In Pennsylvania, the family exemption generally applies to the surviving spouse and minor children of the decedent. They can claim a portion of the estate, ensuring they have necessary support. The Allentown Pennsylvania Renunciation and Disclaimer of Property from Will by Testate can impact how assets are distributed if a family member renounces their share. It is essential to consult a legal expert to understand your rights and options regarding family exemptions.

In Pennsylvania, there are limited exemptions and strategies that can help minimize inheritance tax. While direct renunciation of property through the Allentown Pennsylvania Renunciation and Disclaimer of Property from Will by Testate does not incur tax, planning with a financial advisor can reveal additional approaches. Some family members may qualify for exemptions, so understanding the specifics can offer significant savings. Always consult with a tax professional to explore your options thoroughly.

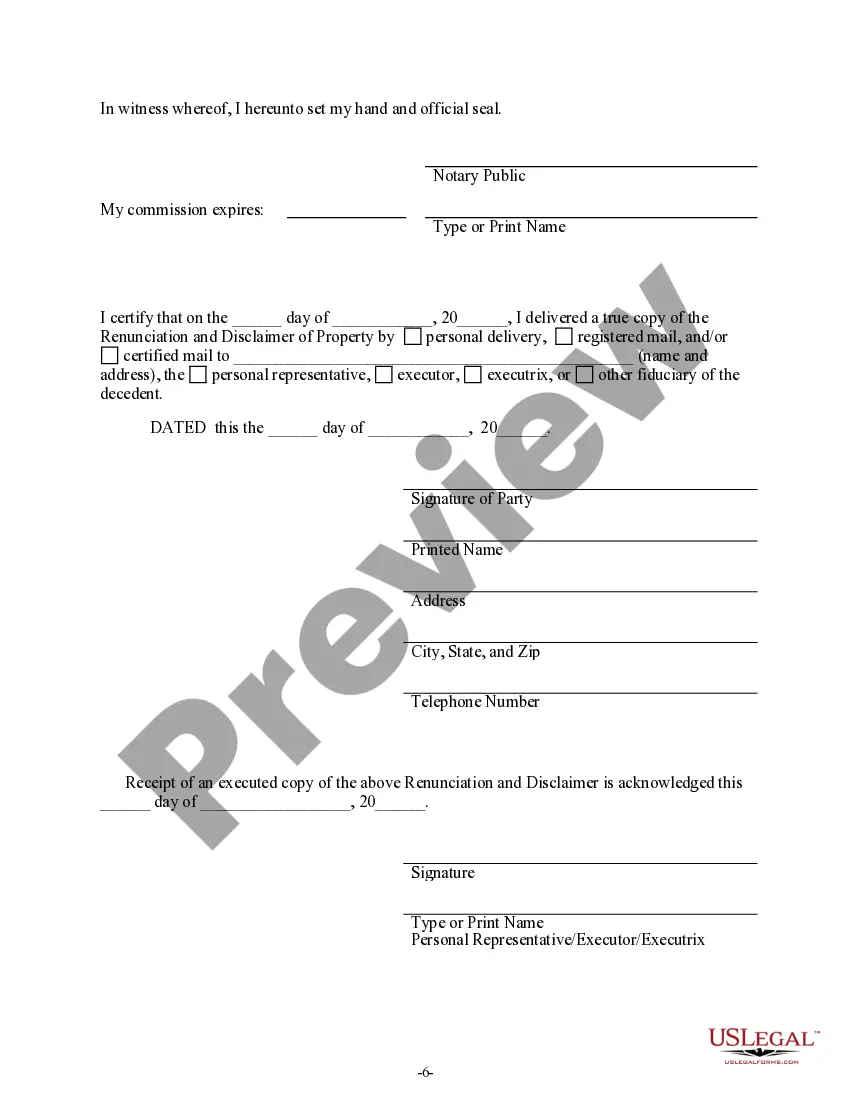

To disclaim an inheritance in Pennsylvania, you must submit a written notice of disclaimer that complies with state requirements. This document should clearly express your intent to renounce your share of the estate. The Allentown Pennsylvania Renunciation and Disclaimer of Property from Will by Testate involves filing this notice with the appropriate court. Make sure you seek professional assistance from a legal expert to navigate the paperwork and procedures effectively.

In Pennsylvania, you typically have nine months to file a renunciation of an inheritance after the date of the decedent's death. This is important when considering the Allentown Pennsylvania Renunciation and Disclaimer of Property from Will by Testate. If you miss this deadline, you may lose your chance to decline the inheritance. It is wise to consult an attorney for guidance to ensure you adhere to the correct timeline.

The purpose of a renunciation form is to formally reject an inheritance or gift as outlined in a will. This document allows individuals to clarify their intentions and protect themselves from any future claims related to the property. Utilizing the Allentown Pennsylvania Renunciation And Disclaimer of Property from Will by Testate ensures that your renunciation is executed effectively and aligns with legal standards.

Filling out a renunciation form PA template involves providing your details, the decedent's information, and a clear statement of your intention to renounce the property. Ensure that each section is properly completed and that the form is signed in the presence of a notary. The Allentown Pennsylvania Renunciation And Disclaimer of Property from Will by Testate provides a reliable template, simplifying this task for you.

To disclaim an inheritance in Pennsylvania, you must submit a formal renunciation, demonstrating your intent to reject the property. This includes filing the appropriate forms and ensuring they adhere to state laws. The Allentown Pennsylvania Renunciation And Disclaimer of Property from Will by Testate offers essential resources to help you navigate this process smoothly.