Contracts for the payment of money, commonly referred to as bills and notes, are governed by the ordinary law of contracts. However, where bills and notes have the quality of being negotiable, they may also be subject to special legislation, embodied in the Uniform Commercial Code, governing such instruments.

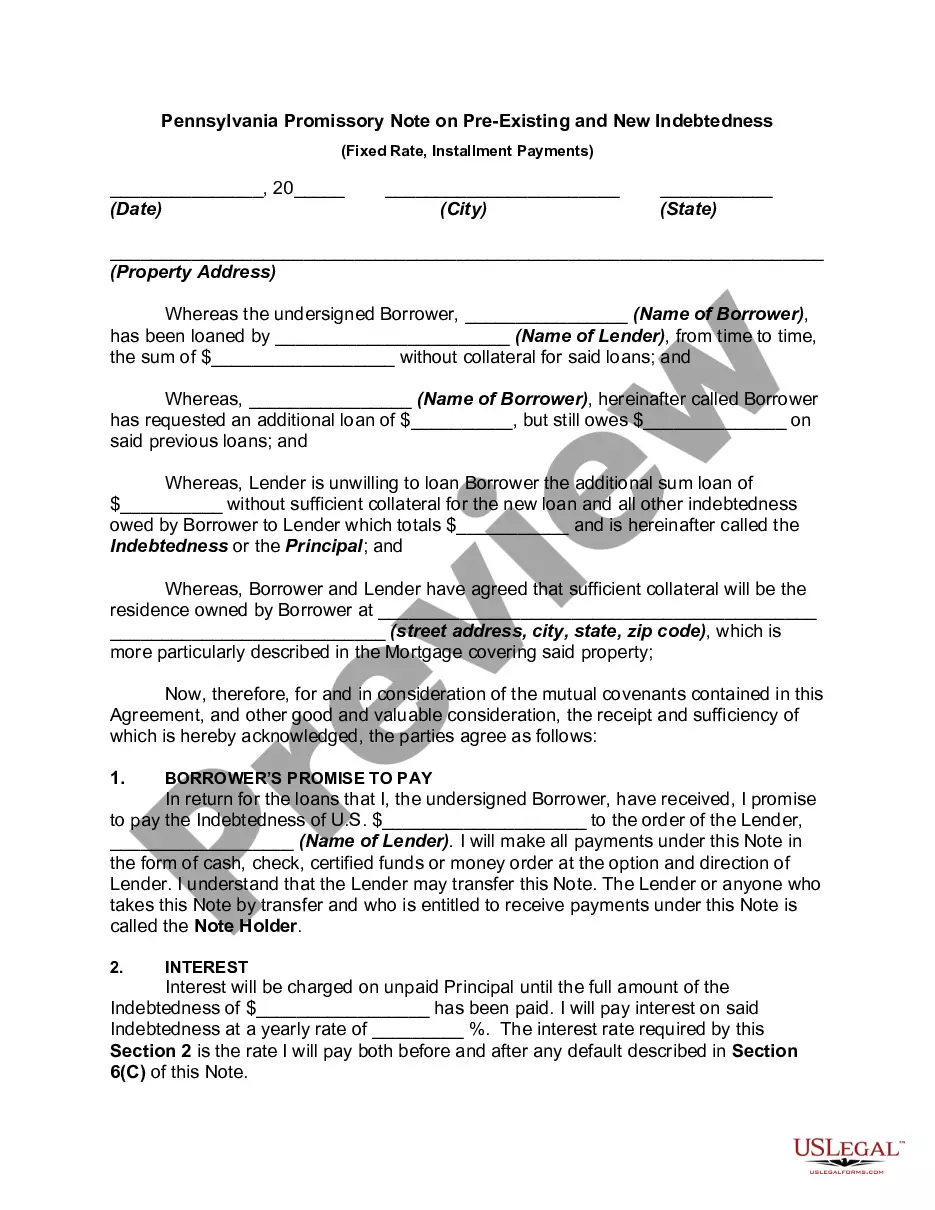

Allentown Pennsylvania Promissory Note on Pre-Existing and New Indebtedness

Description

How to fill out Pennsylvania Promissory Note On Pre-Existing And New Indebtedness?

Are you seeking a trustworthy and budget-friendly provider of legal documents to obtain the Allentown Pennsylvania Promissory Note on Pre-Existing and New Debts.

US Legal Forms is your ideal selection.

Whether you require a simple agreement to establish guidelines for living together with your partner or a collection of papers to facilitate your separation or divorce through the legal system, we have everything you need.

Our platform provides over 85,000 current legal document templates for personal and business purposes. All templates we grant access to are not generic and are structured based on the specifications of different states and regions.

If the template does not suit your legal situation, restart your search.

Now you can create your account. Then select the subscription plan and proceed to payment. After completing the payment, download the Allentown Pennsylvania Promissory Note on Pre-Existing and New Debts in any available format. You can return to the site when necessary and redownload the document without any additional charges.

- To download the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it.

- Keep in mind that you can retrieve your previously acquired form templates at any time from the My documents section.

- Is this your first visit to our site? No problem. You can set up an account with quick simplicity, but prior to that, ensure you do the following.

- Verify if the Allentown Pennsylvania Promissory Note on Pre-Existing and New Debts aligns with the regulations of your state and locality.

- Review the form’s specifics (if available) to ascertain who and what the form is designed for.

Form popularity

FAQ

To write a promissory note for debt in Allentown, Pennsylvania, first identify the debtor and creditor, clearly stating their full names. Include the total amount owed, repayment terms, and any specific conditions for repayment. Writing this down protects both parties and creates a reliable record of the agreement, facilitating smoother transactions for both pre-existing and new indebtedness.

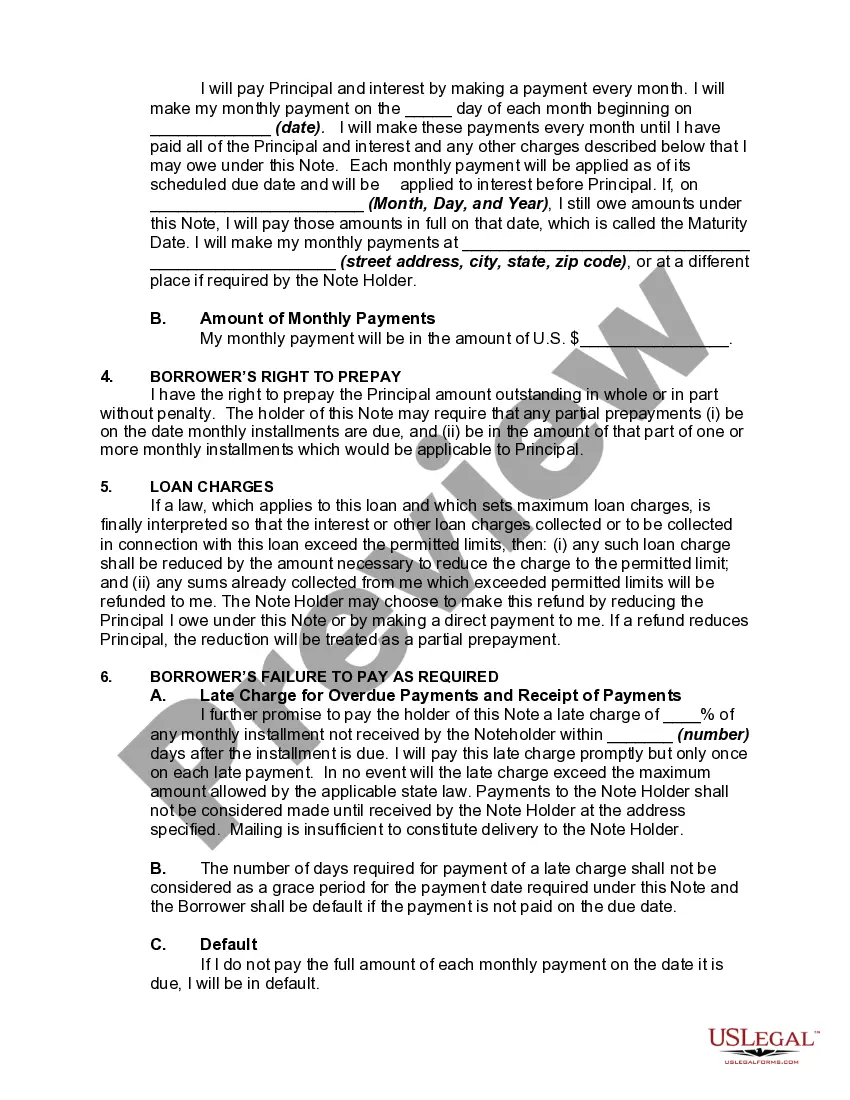

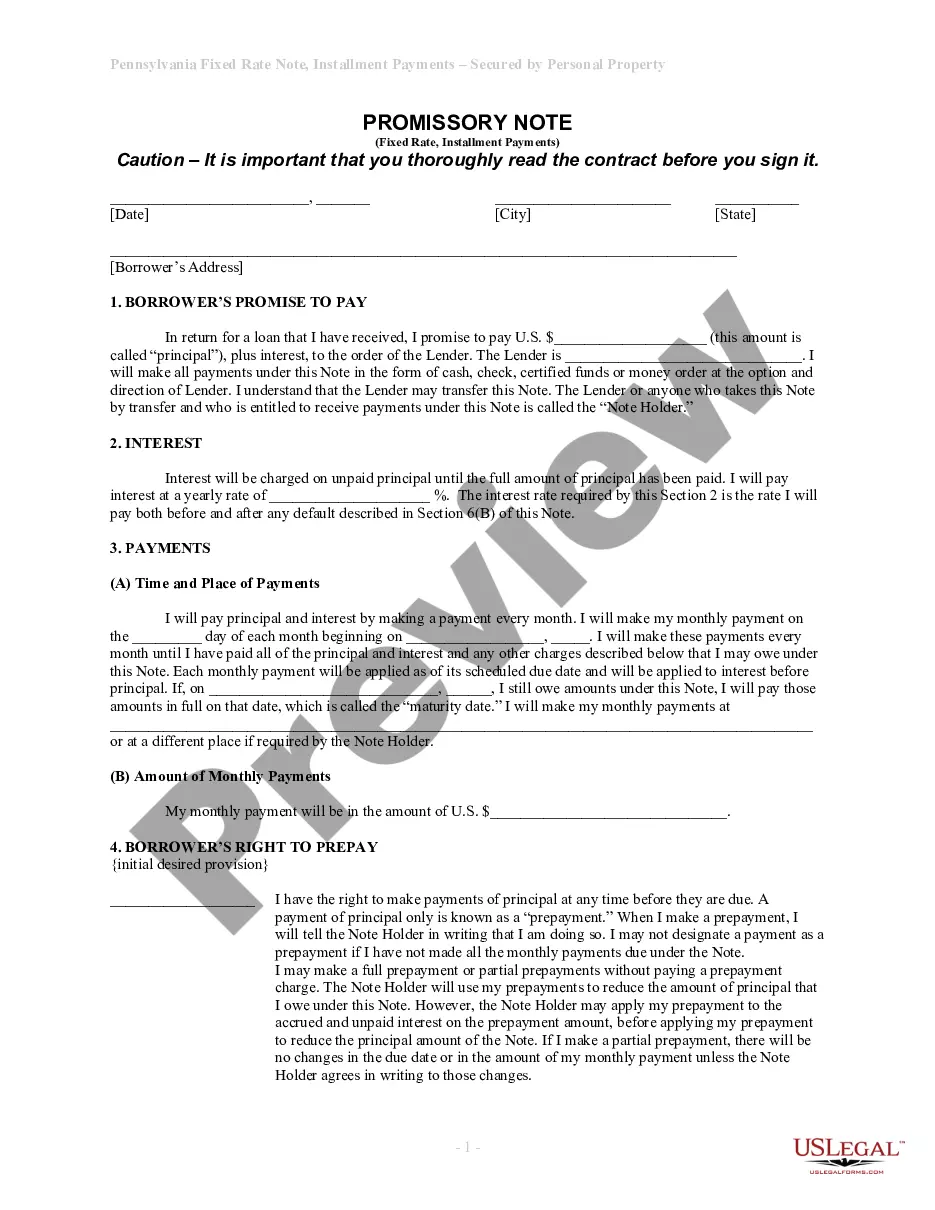

The format of a promissory note typically includes several key components. Begin with the title 'Promissory Note' at the top. Follow this with the names of the borrower and lender, the principal amount, interest rate, repayment schedule, and default terms. Using a structured format will increase clarity and enforceability for your Allentown Pennsylvania Promissory Note on Pre-Existing and New Indebtedness.

Yes, a handwritten promissory note is legal in Allentown, Pennsylvania, as long as it meets specific requirements. It should clearly state the obligations of both parties, including the amount due and the repayment terms. This type of note can serve as a binding agreement for both pre-existing and new indebtedness, making it a viable option for personal transactions.

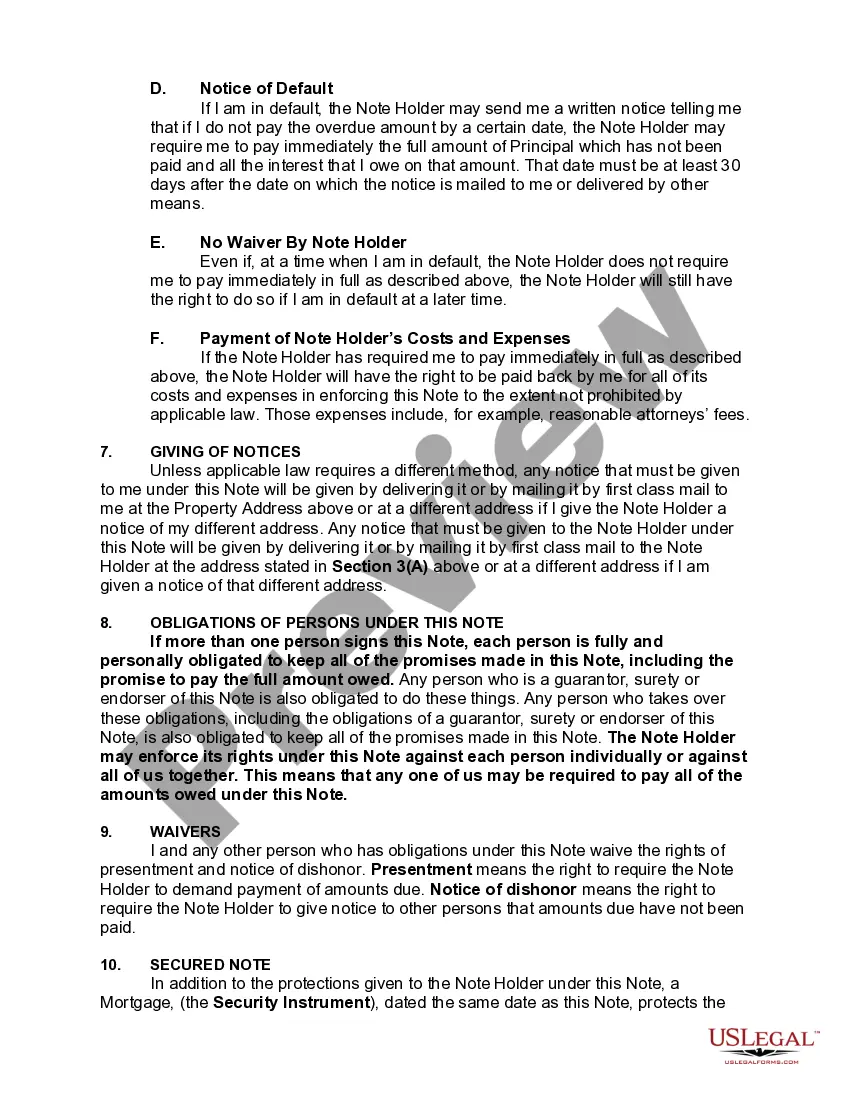

Yes, a promissory note is legal without being notarized in Pennsylvania, as long as it meets the essential requirements for validity. However, not having a notarization may lead to challenges in proving the document in case of disputes. To ensure your Allentown Pennsylvania Promissory Note on Pre-Existing and New Indebtedness holds up in legal scenarios, consider documenting it with clear terms and, if possible, getting it notarized.

In Pennsylvania, a promissory note does not necessarily need to be notarized to be legally binding; however, notarization can add an extra layer of security. Notarized notes may be easier to enforce in court, as they provide verification of signatures. Therefore, while it’s not required, considering notarization can enhance the legitimacy of your Allentown Pennsylvania Promissory Note on Pre-Existing and New Indebtedness.

For a promissory note to be valid, it must clearly state the amount owed, the interest rate, and the repayment terms. Additionally, both the borrower and lender should sign the document, indicating their agreement to the terms. In Allentown Pennsylvania, ensuring mutual consent and clarity helps prevent disputes regarding the Allentown Pennsylvania Promissory Note on Pre-Existing and New Indebtedness.

The statute of limitations on a promissory note in Pennsylvania is four years from the date of default or the last payment. This means that if you hold an Allentown Pennsylvania Promissory Note on Pre-Existing and New Indebtedness, you have a four-year window to take legal action for breaches. Keeping track of these timelines and understanding their implications is crucial for safeguarding your financial interests.

Pennsylvania has laws that provide certain protections for debtors, but the state also enforces creditor rights. While debtors can benefit from exemptions and protections under Pennsylvania law, those with an Allentown Pennsylvania Promissory Note on Pre-Existing and New Indebtedness should be aware of both the rights and obligations that come with their financial agreements. It's essential to understand your situation fully to make informed decisions.

In Pennsylvania, a promissory note does not need to be notarized to be legally valid. However, having a promissory note notarized can add an extra layer of protection and authenticity to the document. For anyone dealing with an Allentown Pennsylvania Promissory Note on Pre-Existing and New Indebtedness, investing in notarization might be a wise choice for avoiding disputes down the line.

In Pennsylvania, a debt becomes uncollectible after the statute of limitations expires, which is generally four years for promissory notes. This timeframe begins from the date of the last payment or the date of default. To secure your interests in any Allentown Pennsylvania Promissory Note on Pre-Existing and New Indebtedness, it is crucial to keep clear records and communicate promptly if a default occurs.