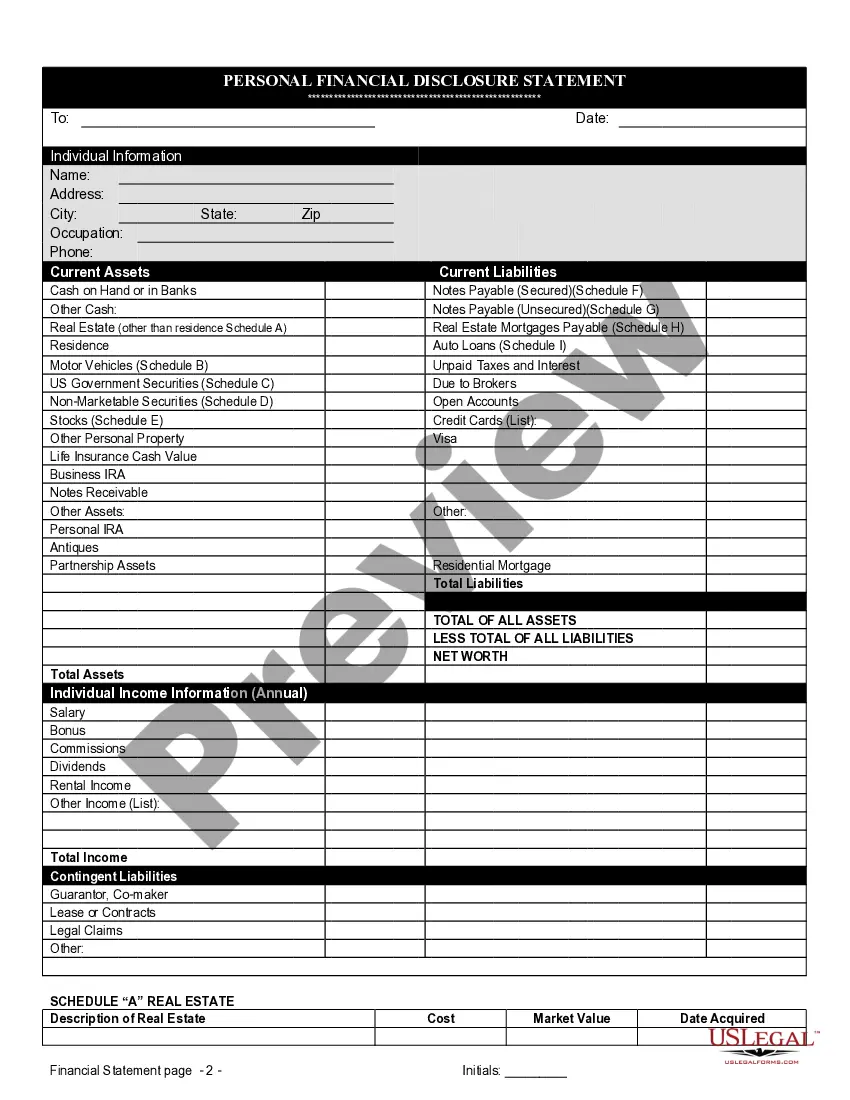

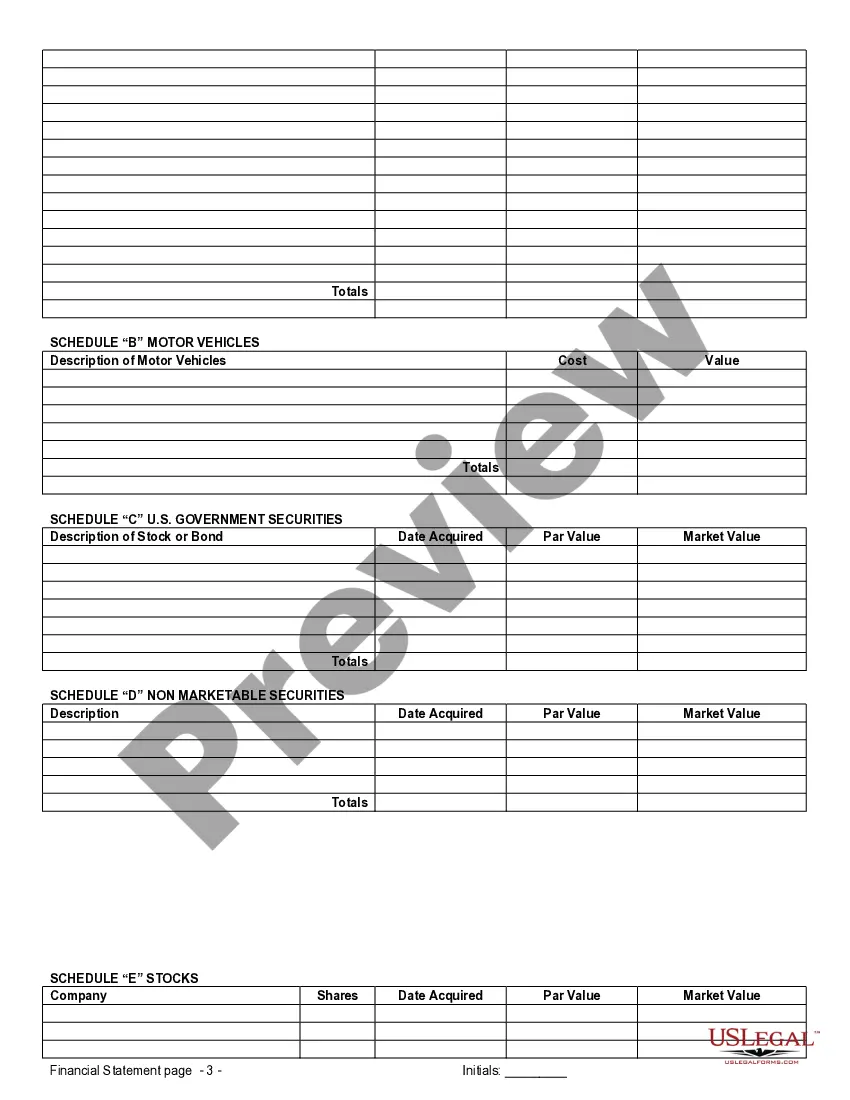

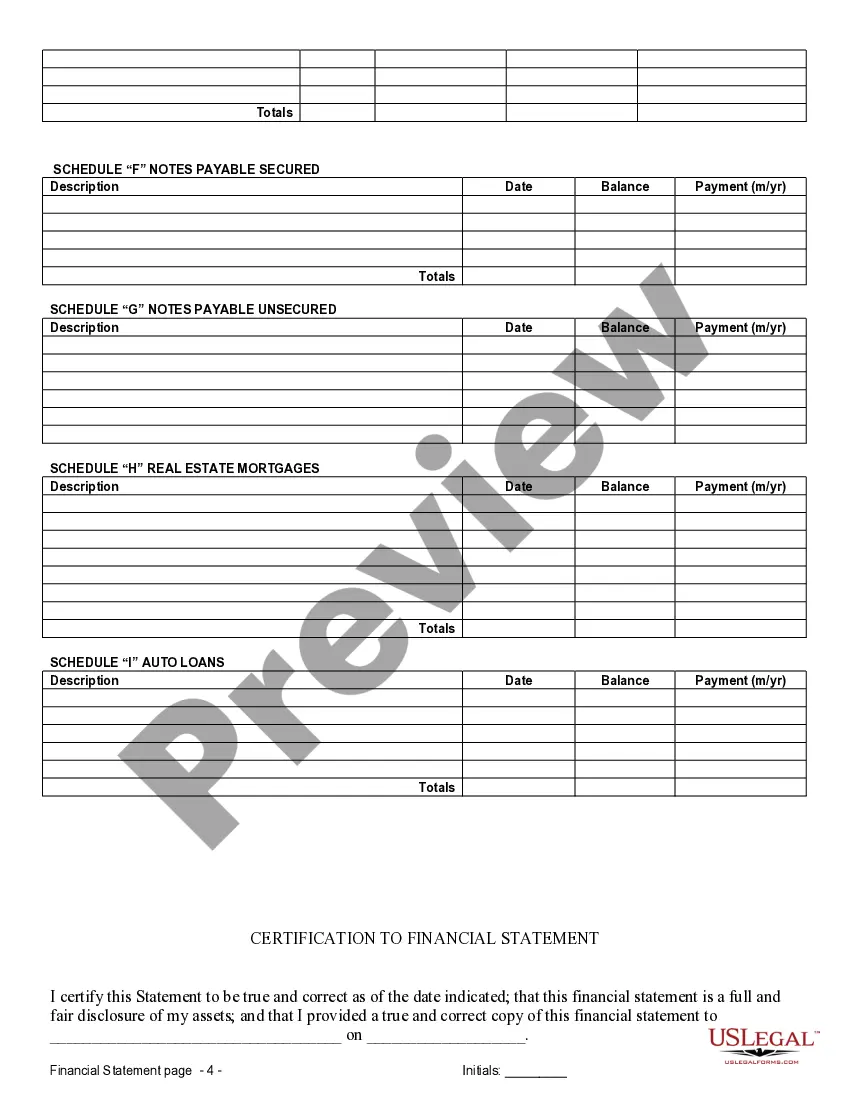

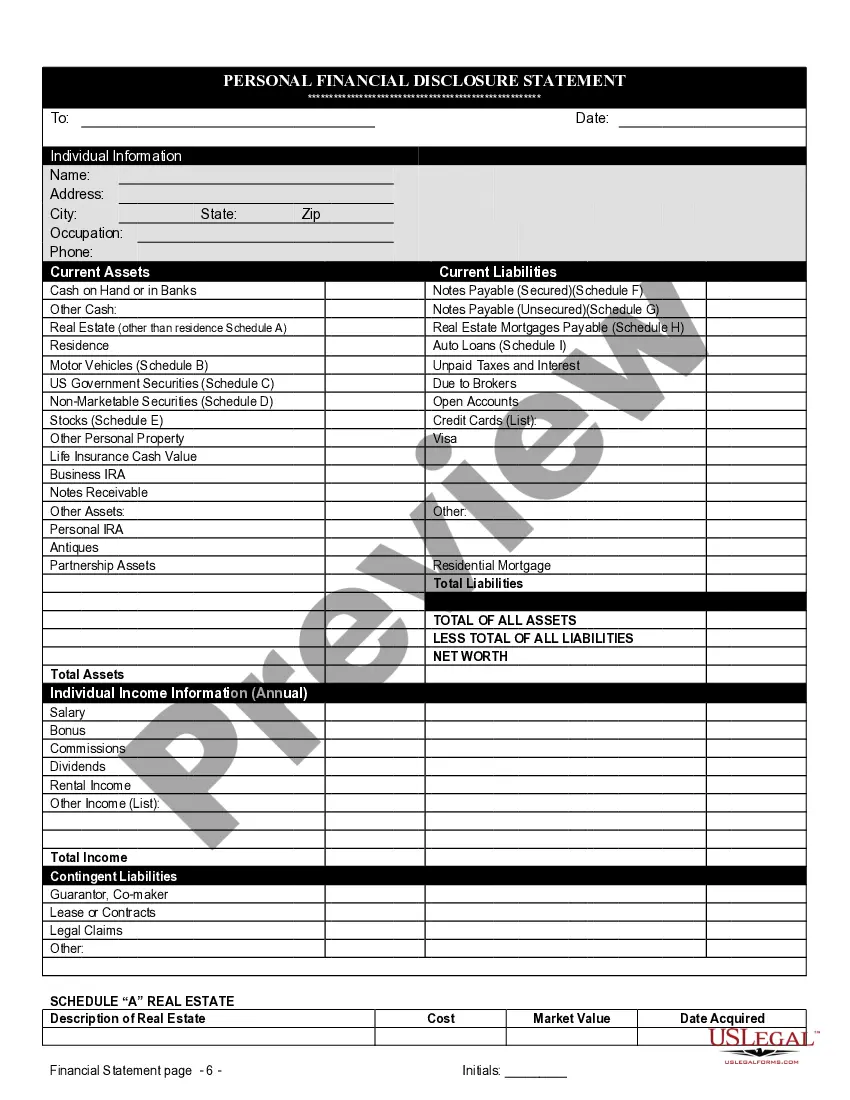

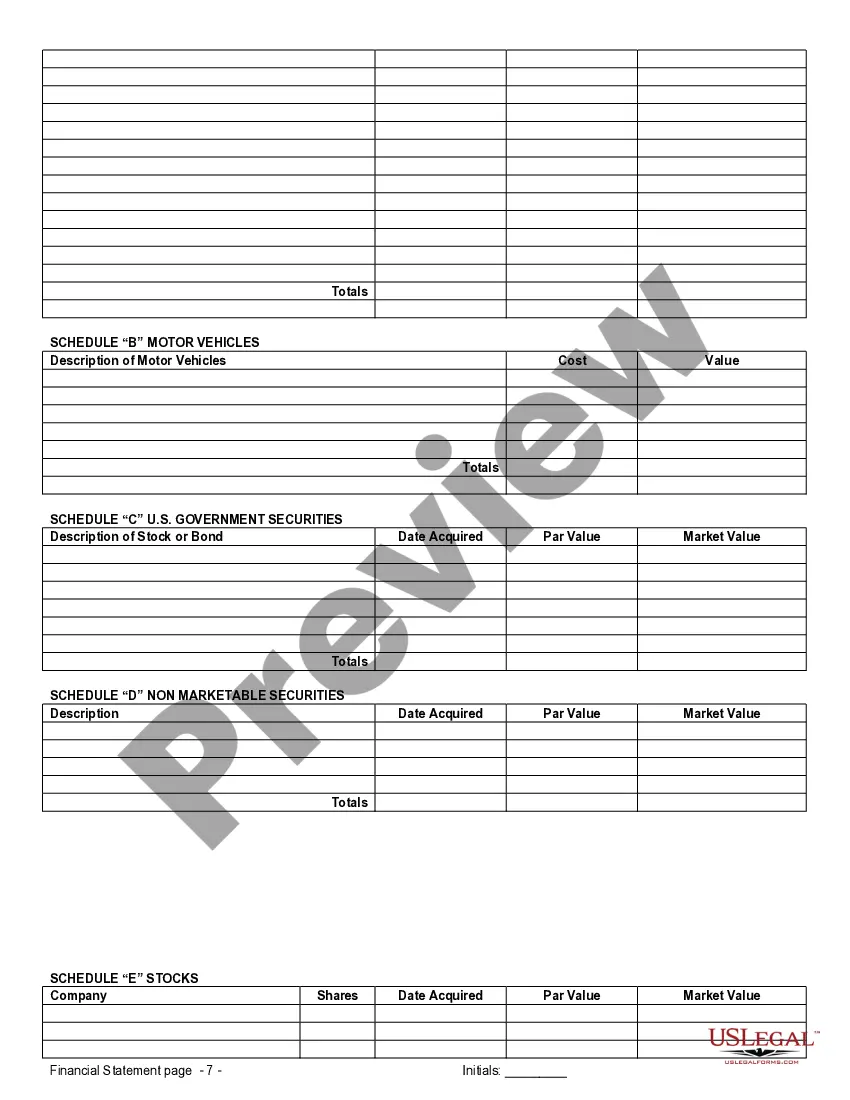

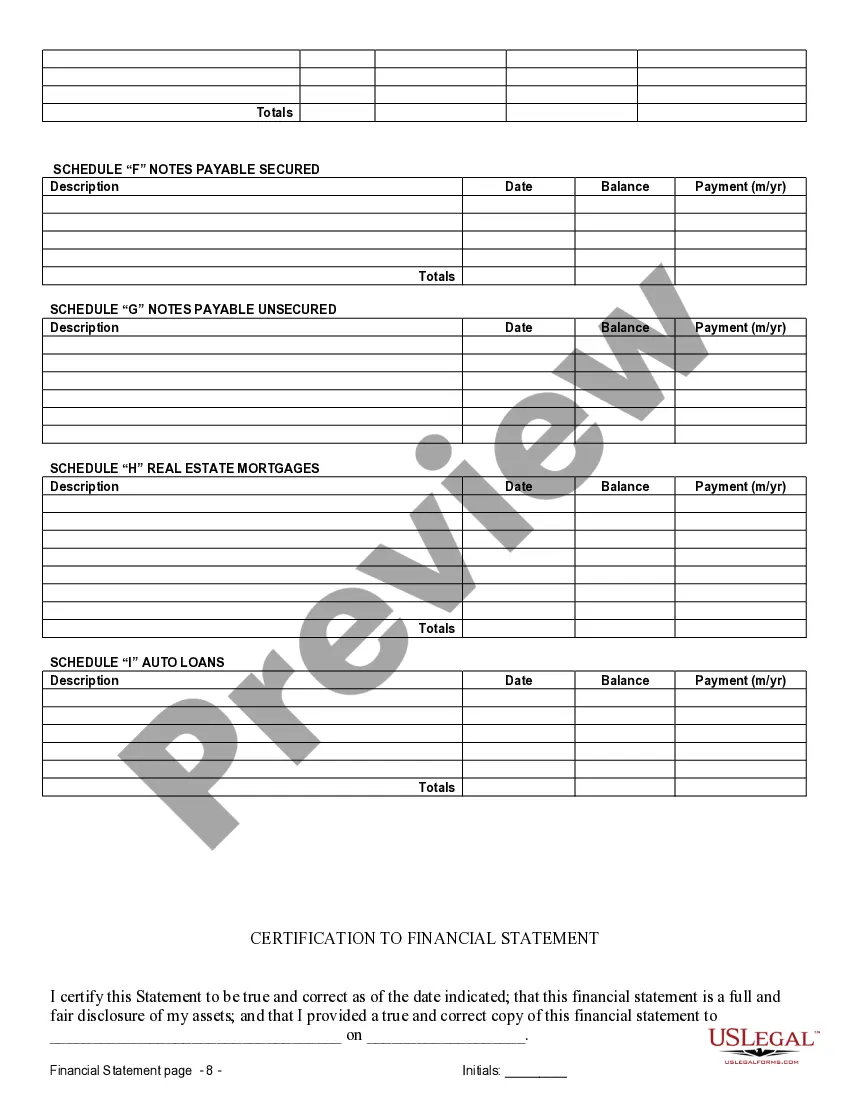

Allegheny, Pennsylvania Financial Statements in Connection with Prenuptial Premarital Agreement In Allegheny, Pennsylvania, financial statements play a crucial role in prenuptial (or premarital) agreements. These statements provide a comprehensive overview of the parties' financial situation, ensuring the transparency and legal fairness of the agreement. Whether you are an individual considering a prenup or a legal professional advising clients on premarital matters, understanding the various types of financial statements in connection with prenuptial agreements is essential. Let's explore the different types below: 1. Personal Balance Sheets: These financial statements detail an individual's assets, liabilities, and net worth as of a specific date, usually before entering marriage. Personal balance sheets provide a clear picture of an individual's financial position, including assets such as real estate, investments, bank accounts, vehicles, and personal possessions. Additionally, liabilities such as debts, loans, mortgages, and outstanding taxes are included. 2. Income Statements: These statements document an individual's income and expenses over a specific period. They showcase the inflow and outflow of funds, providing insight into an individual's financial stability. Income statements also act as proof of an individual's earnings before marriage and can help determine spousal support or potential separate property claims in the event of a divorce. 3. Tax Returns: For couples considering prenuptial agreements, sharing tax returns can provide valuable information regarding income, deductions, investments, and potential tax liabilities. Analyzing tax returns helps determine the financial implications of combining finances and aids in assessing each party's financial capacity, which is especially crucial if alimony or child support issues arise. 4. Bank Statements: Bank statements play a pivotal role in understanding an individual's financial transactions, including income sources, loan payments, and regular expenses. Providing several months' worth of bank statements for each party involved in the prenuptial agreement can reassure both parties of the other's financial stability. 5. Business Financial Statements: If one or both parties own businesses or are self-employed, business financial statements are essential. These statements detail the business's assets, liabilities, revenue, and expenses, providing a comprehensive picture of its financial health. Business financial statements help determine each party's ownership interest, potential income streams, and interests in the event of a divorce. 6. Retirement Account Statements: Including retirement account statements, such as 401(k), IRA, or pension plans, in the prenuptial agreement provides visibility into each party's long-term financial planning. These statements illustrate the contributions made, current balances, and potential future benefits, ensuring all parties involved have a clear understanding of the retirement assets that may be considered in the agreement. By incorporating these various financial statements into the prenuptial agreement process, individuals in Allegheny, Pennsylvania can ensure transparency, fairness, and protection of their financial interests. It is crucial to consult with a legal professional familiar with Pennsylvania family law to determine the specific requirements and considerations for financial statements in prenuptial agreements in Allegheny County.

Allegheny Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement

State:

Pennsylvania

Control #:

PA-00590-D

Format:

Word;

Rich Text

Instant download

Description

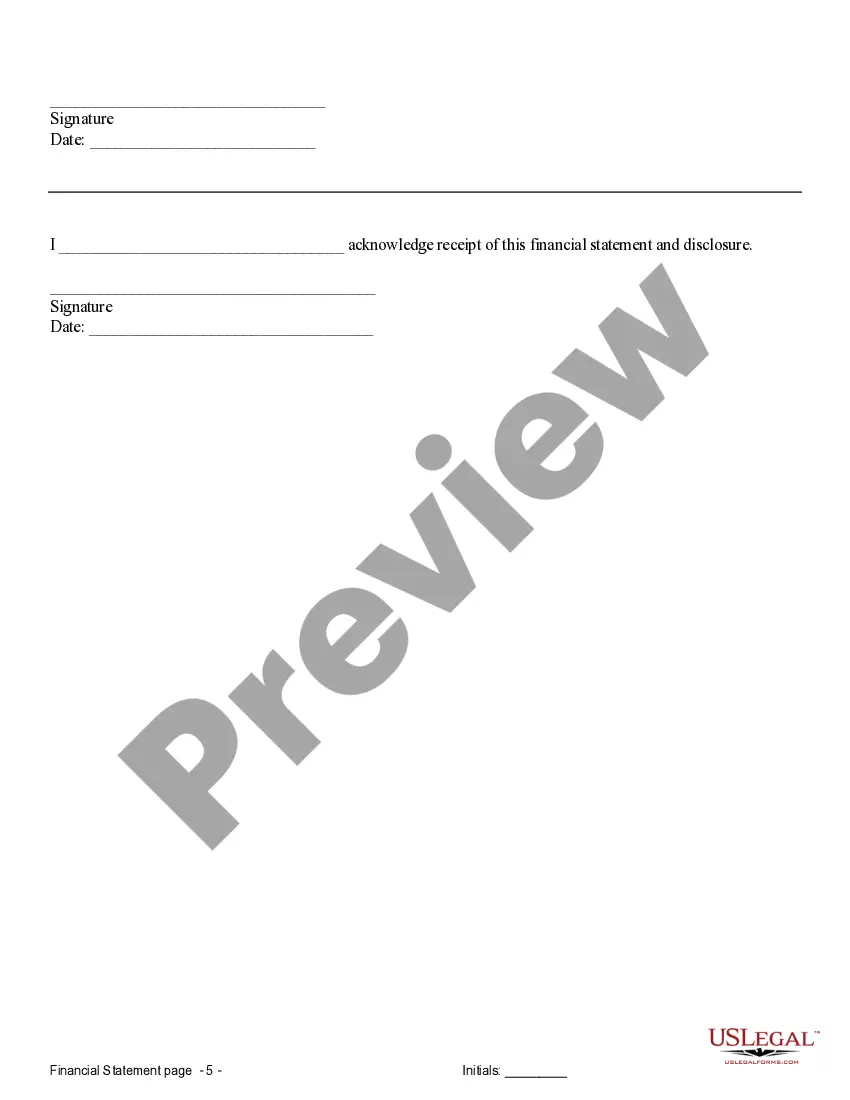

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Allegheny, Pennsylvania Financial Statements in Connection with Prenuptial Premarital Agreement In Allegheny, Pennsylvania, financial statements play a crucial role in prenuptial (or premarital) agreements. These statements provide a comprehensive overview of the parties' financial situation, ensuring the transparency and legal fairness of the agreement. Whether you are an individual considering a prenup or a legal professional advising clients on premarital matters, understanding the various types of financial statements in connection with prenuptial agreements is essential. Let's explore the different types below: 1. Personal Balance Sheets: These financial statements detail an individual's assets, liabilities, and net worth as of a specific date, usually before entering marriage. Personal balance sheets provide a clear picture of an individual's financial position, including assets such as real estate, investments, bank accounts, vehicles, and personal possessions. Additionally, liabilities such as debts, loans, mortgages, and outstanding taxes are included. 2. Income Statements: These statements document an individual's income and expenses over a specific period. They showcase the inflow and outflow of funds, providing insight into an individual's financial stability. Income statements also act as proof of an individual's earnings before marriage and can help determine spousal support or potential separate property claims in the event of a divorce. 3. Tax Returns: For couples considering prenuptial agreements, sharing tax returns can provide valuable information regarding income, deductions, investments, and potential tax liabilities. Analyzing tax returns helps determine the financial implications of combining finances and aids in assessing each party's financial capacity, which is especially crucial if alimony or child support issues arise. 4. Bank Statements: Bank statements play a pivotal role in understanding an individual's financial transactions, including income sources, loan payments, and regular expenses. Providing several months' worth of bank statements for each party involved in the prenuptial agreement can reassure both parties of the other's financial stability. 5. Business Financial Statements: If one or both parties own businesses or are self-employed, business financial statements are essential. These statements detail the business's assets, liabilities, revenue, and expenses, providing a comprehensive picture of its financial health. Business financial statements help determine each party's ownership interest, potential income streams, and interests in the event of a divorce. 6. Retirement Account Statements: Including retirement account statements, such as 401(k), IRA, or pension plans, in the prenuptial agreement provides visibility into each party's long-term financial planning. These statements illustrate the contributions made, current balances, and potential future benefits, ensuring all parties involved have a clear understanding of the retirement assets that may be considered in the agreement. By incorporating these various financial statements into the prenuptial agreement process, individuals in Allegheny, Pennsylvania can ensure transparency, fairness, and protection of their financial interests. It is crucial to consult with a legal professional familiar with Pennsylvania family law to determine the specific requirements and considerations for financial statements in prenuptial agreements in Allegheny County.

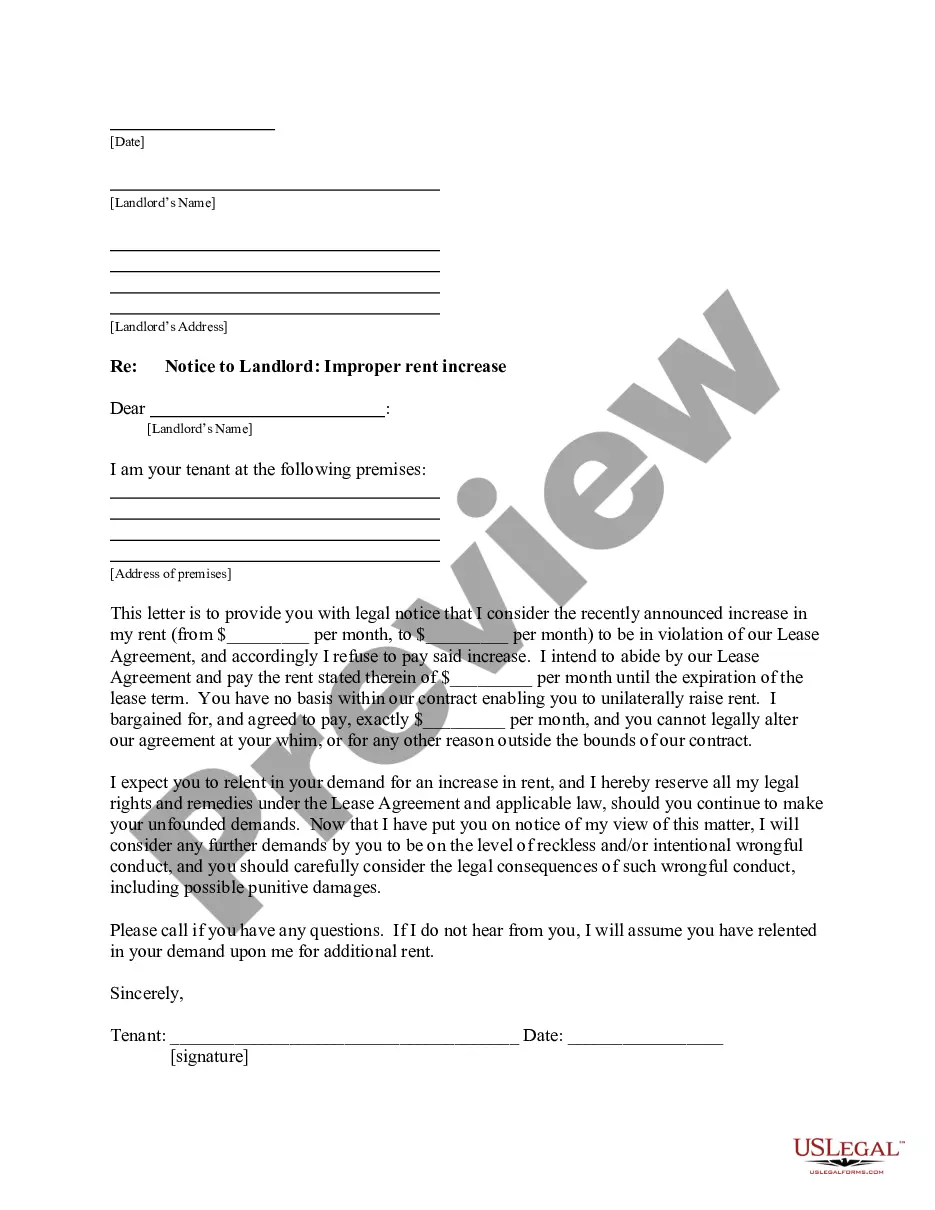

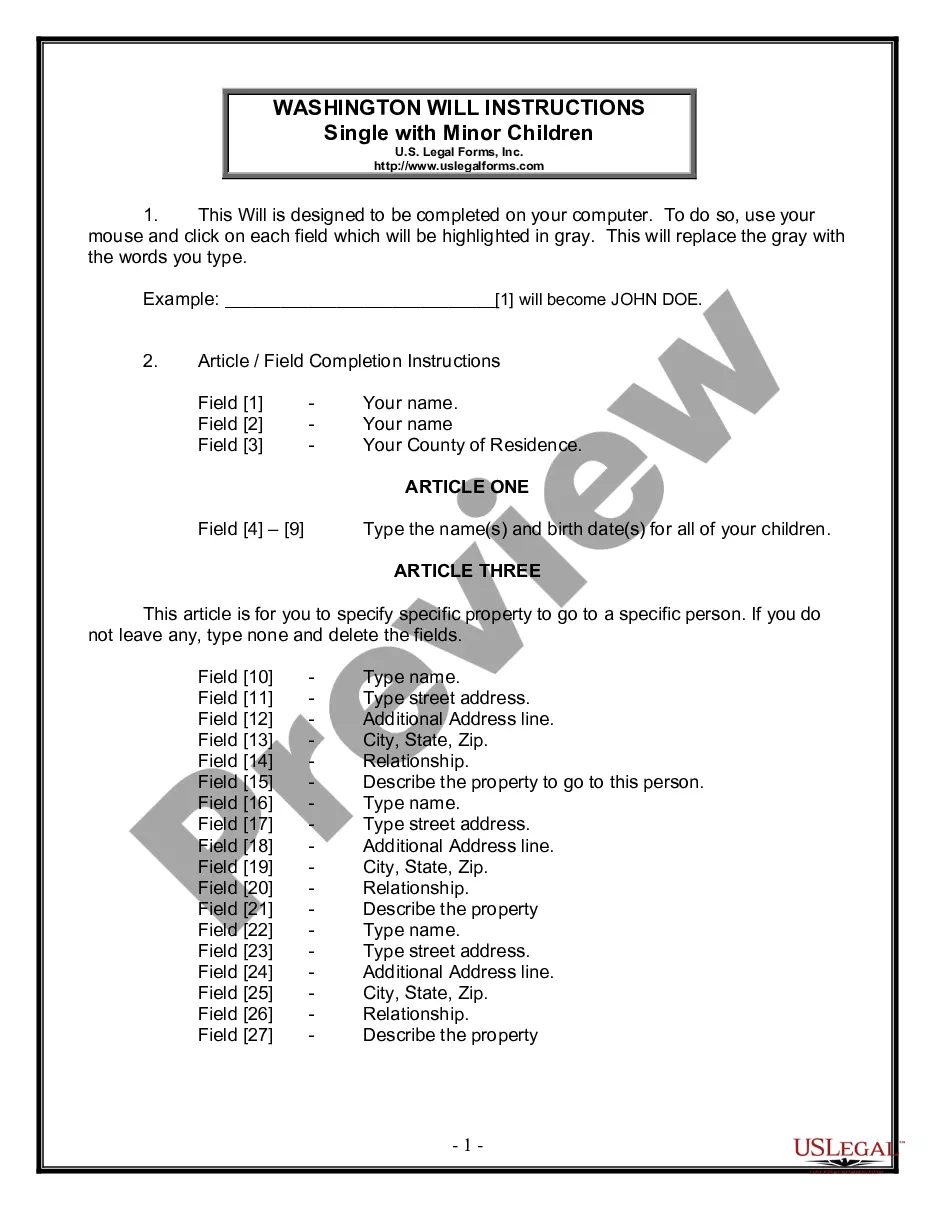

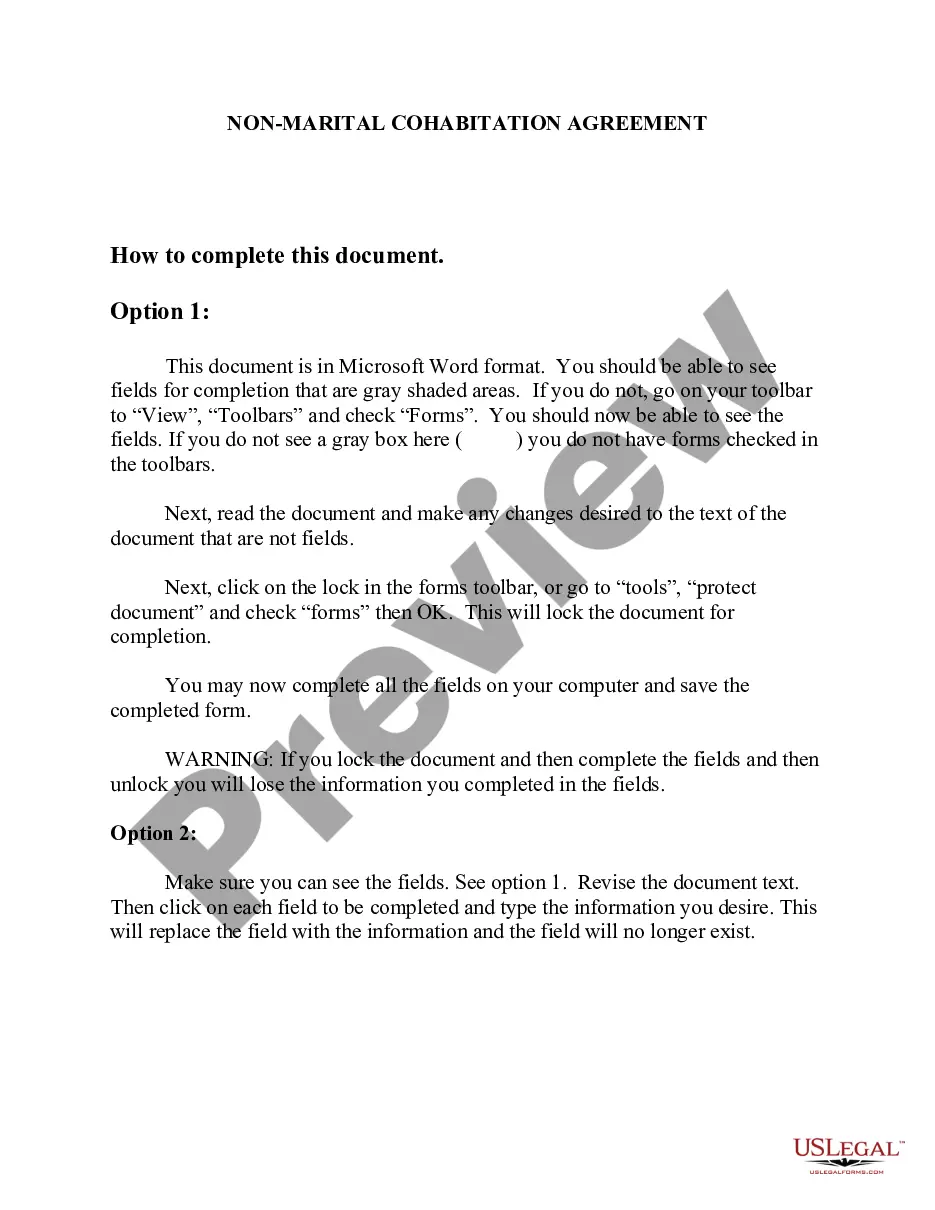

Free preview

How to fill out Allegheny Pennsylvania Financial Statements Only In Connection With Prenuptial Premarital Agreement?

If you’ve already utilized our service before, log in to your account and save the Allegheny Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Allegheny Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!