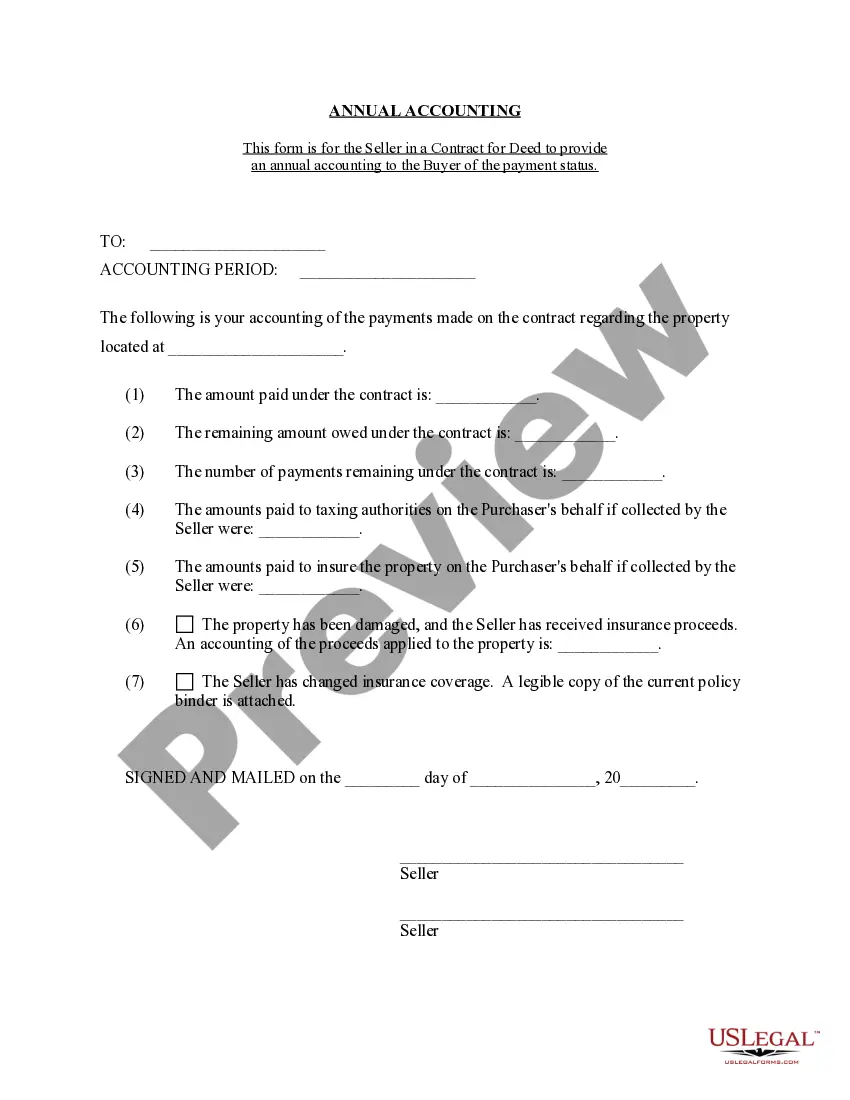

Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Pennsylvania Contract For Deed Seller's Annual Accounting Statement?

We consistently aspire to minimize or avert legal complications when engaging with intricate legal or financial issues. To achieve this, we seek attorney services that are typically very expensive. However, not all legal matters are that complicated. Many can be addressed by ourselves.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions. Our platform empowers you to manage your issues independently without needing a lawyer's services. We offer access to legal form templates that are not always readily available. Our templates are specific to states and regions, which greatly eases the search process.

Benefit from US Legal Forms whenever you require the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement or any other form effortlessly and securely. Simply Log In to your account and click the Get button adjacent to it. If you misplace the form, you can always download it again from the My documents tab.

The process is just as simple if you’re new to the platform! You can set up your account in minutes.

For over 24 years, we've assisted millions by providing ready-to-customize and current legal forms. Take advantage of US Legal Forms now to conserve effort and resources!

- Ensure that the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement complies with the laws and regulations of your state and area.

- It's also essential to review the form’s description (if available) and if you notice any inconsistencies with what you were seeking initially, look for a different form.

- Once you’ve confirmed that the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement is suitable for your situation, you can select the subscription plan and continue to payment.

- After that, you can download the form in any available file format.

Form popularity

FAQ

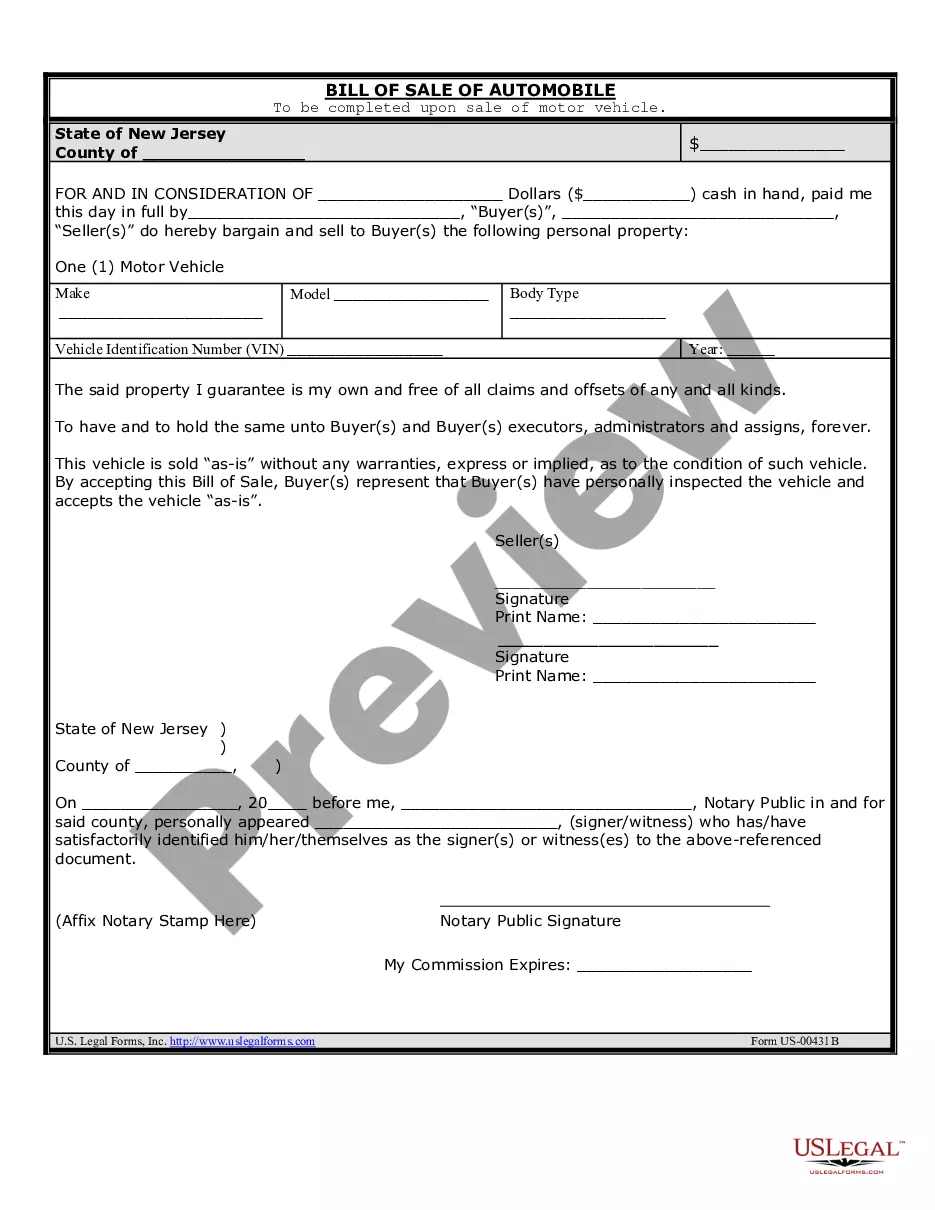

Also termed an installment land contract, a land contract, or a land sales contract. Contract for deed can be considered a special type of real estate contract in which the seller provides funds to the buyer to purchase the property at an agreed purchase price and the buyer repays the loan in installments.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

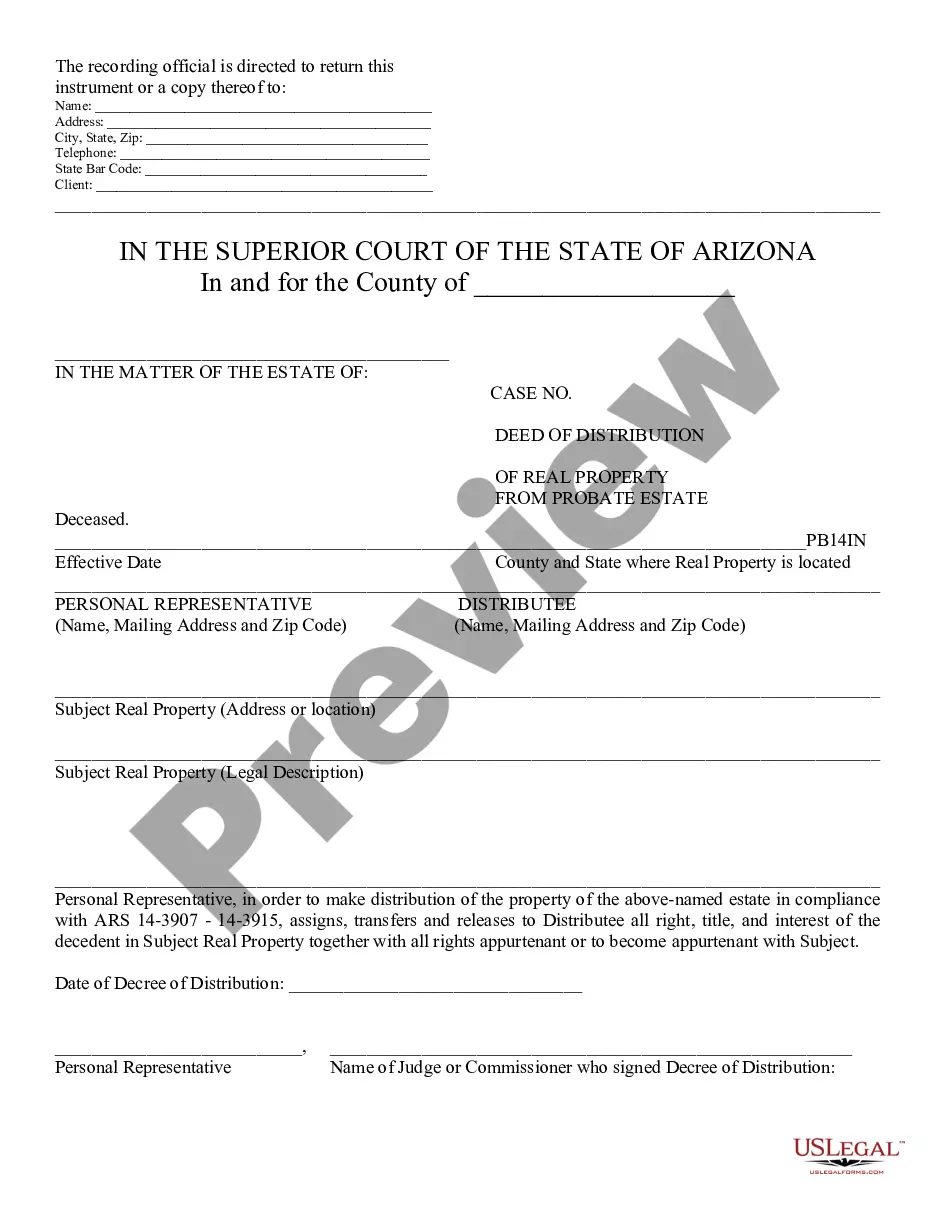

A purchase and sale agreement is a real estate contract. It's a written agreement between buyer and seller to transact real estate. The buyer agrees to pay an agreed-upon amount for the property. The seller agrees to convey the deed to the property. ?The deed is a legal instrument.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Depending upon the legal or common real estate terminology in your area, you may see these types of deals referred to as either land contracts, installment land contracts, contracts for deed, memorandums of contract, real estate contracts or bonds for title.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

What is a Community Facilities District (CFD)? A CFD is a Special Tax District provided in State Law that funds the installation of public improvements or ongoing services within an identified area. A special tax is levied on taxable property within the district boundaries.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.