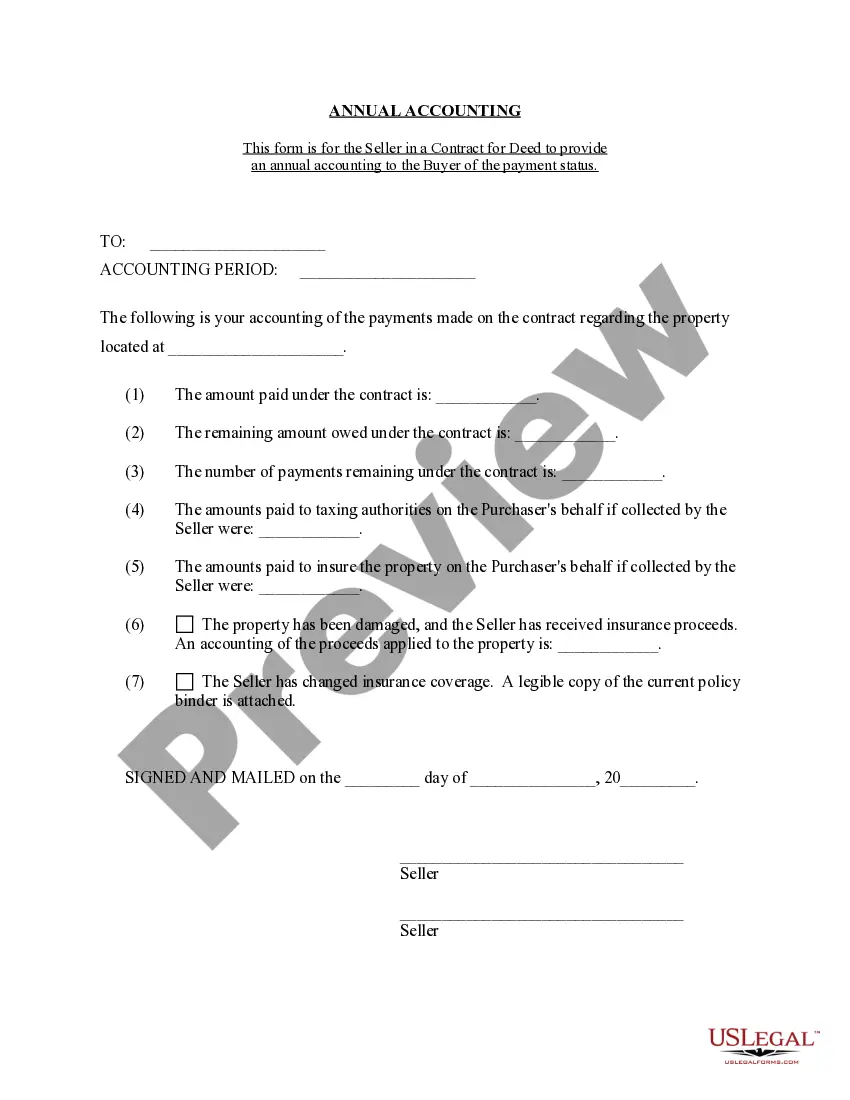

Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Pennsylvania Contract For Deed Seller's Annual Accounting Statement?

We consistently aim to minimize or prevent legal repercussions when handling intricate legal or financial issues.

To achieve this, we seek legal services that are generally quite costly.

Nevertheless, not every legal issue is of equal difficulty. The majority of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always retrieve it again from within the My documents section. The procedure is just as straightforward if you are not familiar with the website! You can set up your account within moments. Ensure that the Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement adheres to the laws and regulations of your state and area. Furthermore, it’s crucial to review the form’s description (if available), and if you detect any inconsistencies with your initial requirements, look for an alternative template. Once you’ve confirmed that the Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement suits your situation, you can select the subscription plan and proceed to payment. You can then download the form in any preferred format. For over 24 years of our existence in the market, we’ve assisted millions by providing customizable and current legal forms. Take full advantage of US Legal Forms now to conserve time and resources!

- Our platform enables you to manage your issues independently without relying on legal advisors.

- We provide access to legal form templates that aren’t always readily available.

- Our templates are specific to states and regions, which greatly eases the search process.

- Benefit from US Legal Forms at any time you need to locate and securely download the Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement or any other form swiftly.

Form popularity

FAQ

Centre County Recorder of Deeds In addition, the office acts as an agent of the State Department of Revenue in the collection of Writ taxes. The office also collects and distributes a fee provided by State Statute for the Administrative Office of Pennsylvania Courts.

The state of Pennsylvania requires that property buyers pay a fee to have a deed transferred over to their name. In most cases, the seller and buyer will split this fee 50/50, but individual sales contracts have the final say. The state taxes the deed transfer at a rate of 1% of the property's sale price.

The Land Contract or Memorandum must state that the buyer is responsible for paying the property taxes. The Land Contract or Memorandum must be selling the property. Option to buy or lease agreements will not qualify for the homestead and mortgage deductions. The Land Contract or Memorandum must be recorded.

Although a deed does not have to be recorded to be valid, it must be recorded for the following reasons: Provide Constructive Notice: Constructive notice is a public declaration of who the legal owner of a property is. Priority of Recording: Pennsylvania is a race notice state.

A deed that is unrecorded for two years is considered fraudulent and void against any subsequent bona fide purchaser or mortgagee (21 P.S. § 443). Is registered with the governing body in addition to being recorded (see Registration of Deeds).

Who prepares the Deed of Sale? The deed of sale is drafted by the seller and it includes the details of the transaction. The document should then be notarized by a lawyer, otherwise, it will have no power when presented to authorities or court.

In person or by mail You must make an appointment to record documents in person. Email appointments.records@phila.gov to schedule. Hours of operation: Monday through Friday, 8 a.m. to 4 p.m. You must be in Room 111 by p.m. to have your document recorded that day.

For a deed to legal in Pennsylvania, it must meet the following basic requirements: It must be in writing, State the name of the current owner, Include the legal description for the real estate being transferred, and.

Contracts for Deed (also known as Agreement for Deed, Contract Sale, Real Estate Installment Agreement, or as I would say ?Contract for Doom?) are legally binding. Upon entering a Contract for Deed, a seller agrees to convey the property to a buyer.

Every state is different, in Pennsylvania, an attorney can prepare a deed and when there is title insurance issued a settlement firm may prepare deed as well. Your deed must be recorded as quickly as possible in the land record's office (Recorder of Deeds) of your County.